Chart of the Week - Global Property Price Boom (and?)

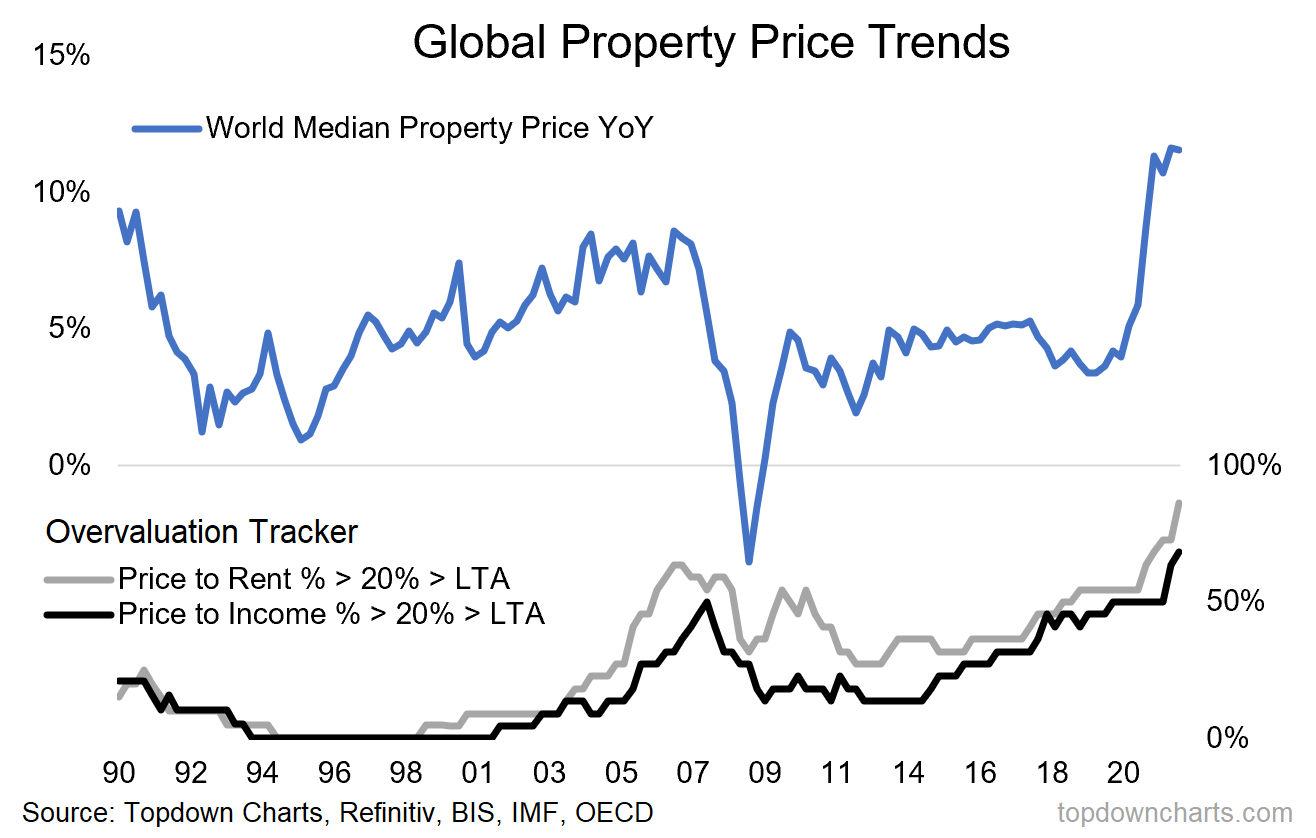

Pandemic Property Price Pop: Globally, property prices have been juiced to historically expensive levels thanks to pandemic (over)stimulus. As an indication of just how quickly prices have risen, the world median property price growth rate has increased more than 10% year over year. That is the fastest pace of increase in more than three decades and nearly double the average increase over the last 10 years.

While there are some countries and regions that are a bit more egregious than others, this is actually a relatively widespread issue. For instance, the “Overvaluation Tracker” shows that 90% of countries’ housing markets are at least 20% more expensive than usual on a price-to-rent ratio basis, and 70% of countries see house price-to-income ratios as at least 20% overvalued.

And of particular interest: looking at both valuation metrics, globally, house prices are more expensive than at the pre-financial crisis peak.

Given the looming macro headwinds to housing (rising interest rates as central banks lurch into tightening, squeeze on discretionary incomes from rising costs, and global recession risk), this presents a clear vulnerability and risk of a housing bust.

Key point: The economic cure of the pandemic has left extreme side-effects.

NOTE: this post first appeared on our NEW Substack: (VIEW LINK)

Best regards,

Callum Thomas

Head of Research and Founder of Topdown Charts

Follow us on:

LinkedIn (VIEW LINK)

Twitter (VIEW LINK)

5 topics