Avoiding Virgin and other zombies

Australia’s first recession in three decades provides an opportunity for fixed income investors who can navigate the liquidity crunch, interest rate risk and threat of defaults, say Coolabah Capital and Metrics Credit Partners.

The two credit-focused managers presented on the final day of the Pinnacle Investment Summit, where they discussed the current state of debt markets, where they see value and how investors can access opportunities.

The two adopt distinctly different approaches. Coolabah employs a highly active strategy that is largely agnostic in trading government bonds, corporate bonds and hybrids – wherever it spots opportunity. On the other hand, Metrics' funds focus on Australian corporate loans to borrowers across a broad range of sectors and various parts of the credit quality spectrum.

“Our portfolio in March held $2.24 billion of major bank senior debt securities and covered securities, but since then we’ve taken profit and now hold none,” says Christopher Joye, CIO and founder of Coolabah.

“For us, it’s about the opportunity set.”

Joye’s team has bought and sold more than $14 billion of credit products in 2020 so far, executing some 12,000 trades and transacting an average of around 70 times a day in ASX-listed and over-the-counter securities.

“We typically execute about $80 million a day to hunt out mispricing,” Joye says.

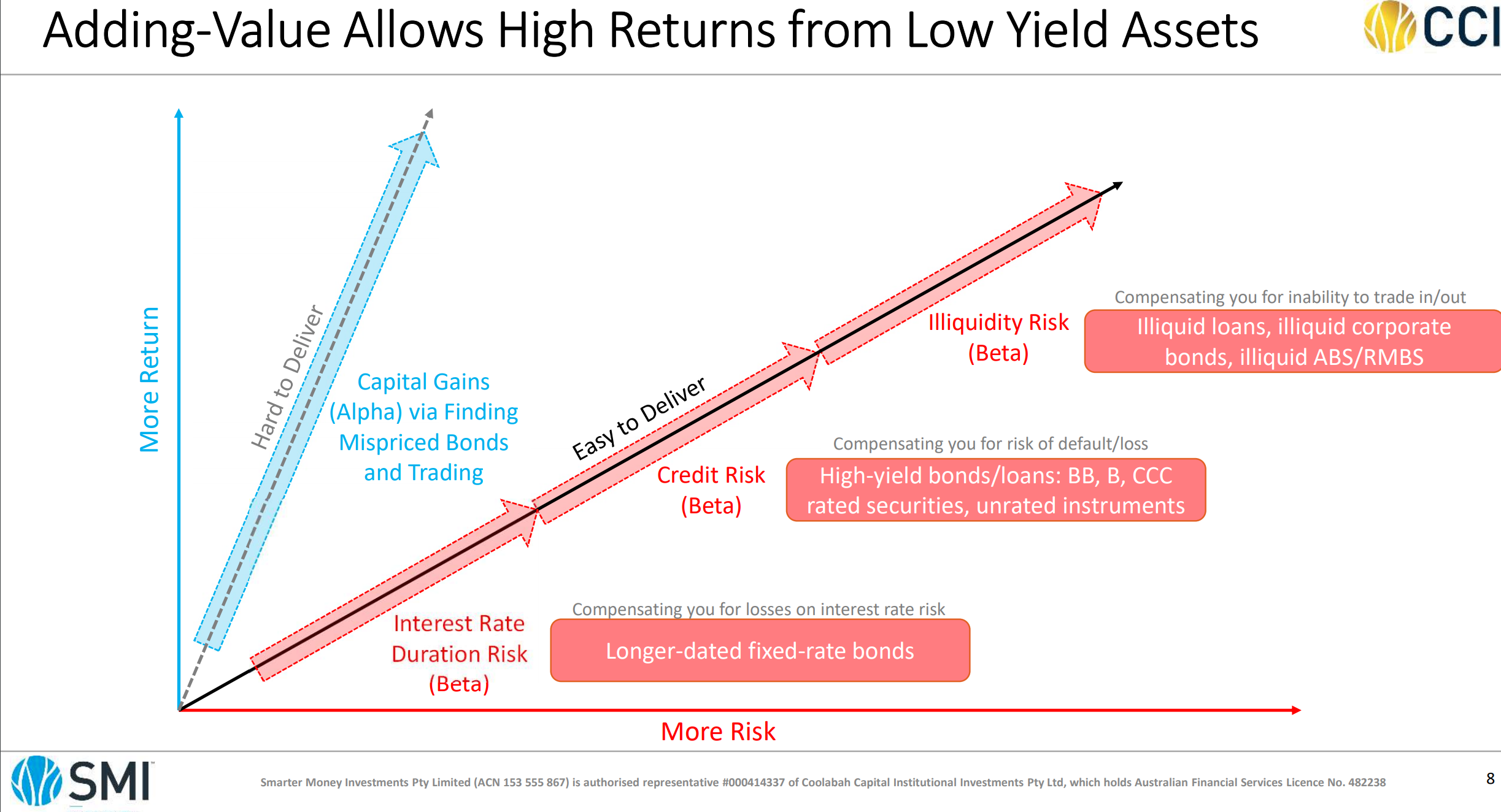

He argues fixed income investors have two choices: chase risk as a way to drive yield, or sift through the world of liquid, low credit risk securities to identify pricing opportunities. The first of these approaches is easier but fraught with risk, while the latter is very labour-intensive.

“Adding risk is really just about chasing yield. And that means identifying assets or bonds with high yields – you buy, hold and then really hope that nothing goes wrong,” says Joye.

“Those yields are a pure risk trade-off, so you’re either taking more default risk, more liquidity risk or more interest rate risk.”

Joye turns one of the core principles of investing on its head, contradicting the view that diversification is always a good thing.

“In fixed income there’s a working belief that diversification is a universally good thing…and you often see portfolios with 200, 500 or 1000 bonds. But those are often loaded up on correlated risk, and we mean correlated default, liquidity and interest rate risk.”

Joye says this led a lot of portfolios to “freeze” in March, when liquidity dried up and left investors unable to trade the credit assets they held. These were largely those concentrated in cyclical areas that perform badly in recessions.

“The worst-hit debt securities were those issued by airlines, retailers, commercial property owners, residential developers, shopping centres and non-bank lenders that finance riskier borrowers.”

Risky business for credit investors

The above examples are one of the three major risk categories Joye highlights, the most obvious being credit risk. This refers to the chance a company that has issued bonds defaults, usually when it has run out of cash to pay bondholders.

One of the most recent instances of a large default in Australia is that of Virgin Australia in November. This occurred after the airline failed to secure an eleventh hour $1.4 billion federal government loan to help cover more than $5 billion in debts – partly driven by COVID travel bans, but trouble had been brewing for years.

This was Australia’s first institutional bond default in 19 years, following on from insurer HIH in 2001. “Virgin defaulted and investors are only going to get between 5 cents and 10 cents in the dollar,” Joye says.

The airline presented to Coolabah as a “classic zombie – over-levered and consistently unprofitable, we wouldn’t have touched it with a 40-foot cattle prod.”

“The trade never made any sense whatsoever…that was sold to investors with commissions,” Joye said.

“Why would have you have bought a Virgin junk bond, when you could have bought CBA yields at the same rate? It’s a very, very sad story.”

Liquidity risk has also loomed large more recently. In March, Bid-ask spreads – the gap between what you pay to buy a bond versus the price of selling – hit levels not seen since the GFC in 2008. This reflected rising fears that highly indebted companies won't survive the COVID contagion.

In a nutshell, no one wants to buy and everyone moves to cash as liquidity dries up. This remains the primary risk facing fixed income investors in the current environment, says Joye. As massive government stimulus measures are wound back from next Monday (28 September) ahead of treasury’s taps turning off completely, many zombie companies – those kept barely alive or “undead” by JobKeeper payments – will fail.

Interest rate risk is the other major risk, which Joye says is the second-biggest threat.

“If you buy a fixed rate bond with a set 10-year return and interest rates go up, you’ve locked in your rate. And so, the value of your bond will fall,” he says.

“But if you have a floating rate bond, its price won’t be affected and instead its yield will rise or fall.”

Government bonds bring a lot of interest rate duration risk – especially during a recession, many people can’t afford to wait 10 years for their bonds to mature before redeeming.

“AAA rated government bonds, all things being equal are meant to be risk free, but if they’ve got duration risk, they’ve suffered losses of as much as 2.4% in a given month…that’s actually higher than the losses we’ve seen on floating senior bank bonds,” says Joye.

Why property debt appeals

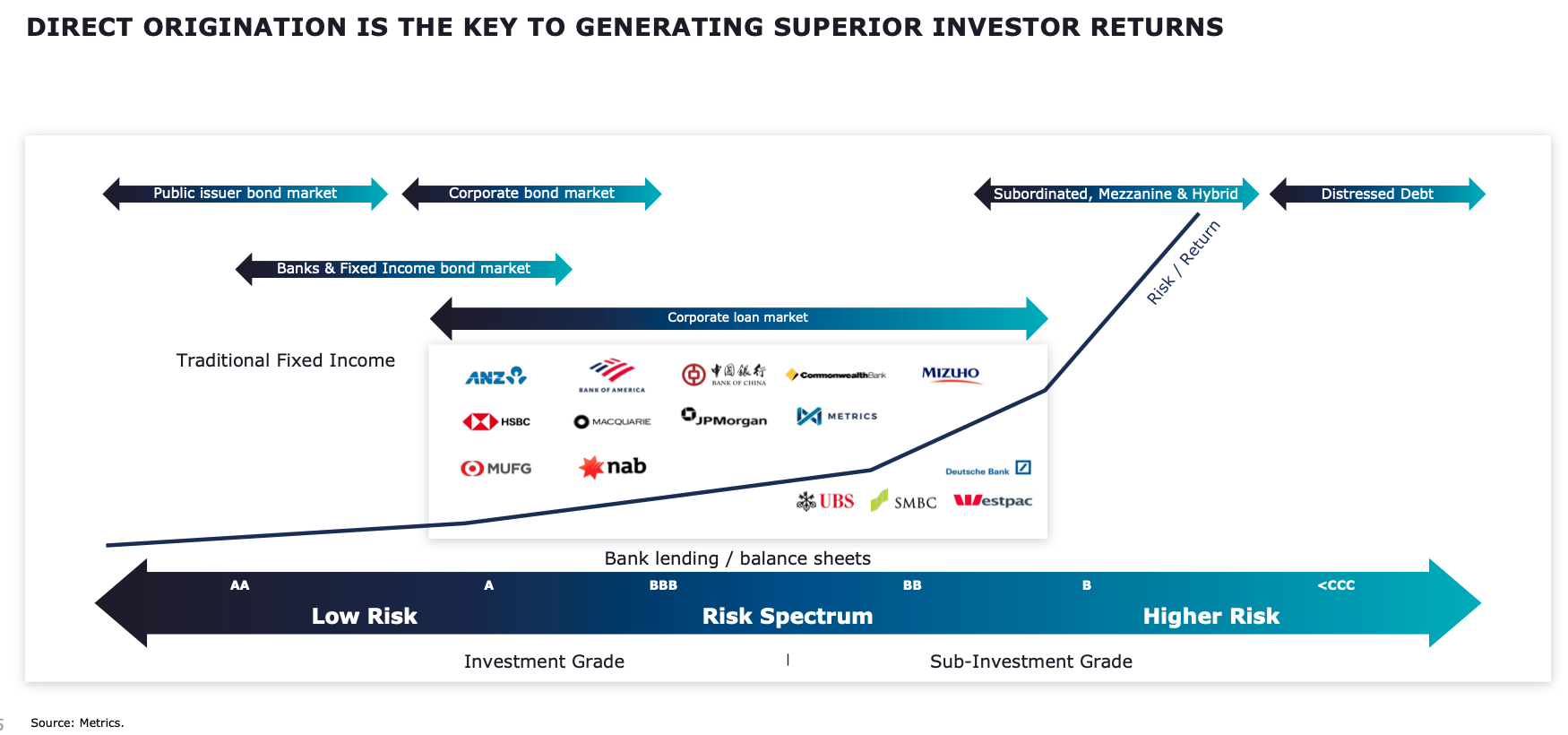

Another credit manager from the Pinnacle stable, Metrics Credit Partners managing partner Andrew Lockhart challenges the view that fixed income investing is all about chasing risk.

“We believe that the market we operate in is attractive,” he says – pointing to the prominence of Australia’s banks within the local economy.

“And from our perspective, there’s no element of hope, it’s very much an ongoing involvement,” says Lockhart, referencing Joye’s claim that yield-chasing investors “buy, hold and hope.”

Metrics zeroes in on the most illiquid parts of the debt market for opportunity. As property values in some parts of Australia have dipped more than 30%, pressuring bank loan books: “that’s the kind of stress we look at.”

It operates in a handful of key areas, including the provision of:

- Loans to publicly listed corporations

- Commercial real estate financing, for example REITs

- Acquisition finance, providing debt funding enabling PE buyouts

- Project & Infrastructure finance.

“Since March we’ve obviously seen heightened risk, but borrowers provide us with very detailed information,” Lockhart says.

“We really understand the earning impacts, how management is responding, how much cash is on the balance sheet and how much committed funding is available to them.”

The funds Metrics creates from these debt assets span the full range of high investment grade credit through to sub-investment grade. “And along that risk continuum there are opportunities to generate good returns,” says Lockhart.

What if loans go bad?

Where credit quality is deteriorating, a lender’s first step is to ask the company to inject additional equity.

“But if shareholders aren’t willing, then it could require an asset sale program and those proceeds then used to pay back lenders,” says Lockhart.

“If the risk is still unacceptable to a lender, it can then trigger a default and then crystallise some of those falls in securities.”

But he emphasises that as a non-bank lender, Metrics doesn’t have the same risks in that banks often become forced sellers: “because they’re highly levered and they’re regulated.”

“Our concern is to ensure capital is preserved, which may mean equity value goes to zero, but it doesn’t mean that your debt value is lost.”

Comparing Metrics’ approach and areas of focus with Coolabah, Lockhart appreciates that Joye’s team “can buy and sell in a day, but for us it will often take 12 months or more to complete a transaction.”

“We’re not trying to be a lender of last resort, but we are a provider of capital to these companies to support them,” Lockhart says.

“Building good relationships and good networks before originating loans is crucial.”

He believes perhaps the biggest opportunity locally is the shifting dynamic that means banks are no longer the natural holders of credit assets on their balance sheets – a change that has been in train since the end of the GFC.

And it follows that a recession is actually good for Metrics’ business. As banks’ lending criteria become more onerous, transaction times blow out and they’re less willing to take risk.

“That creates opportunities for us in speed to market, the ability to move quicker with borrowers and to take advantage of the illiquidity,” Lockhart says.

“Bank balance sheets will continue to shrink, and borrowers will continue to look for alternative sources of funding…and in Australia there isn’t a lot of those.”

The global nature of the recession means even foreign banks have pulled back from lending locally, further expanding the opportunity for Australian non-bank lenders and debt investors.

Of course, there are sectors Metrics won’t touch because of structural challenges. It has never loaned to media companies because of the many long-term pressures faced by print and broadcast companies.

Student accommodation has also never made the grade due to poor debt servicing capacity.

“You’re relying on demand for foreign students to come here to attend domestic universities, things that are outside the control of your borrower…that was always of concern to us,” says Lockhart. His team is also not confident of exiting quickly enough if credit quality was to deteriorate.

Other parts of the tourism sector are excluded too – in addition to aviation, as mentioned earlier – along with hotel and retail property REITs. “We stayed away because they’re exposed to discretionary consumer spending which would see us as having an unacceptable risk.”

“We operate in what is an inefficient, immature debt market in Australia, where most companies are unrated and rely heavily on banks for funding…which means liquidity often drives pricing,” Lockhart says.

“We’re actually generating a return because of the opaque, inefficient nature of the market.”

Like this wire? Let us know by hitting the 'like' button to the left. Or hit the 'follow' button to be notified whenever I post wires.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

1 topic

2 contributors mentioned