Charts and caffeine: Morgan Stanley's bull case for Altium

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,760 (-0.13%)

- NASDAQ - 11,528 (-0.16%)

- CBOE VIX - 29.15

US markets opened significantly lower than where they closed. Energy shares were hit the most - for the reason listed below.

- FTSE 100 - 7,089 (-0.88%)

- STOXX 600 - 405.74 (-0.7%)

- USD INDEX - 104.21 (-0.22%) - after an outstanding run, the bull case for the US Dollar has been fading in recent days.

- US10YR - 3.16% (-14bp)

- WTI CRUDE - US$104.30 (-4.77%)

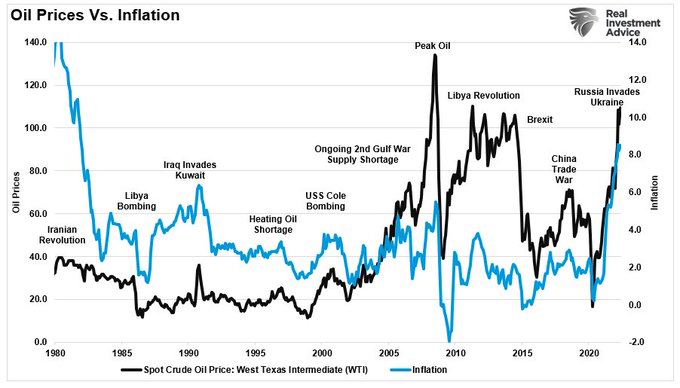

Oil prices have been weighed by fears the Fed’s efforts to fight inflation will slow the economy and reduce demand for fuel.

THE CALENDAR

Rising food prices pushed the United Kingdom’s consumer price inflation to a 40-year high of 9.1%. Even excluding soaring food and crude oil prices, inflation still came in a hair under 6%. While in line with expectations, economists already expect the worst is yet to come.

Meanwhile, in Washington, Federal Reserve chairman Jerome Powell said they could lift the US interest rate by 1% at any future meeting if its efforts to tame rampant inflation were not successful. And yet, the risks of recession are still not "particularly elevated".

Tonight, it's all things PMIs - the surveys that economists use to measure the state of activity around the world.

THE TWEET

THE CHART

STOCK TO WATCH

Today's stock to watch is Altium (ASX:ALU). It stems from a Morgan Stanley note around the global semiconductor chip crisis - a topic that we have talked about extensively here:

.jpg)

Analysts Andrew McLeod and Chris Boulus give an interesting case for why Altium is a top pick to fight the chip shortage. While the supply chain issues are well-known, they think the market has missed how ALU is benefitting from the crisis thanks to greater demand for its products.

It also helps that the company's share price is well below its own target valuation. The company gets an overweight rating with a healthy price target of $35.

Note: While ASX companies indirectly exposed to the semiconductor chip crisis are many, the actual number of players that deal with its challenges day-to-day is actually a very small number. ETF Securities has a SEMI ETF dedicated to the field but none of the semis or semi-equipment companies in Australia are larger than a small-cap.

THE QUOTE

Notwithstanding these efforts, your Administration has largely sought to criticize, and at times vilify, our industry. While today’s geopolitical situation is contributing to this energy crisis, bringing prices down and increasing supply will require a change in approach.

The opinions of Mike Worth, Chevron CEO, have a lot of weight. This timely letter is addressed directly to the President of the United States. To me, it says a lot about how the conversation has shifted so far, so quickly from ESG to energy security by any means. Biden has been demanding oil producers increase supply. But how can you do that if the infrastructure isn't up to scratch or the labour isn't there? The story is an ever-evolving one.

Speaking of which - here's a great chart that I found on how oil prices seem to mimic the rise and fall of inflation in a weirdly beautiful way. Given we have midterm elections in America around the corner, this will be absolutely top of mind.

BEST READS IN BUSINESS NEWS

Warren Buffett’s Estate Planning Sends Charities Scrambling (WSJ): If you read yesterday's Trending on Livewire newsletter, you'll note that we made our Stats Incredible segment about Warren Buffett's charity lunch bids. Well - it's all part of how the billionaire investor promised to give away a massive bulk of his fortune.

.jpg)

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

5 topics

1 stock mentioned

1 contributor mentioned