Charts and caffeine: Five ASX small cap buys to drive your portfolio

Welcome to a small caps special of Charts and Caffeine - our daily markets wrap featuring the best charts and reads from across Livewire's team of editors. Let's get you caught up on the overnight session.

MARKETS WRAP

- S&P 500 - 4,121 (+0.31%)

- NASDAQ - 12,599 (+0.41%)

- CBOE VIX - 25.67

US-listed shares in Didi Global soared in overnight trade after The Wall Street Journal reported that Chinese regulators are set to lift an order banning the company from adding new users. Meanwhile, Spirit Airlines is the subject of yet another takeover offer from rival Jetblue - shares in the former rose more than seven percent on the day. Amazon was also in focus after it formally issued its 20-for-1 stock split. Finally, Apple shares were relatively unchanged despite its key WWDC event being held overnight.

- FTSE 100 - 7,608 (+1%)

- STOXX 600 - 444.12 (+0.92%)

UK Prime Minister Boris Johnson survived his party's vote of no confidence this morning by a comfortable margin. The vote was triggered by a slew of controversies around his conduct during the worst of the COVID lockdowns in 2020.

- USD Index - 102.39

- US10YR - 3.04%

- Natural Gas Futures - US$9.38 (+10%)

- Wheat Futures - US$1,097 (+5.5%)

RBA PREVIEW

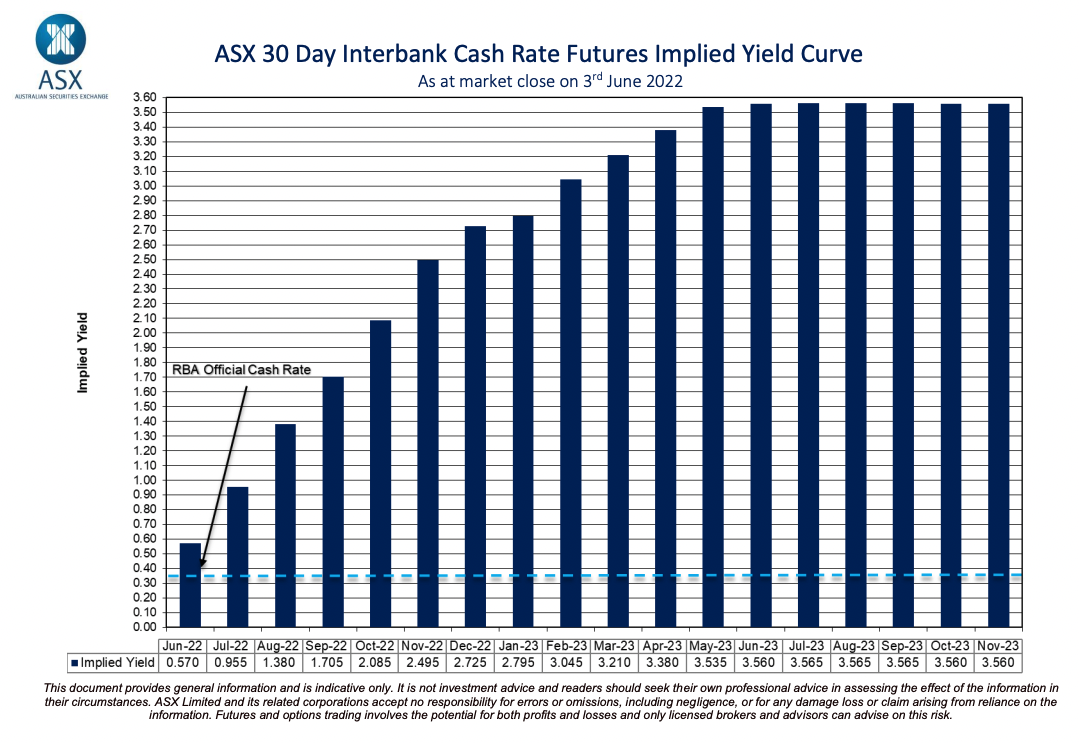

Before we get to the good stuff, we have to talk about the necessary evil in the room - the Reserve Bank's monthly meeting. As flagged in yesterday's morning note, the hike is baked in - it's the size of the hike that matters.

Most economists expect a 25 basis point hike or a 40 basis point hike come 2:30pm this afternoon. (Goldman Sachs' Andrew Boak has the sole 50 basis point hike call).

The biggest headache for the RBA - as with all global central banks now - is the data. The GDP figure was good but came in below the RBA's expectations. Wages data was also softer than expected, though the GDP sub-parts told a different story. How does that balance out against scorching inflation?

Either way, the markets have made up their mind. As of Friday's close, rates traders still think the RBA's cash rate will be at 2.7% by the end of calendar 2022.

THE CHART(S)

As it's a small-cap special of Charts and Caffeine, it would make perfect sense to start off with a chart around all things small-cap valuations. The US chart is the one shown above, and as noted, we haven't seen the forward earnings ratio this low since 2008.

I couldn't find an Australian equivalent but I did chalk up this version - it's the S&P/ASX small ordinaries index measured against the ASX 200 going back to 2006. Conclusion? Large caps are large caps for a reason.

Having said this, the chart is just an index comparison and doesn't take into account the art of individual stock picking. Put it this way - few saw Afterpay/Block (ASX:SQ2) climbing from $3/share to well over $100/share even with the assistance of a global pandemic (unless you were Liz from our Meet the Investor series).

STOCKS TO WATCH

Today, I thought we'd take a look at some small caps names to help send your portfolio into a spin (the good kind). If nothing else, it's the perfect kind of company to take for a ride.

The source of this idea came from something I normally have no interest in - automobiles. But sales of new vehicles in Australia fell by another 6.4% in May because of a continued lack of supply. Sales also dipped in every part of Australia bar the Northern Territory.

However, just because they're not buying new cars does not mean there is no appetite for used cars.

Given this backdrop, UBS, Citi, and Macquarie are all out with their top picks in the small-cap auto space on the ASX. This is what they came back with.

AP Eagers (ASX:APE) and Autosports Group (ASX:ASG): UBS and Macquarie have buy ratings on both companies. When orders continue to far outpace deliveries, margins should be supported (and probably elevated) through FY22. Though, keep an eye out for how property prices may work for or against these names.

ARB Group (ASX:ARB) and GUD Holdings (ASX:GUD) both receive buy ratings at Citi and Macquarie. On ARB, the former thinks the company's strong balance sheet and its partnership with Ford will keep it a steady performer. On the latter, Macquarie is a big fan of GUD's exposure to the automotive accessories market. After all, the demand for cars won't stop - so why shouldn't your need for flashy add-ons?

Bapcor (ASX:BAP) is a buy at Citi on valuation grounds and finally, Eclipx Group (ASX:ECX) is the preferred exposure in auto finance for Macquarie's team.

THE QUOTE

This was an administration that came into office talking about net-zero, the age of oil being over, a new policy paradigm, a pivot to Asia. But in a crisis, has now gone back to tried diplomacy.

We did a whole collection of stocks to watch around all things cars and automotive stocks on the ASX - so let's talk about the main source of fuel: crude oil.

In Jonathan Pain's weekly note, he highlighted this quote from Helima Croft of RBC Capital Markets. The essential essence of it is those new age battery plays, hot lithium stocks and EV manufacturers are all changing the world. But in a crisis, when the going gets tough, there is a return (even if only temporarily) to what you know.

OPEC+ increasing barrel production per day last week was one thing, but actually achieving it is another.

THE TWEET

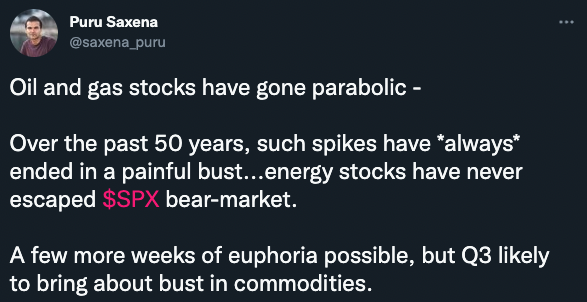

Helima's quote directly relates back to energy equities - many of which have run extremely hard this year so far. Woodside (ASX:WDS) is up 40%+ this year, Santos (ASX:STO) is up nearly 30% year-to-date and even fuel retailer Ampol (ASX:ALD) is up 17%. But how far is too far? It seems even FinTwit is now asking that question.

As a side note, Morgan Stanley just upped Woodside's price target by 23%! It also reckons the company could launch US$4 billion in buybacks. As the meme goes, huge if true.

BEST READS IN BUSINESS NEWS

Lessons Learned From an Analyst’s Journey Into Covid-Zero China (Bloomberg): Harding Loevner portfolio manager Wenting Shen tells a brutal tale of life inside COVID-zero China. She traveled for business but even in spite of being trapped due to lockdowns, she still found time to find a couple of investable ideas.

Value of US and European IPOs tumbles 90% this year (FT): I wonder if there is an Australian equivalent of this piece but even I could guess the ending won't be pretty. If 2021 showed equity investors anything, it might be that companies trying to beat the IPO heat just ended up burning in it.

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

4 topics

14 stocks mentioned