Aussie housing collapse spreads as Brisbane joins the Sydney and Melbourne crash

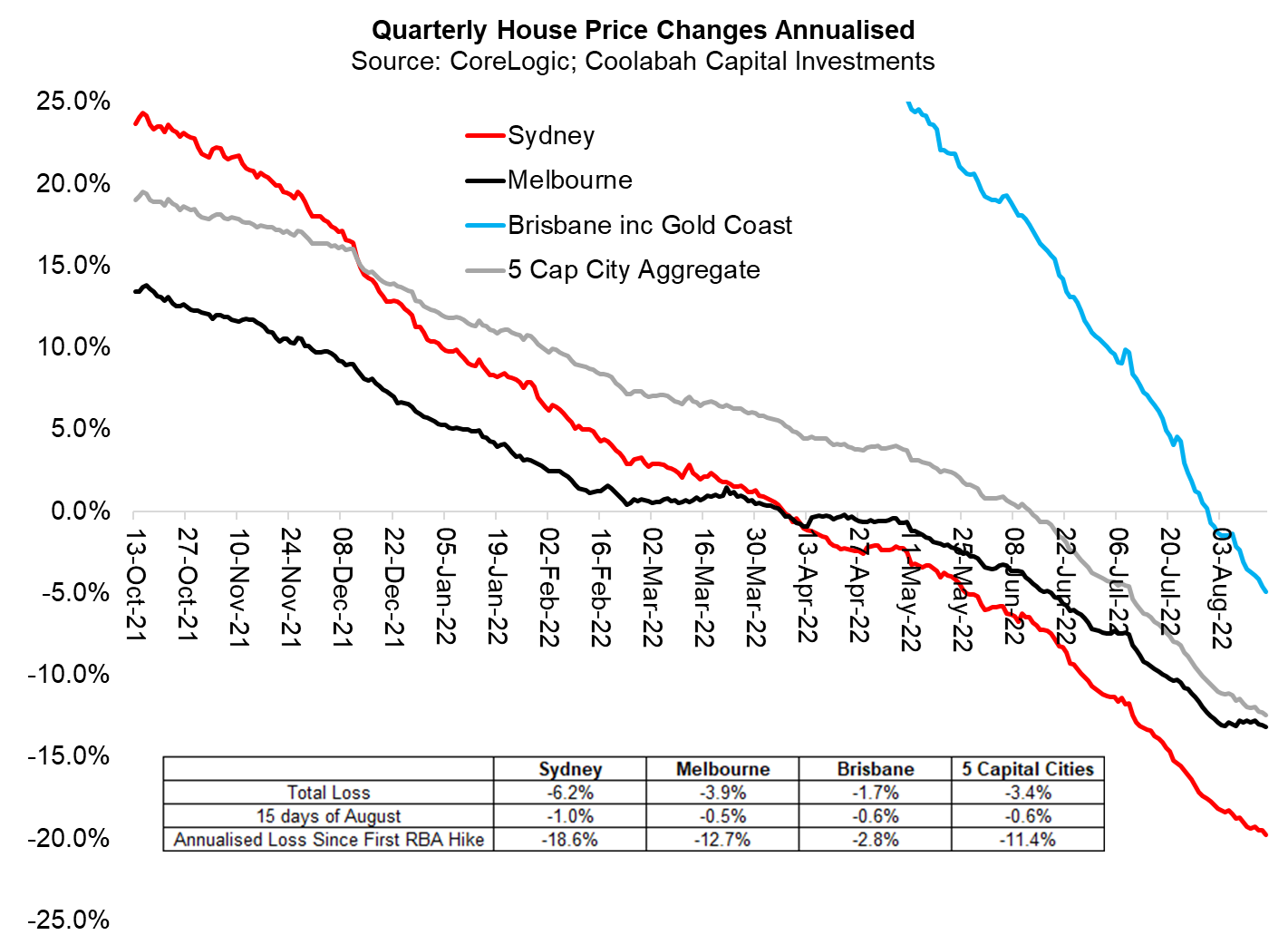

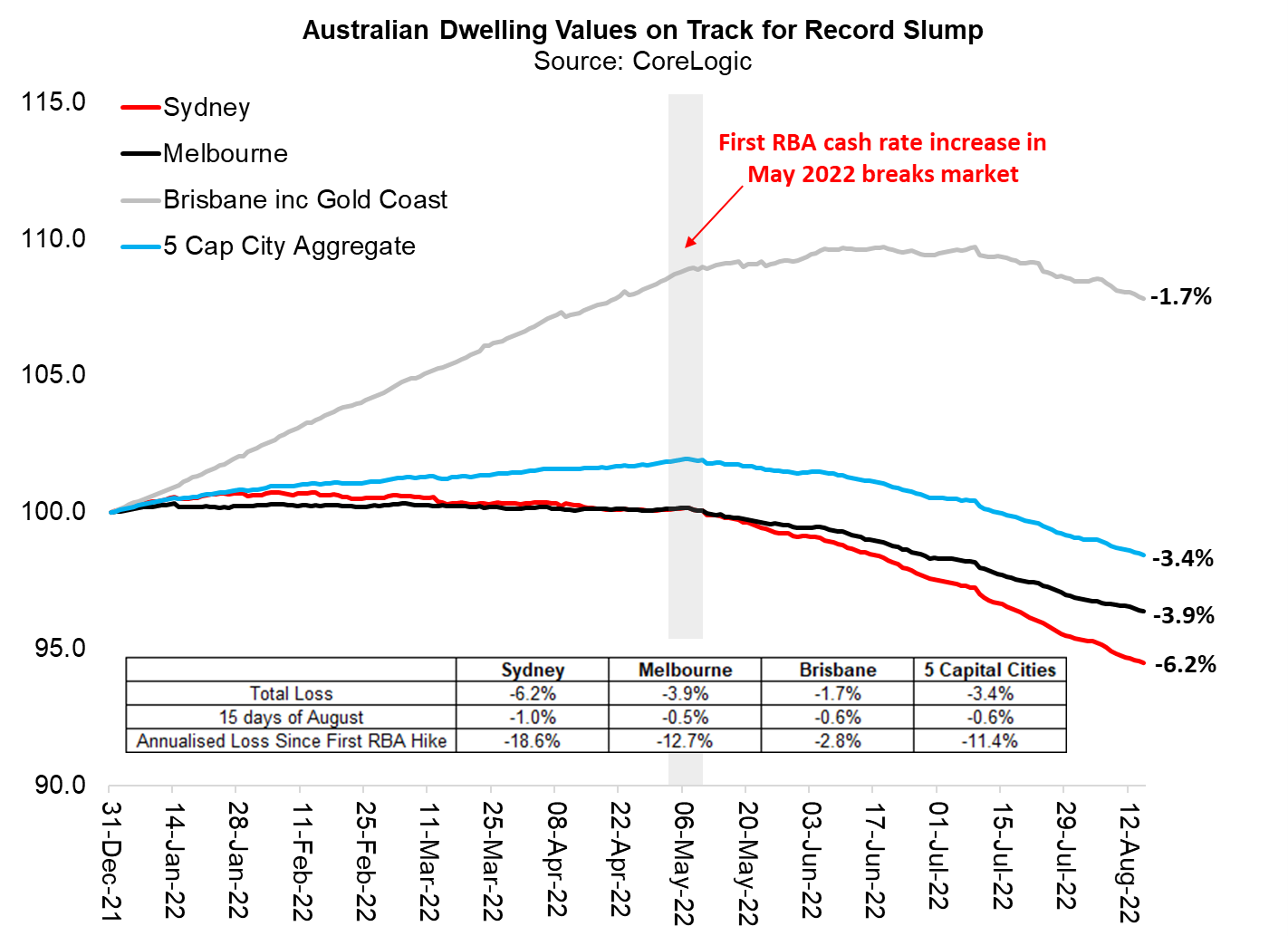

There has been an interesting development in the month of August vis-a-vis the burgeoning Aussie house price collapse. We have carefully demonstrated how the shake-out was initially led by Australia's two largest cities, Sydney and Melbourne, where in just a few months prices have plunged by 6.2% and almost 4.0%, respectively. One of my favourite charts quantifies the rolling quarterly change in dwelling values on an annualised basis, which is enclosed immediately below.

The big news is that Australia's third largest city, Brisbane (including the Gold Coast), has now joined the party after trying to defy gravity for a couple of months. The blue line in the chart below shows Brisbane's quarterly price changes, which highlights how rapidly this market is deteriorating and converging with the losses experienced by the two largest conurbations.

In the first 15 days of August, Brisbane prices have already fallen 0.6% (ie, tracking towards a circa 1.2% loss for the entire month). In fact, Brisbane's losses are now outpacing those evidenced in Melbourne where prices have declined by 0.5% in the first half of August. Observe how Melbourne's quarterly losses (black line) appear to have stabilised at a still very chunky 13% annualised clip. In Sydney (red line), the news is much more grim: prices are already off another 1% in the first 15 days of the month---ie, heading for another near-record, 2% monthly loss---while the quarterly rate of price depreciation is sitting at about 19% per annum.

With the three largest cities rolling-over hard and fast, the wider 5 capital city Aussie house price index (grey line) is likewise tanking, losing 0.6% in the first half of August. It is currently depreciating at an 11% annualised rate, which should increase further as Brisbane falls into line with the experience down the rest of the East Coast (including Canberra).

The two main hold-outs are Adelaide and Perth, where house prices appear to be flat-lining right now, which is what typically occurs before they begin to correct. One rather worrying consideration here is that the while the RBA has hiked its cash rate by 1.85 percentage points in just three months (or over four meetings), borrowers have yet to feel the full force of these changes. There are a range of operational delays and legal notification requirements that mean that many borrowers have only been hit by one or two mortgage rate increases. Over time, they will of course be subject to all of the RBA's rate hikes as banks implement these changes. This is sobering to contemplate given just how quickly housing demand has collapsed since the RBA began raising rates in May...

I am personally long housing, so it is not much fun delivering this news: but our job is to tell you what we think will happen, not bury our heads in the sand.

4 topics