ASX 200 to rise + What's next for the S&P 500 after closing at a 14 month high

ASX 200 futures are trading 25 points higher, up 0.35% as of 8:30 am AEST.

S&P 500 SESSION CHART

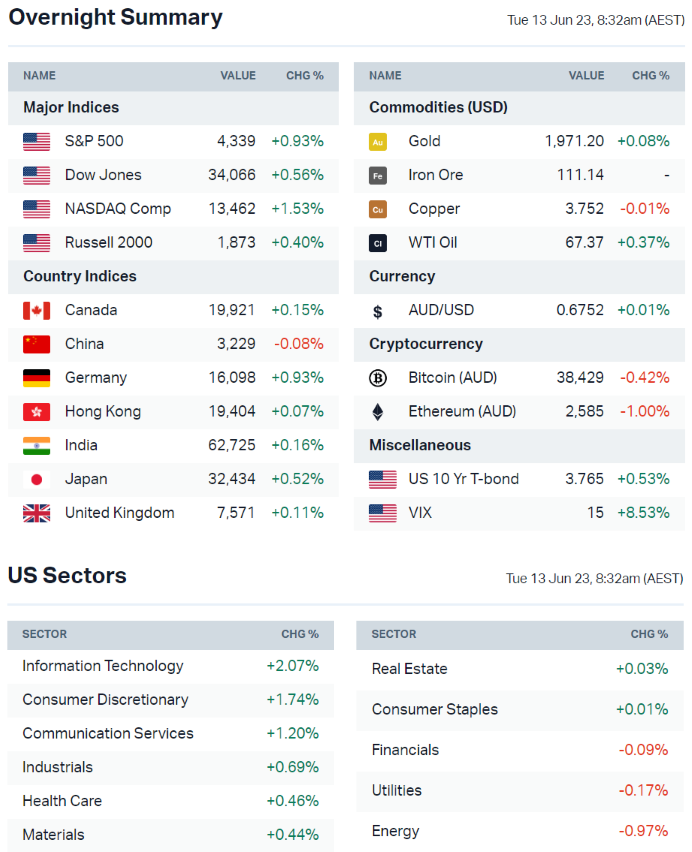

MARKETS

- Monday: S&P 500 finished higher, closed near best levels

- Last Friday: S&P 500 closed up 0.12%, down from session highs of 0.7%

- Bullish focus points: US ISM prices paid fell back to pre-pandemic levels, Goldman Sachs lowered its US recession probability from 35% to 25%, equal-weight S&P 500 outperforming megacap tech in past few sessions and breadth improvement

- Bearish focus points: Central banks pivoting back to tightening (RBA and BoC), AAII bull-bear spread flags to highest since Nov 21, TGA rebuild commenced

- Fed pause probabilities currently at 79.7% (75.9% a week ago) but previewed acknowledge it as a close call and a hawkish lean is expected

- AAII bullish sentiment increased 15.5 pp for the week ended 7 June to 44.5% – The highest since November 2021, flagging cautious signal for equity rally

- Investors load up on call options ahead of Thursday's Fed meeting (Bloomberg)

- Fed to raise rates at least twice more to tame inflation (FT)

- Fed to wait-and-see, recession fears subside, inflation to 'fall off a cliff' (FT)

- Soft landing, earnings recovery, peak Fed can help stocks rise (Yahoo)

- Investors are piling back into S&P 500 equal-weighted ETF (Bloomberg)

STOCKS

- Illumina CEO DeSouza steps down amid Icahn pressure (Bloomberg)

- GrubHub laying off ~15% of its workforce as it tries to control costs (Bloomberg)

- Nasdaq shares tumbled after plans to buy Adeza for US$10.5bn (CNBC)

- Oracle shares rallied after Wolfe Research upgraded the stock to Outperform (CNBC)

ECONOMY

- US CPI due tonight – Headline expected to increase 0.2% month-on-month, pushing year-on-year rate to 4.1% from 4.9%. Core inflation expected to rise 0.4%, which will lower the year-on-year rate to 5.3% from 5.5%

- Saudi output cuts have not shifted bears' concerns about China growth (Bloomberg)

- US economy defies gloomy expectations, raises scope for soft landing (NY Times)

- China producer prices fall at fastest pace in 7-years on weak demand (Reuters)

- China's low inflation gives central bank room to cut rates (Bloomberg)

- Several Chinese banks cut interest rates on range of yuan deposits (Reuters)

- UK recession risks ease on falling energy prices, higher spending (Bloomberg)

-

Manufacturers around the world seeing weakening demand (CNN)

Deeper Dive

Sectors to Watch

Markets continue to climb the wall of worries. It's extended, likely needs a pullback but the question is, what kind of pullback will we get?

- Iron ore: Singapore iron ore futures are down 3.7% since last Friday from US$112 to US$108 a tonne on growing concerns about China's property market.

- Oil: Likewise, WTI crude tumbled 4.2% on Monday to US$67.3 a barrel.

- Uranium: Uranium futures extended gains to US$57.55/lb, up around 18% year-to-date. The Global X Uranium ETF extended gains overnight, up 3.1%. Could we see some more strength follow-through for local names like Paladin Energy, Boss Energy and Deep Yellow?

- Tech: Tech was the best-performing S&P 500 sector overnight, up 2.1%. A lot of our tech-related sector ETFs (above) rallied 1-3%. Are names like Wisetech, NextDC and Altium set for another strong session?

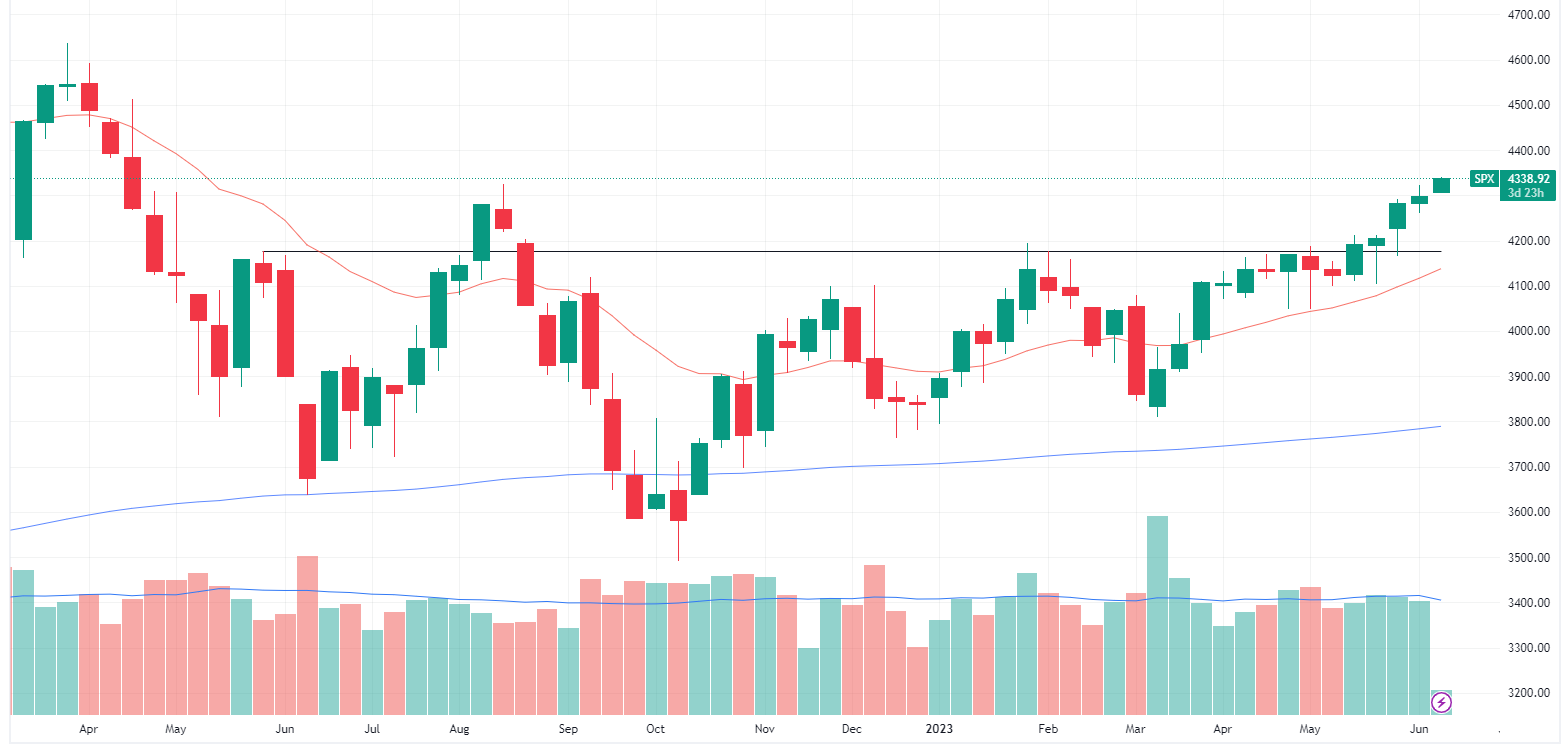

S&P 500 at 14-month highs: What's next

The S&P 500 is in breakout mode, marking its highest close since 22 April.

Is this rally forcing participation amid an improved outlook for earnings and peak Fed? Or is this the type of strength investors should sell into amid a V-shaped bounce in optimism, liquidity risks and still-hawkish central banks? Here's some food for thought:

- CNN's Fear and Greed Index rises to 78, the highest since February 2023

- Bank of America: "Bye bye, bear ... The bear market is over ... more than 90% of the time, the S&P 500 rises over the next 12 months after recovering from a bear market."

- Wells Fargo: "History shows the S&P 500 does not bottom until, on average, six months after the first Fed rate cut."

- Barclays: "... There have only been two comparable instances of such narrow [stock] leadership over the last three decades ... the leaders collapsed in 2000 ... whereas in 2020 the leaders delivered on earnings ... we think the current episode will likely resemble 2020."

- Evercore: "A mountain of money in money markets accounts is 'fuel for an equity momentum market move' and could 'accelerate the arrival of our year end S&P 500 price target of 4,450 as early as 4 July."

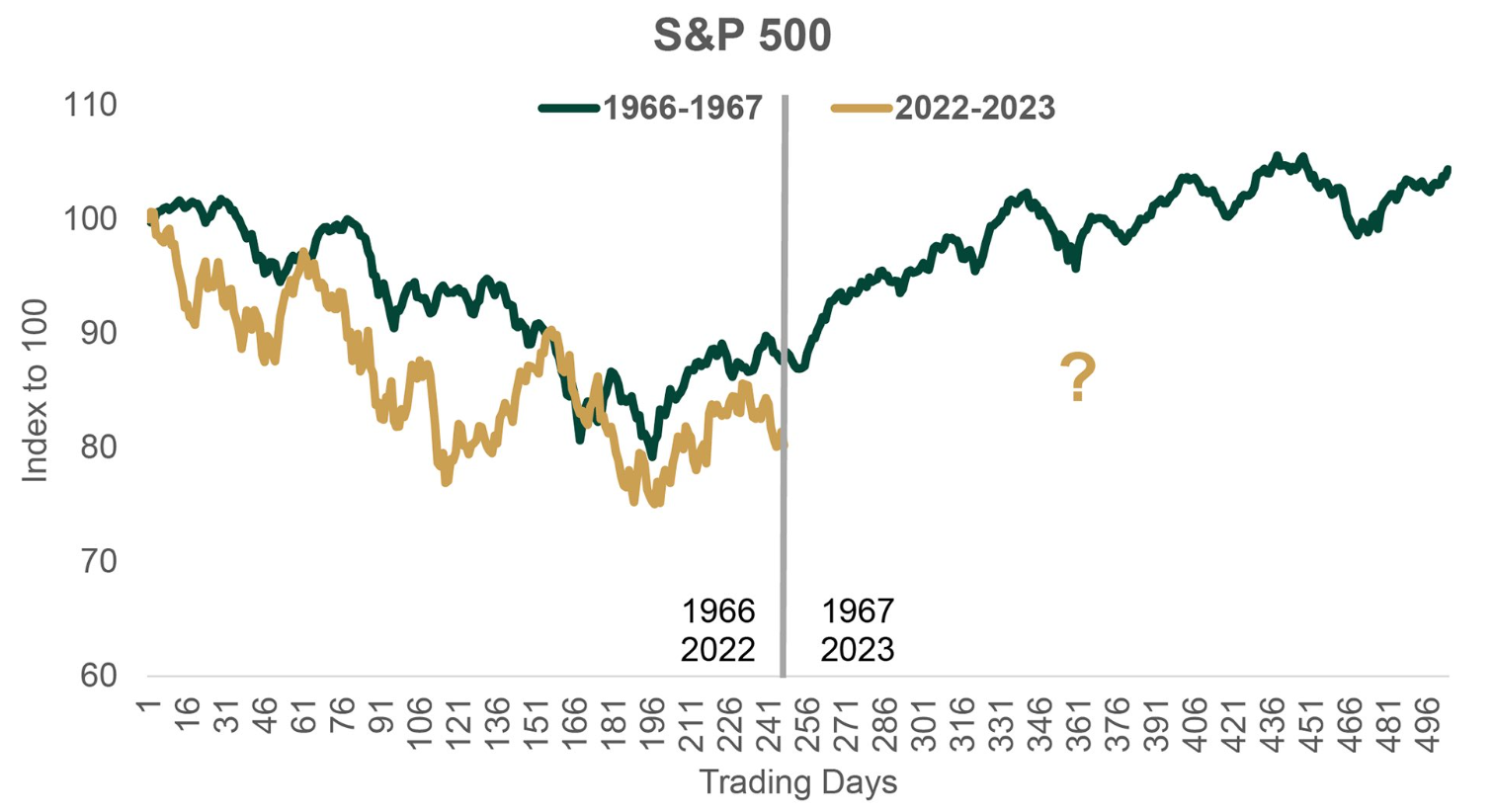

- The 1966 narrative: The S&P 500 rallied 16.5% in 1966 after a 10.6% decline in 1965. Just 8 months after the bottom, the market would slingshot to an all-time high. Current pullbacks are showing similar characteristics, but we're currently lagging the strength of the bounce experienced in 1967.

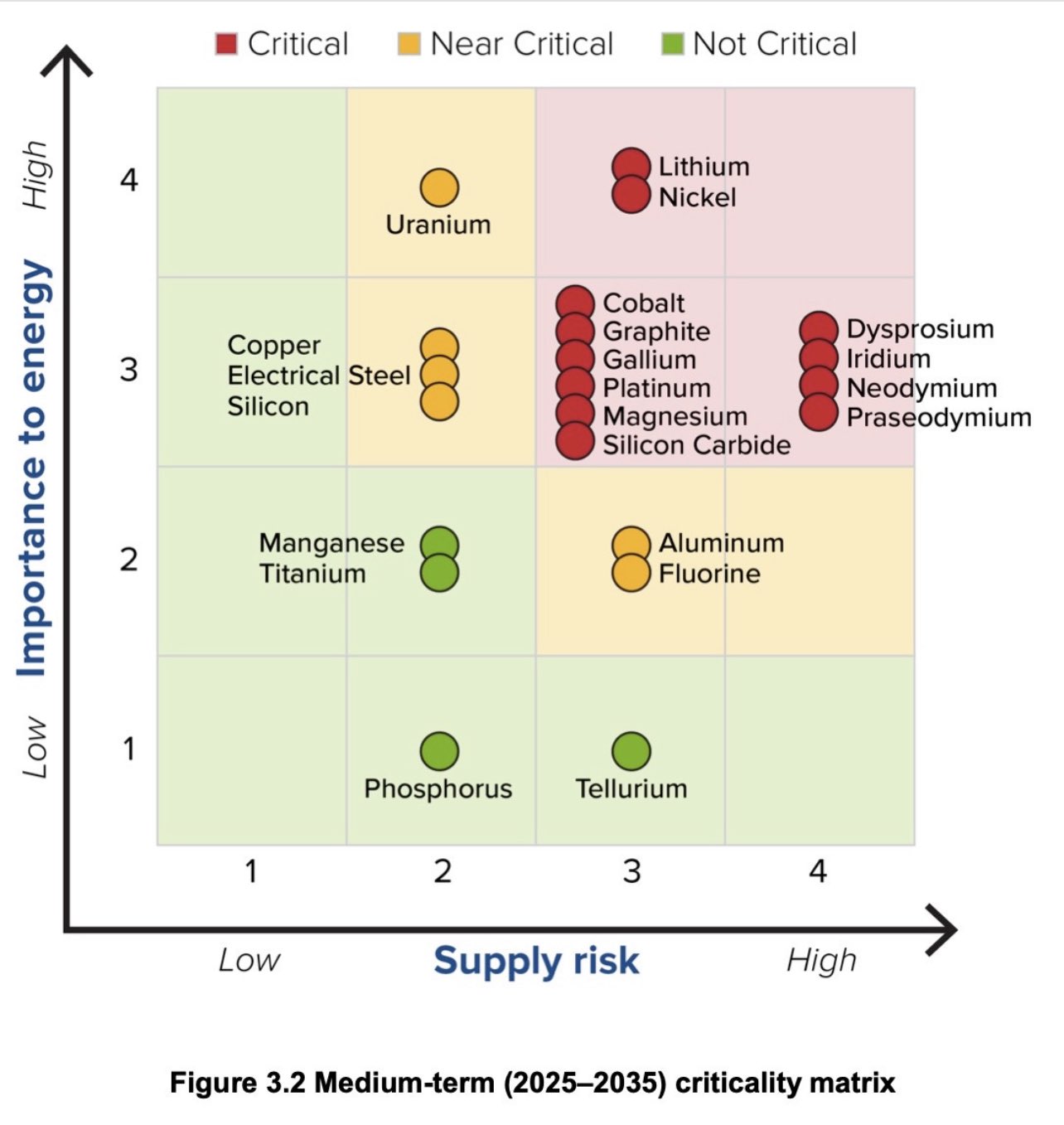

The most important battery metals

The US Department of Energy issued a critical materials assessment draft last week. You can view the full report here.

The table below evaluates the commodities most at risk in the medium term (2025-2035).

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Champion Iron (CIA) – $0.113, Vita Group (VTG) – $0.064, KMD Brands (KMD) – $0.024

- Dividends paid: Hancock & Gore (HNG) – $0.005, Infratil (IFT) – $0.1155, SSR Mining (SSR) – $0.10

- Listing: None

Economic calendar (AEST):

- 10:30 am: Australia Consumer Confidence

- 11:30 am: Australia Business Confidence

- 4:00 pm: UK Unemployment

- 7:00 pm: Germany Economic Sentiment Index

- 10:30 pm: US Inflation

This wire was first published for Market Index by Kerry Sun.

1 topic

1 contributor mentioned