Charts and caffeine: The ASX stocks to guard your portfolio against a global recession

Welcome to a special macro-focussed edition of Charts and Caffeine - our daily markets wrap featuring the best charts and reads from across Livewire's team of expert editors. Let's get you caught up on the overnight session.

MARKETS WRAP

- S&P 500 - 4,101 (-0.76%)

- NASDAQ - 12,548 (-0.74%)

LATE BREAKING NEWS: Longtime Meta (NAS:FB) COO Sheryl Sandberg will step down from her role later this year after 14 years in the job. She will remain on the board and keep her 1.5 million Class A shares. Shares fell more than four percent on the news. (Source: Bloomberg)

- FTSE 100 - 7,533 (-0.98%)

- STOXX 600 - 438.72 (-1.05%)

- US Dollar Index - 102.58 (+0.81%)

- US10YR - 2.919% (+7bp)

- Brent Crude US$115.84 (-5.7%)

- Natural Gas - US$8.75 (+7.44%)

Energy prices have been in focus after reports in the Wall Street Journal suggested some OPEC members are mulling over the possibility of suspending Russia from the cartel.

THE NOTE

Today was a red-letter day for anyone who has even the faintest interest in markets - the Federal Reserve began quantitative tightening today. The world's largest central bank is starting to pare back US$9 trillion in stimulus at a rate of US$95 billion per month. There are two types of QT happening starting today - rolling off maturities as they occur as well as the outright selling of bonds.

Both will have very different market impacts and while it's not clear what the size of that impact will be, there's a general consensus that a dovish tilt toward equities is warranted.

For the Fed specifically, this process also doesn't have the most stellar of track records. The last time they did this in 2017, bonds slid, and stocks dropped across the board (as it did today).

This time, they may have a problem over which it cannot even exert control. While the Fed and Bank of England are starting their QT programs, the ECB is continuing its asset purchases (known over there as PEPP). And as yesterday's edition of CnC explained, they will have to hike interest rates to fight inflation while the ECB continues to pump stimulus into the economy.

Let the games begin - and may I suggest putting on your seatbelt.

THE CHART

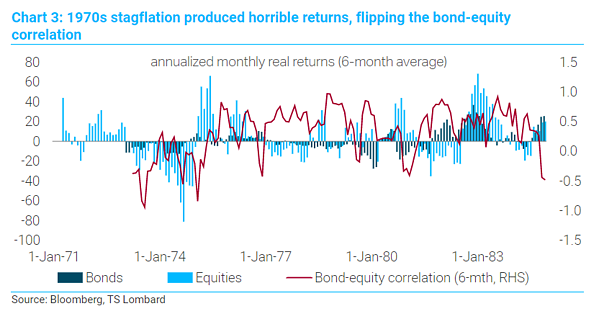

Given what we've just discussed on all things quantitative tightening, I thought we'd take a look at this chart from the brilliant Darlo Perkins at TS Lombard. There is currently a big debate about whether central banks will need to generate a recession in order to force inflation lower. Some say it's not necessary - and Darlo, with a reference to the 1970's - says this time is not going to be different.

Here is an excerpt from his research note:

Even if this is not “the end of the cycle” – that comes later if inflation fails to settle at tolerable levels – the next few months could be ugly.

If you'd like to read his full view, click this link. I highly recommend it.

THE TWEET

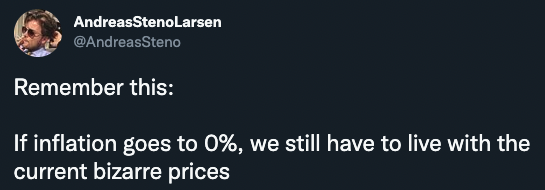

Andreas is head of research at Heimstaden and he actually makes a very good point. Even if inflation were to be 0% month-on-month next print, it doesn't take away the surge that we have already seen.

Enough doom and gloom, I hear you cry! So where can I find some investable ideas?

STOCKS TO WATCH

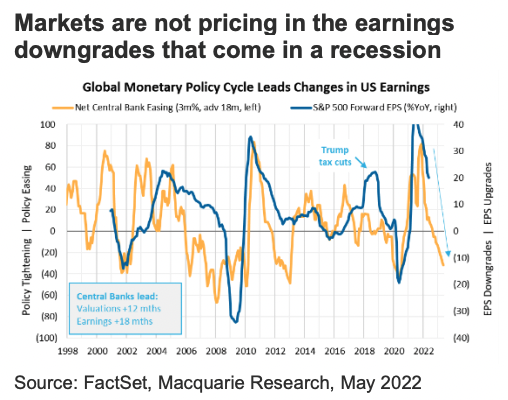

Macquarie is coming to the rescue. In its latest equity strategy note, analysts believe we are still in the shadow of the longest bull market run in history. Ric Deverell and his macro team have this to say about the impact of a recession next year.

If there is a US recession in 2023, ASX equities will not be immune, but we still think they can outperform US stocks.

But even that line pales in comparison to the chart that is literally sitting right next to this quote in the broker note. This is what markets are not pricing in - and there could be more downgrades and disappointment to come.

So where should you put your cash?

The team's "strategy" portfolio is overweight defensive stocks and resources names including:

- BHP (ASX:BHP)

- South32 (ASX:S32)

- Woodside (ASX:WDS - note the new ticker code following the demerger)

- Gold names - Newcrest Mining and Northern Star

- Pilbara Minerals (ASX:PLS)

- ALS Limited (ASX:ALQ)

- Seven West Media (ASX:SVW)

- Supermarkets - Coles and Woolworths

- Healthcare - CSL, Ramsay Health Care, Healius

- REITs - Goodman Group and GPT

- For dividends: Steadfast Group and The Lottery Corporation (aka the new Tabcorp)

What do all these names have in common? Strong earnings plus upside potential and, in many cases, high dividend yields.

THE BEST READS IN BUSINESS NEWS

Where to Look for the Next Wall Street Blowup (WSJ): It was once said by Warren Buffett that you'll only find out who was naked (metaphorically, of course) when the tide goes out. Well, the tide's gone out big time but columnist James Mackintosh argues there may be more to go.

The other E word to rattle markets: Earnings (Livewire): Randal Jenneke at T. Rowe Price pens this piece on all things market risks. Once you read it, I suspect you'll know why I included Ric's note in the "stocks to watch" section.

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

5 topics

19 stocks mentioned