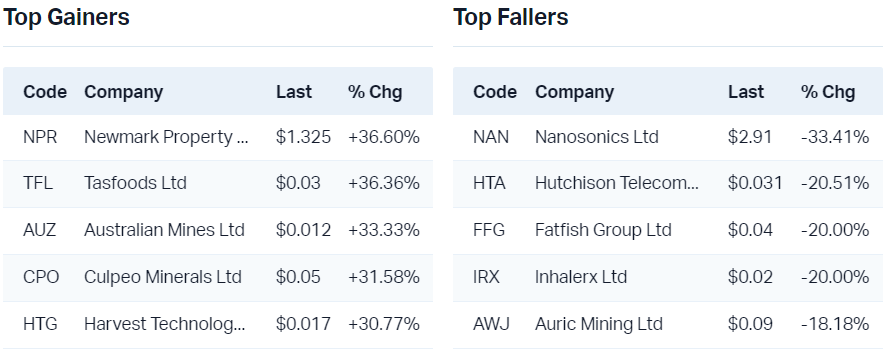

ASX 200 inches higher as resources, led by lithium and gold stocks, stage overdue rebound

Today in Review

Markets

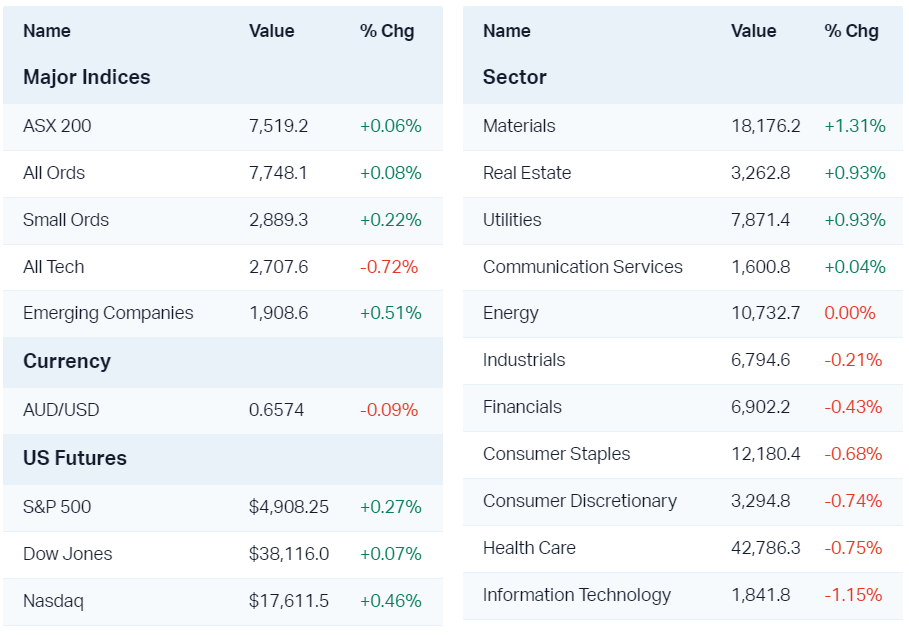

ASX 200 Session Chart

%20Intraday%20Chart%2024%20Jan%202024.png)

The S&P/ASX200 (XJO) finished 4.3 points higher at 7,519.2, basically smack-bang in the middles of the session's tiny 0.5% trading range. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by 153 to 114.

The Materials (XMJ) +1.3% was the best performing sector today, likely in response to stronger metals prices overnight, and those are likely in turn due to media speculation China is about to announce a plan to stem its massive stock market losses.

Pilbara Minerals chart suggests little short covering yet...

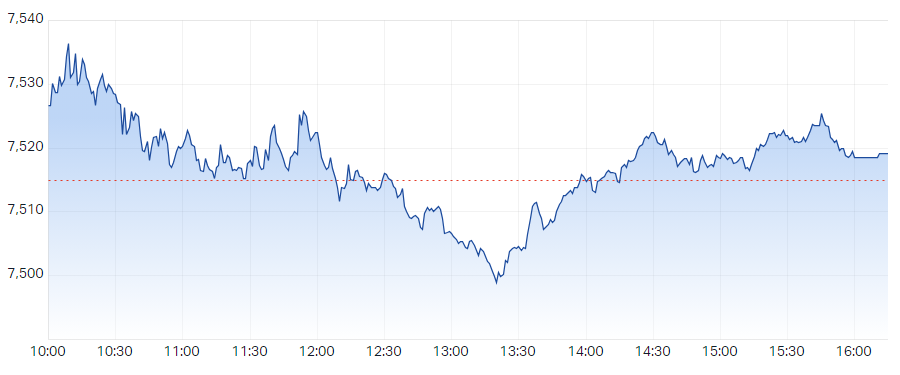

You'll also notice a smattering of lithium stocks in the biggest winners list above. These were help greatly by a well-received December quarter activities report from Pilbara Minerals (PLS: ASX) +5.8%. Check out this article for everything you need to know about why the market liked it so much.

Today's candle delivered a welcome bounce to the PLS chart, but I note it closed well off its highs. This is a sign that the excess demand created by today's good news couldn't be sustained into the close. Volume was hardly substantial, and this tells me very few short sellers took today's news as the cue to get out.

I suggest, while the PLS price can hold above $3.25 there's a chance of a double bottom pattern playing out, but a close below it would likely put $3.10 under pressure, and it's best not contemplating what happens beneath that.

I wouldn't call a demand-side market here until I see higher peaks and higher troughs, but preferably a close above the major point of supply at $4.01. Until then, short and long term trends remain well-established to the downside.

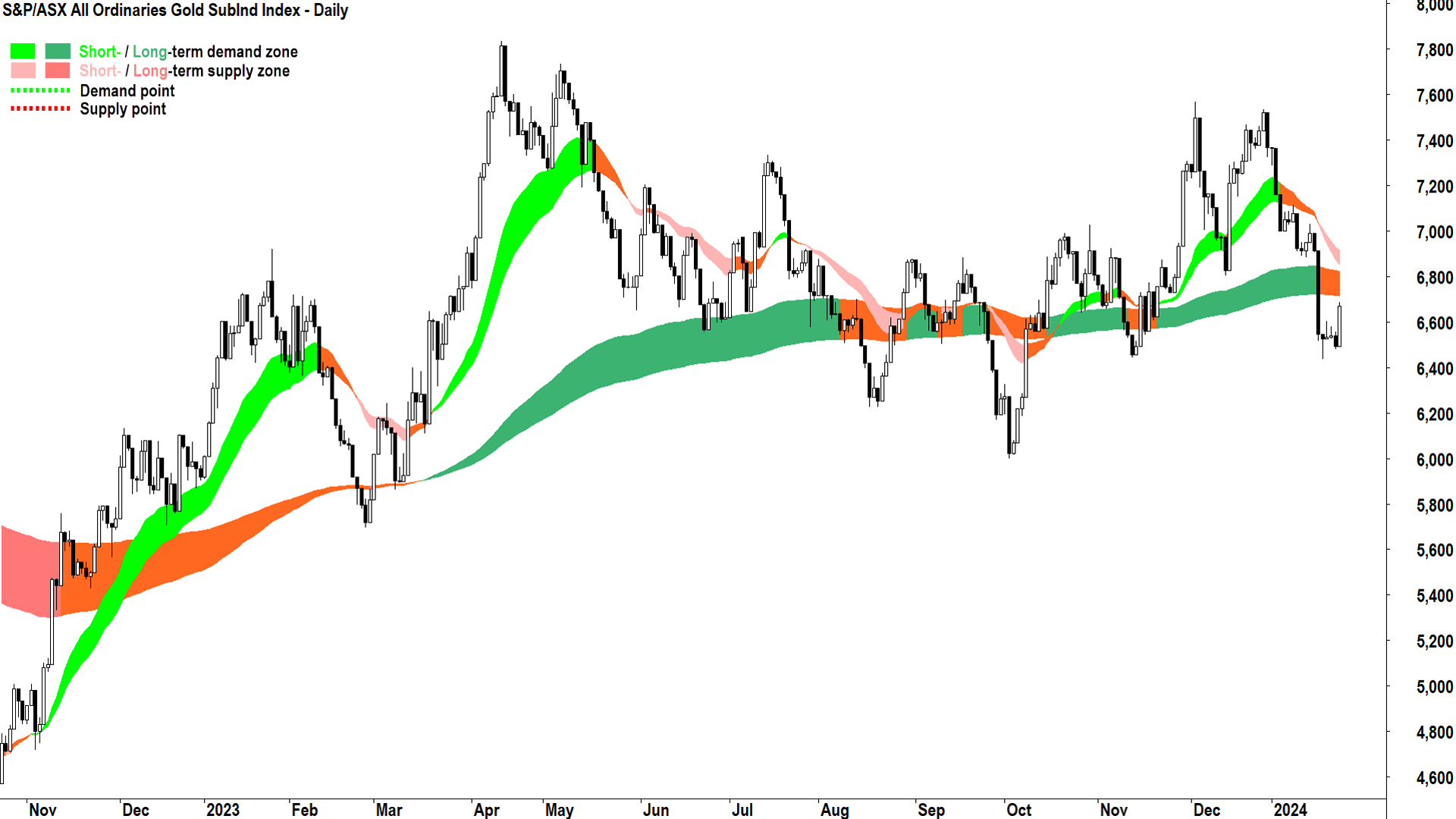

Gold needs to shine, or else...

Within the Materials, the Gold (XGD) subsector was the clear standout, rebounding 2.7% on the back of a positive quarterly update from sector heavyweight Norther Star Resources (ASX: NST) +6.0%.

%20chart.png)

The rally couldn't have come at a better time for the XGD given it has broken below my long term uptrend ribbon, and given the short term trend is well-established to the downside.

Today's strong demand-side candle is encouraging, but if the XGD fails to quickly recover above the long term trend ribbon – particularly if that failure is punctuated by black candles / upward pointing candle shadows, it would signal the supply side has likely completely taken control of prices within the sector.

A healthy pullback, probably!

Doing it tough today was the Information Technology (XIJ) -1.15% and Health Care (XHJ) -0.75% sectors. Ironically, unlike Materials, these have been two of the very best sectors since the start of 2024. I'm going to peg this as a "healthy pullback" and nothing more sinister, but I will be watching the price action closely!

%20chart.png)

Economy

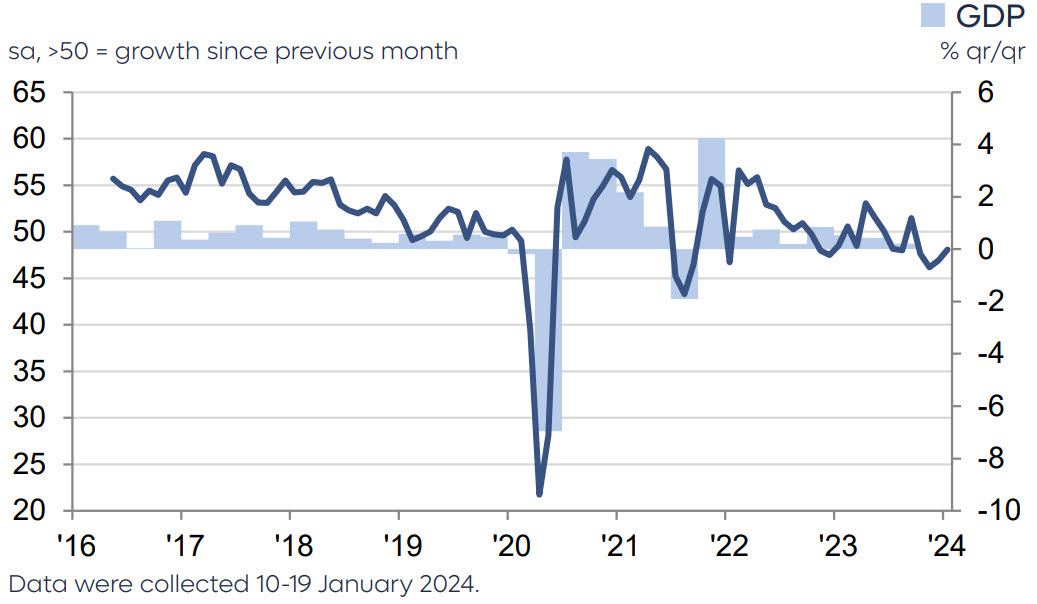

Judo Bank Australia Flash PMI series for January

- Flash Australia Composite PMI Output Index 48.1 (Dec: 46.9), i.e., a 4-month high

- Flash Australia Services PMI Business Activity Index: 47.9 (Dec: 47.1), i.e., a 3-month high

- Flash Australia Manufacturing PMI Output Index: 49.2 (Dec: 45.5), i.e., 5-month high

- Flash Australia Manufacturing PMI: 50.3 (Dec: 47.6), i.e., an 11-month high

- Note values below 50 indicate a contraction in the relevant sector, so whilst Aussie business conditions improved this month, they remain very subdued!

What to watch out for...

Tonight:

From 7:15pm: European Flash PMIs, from 1:45am: US Flash PMIs

Later this week:

Thu - From 11:30am, RBA Bulletin

Fri - ECB interest rate decision; US Durable Goods, US New & Pending Home Sales, US PCE Price Index, US Personal Spending & Personal Incomes

Latest News

ASX stocks just got more expensive, but not dangerous expensive yet 🚫⚠️

2 small stocks with big catalysts in 2024

Cheap ASX stocks with P/Es less than 10: Which will grow earnings in FY24?

Insider Sells: Directors are selling shares in these 6 ASX companies

Everything you need to know about Pilbara Minerals' December quarter report

Morning Wrap: ASX 200 to rise, S&P 500 bags another record close + Pilbara Minerals in focus

Interesting Movers

Trading higher

+14.9% Kogan.Com (KGN) - Kogan.com January 2024 Business Update

+8.7% APM Human Services International (APM) - First bounce since massive fall following 17 Jan First Half Trading Update

+8.4% Iluka Resources (ILU) - No news since 23-Jan Quarterly Review to 31 December 2023, several positive broker updated today including three rating upgrades (see Broker Moves)

+7.0% Karoon Energy (KAR) - No news since 23-Jan CY24 production update and revised guidance, two broker rating upgrades (see Broker Moves)

+6.9% Chalice Mining (CHN) - No news since 22-Jan Corporate update

+6.0% Northern Star Resources (NST) - December 2023 Quarterly Activities Report

+5.8% Pilbara Minerals (PLS) - December 2023 Quarterly Activities Report

+5.4% Kingsgate Consolidated (KCN) - No news since 23-Jan Quarterly Activities/Appendix 5B Cash Flow Report

+5.1% Red 5 (RED) - No news, resuming long term uptrend after bounce from long term uptrend ribbon

+4.6% Australian Ethical Investment (AEF) - No news since 18-Jan AEF Quarterly FUM Announcement, rise is consistent with prevailing short and long term uptrends

+4.5% Perseus Mining (PRU) - December Quarter Report

+4.5% Lynas Rare Earths (LYC) - No news since 22-Jan Quarterly Activities Report, response to several positive broker notes yesterday, (see yesterday's Broker Moves)

+4.5% Nickel Industries (NIC) - Nickel price rallied 1.6% overnight

+4.4% Fineos Corporation Holdings (FCL) - No news, rise is consistent with prevailing short and long term uptrends

Trading lower

-33.4% Nanosonics (NAN) - H1 FY24 trading update and expectations for FY24, fall is consistent with prevailing short and long term downtrends

-8.8% Adriatic Metals (ADT) - Vares Project Production Guidance & Update

-5.8% Supply Network (SNL) - No news 🤔, second large daily fall, possible response to two prior day's supply-side candles

-5.5% Chrysos Corporation (C79) - Chrysos Quarterly Presentation Q2 FY24

-5.4% Seven West Media (SWM) - No news, fall is consistent with prevailing short and long term downtrends

-5.2% Beacon Lighting Group (BLX) - No news 🤔, close below technical support at $2.22

-4.8% Universal Store Holdings (UNI) - No news 🤔

-4.4% Nuix (NXL) - No news since 12-Jan 1H24 Results Update, but continues to suffer since this announcement, string of supply-side candles

Broker Notes

The A2 Milk Company (A2M) retained at accumulate Ord Minnett; Price Target: $7.20

-

Australian Clinical Labs (ACL)

Downgraded to neutral from buy at Goldman Sachs; Price Target: $3.30

Retained at buy Citi; Price Target: $3.60

Altium (ALU) retained at outperform RBC Capital Markets; Price Target: $50.00

Atlas Arteria (ALX) retained at neutral E&P; Price Target: $6.01

Amcor (AMC) downgraded to underweight from neutral at Barrenjoey; Price Target: $14.00 from $14.50

Ansell (ANN) retained at neutral Citi; Price Target: $26.00

AUB Group (AUB) retained at positive E&P; Price Target: $35.70

-

Baby Bunting Group (BBN)

Retained at accumulate Ord Minnett; Price Target: $2.00 from $2.35

Retained at add Morgans; Price Target: $2.00

-

Cooper Energy (COE)

Retained at neutral Goldman Sachs; Price Target: $0.15 from $0.17

Retained at buy Bell Potter; Price Target: $0.16 from $0.17

Cochlear (COH) retained at neutral Citi; Price Target: $255.00

-

Coronado Global Resources Inc. (CRN)

Retained at buy Goldman Sachs; Price Target: $2.20 from $2.43

Retained at buy Bell Potter; Price Target: $1.95 from $2.15

Downgraded to hold from accumulate at Ord Minnett; Price Target: $1.80 from $1.90

Retained at buy UBS; Price Target: $2.00 from $2.20

CSL (CSL) retained at buy Citi; Price Target: $325.00

-

De Grey Mining (DEG)

Retained at outperform Macquarie; Price Target: $1.80

Retained at buy UBS; Price Target: $1.50 from $1.55

Dropsuite (DSE) retained at buy Ord Minnett; Price Target: $0.34 from $0.33

Elders (ELD) retained at buy Bell Potter; Price Target: $9.50 from $8.35

-

EML Payments (EML)

Downgraded to sector perform from outperform at RBC Capital Markets; Price Target: $1.20 from $1.40

Retained at sector perform RBC Capital Markets; Price Target: $1.20

Fineos Corporation Holdings (FCL) retained at sector perform RBC Capital Markets; Price Target: $2.50

Good Drinks Australia (GDA) retained at add Morgans; Price Target: $1.65

Generation Development Group (GDG) retained at add Morgans; Price Target: $2.01 from $1.91

GQG Partners Inc. (GQG) retained at buy Ord Minnett; Price Target: $2.40 from $2.20

-

Healius (HLS)

Retained at neutral Goldman Sachs; Price Target: $1.40

Retained at neutral Citi; Price Target: $1.25

Hansen Technologies (HSN) retained at outperform RBC Capital Markets; Price Target: $6.25

Integral Diagnostics (IDX) retained at neutral Citi; Price Target: $1.95

-

IDP Education (IEL)

Retained at buy Goldman Sachs; Price Target: $27.60

Retained at buy UBS; Price Target: $27.60 from $30.45

Infomedia (IFM) retained at outperform RBC Capital Markets; Price Target: $1.90

-

Iluka Resources (ILU)

Upgraded to hold from sell at Canaccord Genuity; Price Target: $7.00

Upgraded to overweight from neutral at JPMorgan; Price Target: $8.00

Upgraded to neutral from underweight at Barrenjoey; Price Target: $7.20 from $6.50

Retained at buy Goldman Sachs; Price Target: $9.80 from $10.10

Retained at neutral Citi; Price Target: $7.50

Retained at outperform Macquarie; Price Target: $8.30 from $8.90

Retained at sector perform UBS; Price Target: $6.40 from $6.95

-

Judo Capital Holdings (JDO)

Retained at buy Goldman Sachs; Price Target: $1.63 from $1.58

Retained at sell Citi; Price Target: $0.87

Retained at hold Ord Minnett; Price Target: $1.20 from $1.10

Retained at add Morgans; Price Target: $1.50

James Hardie Industries (JHX) downgraded to underperform from neutral at BofA; Price Target: $53.80 from $52.00

-

Karoon Energy (KAR)

Upgraded to overweight from neutral at Barrenjoey; Price Target: $2.37 from $2.08

Upgraded to buy from overweight at Jarden; Price Target: $2.40 from $2.35

Retained at buy Goldman Sachs; Price Target: $2.41 from $2.55

Retained at buy Citi; Price Target: $3.25

Retained at add Morgans; Price Target: $2.80 from $2.95

Macquarie Technology Group (MAQ) retained at sector perform RBC Capital Markets; Price Target: $75.00

Mineral Resources (MIN) retained at accumulate Ord Minnett; Price Target: $67.00

Megaport (MP1) retained at outperform RBC Capital Markets; Price Target: $13.00

-

Nanosonics (NAN)

Downgraded to underweight from neutral at JPMorgan; Price Target: $3.40 from $3.65

Downgraded to market-weight from overweight at Wilsons; Price Target: $3.95 from $5.46

Retained at sell Goldman Sachs; Price Target: $3.00 from $3.80

Retained at sell Citi; Price Target: $3.90

Netwealth Group (NWL) downgraded to neutral from positive at E&P; Price Target: $15.80 from $15.30

Nextdc (NXT) retained at outperform RBC Capital Markets; Price Target: $16.00

Orecorp (ORR) retained at hold Bell Potter; Price Target: $0.55 from $0.58

Pro Medicus (PME) retained at sector perform RBC Capital Markets; Price Target: $90.00

Polynovo (PNV) downgraded to hold from add at Morgans; Price Target: $1.95 from $1.88

Papyrus Australia (PQI) retained at buy Morgans; Price Target: $1.38 from $2.42

Qoria (QOR) retained at buy Ord Minnett; Price Target: $0.34 from $0.32

Ramsay Health Care (RHC) retained at neutral Citi; Price Target: $50.00 from $51.00

Resmed Inc (RMD) retained at neutral Citi; Price Target: $29.00

Sonic Healthcare (SHL) retained at buy Citi; Price Target: $33.00

Stanmore Resources (SMR) retained at buy Ord Minnett; Price Target: $4.30

-

Transurban Group (TCL)

Retained at buy Goldman Sachs; Price Target: $13.10

Retained at neutral E&P; Price Target: $13.63

-

Viva Energy Group (VEA)

Retained at neutral Goldman Sachs; Price Target: $3.40 from $3.43

Retained at hold Ord Minnett; Price Target: $3.35

Retained at buy UBS; Price Target: $3.50

Wesfarmers (WES) retained at sector perform Ord Minnett; Price Target: $42.00

Wisetech Global (WTC) retained at sector perform RBC Capital Markets; Price Target: $75.00

Xero (XRO) retained at sector perform RBC Capital Markets; Price Target: $115.00

Scans

This article first appeared on Market Index on 24 January 2024.

5 topics

11 stocks mentioned