Chart of the Week - Low Energy Investment

Energy CapEx — Renewables vs Oil & Gas: This is an interesting chart with respect to commodity markets, energy security, and the energy transition …perhaps some of the most important issues of our time.

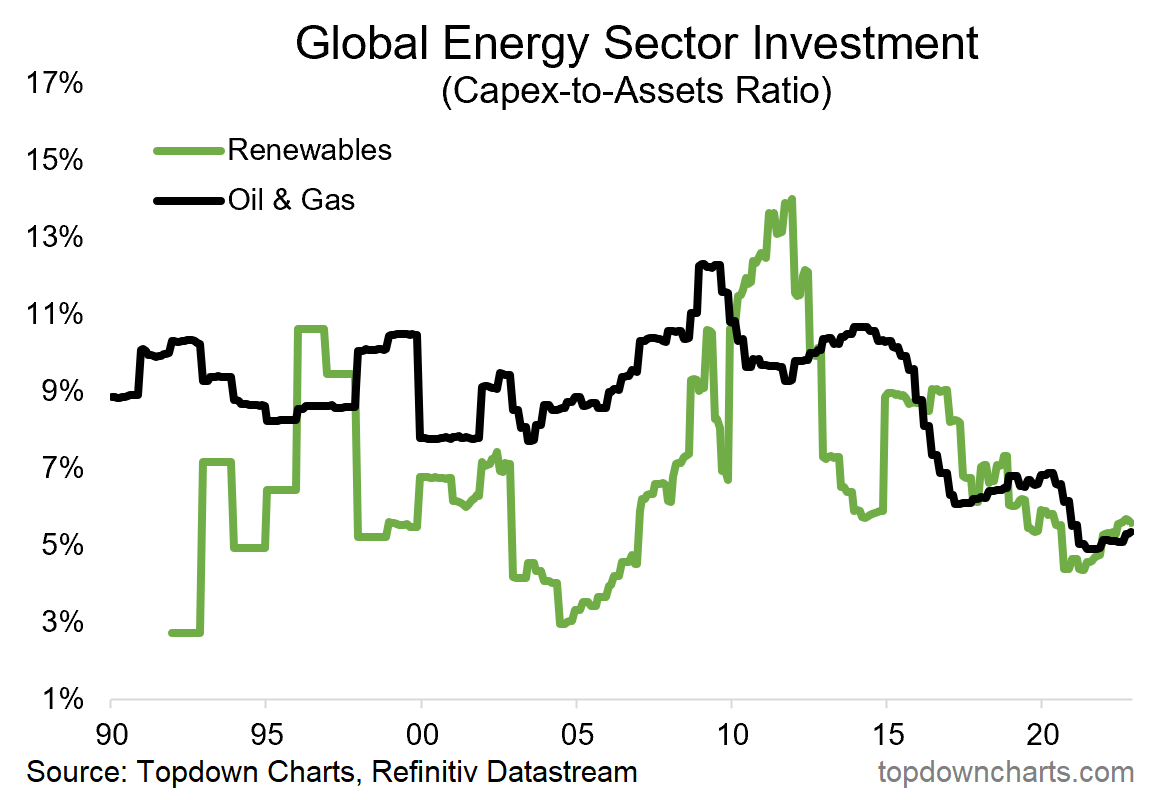

It shows the capex-to-assets ratio for the global renewable energy sector, and the traditional energy sector (Oil & Gas ) — in other words, a standardized way of tracking the pace of capital expenditures (i.e. investment in productive capacity).

I’ve previously highlighted how the record low pace of capex by Oil & Gas producers (and commodity producers in general for that matter — following the 2010’s commodity bear market) was a key element in the surge in energy prices.

But perhaps what is surprising is how weak the pace of capex has also been for renewable energy (and basically the investment so far has not been nearly enough to offset to decline in traditional energy capex, and is still overwhelmingly dwarfed by investment in the Oil & Gas sector).

If any semblance of energy security is to be found either or both of those lines need to go up, and fast, and substantively. And if an energy transition is to be viable and practical, we need to see massive and rapid investment in the alternative/renewable energy space.

Until then, we likely see a higher floor in energy prices, ongoing boom/bust cycles, and much of the push to carbon zero can be seen only as noise and pointless protests in lieu of real action: real investment, real steps to actual sustainability (which needs to feature economic sustainability to be truly sustainable).

So an important chart for commodities in general and commodity-related sectors in the stock market, but also important on the (geo)political side of things in terms of energy security and tracking energy transition aspirations vs realities.

Key point: All energy producers, carbon or not, are massively underinvesting.

NOTE: This post first appeared on our NEW Substack: (VIEW LINK)

Best regards,

Callum Thomas

Head of Research and Founder of Topdown Charts

4 topics