Australia left interest rates unchanged at 4.35%, US ISM services PMI soared to 52.7

Let’s hop straight into five of the biggest developments this week.

1. Australia left interest rates unchanged at 4.35%

The RBA paused its aggressive monetary policy tightening to leave interest rates unchanged at 4.5%. The move was well anticipated by markets, premised on recent indications of slowing growth. The central bank adopted a wait and see stance to give room for further observation of the effects of the historically high rates in attaining its 2-3% inflation target.

2. US ISM services PMI soared to 52.7

Activity in the US service sector grew at a faster rate than expected. The ISM services PMI rose to 52.7 in November, trouncing the previous 51.8 and market forecasts of 52.2. Indications are that America’s festive bonanza is beginning early.

3. Australia’s GDP growth fell to 0.2% q/q

Australia’s economic growth is far weaker than previously estimated. GDP growth in the third quarter slumped to 0.2% from the 0.4% recorded in the second quarter, resoundingly disappointing markets that had bet on a solid 0.5% growth. This points to the fact that high-interest rates are starting to stifle growth.

4. US ADP non-farm employment change fell to 103k

The US labour market is cooling off at a faster pace than expected. The ADP non-farm employment change slumped to 103k from the previous downward revised figure of 106k, substantially undershooting the 131k mark anticipated by market participants. This is a seasonally low figure and points to emerging concerns in the US labour market, notably the manufacturing sector that reduced employee headcount to the lowest since the first quarter of 2022.

5. Canada interest rates remained static at 5.00%

The BOC left the interest rate unchanged for a third consecutive meeting, in line with market expectations. The recent disinflation trend largely underpinned the decision despite an overly hawkish statement by the central bank. The decision was further reinforced by flat consumption spending and stagnating business investment, pointing to the possibility that high rates are slowly becoming economically detrimental.

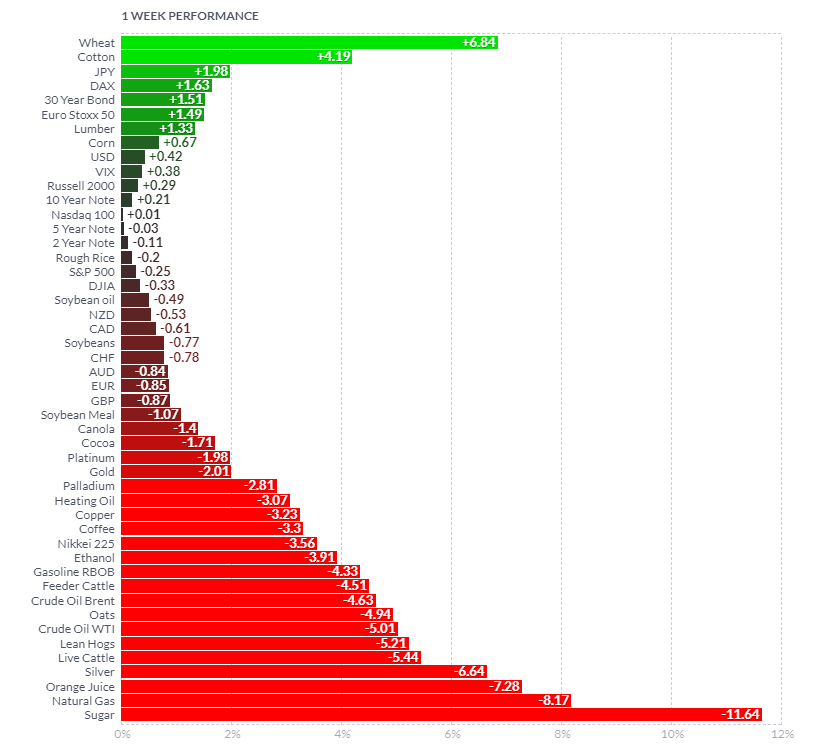

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Energy components tumbled lower on weak demand as the US recorded record production, raising demand concerns and putting paid the concerted efforts by producers to cut supplies. Prices were on free fall with WTI and Brent closing – 9% and - 8.6% respectively, taking prices to 6-month lows with no respite in sight. Sugar was the worst performer for the week after forecasts pointed to a bumper harvest in Brazil while low oil prices undercut the need for ethanol, diverting cane towards sugar production. Wheat soared on festive demand as well as rising demand from China while cotton was up on seasonality as well as colder weather than expected.

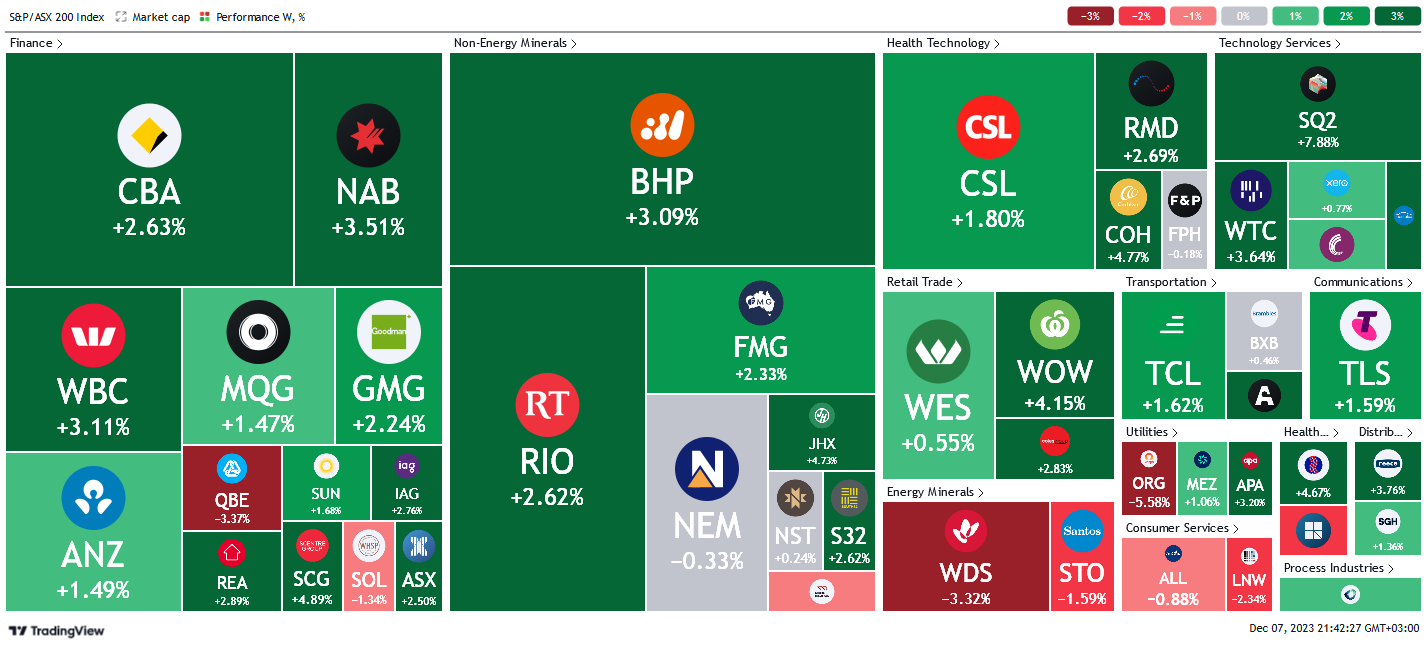

Here is the week's heatmap for the largest companies in the ASX.

The ASX roared back with a convincing performance for the week as investors made a statement about the interest rate pause by the RBA. Financials blew on all cylinders with virtually all stocks in the green as SCG led the charge with a +4.89% posting. QBE and SOL stood out as the only laggards in the sector, closing - 3.37% and – 1.34% down. Nonenergy miners were equally on a roll with all stocks losing up. MIN and NEM were the only disappointments in a sea of green as the sector outsold the index. Healthcare tech, retailers, tech services, and transporters were on overdrive with all stocks in the green. Energy miners were however a major disappointment as demand concerns continued to bite as the entire sector wallowed in the red.

Below shows our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics

3 stocks mentioned