Charts and caffeine: Battle of the ASX health-tech stocks

Welcome to Charts and Caffeine - our daily markets wrap featuring the best charts and reads from across Livewire's team of expert editors. Let's get you caught up on the Friday session.

us markets wrap

- S&P 500 - 4,158 (+2.47%)

- NASDAQ - 12,131 (+3.33%)

- CBOE VIX - 25.72 (-6.47%)

The major indices snapped a seven-week losing streak stateside. Both the S&P 500 and NASDAQ recorded gains of +6% last week up.

- FTSE 100 - 7,585 (+0.27%)

- DAX - 14,462 (+1.62%)

- USD INDEX - 101.64 (-0.19%)

- US 10YR - 2.745%

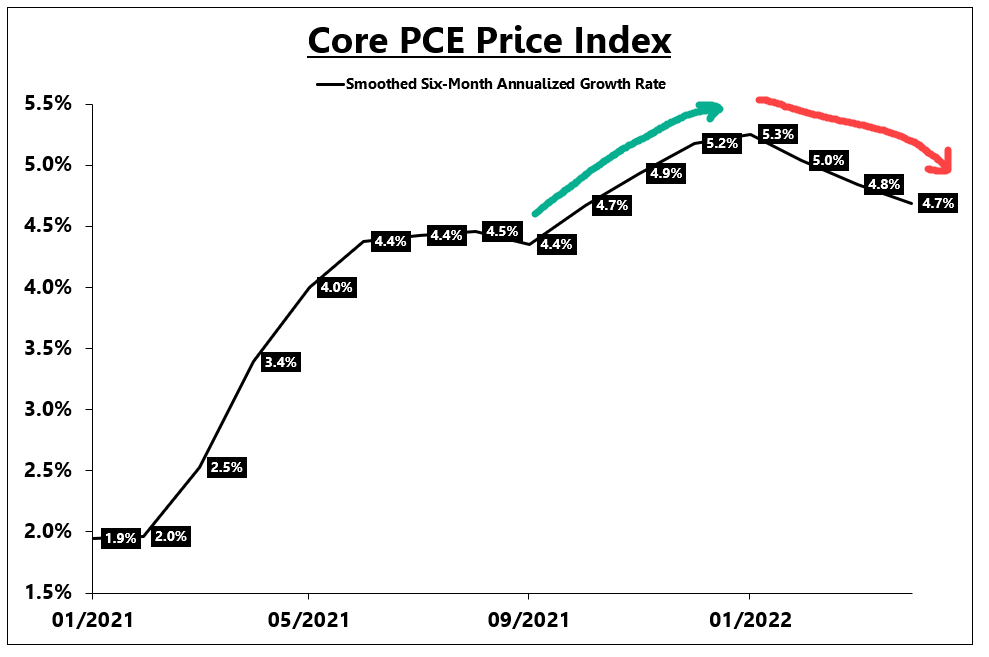

Yields dropped stateside after the crucial inflation print showed signs we may be near the peak. The year-on-year rate declined for the first time in nearly 18 months - as this graph shows us:

- AU 10YR - 3.252%

- GOLD - US$1850

- BRENT CRUDE - US$115.32

stocks wrap

As US quarterly earnings season draws to a close (for a few weeks), we find that more than 75% have beaten the street's estimates. For the other 25% (staring at you Netflix, Target, and Snap), their shares were punished hard.

Among the beats, Ulta Beauty managed to ride out the supply chain and consumer spending crunch. Computer maker Dell also managed to beat analyst expectations for revenue and EPS.

On a more mixed note - Gap and American Eagle Outfitters (think young, trendy, and relatively low-end in retail) trimmed their respective annual profit forecasts. Though - weirdly - Gap finished the session nearly 5% higher. (Yes, you read that right.)

THE calendar

All the action on the macro calendar this coming week will be condensed in the back half. Locally, the biggest story in town will be the Q1 GDP print. It's a borderline call with NAB chief economist Alan Oster and Westpac chief economist Bill Evans calling for 0.1% or 0.2% growth in the first three months of this year. Or to put it another way - there's a real chance we'll see a contraction quarter-on-quarter.

ANZ's David Plank (and co) are looking for a comparatively out-sized 0.6% print - but this is the line that caught my eye.

There is more uncertainty than usual with our pick, with some sharp conflicts in aspects of the data.

It's also a rare instance where the national accounts data will be revealed before an RBA meeting. A weak print could imply the policy path ahead for the Reserve Bank won't be a fun one - having to hike rates into slowing growth (ala the Bank of England).

Here's your watercooler cheat sheet if you need a fast way to win brownie points at the office today.

So while the major bank economists are feeling nervous, Shane Oliver is one who doesn't feel as pessimistic. Here is what he wrote in his Friday note:

While we remain optimistic that recession will be avoided in the next 18 months and so shares can rise on a 6-12 month view, shares are still at risk of more downside in the short term.

In other words, we aren't at the bottom yet.

We also get two very important reads on the US labour market as well. Thursday evening sees the JOLTS report handed down - giving us a look into the number of job openings in the world's largest economy. Listings have nearly tripled since the pandemic low in June 2020.

Finally, the big kahuna of them all - the (actual) jobs report in America. While we will pay attention to the number of jobs created, investors should care a lot more about average hourly earnings. It's all fine that people can get jobs - but are they making good money to do them?

the stat(s)

3.3 per person

Speaking of labour market tightness, the number of available work is now so much that on average, there are now two job openings for every unemployed person in America. It's 3.3 if you live in Utah, Nebraska, or Montana. The picture is the opposite in California, but there's still plenty of work if you want it.

If you thought that stat was wild, then get a load of this:

$210,000

That is now the offer price from Walmart for college graduates who can make it as one of their top-performing store managers. Even if you don't get quite to the apex, they could still pay you $65,000 just for being offered the job. Is this the time to mention that Walmart CEO Doug McMillon makes $25.7 million per year?

stocks to watch

When you think of places to inform your investment decisions, chances are Medicare is not anywhere near the top of that list. But Morgan Stanley and Macquarie have used that same data to come up with two different quality ideas for your portfolio.

Pathology volumes are still benefitting from COVID-19 testing according to the latest numbers, creating an $83 million addressable market. The rise offsets a downturn in diagnostic imaging and IVF uptake. On an earnings valuation basis, they are backing Sonic Healthcare (ASX:SHL).

But proving that two views make a market, Macquarie combed over the exact same data set and concluded Ramsay Health Care (ASX:RHC) and Healius (ASX:HLS) are better long-term buys. The broker has "outperform" ratings on both.

the chart

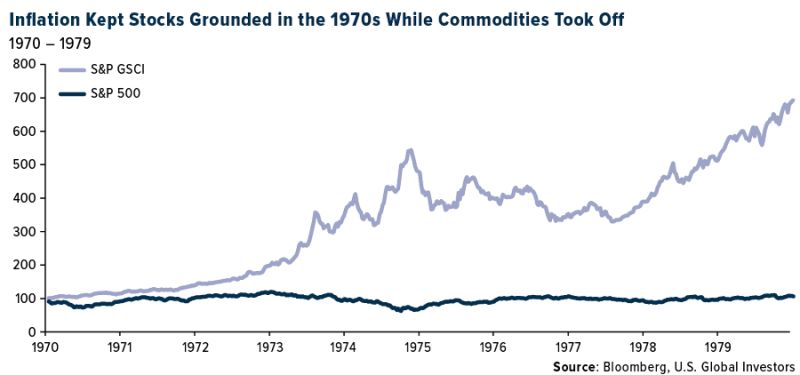

A shout out to commodities analyst (and friend) Gavin Wendt of Mine Life Report for today's chart. As he points out, inflation was last this high in the 1970s, and back then, the best asset to own back then was gold - which went from $35 an ounce at the beginning of the decade to as high as $850 by 1980.

But it wasn't just gold that benefitted from inflation. The 1970s is much like now in the sense that commodities are still a go-to inflation hedge. As this chart shows, the S&P index-tracking commodities surged seven-fold at the same time that the S&P 500 remained mostly flat.

Conclusion? Not all roads lead to equities.

the quote

Even now and after the correction of recent months, high multiple businesses on the ASX are still trading on multiples well above where they got to during the TMT bubble 20 years ago.

This quote comes to us from Joseph Koh at Schroders. His recent piece is available to read on Livewire's website. I'm not going to lie to you. When a wire starts with an extended quote from the Book of Revelations (enough to be the first reading in a Mass, I might add), you never quite know where it's going to. But trust me on this, he does land on a point eventually.

the best in business news

‘Baby Shark’ Producer Dismisses Speculation of $1 Billion IPO (Bloomberg): This is not a joke. The company behind Baby Shark (Pinkfong Co.) is batting back against claims it could be making a debut on the South Korean equity markets. Best of all, it's rejecting those rumours... in text message form. The only thing more 2022 than that would be if that press release came in TikTok form.

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

5 topics

4 stocks mentioned

2 contributors mentioned