China net zero

In 2000 I was a student at Harvard Business School and got the opportunity to do an internship at a venture capital fund in Beijing. On my first day, I woke up early and went for a run before work. Unfortunately, it lasted less than 10 minutes because the air pollution levels were so high I couldn’t breathe properly.

Fast forward 20 years and China has just

committed to achieving carbon neutrality by 2060. This goal is very aggressive,

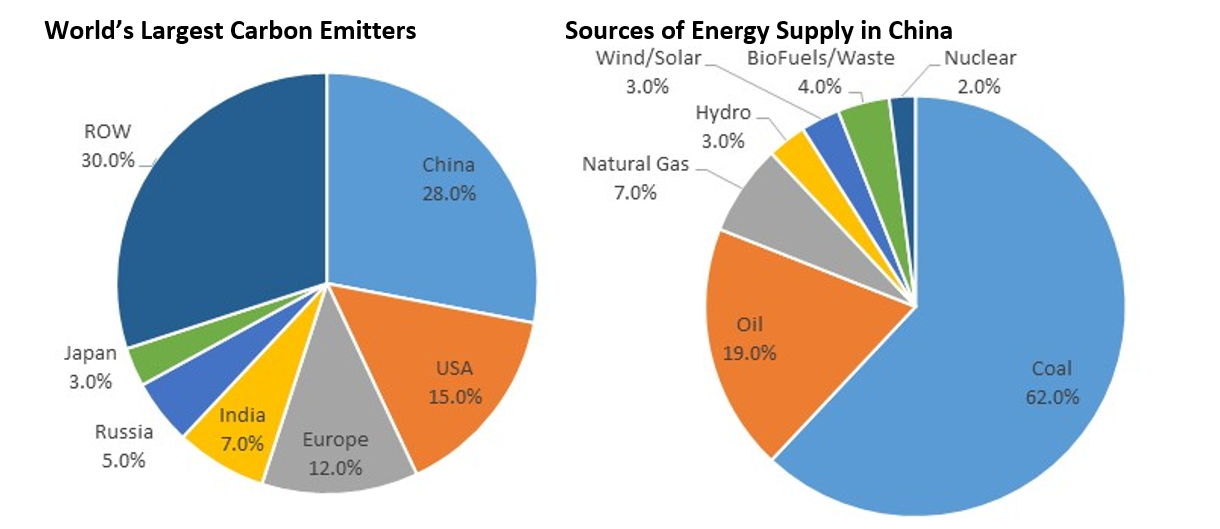

especially for a country that is still industrialising. As shown below, China

currently accounts for approximately 28% of global carbon emissions and

approximately 62% of its energy supply is still from coal.

Source: IEA

In President Xi’s speech to the United Nations on this topic, he outlined that to meet the 2060 timeline, China must aim to have peak CO2 emissions before 2030. Reaching peak emissions in less than nine years will require China’s energy mix to be reset, with a short-term pivot towards renewables – primarily solar and wind. Some economists estimate that China could require anywhere between US$5 trillion and US$15 trillion of investment in renewables to reach these goals.

As part of the broader decarbonisation plan, China has also outlined aggressive policies on New Energy Vehicles (NEVs), which include electric, plug-in hybrid and hydrogen fuel-cell vehicles. China aims to have electric cars account for 20% of all total car sales by 2025 and all new car sales to be either hybrids or NEVs by 2035.

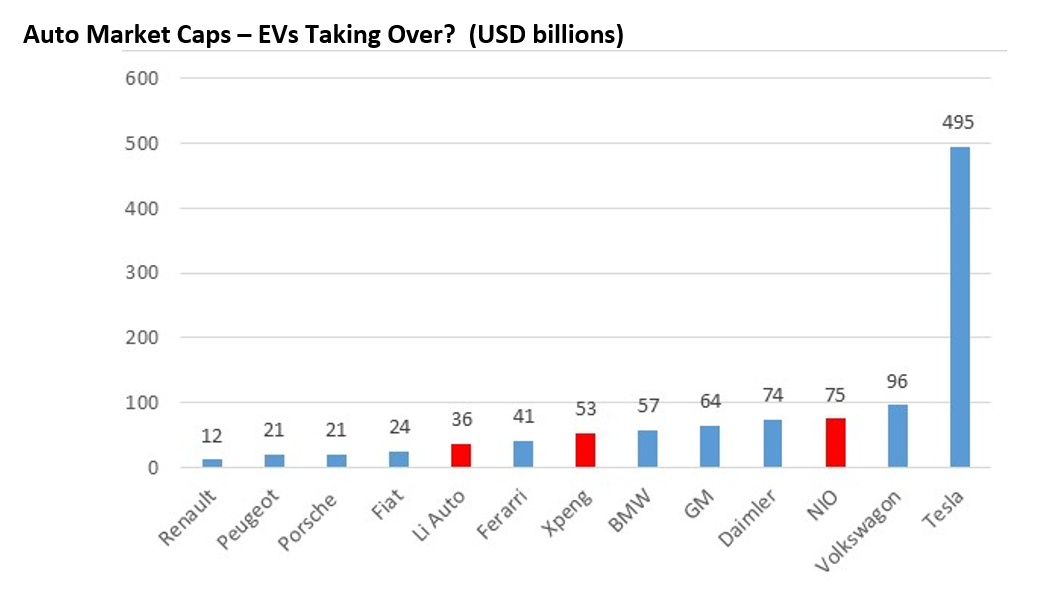

NIO, the Tesla of China, is now a $US75 billion market cap company (bigger than GM) thanks to its meteoric rise in the last few months. Since the beginning of 2020, the stock is up an incredible 1278% and its Chinese EV peers, XPeng and Li Auto, are up 279% and 381% since their IPOs in July and August of 2020, respectively.

Source: Bloomberg as of November 24, 2020

Similar to the rise of the Apple supply chain in Asia in the 1990s, the Tesla and NIO supply chains are emerging as mini-sectors in and of themselves. Currently the EV supply chain is focused on EV batteries with companies like CATL, LG Chem and Samsung SDI at the forefront. Over time we expect this to expand to other sub-sectors like battery chemicals/materials, battery charging infrastructure as well as hardware and software that goes into the NEVs.

The Ellerston Asia team has identified 44 stocks in China and elsewhere in Asia that meet our growth and ESG criteria and are potential beneficiaries of this China decarbonisation thematic. We already have 3 of these stocks in our portfolio - one renewable, one EV company and one EV battery stock - and expect to add more investments in this area in the future.

The reason I chose this topic as one not to be missed in 2021 is because it is unexpected. Most Australian investors have a reluctant attitude towards investing in China in general, and would never associate China as a leader in renewables, EVs and green technologies.

However, the ‘greening’ of China, or China Net Zero, will be an important thematic in 2021 and for years to come. China has the opportunity to shake off its bad reputation as a major polluter and become a world leader in green technologies. Equity investors that identify and invest in the beneficiaries of this thematic early on will be handsomely rewarded.

One Thing Investors Can't Ignore in 2021

The above wire is part of Livewire's exclusive series titled "The one thing investors can't ignore in 2021." The series will culminate in the release of a dedicated eBook that will be sent to readers on Monday 21 December. You can stay up to date with all of my latest insights by hitting the follow button below.

4 topics

1 stock mentioned