CBA and Telstra headline August earnings week ahead

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

Today also marks the beginning of Livewire's August earnings season coverage. For the next three weeks, the team is standing by to provide exclusive and actionable insights on the numbers and companies that matter most to you.

MARKETS WRAP

- S&P 500 - 4,145 (-0.16%)

- NASDAQ - 12,658 (-0.5%)

- CBOE VIX - 21.15

- FTSE 100 - 7,440 (-0.11%)

- STOXX 600 - 435.72 (-0.76%)

- US 10YR - 2.676%

- USD INDEX - 106.58 (+0.84%)

- GOLD - US$1,792/oz

- CRUDE OIL - US$88.53/bbl

earnings week

- Today: Aurizon (ASX: AZJ), Suncorp (ASX: SUN)

- Tomorrow: Megaport (ASX: MP1), News Corp (ASX: NWS)

- Wednesday: Commonwealth Bank (ASX: CBA), Mineral Resources (ASX: MIN), Computershare (ASX: CPU)

- Thursday: Telstra (ASX: TLS), ResMed (ASX: RMD), QBE (ASX: QBE), AGL (ASX: AGL), AMP (ASX:AMP)

- Friday: REA Group (ASX: REA), IAG (ASX: IAG)

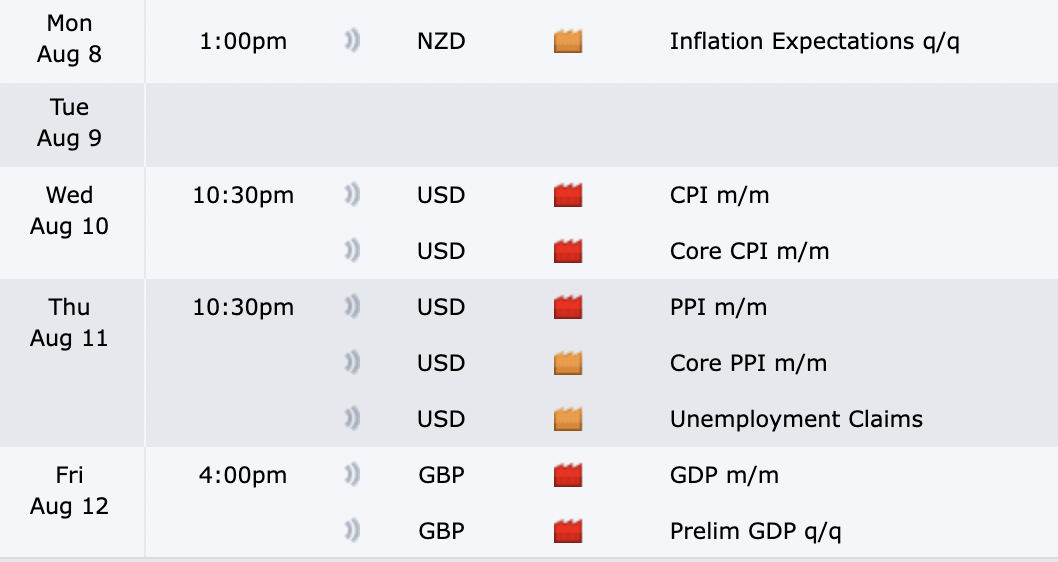

THE CALENDAR

The good news? There isn't as much data on the docket next week to keep track of, especially here in Australia. That means company fundamentals will take centre stage as earnings season really ramps up.

The bad news? The data that is on the docket on the global front is a big deal. Today, we get inflation expectations in New Zealand - an economy where inflation is running so hot that the RBNZ has hiked rates by 150 basis points in three months and has not signalled an end in sight.

On Wednesday and Thursday, we get the most up-to-date reads on inflation in America. The current consensus estimate is for a 0.7% month-on-month increase in core CPI and 0.4% for core PPI. All this is a roundabout way of saying price rises are still enormous stateside.

Finally, the UK has GDP figures released on Friday. Last week, the Bank of England downgraded its economic growth forecasts for the country. In fact, today's Stats Incredible is the reason for that downgrade. UK inflation could have a 13-handle by the end of the year.

That makes this set of numbers all the more important. If a recession is around the corner, then the signs will start to show here.

THE CHART

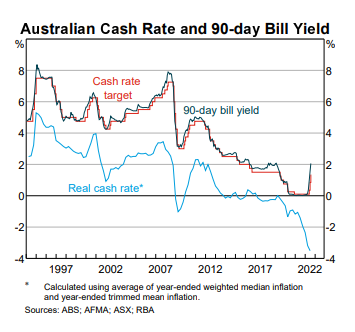

This is a simple yet humbling chart, spotted by my colleague Glenn Freeman. It's the RBA's cash rate target minus the 90-day bill yield. But it's that light blue line that really grabs the most attention. Because of how rampant inflation is, the "real cash rate" has been deeply negative for the better part of five years.

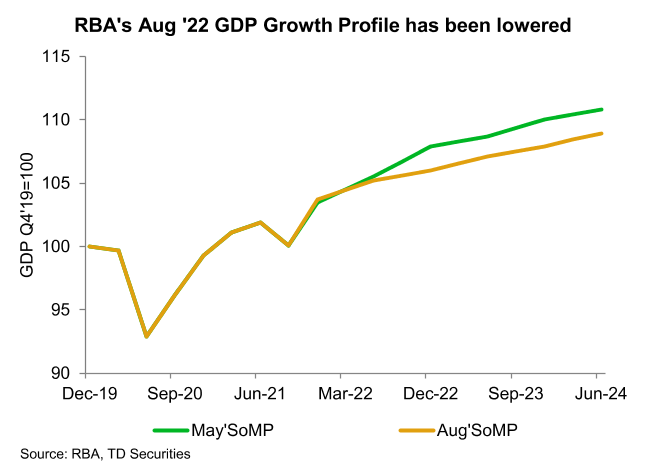

What might this prove? That the impacts of monetary policy take a long time to feed through to the broader economy. And indeed, the longer you don't act, the more harsh the inaction turns up in the data. You can see the impacts of that in Friday's Statement of Monetary Policy which revealed the RBA had downgraded its forecasts for economic growth. This is shown by this TD Securities chart:

THE STAT

Mentions of the word "recession" at the last six Federal Reserve press conferences have accelerated dramatically throughout the year. Charlie Bilello of Compound Capital Advisors did the number crunching:

- December 2021: 0

- January 2022: 0

- March 2022: 4

- May 2022: 9

- June 2022: 6

- July 2022: 26

When they say the professionals will talk us into a recession, perhaps this is what they mean.

STOCK TO WATCH

Today, we're taking a look at the rationale of UBS' re-rate for ASX gold stocks. The flurry of June quarterly reports saw most gold names meet their respective guidance statements. The only problem? The earnings guidance was already reduced.

The good news is that spot gold may still have time on its side, as global central banks continue to tighten policy. UBS analyst Levi Spry continues to see good opportunities but does admit operating and inflation headwinds mean these stocks are probably not as cheap as they first look.

Here's his list of preferences:

Our pick of the large caps remains Northern Star (ASX: NST) with its net cash and strong organic growth pipeline. In small caps, we like Gold Road (ASX: GOR) for its low risk growth and low AIC [all-in sustaining costs]. We ... downgrade Evolution Mining (ASX: EVN) to neutral too.

THE TWEET

Today's report was written by Hans Lee.

GET THE WRAP

If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

4 topics

3 stocks mentioned

2 contributors mentioned