ASX 200 lower as earnings sends major blue chips in starkly different directions

Today in Review

The S&P/ASX200 (XJO) finished 11.3 points lower at 7,603.6, 0.38% from its session high and just 0.06% from its low. Despite the fall in the ASX 200, in the broader-based S&P/ASX 300 (XKO), advancers beat decliners by 159 to 121.

The All Ordinaries Gold Sub-Index (XGD) (+1.5%) was the best performing sector today. The gold price is largely unchanged over the last 24-hours, and prior to today, this index had logged five out of six down sessions. So, today's rally is a little out of step with the short term trend.

%20chart.png)

It will be interesting to see how gold stocks go tomorrow, because as mysterious as today's move was, it was impressively broad-based.

Doing it tough today was the Health Care Sector (XHJ) (-1.6%), largely on the back of another poor performance from sector heavyweight CSL (-2.8%). Things went from bad to worse for CSL shareholders who were already smarting from yesterday's news the company would not proceed with commercialising a key heart drug after disappointing Phase 3 trials.

Today's first half results were roughly in-line with consensus estimates, so it's hard to see where yesterday's price response ends and today's begins. Either way, as we'll see in ChartWatch, either way the end result isn't great.

Also smarting from negative results response was James Hardie Industries (JHX) (-8.5%). The key numbers of revenue, EBITDA, and margins were bang on target compared to consensus estimates, but the company's outlook was considered by some brokers to be below expectations. James Hardie is also featured in ChartWatch.

There were many other big earnings-inspired moves today, and you'll find more details on these and more in the Interesting Movers section below.

ChartWatch

Temple & Webster Group (ASX: TPW)

I often use the term "picture of excess demand" in ChartWatch. Temple and Webster is a poster child for this phrase, with fantastic trends, excellent price action, and wonderful demand-side candles.

Today's candle could have closed a little higher, but it's still a great representation of how demand sweeps back in to buy the dip. If there was an early supply response to today's earnings, it was gobbled up quickly by plenty of greedy demand! The best uptrends are punctuated with buy the dip activity like this, as well as rising troughs, and pervasive white candles. Tick, tick, tick!

CSL (ASX: CSL)

The last few ChartWatch's I've discussed the importance of the gap and run pattern. Big gap plus big move equals big shift in sentiment towards a stock. So far though, we've only looked at it in a bullish context, that is gaps up and moves higher.

This has not been by design, rather, simply in response to earnings season moves so far. Today we saw a few bearish gap and run moves, in particular, on CSL, James Hardie Industries (JHX), and Breville Group (BRG).

In each case, there was likely something in each company's results that caused investors to negatively reassess their respective earnings outlooks. In each case, it's a real shame because prevailing short and long term trends were well-established to the upside. Such is the nature of trend following (you don't know what's coming next), and also of the surprise factor earnings season brings with it.

CSL's gap was yesterday and it's run was today. Together, they effectively nullify its short term uptrend as can be seen by the short term trend ribbon transitioning from light green to amber. Only the long term trend ribbon can save CSL from a larger retracement now. That kicks in around $276, and we really want to see some white candles and/or downward pointing shadows there to indicate excess demand has returned.

James Hardie Industries (ASX: JHX)

Another crying shame! Like CSL, James Hardie's bearish gap and run effectively terminates what was a fantastic short term uptrend. Whilst the short term trend ribbon hasn't changed colour to amber yet, a close below the ribbon with such a definitive supply-side candle is enough for me to be satisfied the supply-side has wrestled control of the price for now.

I suggest the James Hardie price must now hold within/above a range of historical resistance/support I've identified between $52.87 (15 Dec peak high) and $53.46 (8 Jan trough low). Demand-side candles in there are essential to stave off a sharper retracement to the long term trend ribbon which will kick in around $50.

Economy

Today

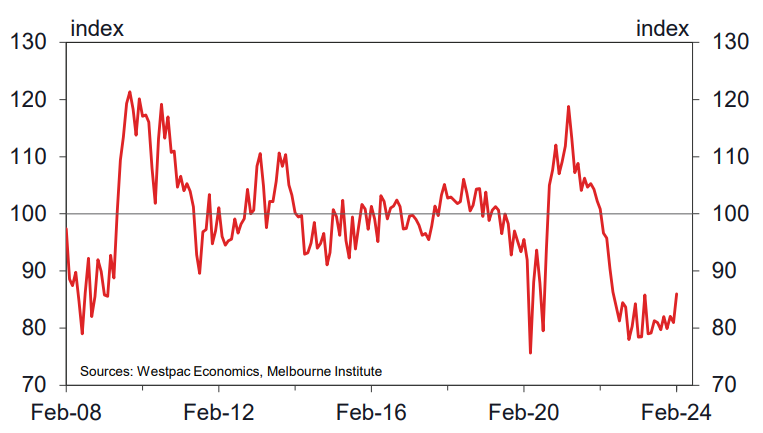

AU Westpac Consumer Sentiment

+6.2% to 86 points vs -1.3% in January

Remains below the key 100 point level which delineates optimism from pessimism

Result was strongest in 20-months and is the largest month-on-month gain since April 2023 when the RBA did it's mini-pause on rate hikes

See chart below, turning off the bottom, but still a long way to go!

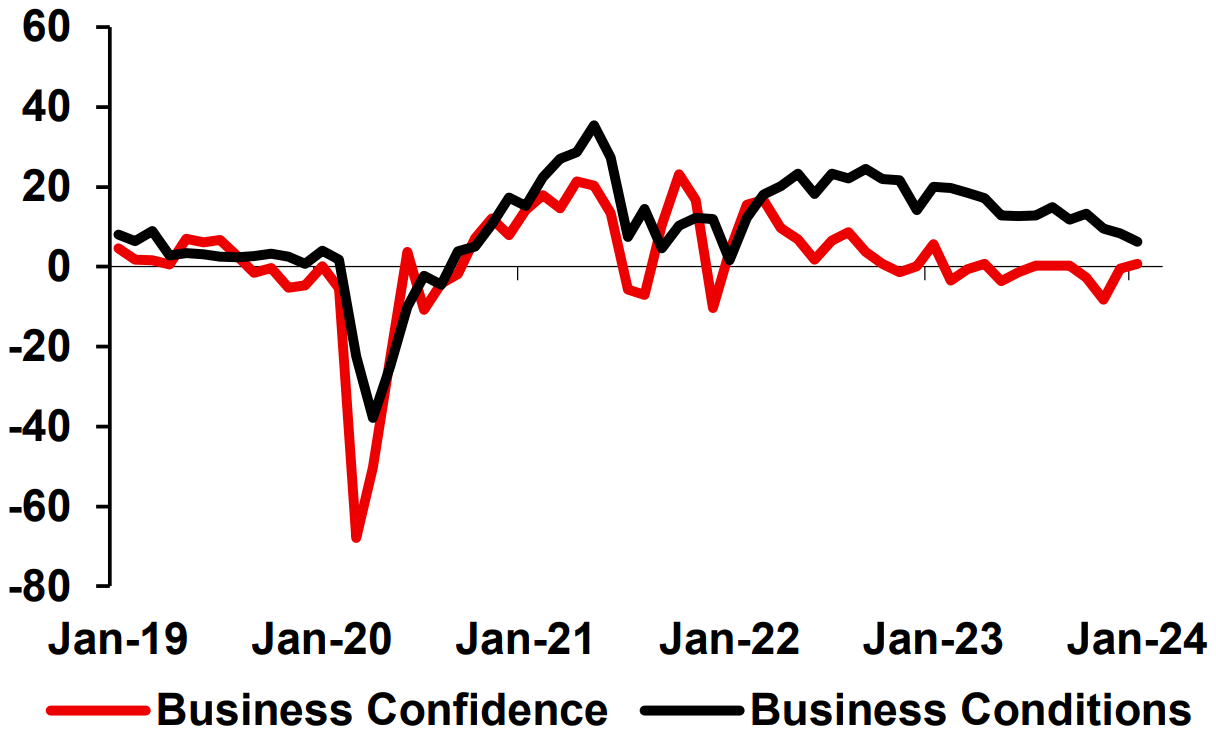

AU NAB Business Confidence

Business Confidence +1 point to +1 (still a big improvement from the -8 in November)

Business Conditions -2 points to +6 (Trading conditions -3pts, Profitability -1pt, Employment -2pts)

Forward orders -1pt to -1, labour costs unchanged at +2%

Services sectors are under pressure and retail remains weak

.%20Source-NAB%20Monthly%20Business%20Survey.png)

Later this week

Wednesday

00:30 USA Core Consumer Price Index (CPI): forecast +0.3% in Jan to 3.7% p.a. vs +0.3% in Dec to 3.9% p.a.

Thursday

11:30 AU Employment change and unemployment rate: forecast +20,700 in Jan vs -65,100 in Dec & forecast 4.0% in Jan vs 3.9% in Dec

Friday

00:30 US Core Retail Sales: +0.1% in Jan vs +0.4% in Dec

Saturday

00:30 USA Core Producer Price Index (CPI): forecast +0.1% in Jan to 1.4% p.a. vs +0.0% in Dec to 1.0% p.a.

04:10 USA Preliminary University of Michigan Consumer Sentiment: 79.9 in Feb vs 79. in Jan

Latest News

Double-digit returns collide with drug trial setback for CSL

Post-earnings broker moves: Audinate, ANZ, Aurizon, Boral, Beach Energy, CAR & JB Hi-fi

Net profits "substantially down" at the Millionaires' Factory

The value investor’s guide to AI

Insider Trades: Directors are buying shares in these 8 small cap ASX explorers

Short Selling: Short interest in Syrah and Chalice Mining tick higher, GUD and Bapcor shorts ease

Don't miss an ASX announcement this reporting season, check out our comprehensive H1 FY24 Earnings Season Calendar and set up and receive announcements direct to your inbox on Market Index: Create Alert Now

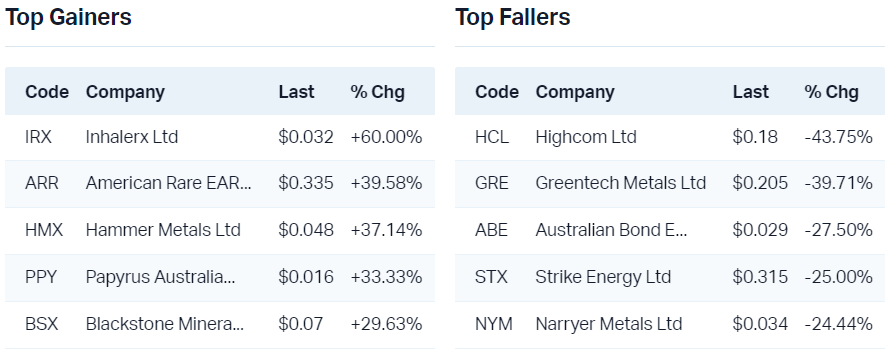

Interesting Movers

Trading higher

+9.9% Temple & Webster Group (TPW) - Half Yearly Report and Accounts

+9.0% Catapult Group International (CAT) - No news, rise is consistent with prevailing short and long term uptrends

+8.4% Challenger (CGF) - 1H24 Financial Results

+8.0% Beacon Lighting Group (BLX) - No news, rise is consistent with prevailing short and long term uptrends

+7.4% EML Payments (EML) - No news 🤔

+7.0% Piedmont Lithium Inc (PLL) - No news 🤔

+6.7% Beach Energy (BPT) - Continued positive response to yesterday's: Beach Energy FY24 Half Year Results, rise is consistent with prevailing short and long term uptrends

+6.4% Emerald Resources (EMR) - No news, rise is consistent with prevailing short and long term uptrends

"+6.3% Cettire (CTT) - Continued positive response to 7 Feb: H1 FY24 Appendix 4D and Financial Report, rise is consistent with prevailing short and long term uptrends

+5.6% JB HI-FI (JBH) - Continued positive response to yesterday's: Appendix 4D and Financial Report - 2024 Half Year, rise is consistent with prevailing short and long term uptrends

+4.7% Bravura Solutions (BVS) - No news, rise is consistent with prevailing short and long term uptrends

+4.7% Hansen Technologies (HSN) - Hansen acquires powercloud, rise is consistent with prevailing short and long term uptrends

+4.5% Accent Group (AX1) - No news, rise is consistent with prevailing short and long term uptrends

Trading lower

-25.0% Strike Energy (STX) - South Erregulla Update

-10.9% Seven West Media (SWM) - Appendix 4D & Half Year Financial Report, fall is consistent with prevailing short and long term downtrends

-8.5% Breville Group (BRG) - Half Year Ended 31 December 2023 - Appendix 4D

-8.5% James Hardie Industries (JHX) - Q3 FY24 Results Pack

-6.6% Zip Co (ZIP) - No news 🤔

-4.6% Seek (SEK) - FY2024 Appendix 4D and Half Year Report

-4.5% Calix (CXL) - Pullback positive response to yesterday's: ZESTY FEED study results published, fall is consistent with prevailing short and long term downtrends

-4.1% Fineos Corporation Holdings (FCL) - No News, closed below long tem trend ribbon, short term trend ribbon transitioning to down

-3.9% Ridley Corporation (RIC) - Possible strategic positioning ahead of first half FY24 results tomorrow-

-2.9% Cedar Woods Properties (CWP) - No news, fall is consistent with prevailing short and long term downtrends

-2.8% CSL (CSL) - Statutory Accounts for the Half Year Ended 31 December 2023

Broker Notes

-

Audinate Group (AD8)

Retained at buy at UBS; Price Target: $21.05 from $13.55

Retained at overweight at Morgan Stanley; Price Target: $22.00 from $13.30

Retained at neutral at Macquarie; Price Target: $17.90 from $15.80

-

ANZ Group (ANZ)

Retained at neutral at Citi; Price Target: $26.00

Retained at buy at Goldman Sachs; Price Target: $27.84

Retained at neutral at UBS; Price Target: $25.00

Retained at overweight at Morgan Stanley; Price Target: $27.40

Retained at neutral at Macquarie; Price Target: $25.00

Retained at neutral at Jarden; Price Target: $26.70 from $26.30

Retained at accumulate at Ord Minnett; Price Target: $31.00

-

Aurizon Holdings (AZJ)

Downgraded to neutral from positive at E&P; Price Target: $3.97 from $4.00

Retained at neutral at Citi; Price Target: $4.00 from $3.90

Retained at neutral at Goldman Sachs; Price Target: $4.05

Retained at neutral at UBS; Price Target: $3.80 from $3.65

Retained at underweight at Morgan Stanley; Price Target: $3.49

Retained at neutral at Macquarie; Price Target: $3.85 from $3.88

Retained at neutral at Jarden; Price Target: $3.95 from $3.80

Retained at accumulate at Ord Minnett; Price Target: $4.70

Black Cat Syndicate (BC8) retained at buy at Shaw and Partners; Price Target: $0.74

-

Beach Energy (BPT)

Upgraded to outperform from neutral at Macquarie; Price Target: $1.95 from $1.55

Upgraded to outperform from sector perform at RBC Capital Markets; Price Target: $1.95 from $1.70

Retained at neutral at Citi; Price Target: $1.65

Retained at sell at Goldman Sachs; Price Target: $1.67 from $1.66

Retained at buy at Bell Potter; Price Target: $1.90

Retained at equalweight at Morgan Stanley; Price Target: $1.65

Retained at overweight at Jarden; Price Target: $1.85

Retained at accumulate at Ord Minnett; Price Target: $2.50

Breville Group (BRG) retained at neutral at Jarden; Price Target: $23.80

-

CAR Group (CAR)

Downgraded to neutral from outperform at Macquarie; Price Target: $32.70 from $35.30

Downgraded to neutral from overweight at Barrenjoey; Price Target: $36.00 from $30.00

Downgraded to underperform from outperform at CLSA; Price Target: $35.00 from $31.00

Retained at neutral at Citi; Price Target: $34.30

Retained at neutral at Goldman Sachs; Price Target: $33.00 from $32.00

Retained at buy at UBS; Price Target: $38.50 from $32.40

Retained at underweight at Jarden; Price Target: $29.00 from $27.50

Retained at lighten at Ord Minnett; Price Target: $26.00 from $25.00

Challenger (CGF) retained at overweight at Jarden; Price Target: $7.25

Cochlear (COH) retained at underweight at Morgan Stanley; Price Target: $258.00

Charter Hall Social Infrastructure REIT (CQE) retained at underweight at Jarden; Price Target: $3.05

-

CSL (CSL)

Retained at buy at Citi; Price Target: $325.00

Retained at overweight at Morgan Stanley; Price Target: $318.00

Retained at outperform at Macquarie; Price Target: $317.50 from $322.50

Retained at overweight at Jarden; Price Target: $298.57 from $316.16

Retained at hold at Ord Minnett; Price Target: $310.00

IDP Education (IEL) upgraded to buy from outperform at CLSA; Price Target: $23.50 from $24.50

IGO (IGO) retained at outperform at Macquarie; Price Target: $9.20

-

Iluka Resources (ILU)

Retained at buy at Goldman Sachs; Price Target: $9.80

Retained at outperform at Macquarie; Price Target: $8.30

Janison Education Group (JAN) retained at buy at Bell Potter; Price Target: $0.50 from $0.55

-

JB Hi-Fi (JBH)

Upgraded to neutral from negative at E&P; Price Target: $56.19 from $43.43

Upgraded to hold from underperform at Jefferies; Price Target: $52.50 from $38.50

Retained at buy at Citi; Price Target: $65.00

Retained at neutral at Goldman Sachs; Price Target: $56.50 from $54.10

Retained at neutral at UBS; Price Target: $60.00 from $55.00

Retained at underweight at Morgan Stanley; Price Target: $50.00 from $43.90

Retained at neutral at Macquarie; Price Target: $64.00 from $55.00

Retained at underweight at Jarden; Price Target: $50.80 from $40.20

Retained at sell at Ord Minnett; Price Target: $37.50 from $36.40

James Hardie Industries (JHX) retained at neutral at Jarden; Price Target: $48.00

Arcadium Lithium (LTM) retained at outperform at Macquarie; Price Target: $11.00

-

Lynas Rare Earths (LYC)

Retained at buy at Goldman Sachs; Price Target: $7.20 from $7.50

Retained at outperform at Macquarie; Price Target: $7.00

Mineral Resources (MIN) retained at outperform at Macquarie; Price Target: $75.00

Noumi (NOU) initiated at buy at Bell Potter; Price Target: $0.16

Propel Funeral Partners (PFP) retained at buy at Bell Potter; Price Target: $6.20 from $5.90

Pilbara Minerals (PLS) retained at outperform at Macquarie; Price Target: $4.50

Pinnacle Investment Management Group (PNI) upgraded to buy from hold at Ord Minnet; Price Target: $13.00 from $10.50

QBE Insurance Group (QBE) retained at outperform at Macquarie; Price Target: $16.60

Scentre Group (SCG) retained at overweight at Morgan Stanley; Price Target: $3.30

Seek (SEK) retained at buy at Jarden; Price Target: $29.60

Synlait Milk (SM1) retained at hold at Bell Potter; Price Target: $0.75 from $0.95

Santos (STO) downgraded to neutral from buy at Citi; Price Target: $7.75 from $8.25

Temple & Webster Group (TPW) retained at buy at Jarden; Price Target: $8.56

Woodside Energy Group (WDS) retained at sell at Citi; Price Target: $27.00 from $26.50

Worley (WOR) retained at buy at UBS; Price Target: $21.30 from $22.50

Scans

This article first appeared on Market Index on 13 February 2024.

5 topics

10 stocks mentioned