Citi's new favourite ASX tech stock + Two charts every energy bull needs to see

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,856 (-1.13%)

- NASDAQ - 11,852 (-0.85%)

- CBOE VIX - 27.16

- USD INDEX - 110.15

- US 10YR - 3.559%

- FTSE 100 - 7,193 (-0.61%)

- STOXX 600 - 403.42 (-1.09%)

- UK 10YR - 3.31%

- GOLD - US$1665/oz

- WTI CRUDE - US$84.28/bbl

- DALIAN IRON ORE - US$98.99/T

THE CALENDAR

Tonight's a quiet one on the economic front - only ECB President Christine Lagarde is speaking in Frankfurt, Germany. Analysts don't expect to see anything made of note there.

Thursday is the big one - the Federal Reserve, the Bank of Japan, and the Bank of England all hand down their interest rate decisions in a 24-hour period (and many others for that matter). A comprehensive wrap of all the major central bank actions will be in Friday's report.

In case you missed it, the latest episode of our video economics series Signal or Noise is now live to view on the website. We hope you'll enjoy it. In fact, one of the topics discussed in that episode is the subject of today's charts:

THE CHARTS

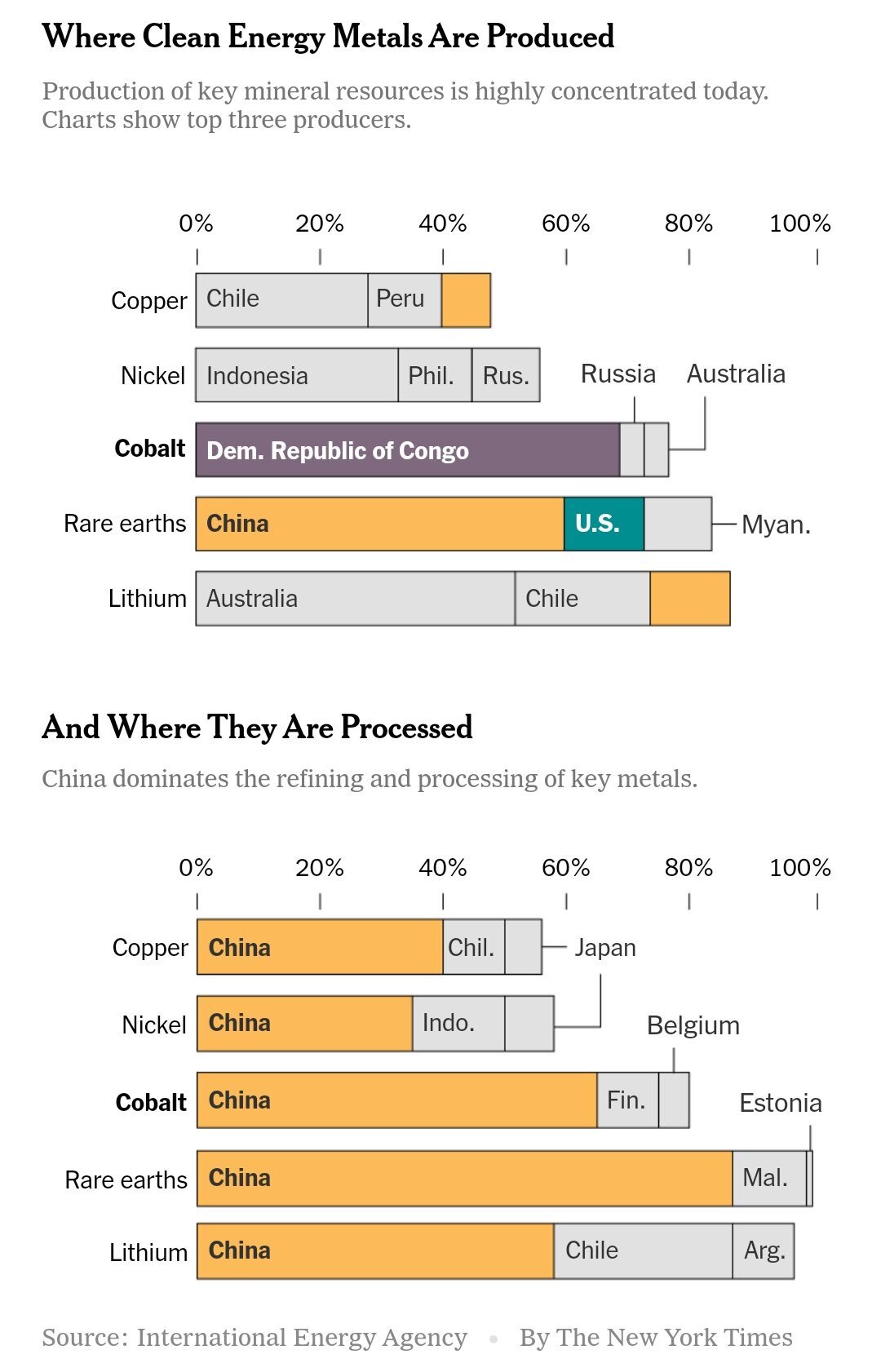

If you're an energy sector bull, these charts are for you. For those who are hoping the transition to a cleaner and greener future will end well, you might want to ask for some favours from the Chinese government. As the following chart shows, many of the world's biggest and most important metals are produced in China - including a plurality of rare earths and a portion of the world's copper supply.

But the real dominance is where the metals are actually processed and refined for use. And in the case of rare earths, you can literally say it's done in-house.

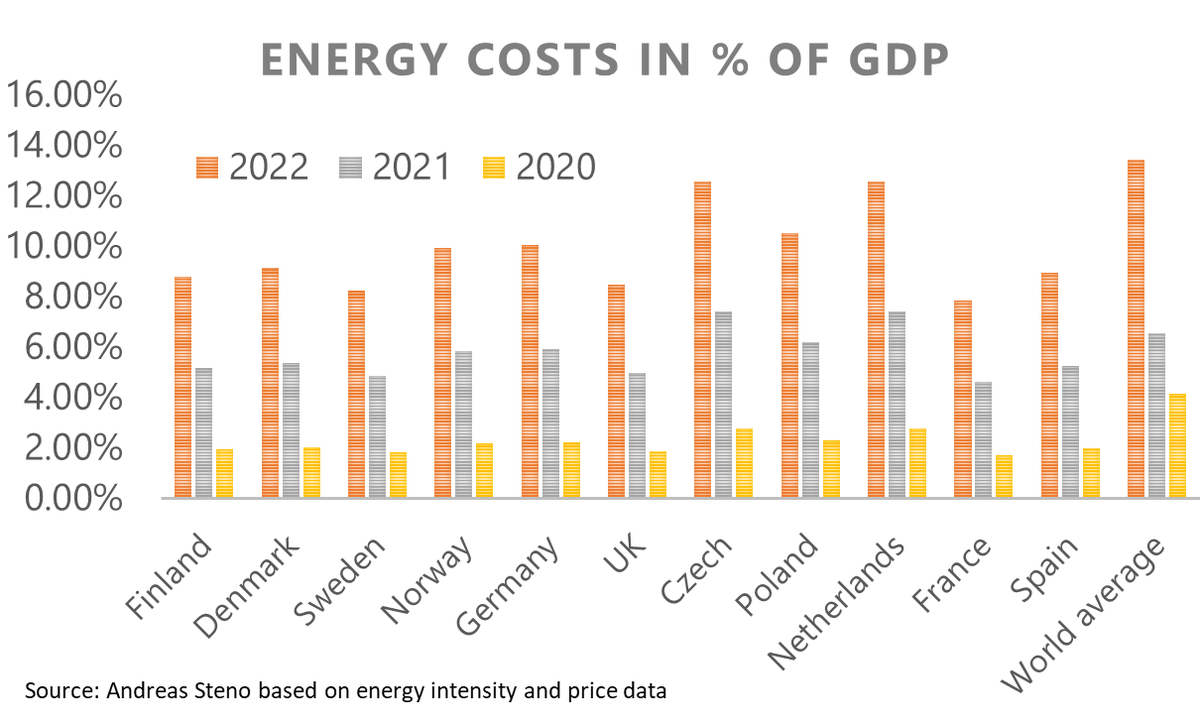

If you thought that was remarkable, you need to consider that's a story for a decade or more down the line. Now, if we bring this energy discussion back to the current time period, you'll notice just how much energy security is a topic right now. Energy costs, as a percentage of GDP across the major European nations, have soared in 2022 compared to recent memory. And as Andreas Steno Larsen of Heimstaden found out, that's quite a scary sight.

STOCKS TO WATCH

Today, it's all about tech and Citigroup's re-rating of the ASX tech sector. August reporting season was better than expected, with most companies not seeing a slowdown from softening macro environment. Having said this, there were pretty depressed expectations for the tech sector coming into August, so that might have explained the outsized moves.

The standouts are well known - Altium (ASX: ALU)'s Octopart business allowed revenues to soar much higher than expected. Wisetech (ASX: WTC) was able to pass on the price increases due to its leverage and position in the market.

But here's the interesting part - Altium and Wisetech were both downgraded in the wake of their results. In its place, Siteminder (ASX: SDR) is now a buy while both REA (ASX: REA) and Domain (ASX: DHG) are now neutral-rated.

The top spot in the revised rankings for ASX tech now belongs to HUB24 (ASX: HUB) at the top of the pecking order. Xero (ASX: XRO), formerly in the top spot, is now in third place given there are concerns about how its UK market might perform in a recession.

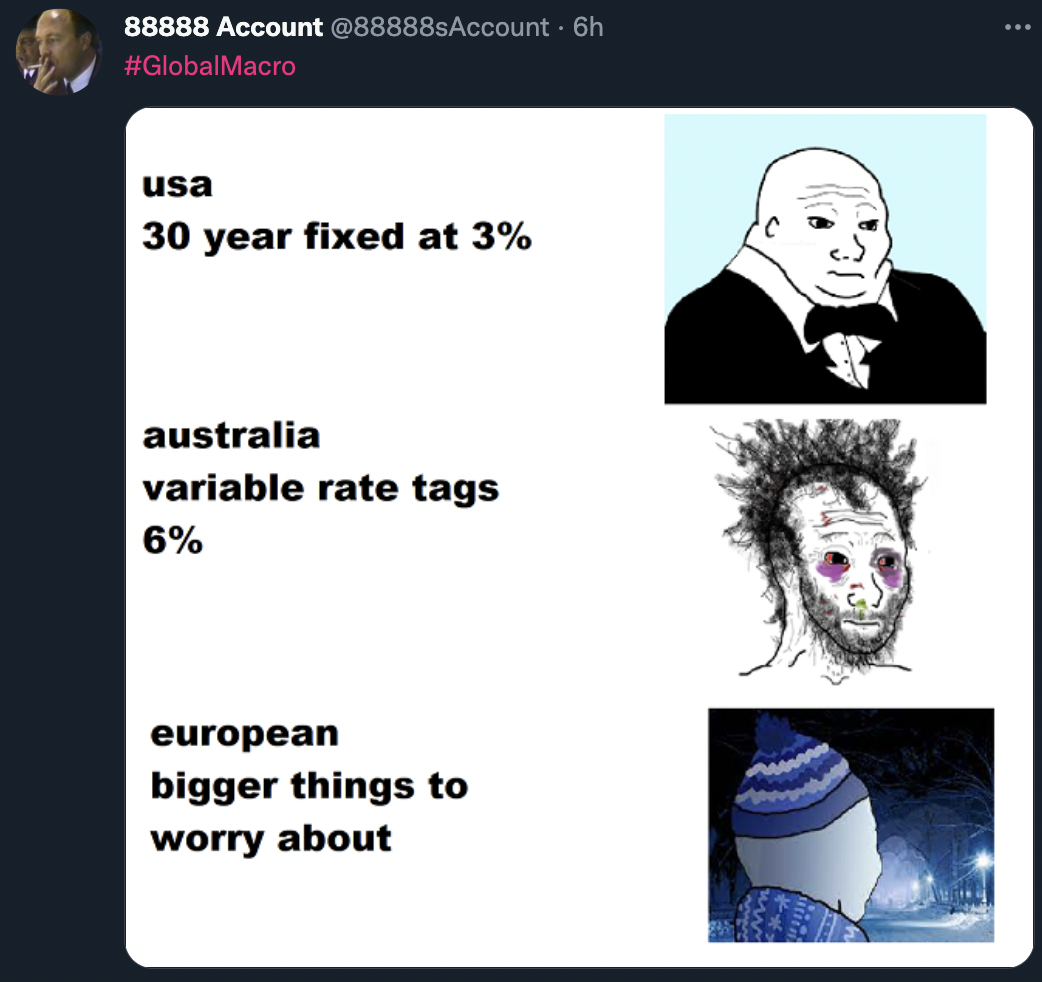

THE TWEET

Hans Lee wrote today's report. There is no report tomorrow as there is a nationwide public holiday. Chris Conway will return with Friday's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content, and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 topics

7 stocks mentioned

2 contributors mentioned