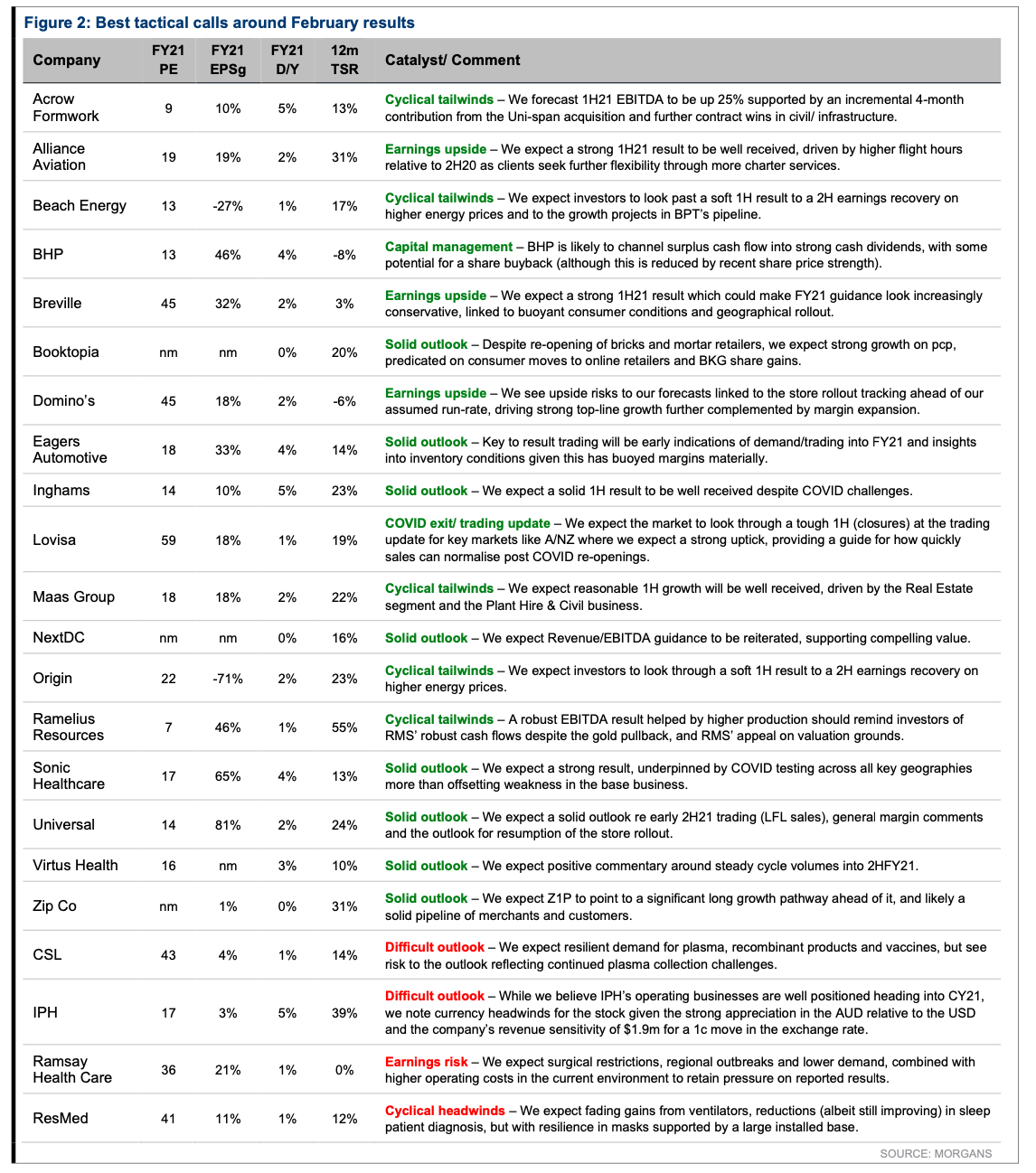

Best tactical calls around February results

Happy surprises should outnumber unpleasant surprises for Australian equity investors this earnings season as cyclical tailwinds blow stronger, dividends make a come-back and more companies provide forward guidance.

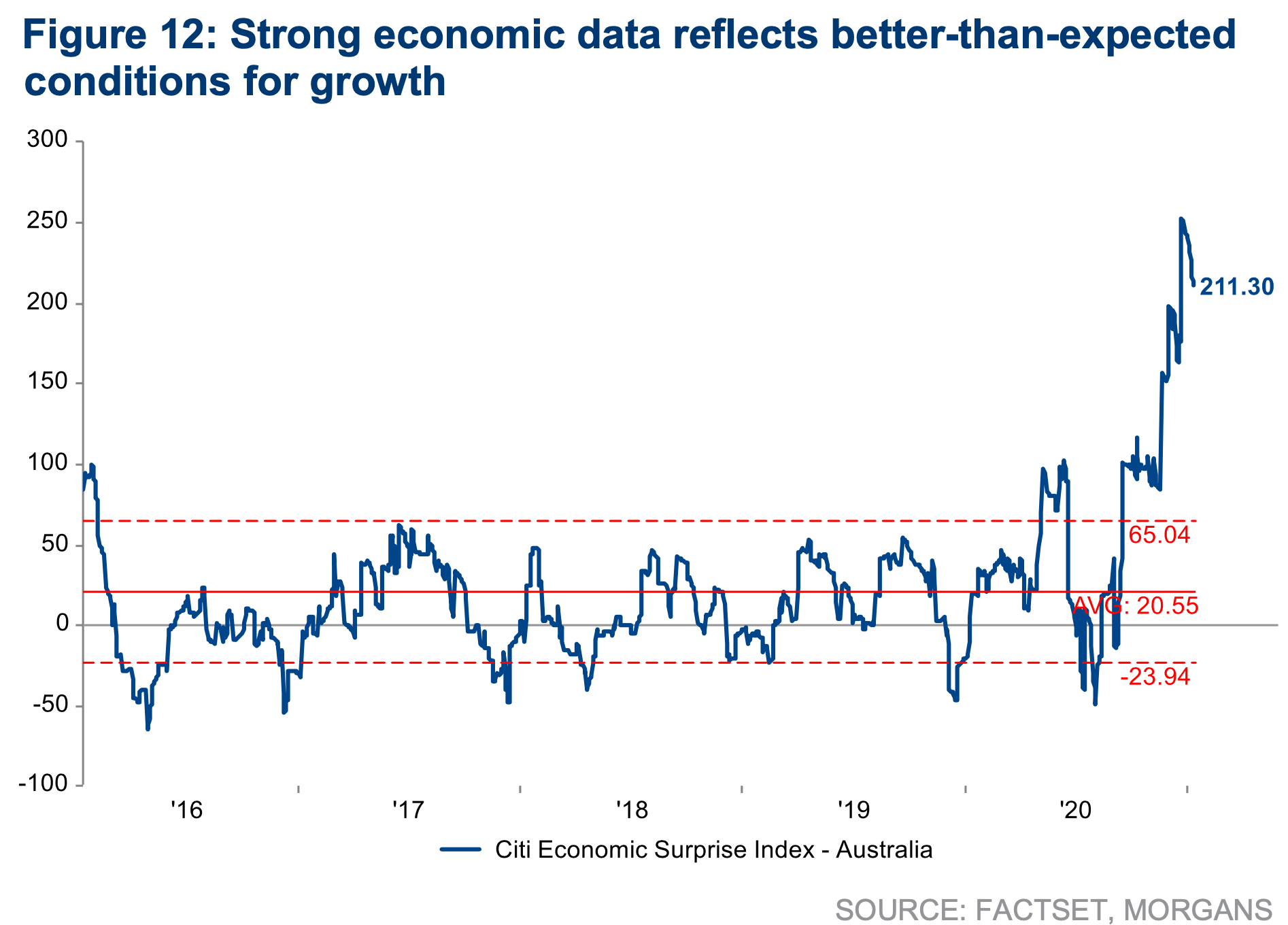

Plenty of room for “upside surprise”. Investors have a lot to feel optimistic about as the economy continues to defy expectations – indeed, our chief economist Michael Knox is calling for a sharp V-shaped recovery. But analysts’ earnings and dividend forecasts are yet to factor in the recent good form.

- The ASX 200 index has rebounded 47% since the 23 March low, despite a decade-high earnings decline of 17.5% in FY20.

- Some extreme valuations by historical standards, the ASX 200 (ex-Resources) now trading on a 12-month forward PE ratio of 21-times, versus the 10-year average of 14.9-times

But on the other hand, we also think there is a risk that companies heavily exposed to the COVID trade will find it difficult to meet lofty expectations. Overall, we expect outlook commentary to be better than we saw last August and think there will be a strong incentive for companies to provide first-time guidance.

In this environment, investors need to take a thematic-driven approach to their portfolios as February results roll in.

While the recent good form in the economy will benefit segments of the market (retailers, banks, resources), elevated valuations and currency headwinds will temper the performance of others (healthcare, offshore industrials/fintech).

In the following wire, we consider some key strategic questions investors should consider:

1. Can cyclicals continue to deliver upside surprise?

The short answer here is “yes”. As shown in our “best tactical calls” chart, around 70% of the stocks we expect to deliver a positive response are cyclical companies. Of the 52 stocks we believe will react positively to February’s results:

- Nine are retailers

- Seven are in resources and energy

- Six are technology firms.

Of the ASX100 and Ex-ASX100 stocks under coverage, Morgans analysts expect that 28% in each category will deliver a positive price response.

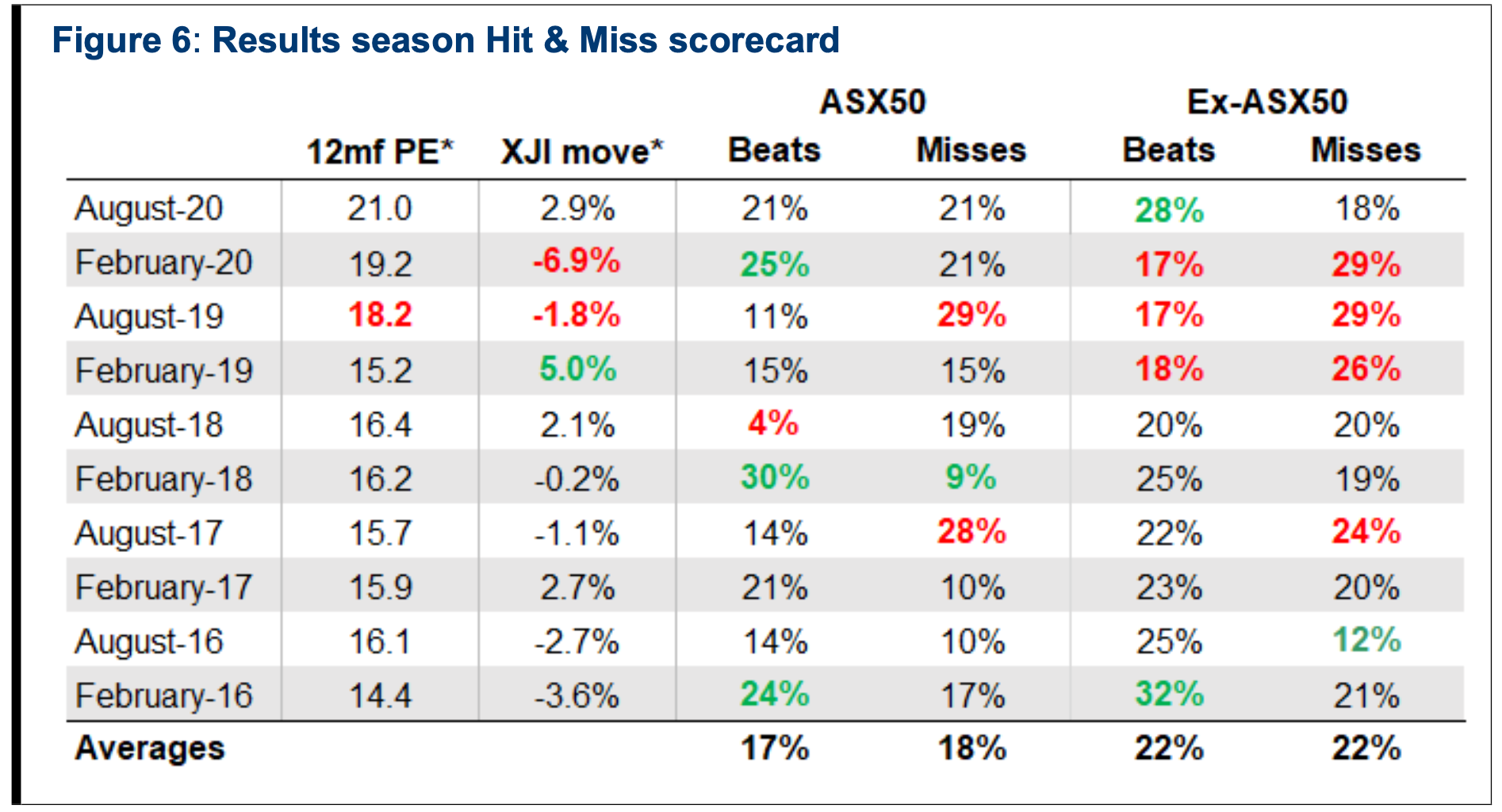

Correlating this to “beating” market expectations, then the projected “beat-rate” looks far higher than usual, as was the case in August (Figure 6).

Source: Morgans, IRESS, FACTSET

Consensus EPS forecasts have market earnings (ASX200 ex-Resources) recovering to FY19 levels early 2023, after the sharp 24% fall in CY20. The current FY23 price-to-earnings multiple of the market of around 17-times represents reasonable value assuming some upside risk to the economic recovery, but investors are clearly being asked to be patient and to bear elevated risks in the interim.

The market continues to look through reduced 2021-22 earnings, placing higher importance on the forecast earnings recovery remaining intact. Recent trends in 2021 EPS forecasts have been encouraging (up 9% since August) and we think this momentum will be validated in February, led by domestic cyclicals.

2. Where should you look for yield?

Dividend deferrals and cuts have knocked income investors hard over the past nine months, reducing the forecast 12-month forward yield of the ASX200 to 3.4%, below its 10-year average of 4.7%. While we don’t expect yields to return to average over the short-term we believe companies will respond as economic risks continue to abate.

Utilities, Materials, Energy and Telco offer the highest projected yields, but we see risks in the last two of these sectors. This is because pricing and competition challenges may firms in energy and telecommunications will look to preserve capital until conditions improve.

Bank dividends are back

In the Financials space, we expect the major Australian banks to boost their dividend payout ratios on a sustainable basis, in the range of 65-75% over our forecast period. This belief is underpinned by APRA’s December removal of dividend limits and asset quality improving. On our revised dividend forecasts, FY21 dividend yields for the banks, from highest to lowest are:

- Westpac (ASX: WBC): 5.8%;

- ANZ Bank (ASX: ANZ): 5.2%;

- National Australian Bank (ASX: NAB): 4.9%;

- Commonwealth Bank (ASX: CBA): 3.6%;

- Bank of Queensland (ASX: BOQ): 3.5%.

We also think investment manager and trustee group Perpetual (ASX: PPT) and the Australian Securities Exchange (ASX: ASX) could surprise with higher dividends at the half.

And in Resources, the majors are already comfortably de-geared, such that most of their surplus sale proceeds are likely to make their way back into the hands of shareholders. We expect above average dividends by the major miners.

Turning to the other side of the ledger, we expect a more challenging dividend environment for the insurers who have been hit by higher COVID-19 provisioning. We don’t expect QBE Insurance (ASX: QBE) or Insurance Australia Group (ASX: IAG) to pay a first-half 2021 dividend, given payout ratio targets.

3. Will the rotation into cyclical stocks last?

The 2020 ASX market performance has been led by notable sectors that have generally benefitted from the lockdown and the ongoing health crisis: IT (+44%), Retail (+8.3%), and Consumer Staples (+2.9%).

While the underlying risks to the economy will provide some support to the above industries, we believe a rotation into more cyclically linked sectors such as Energy, Travel, Transport and Financials is likely. There are a few reasons for this:

Positive upgrade momentum: Positive revisions were a vital factor driving returns ahead of the August results. Positive vaccine developments have boosted analysts’ expectations of a likely end to the global pandemic in the second half of 2021. The significant performance dispersion between many “COVID-19 winners” and “COVID-19 losers” in 2020 leaves room for rotation in 2021.

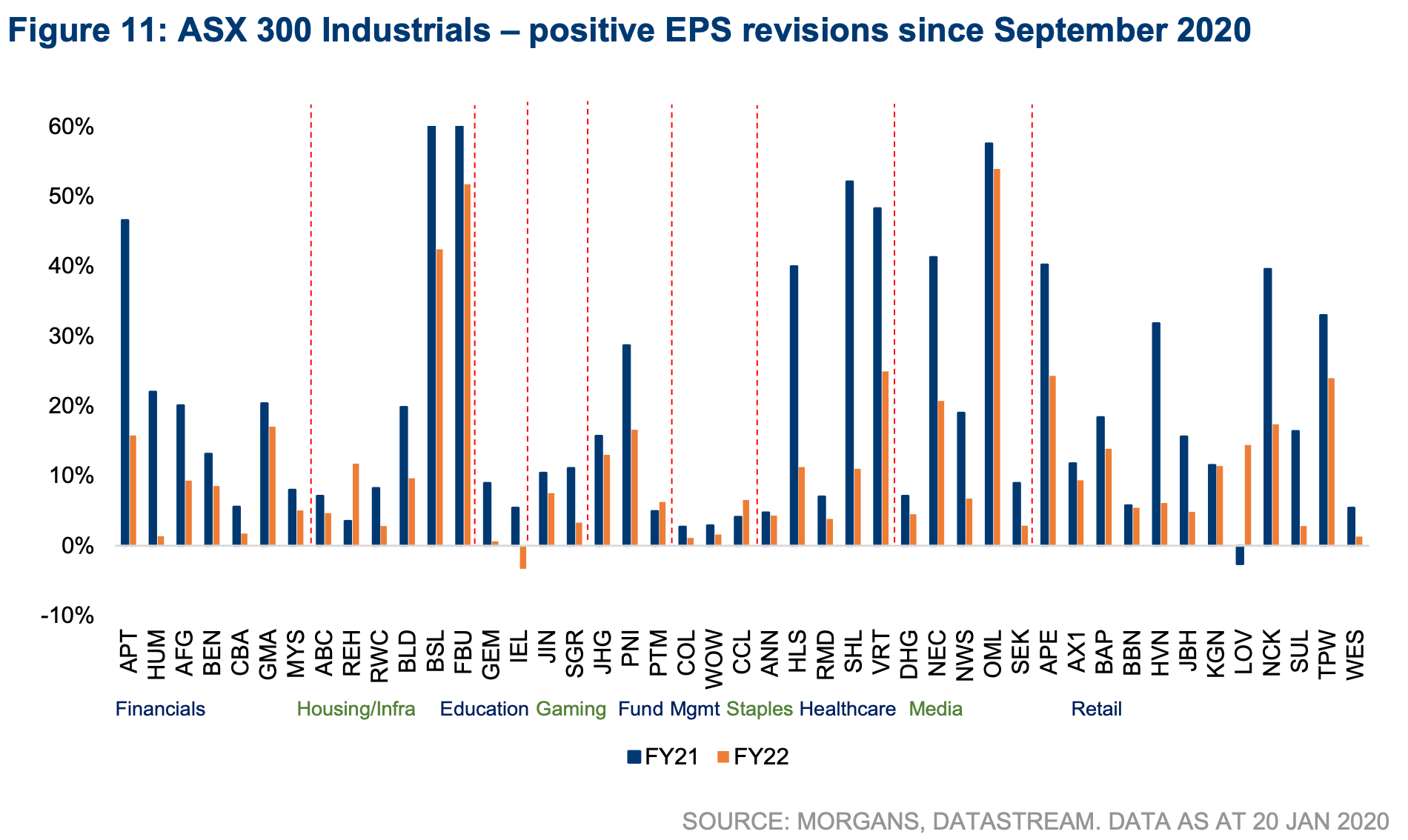

As Figure 11 illustrates, a significant proportion of recent EPS upgrades is from the COVID-19 loser cohort. In our view, this was caused by a combination of low expectations (high earnings uncertainty) and a faster-than-expected recovery in the economy (Figure 12).

Earnings growth has broadened: This is diminishing the appeal of high PE names, which have soared during the COVID period, further widening the gap between Growth and Value. External factors such as lower interest rates, ample liquidity and positive underlying structural trends have pushed valuations to extremes.

We believe the premium attached to Growth stocks will continue to narrow over the coming weeks. The price paid for earnings growth is becoming harder to justify, with all but Financials, REITs and Materials trading on a normalised forward PE for FY22 of less than 20-times. While many companies on undemanding multiples are expected to see a significant rebound in earnings (Figure 11). Stocks that we believe are well-positioned to deliver upside surprises here are:

- Virtus Health (ASX: VRT),

- Eagers Automotive (ASX: APE),

- Beach Energy (ASX: BPT),

- Commonwealth Bank (ASX: CBA)

- TPG Telecom (ASX: TPG)

- Australian Finance Group (ASX: AFG)

- Jewellery retailer Lovisa Holdings (ASX: LOV).

Trends among stock shorters highlight a positive shift in sentiment: For most of 2018 and 2019 short sellers were highly short the domestic economy (Banks, Retailers, WOW, WES). Despite the ongoing risks around COVID-19 these positions have now cleared indicating that investor attitude towards the domestic economy has fundamentally shifted.

This change in sentiment should prompt further support for stocks most leveraged to a recovery (Small Cap Industrials, Retailers, Financials, Transport).

Short sellers continue to cut positions steadily since the August reporting season, despite the continued rally in the market and extended short-term valuations. This is a bullish signal for investor sentiment and suggests the risks surrounding the recovery (re-emergence of COVID-19 cases and vaccine rollout) are low.

Aussie mining major BHP (ASX: BHP) remains the most shorted by value with over A$4.7 billion. However, we do not share this view; we see iron ore and copper benefitting from strong price appreciation and better operating conditions.

A2 Milk (ASX: A2M) with A$646m and employment portal SEEK (ASX: SEK) with A$525 million also have significant short positions relative to their market cap.

This wire is based on a Morgan's Best tactical calls report, which is made available to stockbroking and wealth management clients.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics