ASX earnings season vs tech sector majors REA, CAR, Wisetech & Altium, key numbers & charts

The major brokers are busy tweaking their estimates as first half FY24 earnings season gets underway in earnest this week, and this means there’s a deluge of broker research notes coming across my desk. A few particularly caught my eye today as they had a similar theme: ASX tech sector majors.

.png)

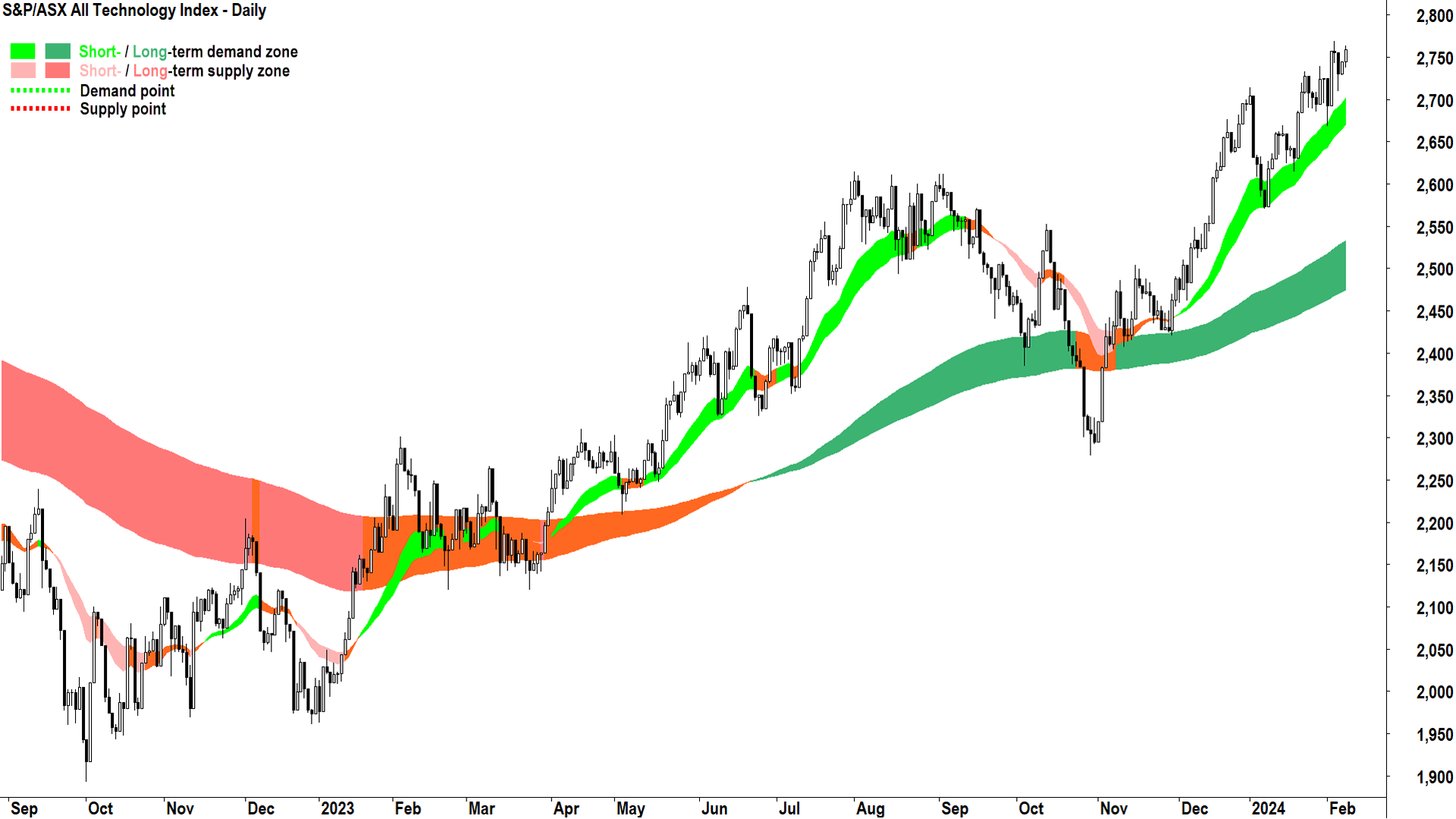

The S&P/ASX All Technology Index (XTX) has been one of the best performing sectors this year, driven by gains in sector heavyweights CAR Group (ASX: CAR), REA Group (ASX: REA), Wisetech Global (ASX: WTC), and Altium (ASX: ALU).

Let’s review some of the key items brokers are looking out for in the upcoming first half results for these highly influential stocks in the ASX tech sector, as well as today’s numbers from REA Group (REA).

Don't miss an ASX announcement this reporting season, check out our comprehensive H1 FY24 Earnings Season Calendar and set up and receive announcements direct to your inbox on Market Index: Create Alert Now

REA Group (ASX: REA) Thursday, 8 February

View the first half result here: Appendix 4D and Interim Financial Report H1 FY24 and the presentation here: REA Group Investor and Analyst Presentation H1 FY24

Today REA Group reported an 18% increase in revenue to $726 million and a 22% increase in EBITDA to $426 million, ahead of consensus estimates of $722 million and $415 million respectively. UBS described the result as “Overall, solid” noting the top-line numbers were a “slight beat” for them as cost control was better than expected. UBS retained their “NEUTRAL” rating on REA and their $167 price target.

Key numbers to watch out for:

Revenue $726 million vs consensus $722 million

EBITDA $426 million vs consensus $$415 million

National listing volumes +12% vs consensus +4%

Residential listing yields 15% vs consensus 14%

ChartWatch

ST/LT Trends: ⬆️ / ⬆️

Price action: 📉

Candles: ⬜⬛

Key Support / Resistance: 18 Jan trough low @ $173.85 / 30 Jan high @ $188.45

Commentary: Change in price action to lower peaks and lower troughs undermines what still is a strong short term uptrend. Still, with candles becoming increasingly mixed (today’s candle is shaping as particularly indicative of increasing excess supply), holding the support point at $173.85 is crucial.

CAR Group (ASX: CAR) Monday 12 February

Macquarie says the first half FY24 result is “expected to be good”, with “no negative surprises expected”. The broker respects that after the recent strong stock price performance, the valuation is “stretched”, but also that CAR’s “business quality and market position are attractive”. The broker has an “OUTPERFORM” rating with a $35.30 price target.

Morgan Stanley has a very similar view. Whilst the broker is still very positive towards the stock, currently at an “OVERWEIGHT” rating with a $30.00 price target, they note “after the recent moves higher in the shares, the market will likely require a strong 1H + outlook to hold its multiples.”

Key numbers to watch out for:

Revenue +38%

EBITDA +36%

Margin -1%

ChartWatch

ST/LT Trends: ⬆️ / ⬆️

Price action: 📈

Candles: ⬜

Key Support / Resistance: 31 Jan trough low @ $32.56 / 2 Feb peak high @ $33.82

Commentary: A picture of excess demand with excellent trends, price action and candles.

Wisetech Global (ASX: WTC) Wednesday, 21 February

Citi expects Wisetech’s EBITDA is going to slow by 3% in the first half of FY24 (slightly ahead of consensus for a 4% slowdown). Volumes likely experienced headwinds due to “destocking and soft macro”. Margins will decline by around 10 basis points due to elevated hiring and incorporating lower margin businesses from recent acquisitions. Margin guidance is the key sticking point as the market will be seeking further clarity on whether FY26 margin guidance of 50% can be achieved. Citi has an “NEUTRAL'' rating and an $71.75 price target.

Morgan Stanley sees FY24 revenue and EBITDA guidance as the key sticking points of the upcoming Wisetech results. The market will want to know previous guidance of +30% and +23% respectively are achievable. This half could still indicate a lingering “challenging environment” for Wisetech’s customers but feels the bigger picture growth outlook “remains very much intact”. Whilst this result could trigger “high share price volatility”, Morgan Stanley has an “OVERWEIGHT” rating on the stock and an $85.00 price target.

Key numbers to watch out for:

Revenue +30%

EBITDA Margin 41%

FY24 Revenue/EBITDA guidance of 30%/23%

ChartWatch

ST/LT Trends: ⬇️ / ⬆️

Price action: ⬇️ Peaks / ⬇️ Troughs 📉

Candles: Mostly supply-side since 15 November

Key Support / Resistance: 29 Jan trough low @ $70.24 / 23 Jan peak high @ $76.86

Commentary: The technicals suggest excess demand is reasserting itself after FY23 results disappointment. A close above $76.86 will confirm the re-establishment of the short and long term uptrends as well as a return to good price action. The increasing frequency of demand-side candles over the past few weeks is a strong indication of building short term demand.

Altium (ASX: ALU) Tuesday, 27 February

Morgan Stanley believes the market will be watching intently for indications how the company intends to monetise Altium365, as well as other “guide posts” on how the company intends to achieve its existing FY26 guidance of US$500 million. Price increases and enterprise sales growth are two key factors which could surprise on the upside. The broker acknowledges market expectations are “high” given the recent stock price performance but has an “OVERWEIGHT” rating with a $50 price target.

Citi feels monetisation of Altium365 is “starting to kick off” as Altium leverages this product to “crack the Enterprise segment”. The broker has recently upgraded their rating on the stock to “BUY” from “NEUTRAL” and increased their price target substantially to $56.50 from $46.65.

Key numbers to watch out for:

Revenue Growth +38%

EBITDA +36%

Margin -1%

ChartWatch

ST/LT Trends: ⬆️ / ⬆️

Price action: 📈

Candles: ⬜⬛

Key Support / Resistance: 30 Jan peak high @ $50.00 / 2 Feb peak high @ $51.98

Commentary: A few mixed candles over the last week are the only minor indication of some trepidation among the demand-side after the recent strong price performance. Trends and price action remain indicative of solid excess demand.

Carl’s Technical Analysis Methodology Key

Trends (ST Trend ribbon: 21 & 34 EMAs || LT Trend ribbon: 144 & 233 EMAs)

⬆️ = Uptrend, the ribbon is rising indicating a higher probability the market is in a general state of excess demand

⬇️= Downtrend, the ribbon is declining indicating a higher probability the market is in a general state of excess supply

➡️ = No trend, the ribbon is flattening indicating a higher probability the market is in equilibrium

Price Action

📈 = Rising peaks and rising troughs indicating buy-the-dip activity and supply removal (i.e., indicating a higher probability market is in a general state of excess demand)

📉 = Falling peaks and falling troughs indicating sell the rally activity and demand removal (i.e., indicating a higher probability market is in a general state of excess supply)

⬅️➡️ = Neither of the above scenarios, market price action is indecisive

Candles

⬜ = Predominantly demand-side candles in the recent past, i.e., white bodies and or downward-pointing shadows (i.e., indicating a higher probability market is in a general state of excess demand)

⬛ = Predominantly supply-side candles in the recent past, i.e., black bodies and or upward-pointing shadows (i.e., indicating a higher probability market is in a general state of excess supply)

⬜⬛ = Mixed, i.e., indicating no discernible trend towards demand-side or supply-side candles in the recent past

This article first appeared on Market Index on 8 February 2024.

3 topics

4 stocks mentioned