ASX 200 nails 5 from 5, sniffs record as resources rejoice MinRes update, China rate cut

Today in Review

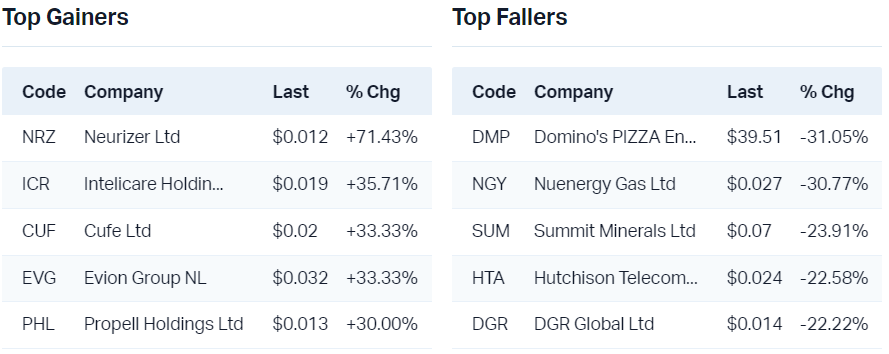

Markets

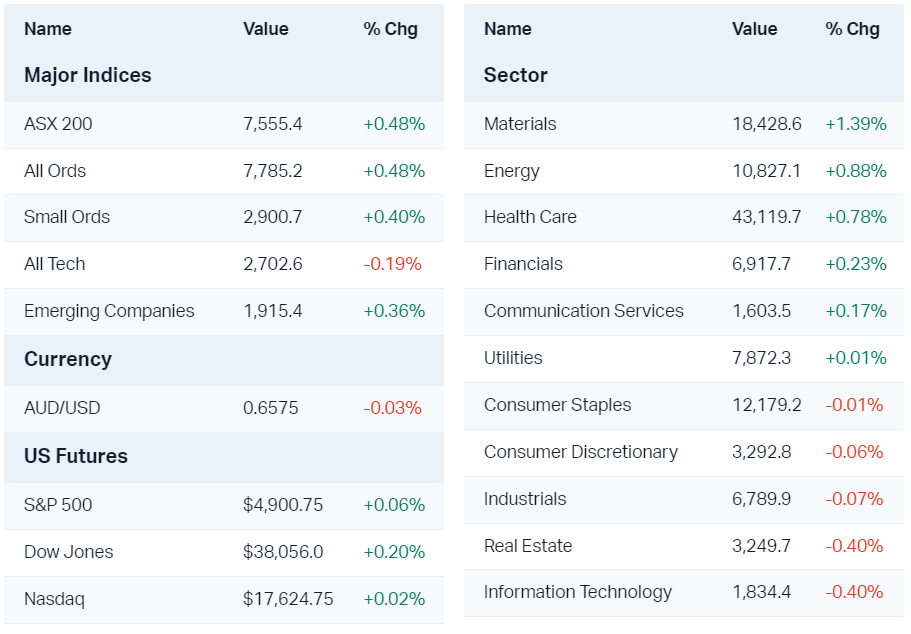

ASX 200 Session Chart

%20Intraday%20Chart%2025%20Jan%202024.png)

The S&P/ASX200 (XJO) finished 36.2 points higher at , 0.48% from its session low and just 0.05% from its high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by 154 to 113.

For the week, the XJO finished up 134.2 points or 1.8% higher. It's now only 78 points or just 1% from setting a new record high...a tantalising prospect indeed!

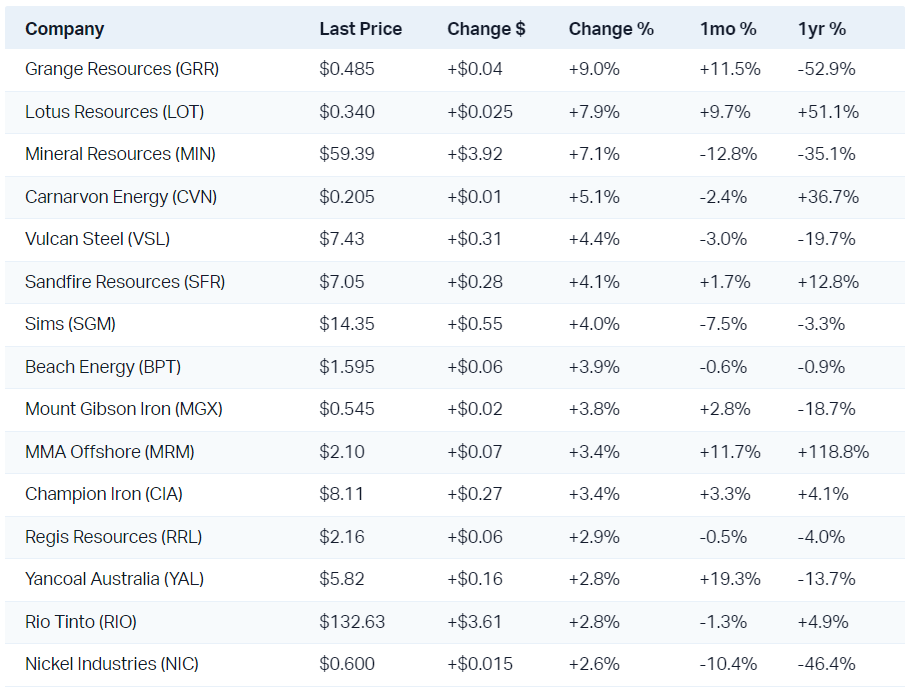

Materials (XMJ) +1.4% and Energy (XEJ) +0.9% were the best two performing sectors today, likely in response to The People's Bank of China's 50 basis point cut to Chinese banks' reserve ratio requirement (RRR). Relending & rediscounting rates were also each cut 25 basis points.

The PBoC also indicated there remains potential for further monetary policy easing, including loans to support the country's beleaguered real estate developers. The cut to the RRR is expected to add around US$140 billion in stimulus to the Chinese economy, which last year logged GDP of nearly US$18 trillion, so a bit more than mere peanuts!

Certainly, investors thought so, pushing major Chinese stock indices higher today. The CSI China Mainland Real Estate Index is tracking 5.6% higher at the time of writing, and is an impressive 10.2% higher than Tuesday's low.

%20chart.png)

The S&P/ASX 200 Resources Index (XJR) contains a mix of Australia's largest mining and energy companies. This makes it an interesting sub-sector index to track compared to its better known counterparts, the Materials (XMJ) and Energy (XEJ) sectors.

From a technical standpoint, the recent rally is encouraging, dragging the XJR above both the short and long term trend ribbons. It's a good start, but more work needs to be done to turn the prevailing short term downtrend ribbon, and swing the long term trend ribbon back to up from its current neutral status.

The above should be achieved by the XJR logging higher peaks and higher troughs, preferably with plenty of demand-side candles (i.e., white bodies and or downward pointing candle shadows). Ultimately though, the XJR seems content to trade in a very well defined range between 5677 and 6551. The good news for now is we're still closer to the bottom of this range than the top!

Economy

No major economic data releases today!

What to watch out for...

Later this week:

Fri - ECB interest rate decision; US Durable Goods, US New & Pending Home Sales, US PCE Price Index, US Personal Spending & Personal Incomes

Latest News

How the Domino’s (ratings) fell!

20 stocks to watch this February ASX reporting season

The biggest gold hits of the week – Emerald Resources, Spartan Resources

2 key takeaways from MinRes' December quarter report

Is the worst over for Pilbara Minerals?

Which bank? What the brokers love and hate in 2024

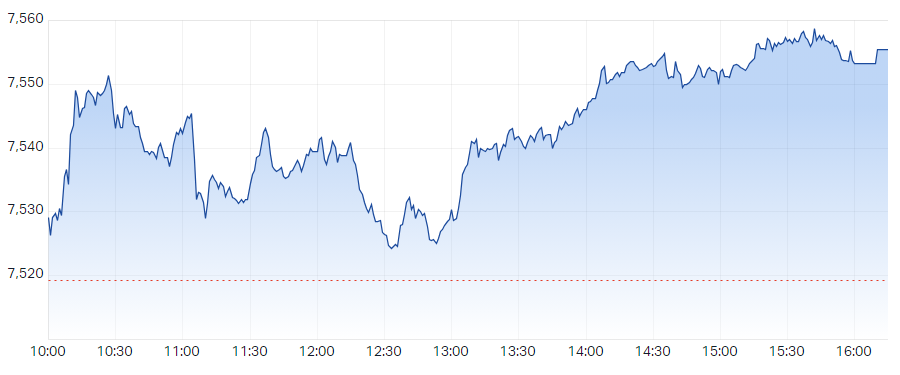

Interesting Movers

Trading higher

+10.3% Develop Global (DVP) - No news, possible short covering rally in several mining stocks which have been heavily sold off recently, China rate cut contributing to sector rally

+9.0% Grange Resources (GRR) - GRR - Quarterly Report for 3 months ended 31 December 2023

+8.8% Weebit Nano (WBT) - No news, Weebit hasn't been on this list for a while so was perhaps overdue!

+8.4% Kogan.Com (KGN) - Continued positive response to 24 Jan Kogan.com January 2024 Business Update

+7.9% Lotus Resources (LOT) - No news, general strength in uranium sector, rise is consistent with prevailing short and long term uptrends

+7.1% Mineral Resources (MIN) - FY24 Q2 Quarterly Activities Report

+6.4% Resmed Inc (RMD) - ResMed Announces Results for the Second Quarter of FY2024

+6.1% 29METALS (29M) - No news, China rate cut contributing to sector rally

+5.9% Beacon Lighting Group (BLX) - No news, consistent with recent high volatility

+5.1% Carnarvon Energy (CVN) - No news, trying to bounce from short term uptrend ribbon, rise is consistent with prevailing long term uptrend

+4.8% Red 5 (RED) - No news, bouncing from short term uptrend ribbon, rise is consistent with prevailing long term uptrend

+4.7% Incitec Pivot (IPL) - IPL announces details of $500m capital return

+4.5% Humm Group (HUM) - No news, rise is consistent with prevailing short and long term uptrends

+4.5% Nanosonics (NAN) - Bounce after massive sell off on 23 Jan H1 FY24 trading update and expectations for FY24

Trading lower

-31.0% Domino's Pizza Enterprises (DMP) - Trading Update

-9.1% Sayona Mining (SYA) - Operational Review to Optimise NAL Cost Structure, fall is consistent with prevailing short and long term downtrends

-5.5% Piedmont Lithium Inc (PLL) - Sayona news is related, fall is consistent with prevailing short and long term downtrends

-5.0% Block Inc. (SQ2) - No news, fall is consistent with prevailing short term downtrend, long term trend ribbon under pressure

-4.8% Homeco Daily Needs Reit (HDN) - No news, broke below $1.195 technical support level

-4.5% Worley (WOR) - No news, fall is consistent with prevailing short term downtrend, long term trend turning down, broke below $15.41 technical support level

-4.2% Chrysos Corporation (C79) - Continued fallout from 24 Jan Chrysos Quarterly Presentation Q2 FY24

-3.9% Charter Hall Social Infrastructure Reit (CQE) - No news, fall is consistent with prevailing short term downtrend, long term trend turning down, broke below $2.75 technical support level

Broker Notes

The A2 Milk Company (A2M) retained at neutral Goldman Sachs; Price Target: $4.30 from $4.00

AMA Group (AMA) retained at buy Bell Potter; Price Target: $0.14 from $0.15

-

ANZ Group (ANZ)

Downgraded to neutral from overweight at Jarden; Price Target: $26.30 from $26.50

Retained at negative E&P; Price Target: $21.00

APA Group (APA) retained at neutral Macquarie; Price Target: $8.94

ARB Corporation (ARB) retained at hold Ord Minnett; Price Target: $36.00

-

AUB Group (AUB)

Retained at buy Goldman Sachs; Price Target: $32.00 from $31.00

Retained at positive E&P; Price Target: $35.70

Accent Group (AX1) retained at positive E&P; Price Target: $2.43

Boral (BLD) downgraded to sell from neutral at Goldman Sachs; Price Target: $4.90 from $4.70

Breville Group (BRG) retained at buy Goldman Sachs; Price Target: $30.20 from $25.70

Big River Industries (BRI) retained at buy Ord Minnett; Price Target: $2.43 from $2.48

Bluescope Steel (BSL) retained at buy UBS; Price Target: $25.80 from $24.00

BWP Trust (BWP) retained at hold Ord Minnett; Price Target: $3.60

Chrysos Corporation (C79) retained at buy Bell Potter; Price Target: $8.30 from $8.70

Catapult Group International (CAT) retained at positive E&P; Price Target: $3.16

Commonwealth Bank of Australia (CBA) retained at negative E&P; Price Target: $80.00

-

Credit Corp Group (CCP)

Upgraded to buy from hold at Canaccord Genuity; Price Target: $20.00 from $13.20

Retained at positive E&P; Price Target: $24.81

Cluey (CLU) retained at buy Bell Potter; Price Target: $0.20 from $0.22

Cooper Energy (COE) retained at neutral Jarden; Price Target: $0.15

-

Cochlear (COH)

Downgraded to sell from neutral at Citi; Price Target: $255.00

Retained at underweight Morgan Stanley; Price Target: $240.00

Coles Group (COL) retained at sell Goldman Sachs; Price Target: $14.00 from $13.35

Computershare (CPU) retained at buy Goldman Sachs; Price Target: $27.00

-

CSR (CSR)

Retained at buy Goldman Sachs; Price Target: $7.10 from $6.50

Retained at positive E&P; Price Target: $6.47

Corporate Travel Management (CTD) downgraded to neutral from buy at Goldman Sachs; Price Target: $20.70 from $20.60

Cettire (CTT) retained at positive E&P; Price Target: $3.48

-

Core Lithium (CXO)

Retained at sell Goldman Sachs; Price Target: $0.14 from $0.15

Retained at neutral Macquarie; Price Target: $0.20

-

Domino's Pizza Enterprises (DMP)

Downgraded to underperform from hold at Jefferies; Price Target: $46.00 from $47.00

Downgraded to hold from add at Morgans; Price Target: $50.00 from $61.00

Downgraded to neutral from overweight at Jarden; Price Target: $50.00 from $65.00

Retained at sell UBS; Price Target: $42.00 from $43.00

Retained at overweight Morgan Stanley; Price Target: $68.00 from $70.00

Retained at sell Goldman Sachs; Price Target: $37.50 from $40.30

Downer EDI (DOW) retained at neutral Macquarie; Price Target: $4.10

DUG Technology (DUG) retained at positive E&P; Price Target: $2.81

-

Endeavour Group (EDV)

Upgraded to equal-weight from underweight at Morgan Stanley; Price Target: $5.80 from $5.60

Retained at buy Goldman Sachs; Price Target: $6.40

Fletcher Building (FBU) retained at buy Goldman Sachs; Price Target: $4.90 from $5.00

-

Flight Centre Travel Group (FLT)

Retained at neutral Goldman Sachs; Price Target: $20.70 from $20.00

Retained at positive E&P; Price Target: $27.37

-

Genesis Minerals (GMD)

Upgraded to outperform from neutral at Macquarie; Price Target: $2.00

Retained at hold Ord Minnett; Price Target: $1.70 from $1.75

-

GQG Partners Inc. (GQG)

Retained at outperform Macquarie; Price Target: $2.25

Retained at outperform Macquarie; Price Target: $2.25 from $2.15

Harvey Norman Holdings (HVN) retained at neutral Goldman Sachs; Price Target: $4.00 from $3.80

-

IDP Education (IEL)

Downgraded to hold from add at Morgans; Price Target: $23.45 from $27.90

Retained at overweight Jarden; Price Target: $27.25 from $29.00

Retained at buy Bell Potter; Price Target: $25.00 from $27.00

Infomedia (IFM) retained at positive E&P; Price Target: $1.99

Iluka Resources (ILU) retained at equalweight Morgan Stanley; Price Target: $7.15 from $7.40

Imdex (IMD) retained at buy Citi; Price Target: $2.20

JB HI-FI (JBH) retained at neutral Goldman Sachs; Price Target: $54.10 from $44.80

Judo Capital Holdings (JDO) retained at equalweight Morgan Stanley; Price Target: $1.21 from $1.07

James Hardie Industries (JHX) retained at buy Goldman Sachs; Price Target: $62.50 from $65.45

-

Kogan.Com (KGN)

Retained at sell Citi; Price Target: $4.30

Retained at buy Ord Minnett; Price Target: $10.70

Light & Wonder Inc. (LNW) upgraded to buy from overweight at Jarden; Price Target: $147.00 from $141.00

Lovisa Holdings (LOV) retained at positive E&P; Price Target: $26.61

Liontown Resources (LTR) upgraded to buy from neutral at UBS; Price Target: $1.25 from $1.50

Magellan Financial Group (MFG) downgraded to underperform from neutral at Macquarie; Price Target: $7.60 from $7.00

Mineral Resources (MIN) retained at outperform RBC Capital Markets; Price Target: $75.00

Monadelphous Group (MND) retained at outperform Macquarie; Price Target: $15.05

Metcash (MTS) retained at neutral Goldman Sachs; Price Target: $3.60 from $3.70

National Australia Bank (NAB) downgraded to negative from neutral at E&P; Price Target: $26.00

-

Nanosonics (NAN)

Retained at hold Bell Potter; Price Target: $3.20 from $4.85

Retained at hold Ord Minnett; Price Target: $4.00

-

Northern Star Resources (NST)

Retained at neutral UBS; Price Target: $11.95

Retained at neutral Citi; Price Target: $13.00 from $12.30

Upgraded to accumulate from hold at Ord Minnett; Price Target: $13.90 from $12.40

Retained at equalweight Morgan Stanley; Price Target: $12.95

Retained at neutral Goldman Sachs; Price Target: $11.23 from $11.05

Retained at outperform Macquarie; Price Target: $16.00 from $15.50

NRW Holdings (NWH) retained at neutral Macquarie; Price Target: $2.70

OOH!Media (OML) retained at positive E&P; Price Target: $1.74

Propel Funeral Partners (PFP) retained at outperform Macquarie; Price Target: $5.95

Plato Income Maximiser (PLA) retained at neutral Citi; Price Target: $3.60

-

Pilbara Minerals (PLS)

Retained at hold Bell Potter; Price Target: $3.60

Retained at sell UBS; Price Target: $2.75 from $3.05

Retained at underperform Morgan Stanley; Price Target: $2.85

Retained at sell Goldman Sachs; Price Target: $2.95 from $3.20

Retained at outperform Macquarie; Price Target: $4.50 from $4.40

Pro Medicus (PME) downgraded to sell from neutral at Citi; Price Target: $72.00

-

Premier Investments (PMV)

Retained at overweight Morgan Stanley; Price Target: $32.00

Retained at sell Goldman Sachs; Price Target: $23.50 from $22.30

Perseus Mining (PRU) retained at outperform Macquarie; Price Target: $2.60

Prospect Resources (PSC) upgraded to buy from neutral at UBS; Price Target: $5.40

Peter Warren Automotive Holdings (PWR) retained at positive E&P; Price Target: $3.07

Qualitas (QAL) retained at positive E&P; Price Target: $3.60

Regis Resources (RRL) retained at outperform RBC Capital Markets; Price Target: $2.50

Reliance Worldwide Corporation (RWC) retained at buy Goldman Sachs; Price Target: $4.70 from $4.25

-

Steadfast Group (SDF)

Downgraded to neutral from overweight at JPMorgan; Price Target: $6.45 from $6.40

Retained at neutral Goldman Sachs; Price Target: $5.90

Sims (SGM) upgraded to neutral from sell at UBS; Price Target: $14.00 from $12.00

Super Retail Group (SUL) retained at buy Goldman Sachs; Price Target: $17.80 from $14.40

Seven Group Holdings (SVW) retained at outperform Macquarie; Price Target: $33.60

Treasury Wine Estates (TWE) retained at buy Goldman Sachs; Price Target: $12.40

Ventia Services Group (VNT) retained at outperform Macquarie; Price Target: $3.30 from $3.25

Vulcan Steel (VSL) retained at buy UBS; Price Target: $8.20 from $9.00

Westpac Banking Corporation (WBC) retained at neutral E&P; Price Target: $20.00

-

Woodside Energy Group (WDS)

Retained at neutral UBS; Price Target: $32.60 from $32.90

Retained at neutral Macquarie; Price Target: $31.00

Webjet (WEB) retained at buy Goldman Sachs; Price Target: $8.10

-

Wesfarmers (WES)

Upgraded to buy from neutral at Goldman Sachs; Price Target: $62.90 from $49.80

Upgraded to neutral from buy at Goldman Sachs; Price Target: $62.90 from $49.80

Worley (WOR) retained at outperform Macquarie; Price Target: $18.85

Woolworths Group (WOW) retained at buy Goldman Sachs; Price Target: $43.30 from $42.40

Scans

This article first appeared on Market Index on 25 January 2025.

5 topics

13 stocks mentioned