Chart of the Week - Bond Yields Going Down!

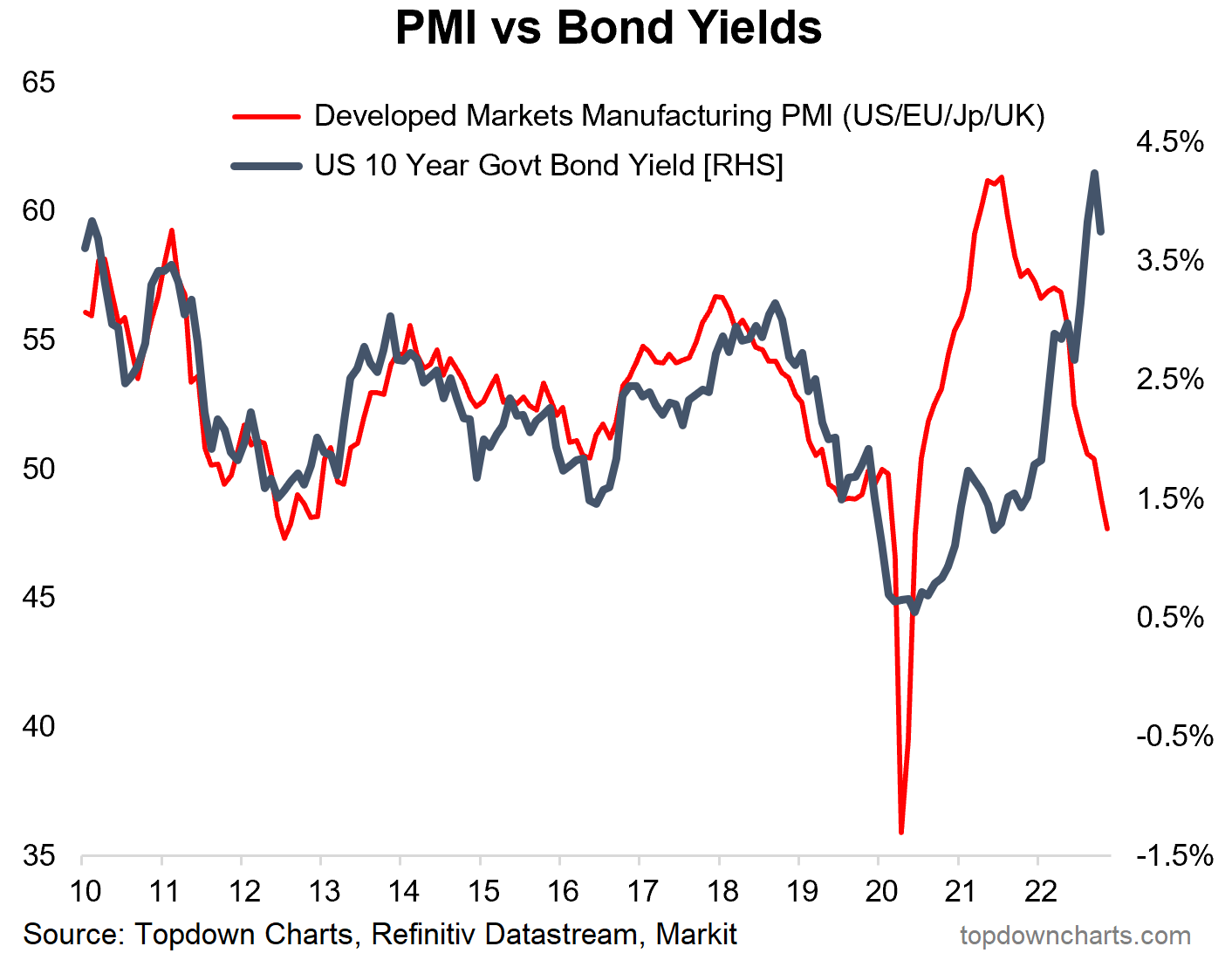

Bond Yields vs the PMI: As alluded to in the section on treasuries in our latest report, one impact of a weakening growth outlook would be relief for bonds (our base case is a sharp global economic recession into early-2023).

The latest developed markets flash manufacturing PMI [Purchasing Manager’s Index — a good real-time gauge of the economic pulse] dropped further into contractionary territory during November, which is a clear indication that the economic slowdown is already underway.

If we take the chart below of bond yields vs the PMI literally… it is pointing to the US 10-year treasury yield dropping back below 1.5% (!).

I do wonder though if it ends up like the closing of the previous gap, where it took quite some time before bond yields caught up to the PMI (indeed it was around this time last year that we outlined the clear and present upside risks to yields …now things have come full circle!). In other words, maybe there will be a delayed reaction for bond yields to catch down to the currently collapsing PMI.

But one thing I am certain of is that if we do get a proper full-blown recession, bonds will perform well in absolute terms, and will actually perform their usual diversification role this time around (as opposed to both stocks AND bonds falling in 2022).

Key point: Bond yields are likely to fall further in the event of recession.

NOTE: This post first appeared on our NEW Substack: (VIEW LINK)

Best regards,

Callum Thomas

Head of Research and Founder of Topdown Charts

3 topics