Australian rates to fall to neutral but not much more

Find out why we maintain a less dovish view than the RBA, favour Australian bonds over U.S. bonds and anticipate further flattening of the Australian yield curve.

The Reserve Bank of Australia (RBA) has cut rates 50bps this year to 3.85% and is adopting some rather dovish rhetoric. Money markets are suggesting that the RBA cuts by another 75bps to 3.1% by the end of 2025. However, we think it more likely that the RBA cuts by only 50bps by year end to 3.35%.

RBA is responding cautiously to global uncertainty

Post-Liberation Day, we think the RBA is uncertain about the outlook and concerned about global uncertainty. It views uncertainty by itself as a shock to growth or tightening of financial conditions, because it could cause the private sector to hold off spending and borrowing decisions until resolution. However, the risk in responding too dovishly to uncertainty is that officials ignore the other tail of it – that global uncertainty could be resolved in a positive fashion. What is interesting is that RBA Governor Bullock is expressing scepticism about the upbeat message coming from markets about the global outlook as they rally off Post-Liberation Day lows. While we can understand the Bank choosing not to get caught up in the noise of market sentiment, we feel that it is overlooking some of the nuances in market signalling. For example, we note that there have been some surprising developments on the capital flows front, manifesting in a very clear offshore bid for Australian dollar- (AUD-) denominated assets, and a stronger-than-expected currency. Even if one is concerned about global growth and the signal from the recently sharp increase in global risk appetite, markets are suggesting that Australia is a relative safehaven, consistent with a robust growth outlook. If private sector confidence is the issue the RBA is concerned about, global investors are suggesting that it perhaps need not be so concerned.

Domestic conditions justify a return to neutral

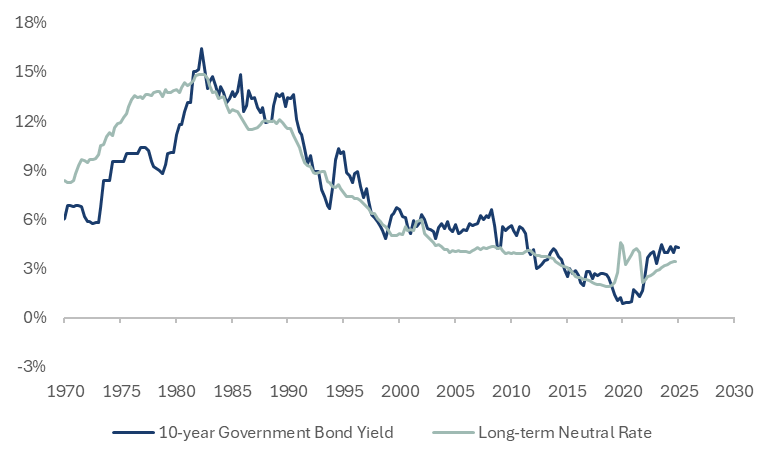

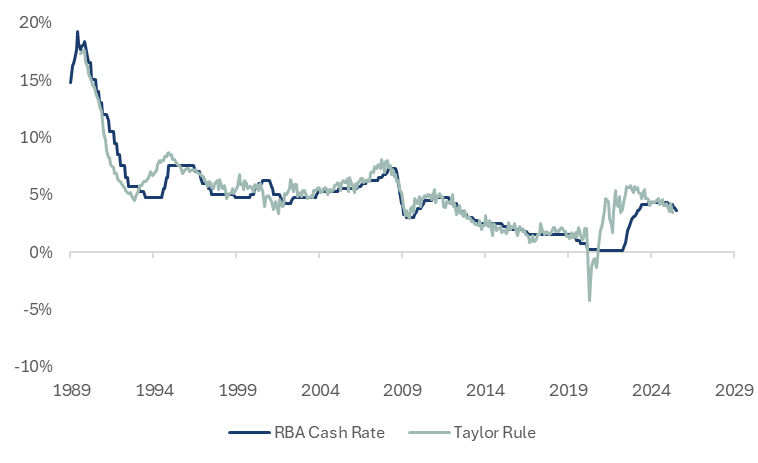

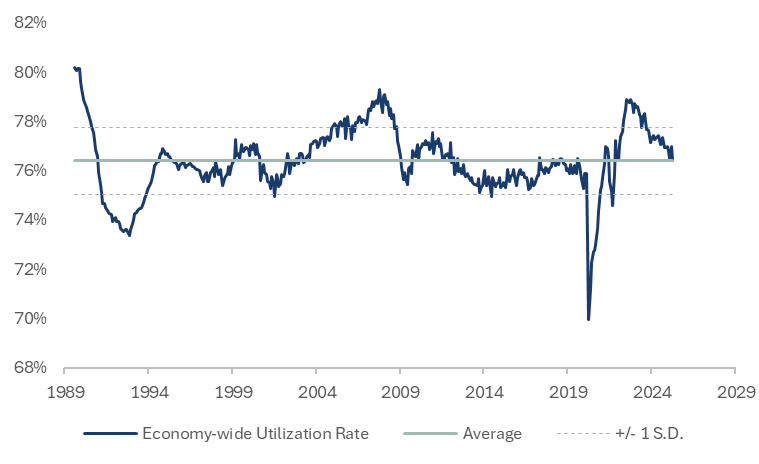

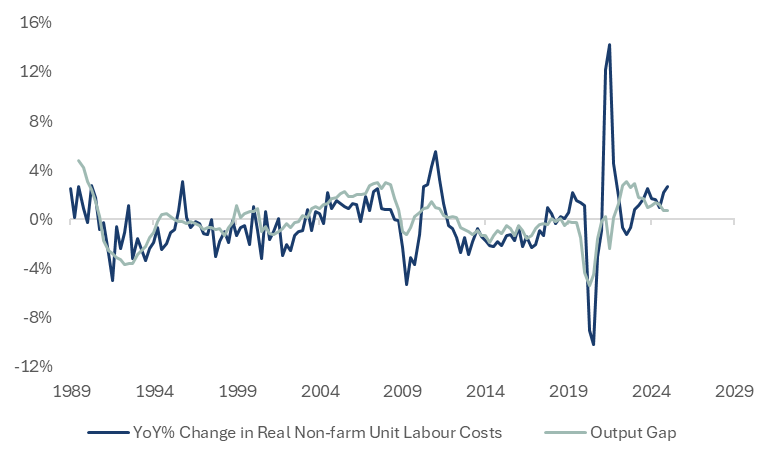

The RBA says that its chief concern is the health of domestic demand, especially given that the public sector has contributed so much to growth in recent years. On domestic considerations alone, the RBA says that there is room to cut rates. Notwithstanding our hawkish interpretation of global capital flows and market sentiment, we agree with this view. Historically, the RBA tends to set rates in line with the following policy prescription - a neutral rate plus the “output gap”. The neutral rate can be approximated using historical long-term nominal gross domestic product (GDP) growth while also adjusting for the constraints from household negative gearing. The output gap is a measure of how far above (below) the economy is operating relative to its supply side potential and can be gauged from survey data on business capacity utilisation, as well as labour market data. It is a powerful leading indicator of wage bargaining power. On this basis, we note that the long-term neutral rate is around 3.4%. But the output gap is currently around 0%. Therefore, the short-term equilibrium cash rate is 3.4%. A return to neutral policy rate settings is warranted by current domestic conditions, and this means roughly 50bps worth of cuts from current levels.

Australian 10-year bond yields and neutral rate

RBA cash rate and "Taylor rule"

Australian output gap

Australian real unit labour costs (labour share of GDP) and output gap

Australia's inflation outlook is more benign than the U.S.

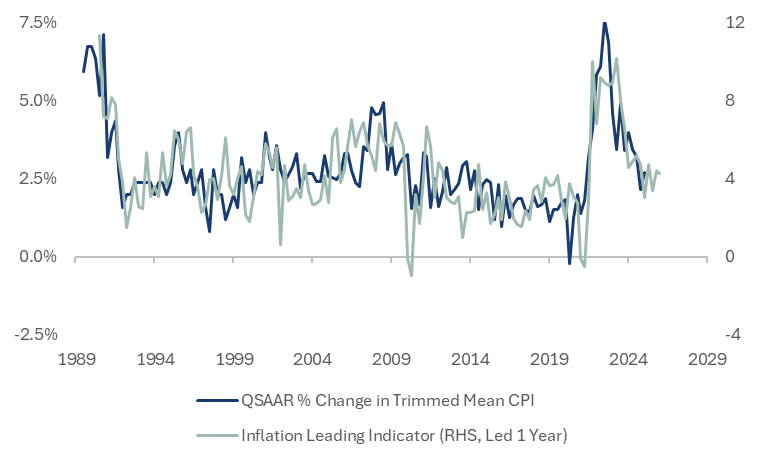

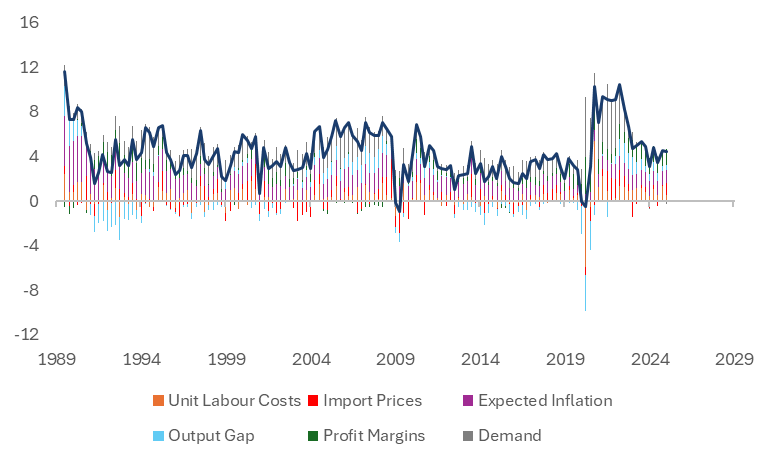

What is interesting in this analysis is that the RBA is unconstrained and cutting rates, while the Fed is constrained and leaving rates on hold. Why is it that the RBA can do something a little different to the Fed? Part of the answer is that inflation outcomes globally are diverging. Noting that the RBA has a 2-3% target band for inflation, while the Fed has a 2% target, the RBA can start cutting rates when inflation is in the high 2's, whereas the Fed needs to see or forecast prints closer to 2% before entertaining the thought. Our proprietary models of Australian core inflation suggest that we are likely to see prints towards the upper end of the RBA’s 2-3% band over the next year. But leading indicators suggest that the Fed is likely to see prints meaningfully above its 2% target in the near term. Consistent with these views, it is worth highlighting that the RBA is open to the idea that we see a wider dispersion of inflation outcomes across countries going forward, with countries imposing tariffs or retaliating against tariffs likely to see higher inflation than those they don’t. Clearly, Australia is in the non-retaliating camp, and therefore likely to experience lower inflation than the U.S. in the near future.

Australian core CPI and leading indicator

Australian core inflation leading indicator components

Although we are less dovish than the RBA in its current rates outlook, we think that Australian rates have room to fall relative to U.S. rates. We like Australian bonds relative to US bonds. We also think there is room for the Australian yield curve – the spread between long- and short-term rates – to flatten in the coming months, as markets price out a rate cut for 2025.

About WAM Income Maximiser (WMX)

WAM Income Maximiser aims to provide monthly franked dividends and capital growth to shareholders by investing in Australia’s highest quality companies and corporate debt instruments. These companies are selected for their strong capital management and ability to sustain or grow their distributions over time, primarily in the form of franked dividends and share buybacks. The debt component of the investment portfolio will focus on primarily investment grade corporate debt, aiming to provide stable income and capital protection to the investment portfolio for shareholders. Learn more via our website: (VIEW LINK)

5 topics

1 stock mentioned