Buy bonds now, if you haven’t already

At this point in the cycle, we believe risks are asymmetrical and skewed to the downside regarding government bond yields. With the Federal Reserve expected to pause rate hikes in 1Q2023, potentially followed by rate cuts and the end to quantitative tightening by early 2024, we see US Treasury yields on a downwards trajectory throughout 2023. In supporting this view, Morgan Stanley expects inflation to keep moderating into 2023, whilst PMIs and other economic indicators are likely to fall into restrictive territory next year, along with a softening in the US labour market.

Alternatively, in the case where the economy is more resilient than expected, we see little need for the Fed to hike rates beyond 5.0% - the level currently discounted by the market. In this scenario, Morgan Stanley still expects inflation to moderate, meaning that the upside on bond yields is: i) capped; and ii) concentrated at the front end of the curve.

This outlook for weaker growth and moderating inflation next year makes government bonds more attractive in a multi-asset portfolio context given the current higher starting 10 year Treasury yield of ~4.0% in both Australia and the US, along with restored diversification benefits. Recently we have been rebuilding our duration within our recommended portfolio positioning, with our model portfolios now showing a modest overweight duration.

In the following review we highlight 2 ETFs and 1 Managed Fund that

provide appropriate exposure to Global Bonds.

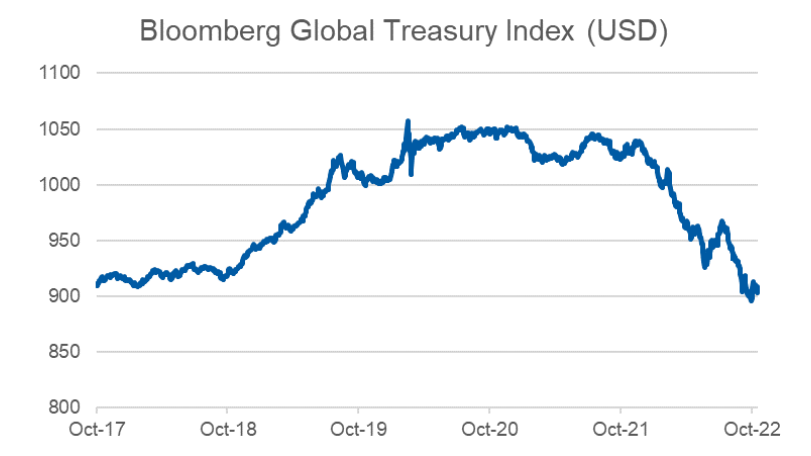

Global government bonds have recorded poor performance throughout 2022, with the Bloomberg Global Treasury (USD) Index down ~12% year to date (see Figure 1). In particular, since October, global bond yields have been range trading whilst global equities, as per the MSCI World Net Local Total Return (USD) Index, have recorded a ~10% rally.

Figure 1: Global Treasuries have reversed all gains since 2017 in the last 12 months

Whilst the Federal Reserve struck a relatively hawkish tone

at its last meeting, the market is currently still positioning for

the first “pivot”, not yet towards cutting rates but rather

towards a slower pace of rate hikes. This outlook has been

mostly driven by the “shift-in” from other central banks

rather than by the Fed itself. Whilst pressure has continued

to build at the short end of the curve, the back end has

traded within a narrower range. This has accentuated the

yield curve inversion, with the US 10 year-2 year Treasury

spread reaching around -55bps last week.

Recently, we have become significantly more positive on bonds and have been rebuilding our duration in our recommended portfolio positioning in the last couple of months. Early last week we moved to a modest overweight duration. We now believe the risks on global bond yields are asymmetrical and skewed lower as the headwinds that have kept global Treasury yields high are likely to abate in the first half of 2023. This is based on a moderating of the five key headwinds listed below:

- High inflation

- Robust employment

- PMIs fading, but still in expansion territory

- Quantitative tightening; and

- Aggressive rate hikes.

Inflation

Regarding inflation, the US consumer price index (CPI)

for October came in sharply below expectations.

Headline CPI came in at 0.44% for the month, versus

Morgan Stanley’s forecast of 0.66% (Consensus: 0.6%),

while the core CPI rose 0.27% on the month (Morgan

Stanley forecast: 0.47%; Consensus: +0.5%). On a YoY

basis, headline inflation declined to 7.7%, versus 8.2% in

the prior month, while core inflation came in at 6.3%YoY,

down from 6.6%YoY in September.

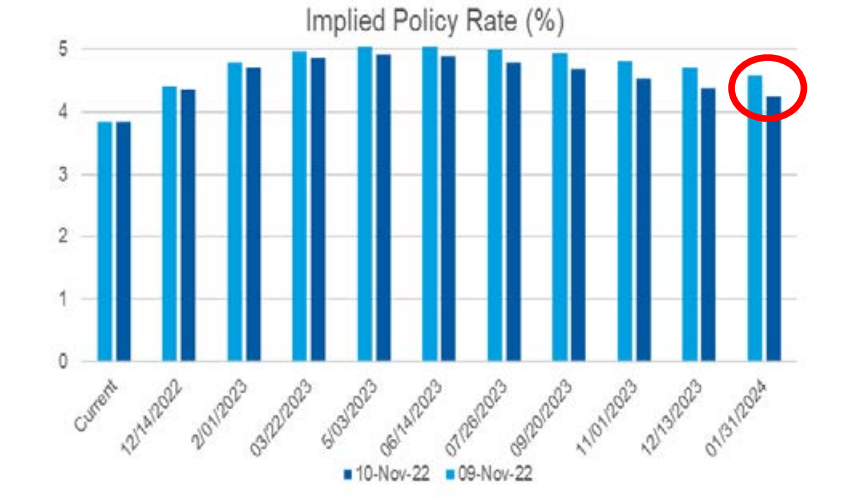

The immediate outcome from the weaker than expected

CPI data was a ~30bps fall in the US 10-year Treasury yield

along with a sharp repricing of Fed cash rate expectations.

The Fed cash rate forecast for Dec 2023 fell from 4.7% to

4.4% (see Figure 2).

Figure 2: Market-implied US cash rates now see a lower

peak rate and quicker rate cuts in 2023

This softening of core inflation in October is welcome news

for the Fed. Policymakers have indicated that their

preferred next move would be a step-down to a 50bp rate

increase at the December Federal Open Market Committee

(FOMC). Signs of a deceleration in inflation will help Fed

officials moderate the pace of tightening, although a

stronger than expected December payroll date (300K+)

could still complicate the issue at the margin (see US

Economics: North America: CPI, 10 Nov 2022).

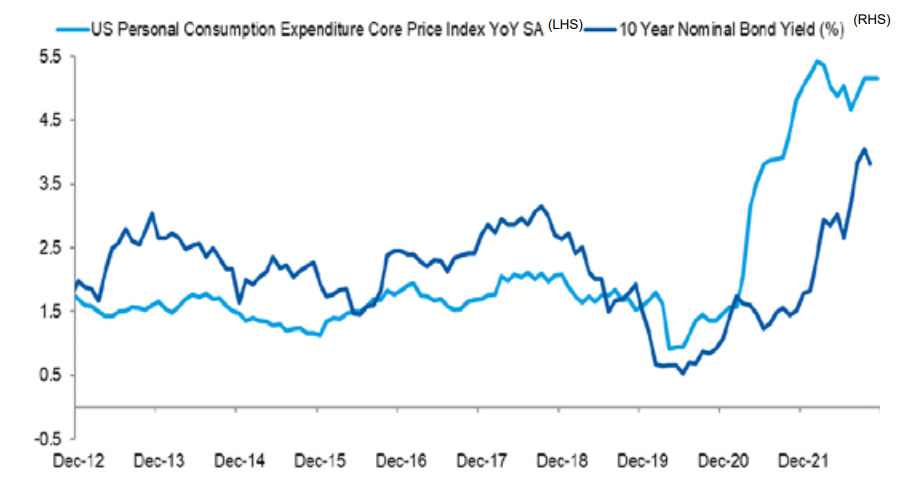

Figure 3: Normalising US core inflation is expected to

exert downside pressure on bond yields in 2023

Employment

US employment has remained remarkably robust despite

the recent inflationary pressures and the associated

weakening macro momentum. The October US

employment report delivered an upside surprise in terms of

job growth as non-farm payrolls increased by +261K on the

month, versus Morgan Stanley’s expectation of +180K

(Consensus: +193K), although the unemployment rate did

increase slightly from 3.5% to 3.7%. Wages came in strong,

with average hourly earnings rising +0.4% on the month

versus Morgan Stanley’s expectation of +0.3%

(Consensus: +0.3%). In addition, leading employment

indicators - although showing momentum might have

peaked – at present remain solid. Currently, this remains

the main impediment to lower Treasury yields and the

associated turnaround in central bank policy. However, as

the effects of monetary tightening feed through to the real

economy, we expect to see the US unemployment rate rise

gradually throughout 2023 to 4.3% by 4Q23.

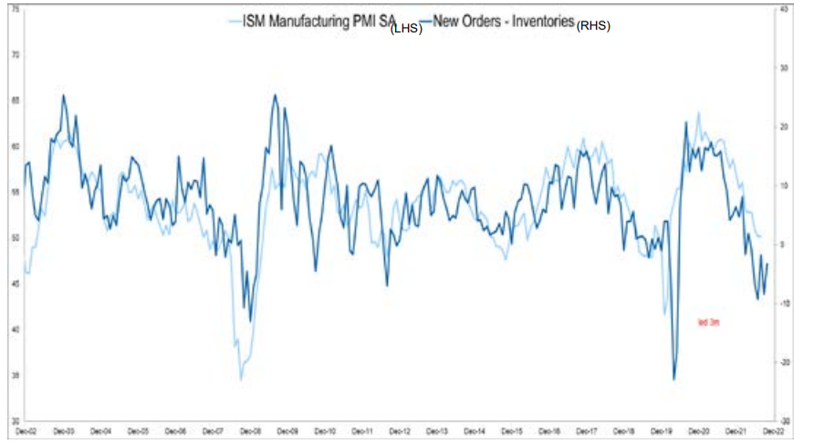

PMIs

The October US ISM Manufacturing index fell to 50.2.

Whilst the index hasn’t yet fallen into contraction territory

(i.e.: prints below the 50 mark), leading indicators within the

ISM data - i.e. the sub-indices on New Orders (49.2), Export

Orders (46.5) and Unfilled Orders (45.3) - are all below 50.

Therefore, the overall index is likely to dip below 50 in the

next couple of months (see Figure 4).

Figure 4: US PMI New Orders – Inventories pointing to

further weakening at the headline ISM PMI level

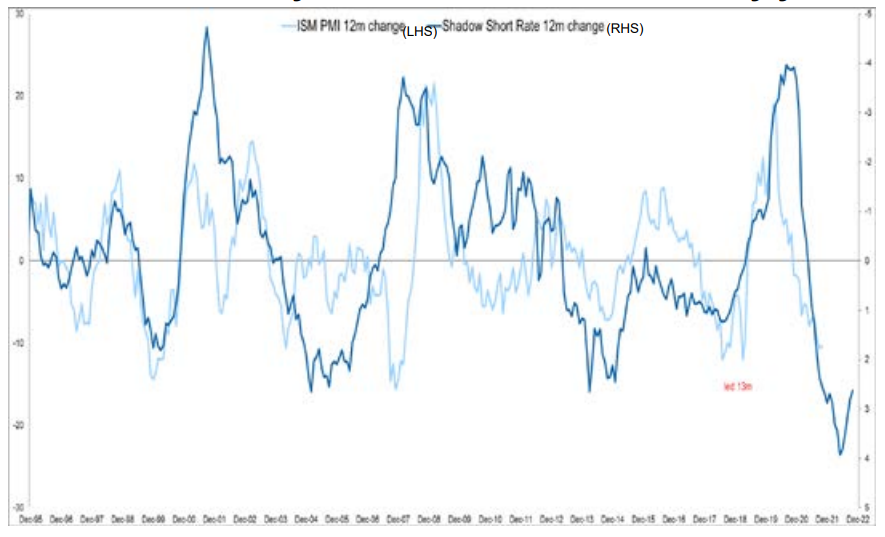

We also note that the Fed itself has indicated the economy

is not yet reflecting the full effect of monetary tightening,

which generally comes with a substantial lag. This is

supported by the current readings of monetary setting

measures, such as Morgan Stanley’s Shadow Short Rate -

which also points to further fall in manufacturing activity

(see Figure 5).

Figure 5: The impact of tighter monetary conditions

have not been fully reflected in the US economy yet

We note however that the US ISM Non-manufacturing

index is currently at a more favourable level, with the overall

index reaching 54.4 in October and New Orders at 56.5 -

even if both of those readings are down from the peaks

seen earlier this year. In addition, this lag is to be expected

given the manufacturing index generally leads the services

index.

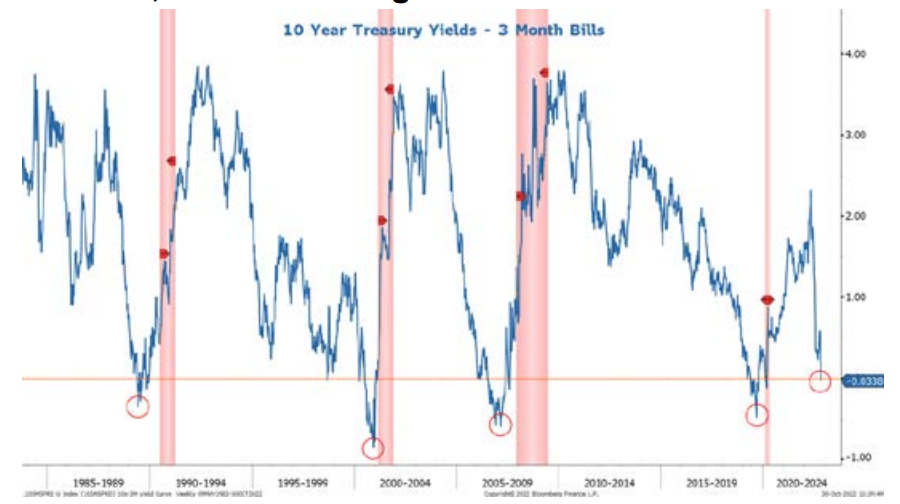

More broadly, Morgan Stanley’s outlook regarding the US

economy is that we will likely avoid a recession, even if it

becomes a close call, with US GDP growth expected to rise

by only 0.5% in 2023. However, while a 2023 recession is not our base case, many indicators suggest it may be

inevitable – and therefore our cautious view could be too

optimistic. In particular, the US 10 Year-3 Month Treasury

yield curve has finally inverted and this is one key indicator

Chair Powell has said he is watching closely as a sign the

Fed has gone too far regarding monetary tightening. It is

important to highlight that an inverted 10 Year-3 Month

Treasury yield curve has a track record of indicating a

recession within 12 months (with no false positives

historically) - so there is good reason the Fed should be

considering pausing at this point.

Figure 6: US 3 month–10 year US Treasury yield has

inverted, a recession signal…

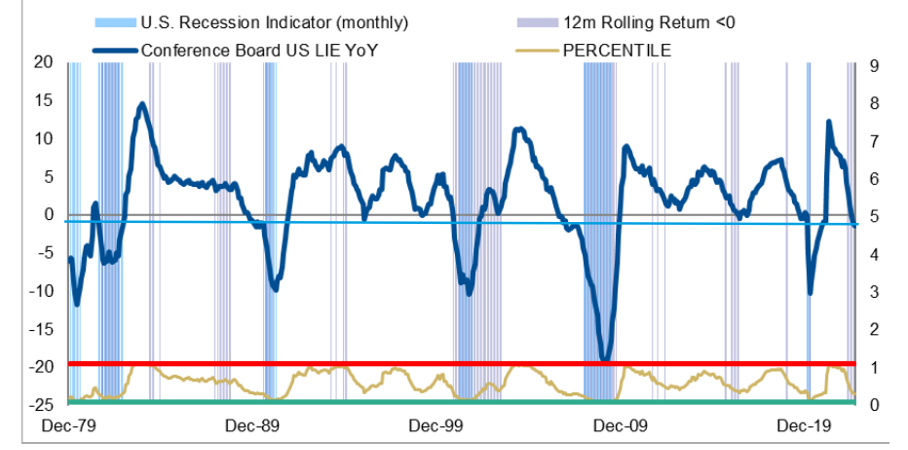

Finally, another key indicator which has historically

forewarned a recession is the Duncan Leading Indicator.

This recently moved into negative territory following the

3Q22 GDP data release - as noted by our CIO Mike Wilson

(see US Equity Strategy: Weekly Warm-up: “Spooky” Price

Action Supports Tactical Call as All Eyes Shift to the Fed,

31 Oct 2022). In addition, we also follow the more broadly

used Conference Board Leading Economic Indicator (LEI),

which has now fallen to -1.14. A level lower than -1 has

always led to a recession historically (see Figure 7).

Figure 7: …and the US Leading Economic Indicator

points to the same outcome

When combined with the inverted US 10 Year-3 Month Treasury yield curve, the data is much more supportive of a Fed pause than we have seen at any other point in this cycle – thereby potentially indicating lower government bond yields in the near future.

Figure 8: US 10-year Treasury yields are likely to fall on

slower economic activity

Quantitative Tightening

The Fed started passive quantitative tightening (QT) in June of this year and stepped up the pace in September, allowing US$60bn of Treasuries and up to US$35bn of mortgage-backed securities (MBS) to run off its balance sheet each month. However, reserves held by banks began to decline even before QT started, as the rise in short-term interest rates let banks move non-operating deposits to money funds, which ended up in the Fed’s reverse repo (RRP) facility. Key for the Fed moving forward will be letting market rates firm slightly as reserves fall, then lowering the RRP rate. This will likely result in the RRP falling as the balance sheet keeps contracting. Essentially, the Fed’s goal is to contract the balance sheet significantly, but avoid a repo market squeeze like which occurred in September 2019. We also believe the Fed’s QT stance will remain passive, with no active sales. The housing market has already turned lower, so selling MBS could be excessive, particularly given calibrating policy with rate hikes is challenging enough.

The key question for investors is: Will the Fed call an end

to QT when the central bank eventually lowers the Fed

funds rate? In 2019, QT ended when rates were first

lowered. However as the Fed was already planning to end

QT around that time, this timing was a coincidence. While

we could see the same coincidence this time as well, it is

important to note that the Fed sees the two policy tools as

independent. Morgan Stanley’s forecast for the first 25bp Fed rate cut is in December 2023. We believe at this stage

that QT will continue at its current pace through the

second quarter of 2024, which implies the two Fed tools

moving in opposite directions for a time. However, QT might

end earlier if the economy goes into recession, with the Fed

potentially contemplating significant rate cuts of 100bps or

more. Similarly, if markets were dysfunctional - like in

March 2020 or the recent episode in the UK Gilt market -

we would expect QT to end, at least temporarily (see The

Weekly Worldview: Will Balance Sheet Reduction Happen

on the QT?, 7 Nov 2022).

US Cash rate trajectory for 2023

The FOMC hiked rates by 75bp at its recent November

meeting and also indicated ongoing increases will be

necessary. The policy rate remains well below peak, which

Morgan Stanley expects will be reached in January 2023 at

4.625%. However, Chair Powell also noted that policy lags

may be appropriate "as soon as the next meeting".

Therefore, provided data releases are in line with Morgan

Stanley’s expectations, this could result in the Fed slowing

the pace of rate increase to 50bp in December.

However, a slower pace does not mean a lower peak. According to Chair Powell, the FOMC now sees the policy rate peaking higher than previously thought. Morgan Stanley expects the median will re-anchor closer to 5.0% in the December Summary of Economic Projections. In particular, we see the rates market pricing a shallower as well as longer, drawn-out rate hike path, with nearly the same terminal rate as before the last FOMC meeting.

With all that in mind the FOMC will likely need to keep

hiking rates (i.e. no pause or pivot) until they see at least

a few consecutive readings of both slower US core

inflation and softening labour market conditions. We

expect this outcome to eventuate in the first few months of

2023 at the very earliest. Until then, the Fed must maintain

the pressure on markets, in turn negating a pre-emptive

easing of financial conditions, and until lower inflation

actually eventuates.

Although this suggests it is difficult to forecast the peak

in US Treasury yields, this outcome is moving closer,

particularly as the US economy slows and inflation

recedes. Morgan Stanley is now of the view that Treasury

yields will move lower gradually over 2023, led by declining

2-year yields. We see 10-year US Treasury yields trading

around 3.75% by the middle of 2023, and at around 3.50%

by the end of 2023.

Dynamics are similar in the euro area, where Morgan

Stanley forecasts a gradual decline in 10-year Bund yields

in 1H23 - after the recent peak reached at around 2.50%

last October. In particular, the decline in eurozone HICP

inflation below 5%YoY by mid-year and significantly lower-than-expected 2023 eurozone GDP growth will likely

warrant a lower European Central Bank (ECB) terminal rate

than market expectations. The lower path of short-term

rates and the decline in inflation is expected to more than

offset the negative impact of ECB QT, pushing Morgan

Stanley’s Bund model fair value close to 1.50% by late

2023. Morgan Stanley forecasts the 10-year Bund yield at

1.60% in 2Q23 and 1.50% in 4Q23 (see 2023 Global

Strategy Outlook: The Year of Yield, 13 Nov 2022).

Investment Conclusion

With the Fed expected to pause rate hikes in 1Q2023,

potentially followed by rate cuts and the end to QT by early

2024, we see US Treasury yields on a downwards

trajectory throughout 2023. In support of this view, we

expect inflation to keep moderating into 2023 whilst we see

PMIs and other economic indicators falling into restrictive

territory next year, along with a rise in the US

unemployment rate. In the alternative scenario where the

economy is more resilient than expected, we still see little

need for the Fed to hike rates beyond 5.0% - the level

currently discounted by the market. In this scenario,

Morgan Stanley still expects inflation to moderate, meaning

that the upside on Treasury yields is: i) capped; and ii)

concentrated at the front end of the curve.

This outlook for weaker growth and inflation next year

makes government bonds more attractive in a multi-asset portfolio context given: i) the current higher starting

10 year Treasury yield of ~4.0% in both Australia and the

US; along with ii) restored diversification benefits. This is

why we have been rebuilding our fixed income duration

in our recommended portfolio positioning in recent

months, with our portfolios now showing a modest

overweight duration.

For equity markets, this implies there is a window where

stocks will likely rally on the expectation inflation is

moderating – i.e. which allows the Fed to pause its rate

hikes at some point in the near future. Moreover, this pause

will likely occur while 12 month forward EPS forecasts

remain elevated (and until company guidance is expected

to lower the outlook early next year). The recent rally has

taken the S&P 500 up around 14% from the intra-day lows

on October 13th. Essentially, any further upside in the short term is premised on the Fed’s response to the recent

weaker inflation data and the potential fall in Treasury yields

- in turn restoring some equity risk premium. However, at

this point, we remain concerned earnings downgrades will

weigh on stock markets in 1Q23 and before a more

sustainable recovery can take place.

Implementation Ideas

Given our expected trajectory for global bond yields, and in particular with more downside expected in Europe than the US, we prefer implementing our fixed income positioning via Global bond investments rather than focused solely on the US. We provide two ETF implementation ideas and one managed fund recommendation below.

PIMCO Global Bond Fund (APIR: ETL0018AU)

MWSM Research PIC Status: Approved – Focus List.

The PIMCO Wholesale Global Bond Fund is a Global Fixed

Interest Fund that invests in a diversified portfolio of

investment grade bonds denominated in major world

currencies. The Fund actively manages exposure to

interest rates, currencies, credit and countries. The

investment team aims to outperform the Bloomberg Global

Aggregate Index (AUD hedged) by 100bps over a five to

seven-year period (gross of fees and taxes) with an

allowable tracking error of 2-3% p.a. over a full cycle.

PIMCO’s philosophy focuses on long-term value, a broad

opportunity set, diversification of alpha and risk

management. The Fund aims to achieve this by identifying

favourable secular and cyclical trends, capitalizing on

relative value opportunities, and avoiding credit events. The

PIMCO Global Bond Fund is our preferred International

Bond strategy given PIMCO’s size and global presence,

skilled and experienced portfolio managers, large analyst

pool, and best in class systems (see Managed Fund

Research Report: PIMCO Global Bond Fund, 16 Aug

2022).

Vanguard Global Aggregate Bond Index (Hedged) ETF

(VBND.AX)

MWSM Research PIC Status: Approved – Focus List

Vanguard Global Aggregate Bond Index (AUD Hedged)

ETF (VBND.AX) tracks the return of the Bloomberg

Barclays Global Aggregate Float-Adjusted and Scaled

Index hedged in Australian dollars. The underlying index

includes exposure to debt from 24 local currency markets.

The benchmark includes treasury, government-related,

corporate and securitized fixed-rate bonds from both

Developed and Emerging Market issuers. With ~28,000

holdings in the index, all securities must be of a minimum

investment grade quality with a weighted average credit

quality of AA-. Approximately ~50% of the portfolio is in

treasury bonds. VBND.AX is our preferred ETF in this

category due to its low cost, tight tracking error and good

liquidity (see ETF Research Report: International Fixed

Income ETF Review, 2 Mar 2022).

Vanguard International Fixed Interest Index (Hedged) ETF (VIF.AX) MWSM Research PIC Status: Approved – Focus List

Vanguard International Fixed Interest Index (AUD Hedged)

ETF (VIF.ASX) tracks the return of the Bloomberg Barclays

Global Treasury Scaled Index hedged into Australian

dollars. The underlying index includes fixed-rate and local

currency government debt from investment grade

countries, including both Developed and Emerging

markets. The ETF invests in fixed income securities that

generally range in credit quality from BBB- to AAA. The

index has ~1,800 holdings and an average AA- credit

quality. Approximately ~35% of the ETF is the US and

~25% in Japan. The ETF has a high duration, due to the

large allocation to treasury bonds, at approximately 7 to 8

years. VIF.AX is our preferred ETF in this category due to

its low cost, tight tracking error and diversification of

holdings (see ETF Research Report: International Fixed

Income ETF Review, 2 Mar 2022).

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with content like this by hitting the ‘follow’ button below and you’ll be notified every time we post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics