Charts of the Week - Bank stress, US drought and China’s shoppers

.png)

This week’s charts begin by breaking down trends in US bank lending as concerns about a credit crunch persist. Climate remains in focus; we show how drought in Kansas is hitting the wheat fields, with implications for global food prices. We examine China from several angles – using satellite data to reveal that the number of shoppers parked at shopping malls has stopped bouncing back; visualising the nation’s trade partners; and noting the local stock market’s disconnect from growth-value swings seen in the US. Moving to Europe, we show how wages are starting to catch up to inflation, and demonstrate an indicator of British economic resilience.

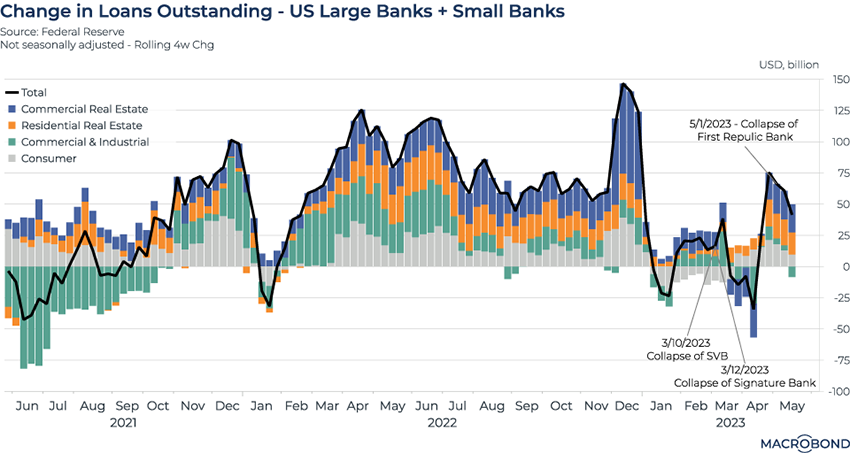

US bank loans at a time of stress

.png)

Amid a spate of US bank failures, we’ve examined prospects for a potential credit crunch from several different angles.

This chart breaks down trends in the value of loans extended by US domestic banks.

The second-quarter turmoil amid the collapse of Silicon Valley Bank resulted in shrinking loan supply, a trend that bottomed out in April. The flow of commercial real estate and C&I (Commercial & Industrial) loans decreased for four consecutive weeks during that period.

These segments bounced back by May after the additional support provided by the Federal Reserve. Since the collapse of First Republic a month ago, increases have eased.

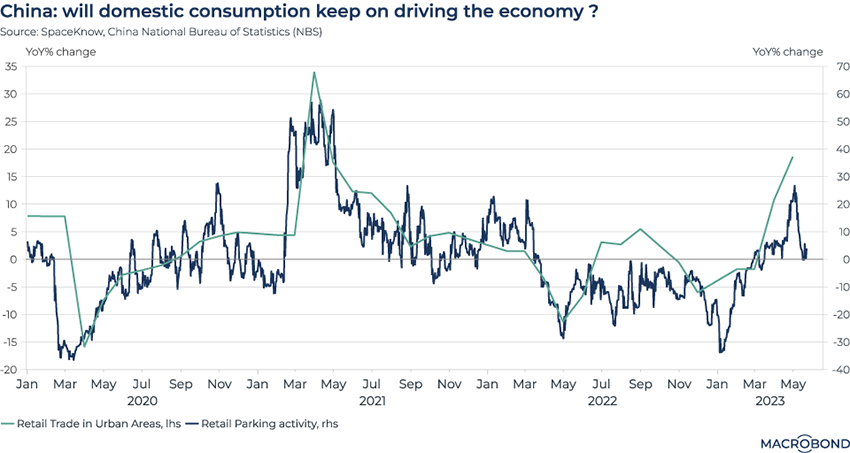

Chinese trips to the shopping mall are leveling off

.png)

We’ve added data from SpaceKnow, which combines satellite imagery with proprietary algorithms to generate data about human activity in almost real time. We’ve applied this unique data provider to shine a light on Chinese consumers’ activities.

We’ve written extensively about China’s great reopening and the boost it has given global growth. But will this rebound be sustained?

SpaceKnow offers an indicator that tracks parking activity close to Chinese shopping malls. We’ve charted it against national statistics about urban retail trade. The correlation is high (above 0.7).

While the latter indicator has shown a steady pickup in growth, the satellite data – which is effectively a more recent “nowcast” – shows a sharp slowdown in the year-on-year increase in the number of parked vehicles around shopping centres.

Are consumers returning to online shopping after post-lockdown splurges at bricks-and-mortar shops, or does the satellite data herald a broad slowdown in consumer spending?

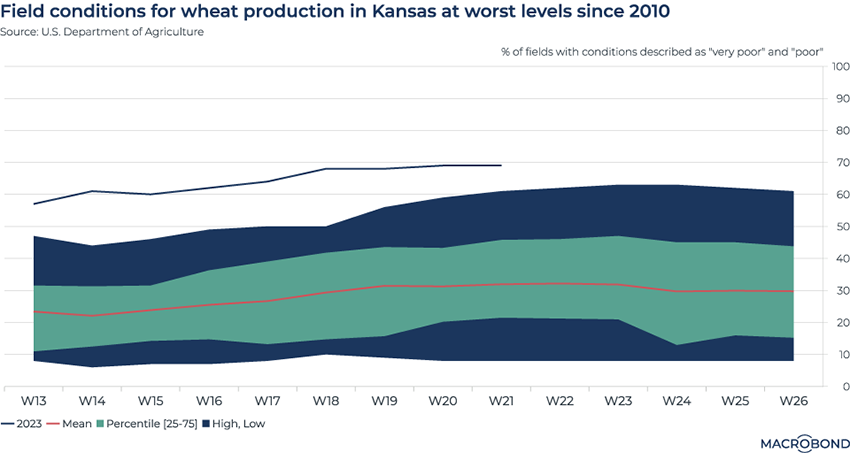

Drought and the US agricultural heartland

.png)

We recently wrote about how drought threatened Thai rice production. As the world continues to grapple with food inflation, a lack of rainfall is also hitting the US grain belt.

This year, drought has compounded difficulties with a winter wheat crop that was already damaged by extreme cold. (Farmers in Kansas normally plant a wheat crop in the autumn that grows during the winter and early spring, with the grain harvested in the summer.)

Our chart tracks the percentage of fields with conditions described as “poor” or “very poor.” The line is well above the last decade’s 25-75 percentile range, let alone the average.

The USDA recently said that farmers in Kansas, the No. 1 US state for wheat production, will likely abandon about 19 percent of the acres they planted last autumn. That’s an increase from 10 percent last year.

All of this has implications for supply in the world wheat market – especially if the UN-brokered deal on Ukrainian shipments through the Black Sea is derailed by Russia.

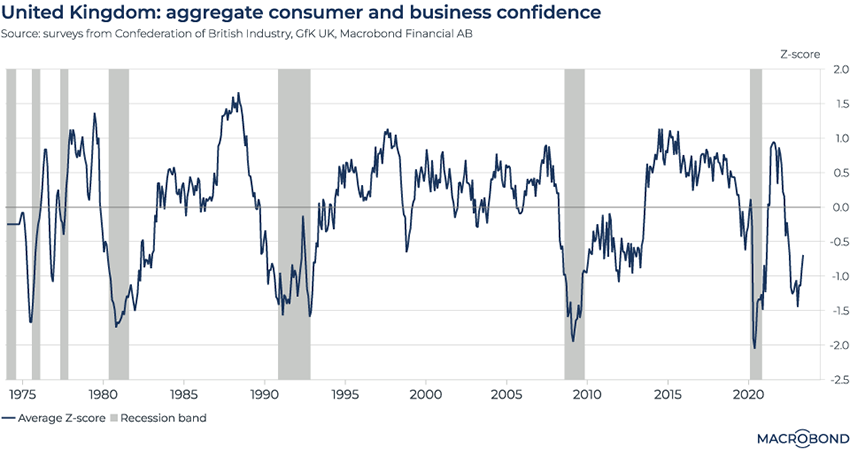

The UK’s surprising resilience

.png)

Tip: this chart allows for change region functionality.

Defying the Bank of England’s previously ultra-pessimistic outlook, the UK economy was surprisingly resilient in recent months. The IMF recently said it expects the UK will escape recession in 2023, helped by a return of stability after Liz Truss’s brief prime ministerial tenure.

Indeed, while GDP growth has been basically stagnant for four straight quarters, the only period that dipped into negative territory was the third quarter of last year.

The chart above assesses consumer and business confidence surveys and tracks Z-scores, a statistical term describing the variation from the norm. Historically, a drop below 1 standard deviation from the mean has been a sign of recession.

While the average Z-score decidedly dipped below 1 for a time, it did not stay there for long and is rebounding. This indicator did not come close to the depths seen in the 2008 or pandemic recessions.

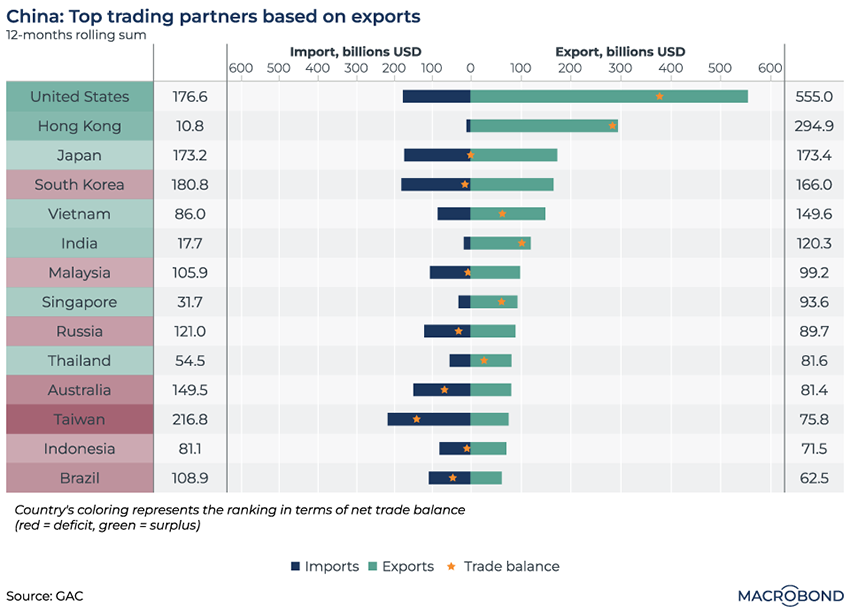

Visualising China’s trade partners by deficits and surpluses

.png)

This visualisation ranks China’s major trading relationships.

As the world’s factory, China runs a trade surplus with the economies highlighted in green. The list is led by the United States: China’s exports to its largest trading partner have reached USD 555 billion, about triple the level of imports.

The nations in red are those where China has a trade deficit. They’re generally known for producing the inputs demanded by China’s industrial machine. The list includes commodity exporters Australia and Brazil, as well as Taiwan, the world’s dominant semiconductor producer.

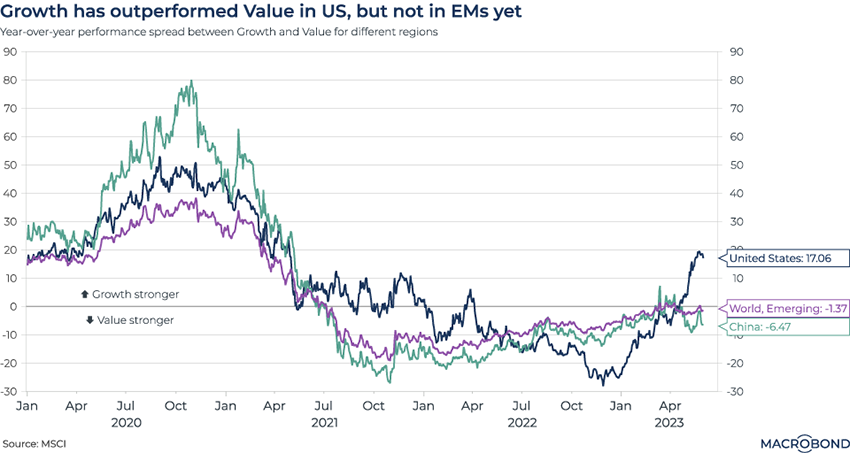

The growth-value pendulum no longer swings in unison for China and the US

.png)

Last week, we noted how the rebound in tech stocks was driving the S&P 500 as energy shares faded, a reverse of trends seen in 2022.

This week, our chart breaks down global equities in a different way – showing how “value” and “growth” stocks (as defined by MSCI indexes) are diverging in different economies. A reading above zero indicates growth was outperforming value, and vice versa for a negative number.

Growth stocks get their name from perceptions of their future earnings potential, while value stocks offer more predictable business models at cheap valuations.

With tech stocks usually considered “growth” and energy usually considered a “value” play, it’s no surprise that a growth strategy outperformed in both the US and EMs including China during the pandemic year of 2020.

The US and China have been more divergent over the past year. In China, value is still outperforming growth as local tech shares lag behind their US counterparts.

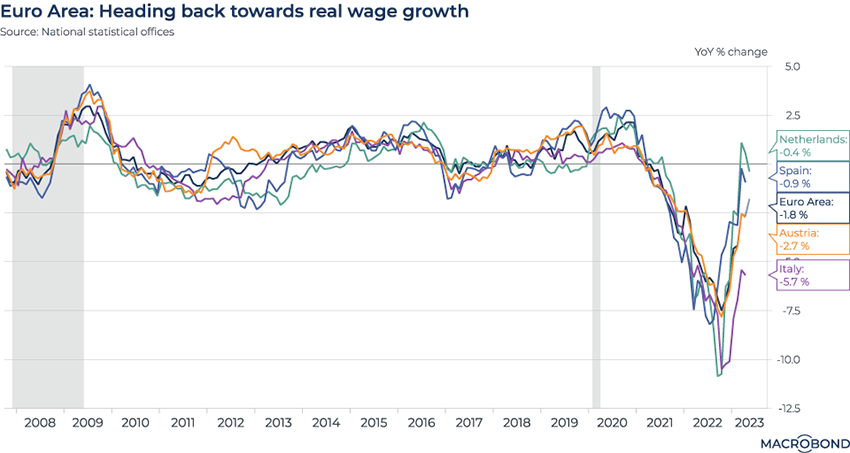

Real wage erosion finally stabilises in Europe

.png)

In 2022, we highlighted how inflation was ravaging wages in Europe, more than wiping out any pay increases. Workers will be happy to learn that they are starting to catch up – or, at least, see their purchasing power erode more slowly.

Wages tend to suffer a time lag before they adjust to inflation spikes. As our chart shows, that adjustment is finally occurring. Adjusted for inflation, wages in the eurozone are down 2.6 percent year-on-year. In late 2022, they were shrinking by more than 7 percent on that basis.

Discrepancies are wide across the region. The Netherlands is posting outright real wage growth, while Italy is lagging behind. But the pattern is very similar across the EU’s member states.

Should this trend continue, central bankers may begin to worry about the dreaded “wage-price spiral.” Wages in the eurozone increased at a record year-on-year pace in the last quarter of 2022, according to Eurostat.

(It’s notable that the recessions of 2008 and 2020 appear to have been good for real wage growth – assuming you kept your job and were able to take advantage of the cheaper cost of living.)

5 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)