Competitive advantage, strong tailwinds, and an attractive valuation – This ASX company ticks all the boxes

As Warren Buffett said in an interview in 1999, “the inescapable fact is that the value of an asset, whatever its character, cannot over the long term grow faster than its earnings do”. With this in mind, we like investing in competitively advantaged businesses with tailwinds. Investing in Australia is a good start, due to the benefits from above-average population growth, in-demand natural resources, geographic location, capital city liveability and stable government. But there are parts of the economy which should grow even faster than average, including: healthcare expenditure; immigration; international student demand; inbound tourism; and services related to the National Disability Insurance Scheme (NDIS). Companies with exposure to these themes often trade on very high valuations. One high-quality company that has exposure to all five of these trends and trades on an attractive valuation is NIB Holdings Limited (ASX: NHF).

Company Overview

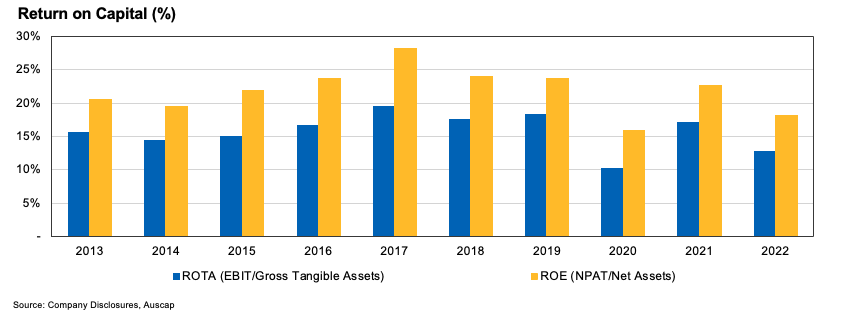

Incorporated in 1953, NIB is Australia’s fourth largest health insurer, with policyholder market share of 9.4% as at September 2022. NIB has been led by CEO Mark Fitzgibbon since 2002, who currently owns approximately $19m worth of shares excluding unvested performance rights. We think NIB has a long track record of being able to balance pursuing new opportunities with the long-term interests of its key stakeholders, including shareholders. Between FY08 and FY22, NIB’s Earnings Per Share (EPS) has grown at a 13% Compound Annual Growth Rate (CAGR) with an average Return On Equity (ROE) of 22% over the last decade.

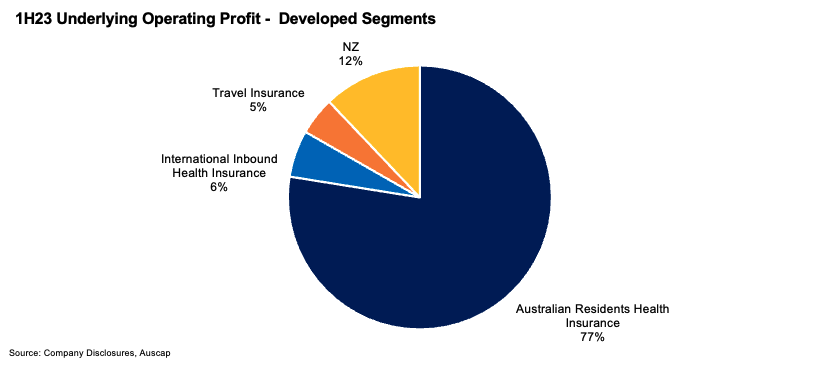

NIB has four developed operating segments: “arhi” (Australian Residents Health Insurance), “nz” (New Zealand), “iihi” (International Inbound Health Insurance) and “nib travel” (Travel Insurance). NIB also has three developing segments: Honeysuckle Health (a JV using data science for disease prevention, treatment and management), Midnight Health (online and telehealth solutions for women and men’s health) and NIB Thrive (NIB’s entry into the NDIS intermediary market). Honeysuckle Health and Midnight Health, both currently loss-making, are important strategic differentiators for NIB’s existing private health insurance (PHI) offering, as they expand membership’s focus from disease treatment to “supporting good health”, which is more universally relevant for younger members. Having seen parallels with their role in PHI, NIB has just entered the NDIS market after three years of due diligence.

arhi (Australian Residents Health Insurance)

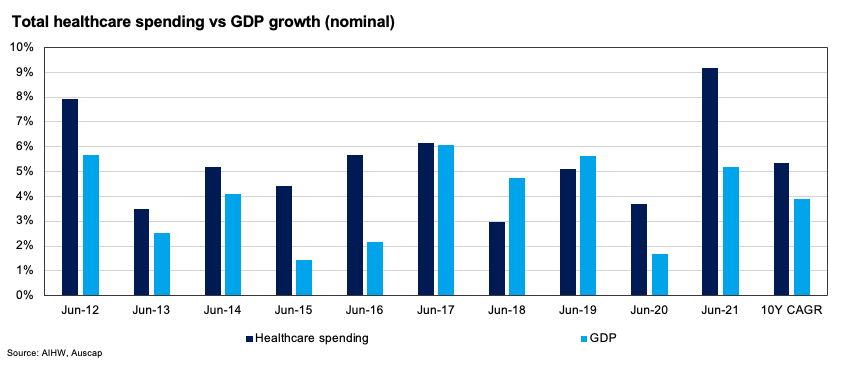

Australian healthcare expenditure represented 10.7% of Australian GDP in FY21, growing 5.4% per annum over the last decade. With Australia’s growing and aging population and the increased prevalence and treatment of chronic diseases, we think the strong demand for healthcare services is likely to continue. Most of this burden is borne by governments, with individuals directly funding just 15% of healthcare expenditure. In FY21, the ratio of government health spending to total tax revenue collected hit 26.8%, the highest level on record. PHI plays a crucial intermediary role in the health sector, as private healthcare uptake takes pressure off the public system whilst the PHI industry’s incentive to process claims efficiently helps ensure appropriate rigour is applied to managing the healthcare sector’s growing cost burden.

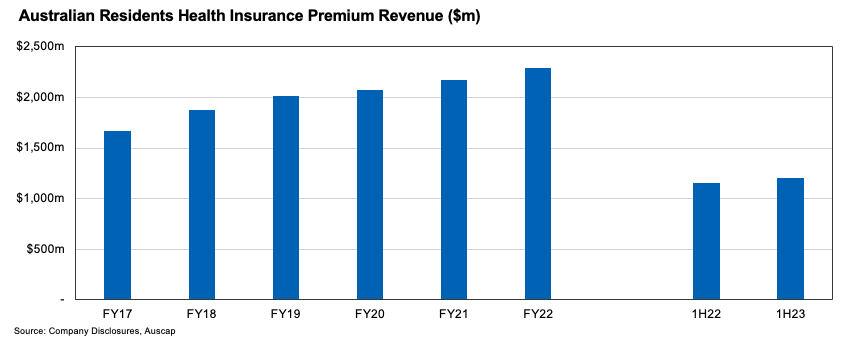

PHI economics are attractive. Revenue is linked with healthcare expenditure, claims are relatively steady and the government is strongly aligned to ensure the industry succeeds. Members are incentivised by the tax system and service levels to take out private health insurance, with private waiting times often being much shorter relative to the public system. Premium price growth is approved by the Federal Minister for Health in annual reviews, with premium growth roughly tracking healthcare expense inflation historically. Competition in the sector tends to be rational, as a health insurer aggressively trying to win customers off a peer runs the risk of adverse selection issues. NIB has experienced strong growth in premium revenue over time.

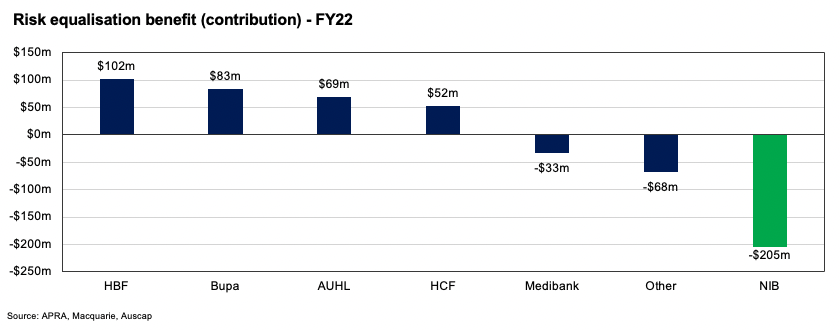

NIB’s financial characteristics are better than the industry average. NIB’s policyholder growth has materially outperformed the industry, with NIB’s distribution partnerships and marketing initiatives driving its policyholder market share from 6.4% at its 2007 IPO to 9.4% as at September 2022. As a result of this success, arhi’s average customer age is 41.8, below the sector average, making NIB the biggest contributor to the risk equalisation pool. Whilst this is a financial negative, it means that NIB’s policyholder growth is playing an outsized role in ensuring that the PHI industry remains sustainable. Nevertheless, as NIB is an efficiently run organisation and risk equalisation does not adjust for every risk factor associated with higher claims expenses, NIB has been able to consistently hit a net margin target of approximately 6-7%, in excess of the industry average.

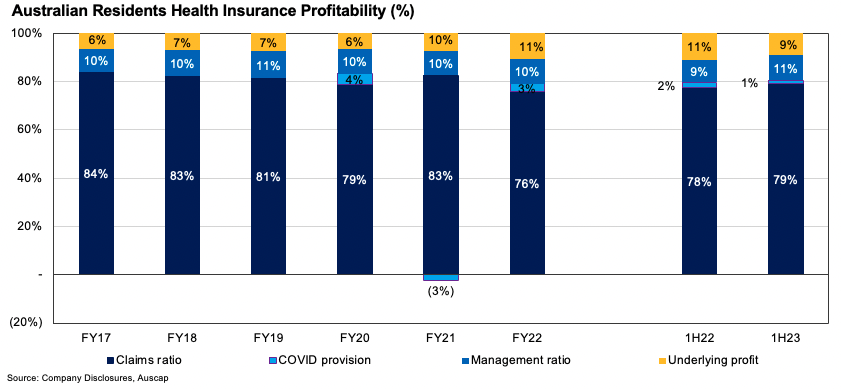

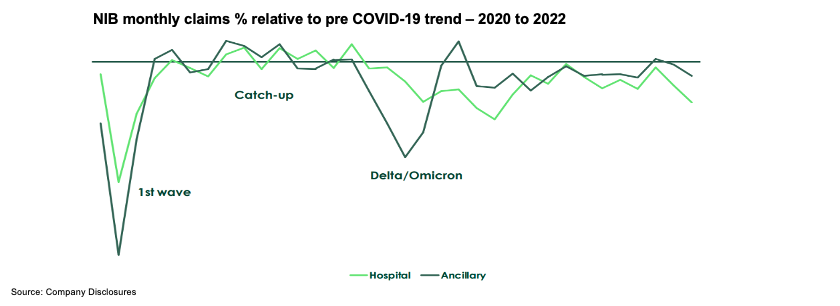

In recent years, policy downgrading, declining youth participation and rising costs meant some industry analysts have questioned the structural outlook for the PHI industry. This all changed with the onset of the COVID-19 pandemic. Public waiting lists and a greater focus on healthcare availability led to a return of strong policyholder growth and improved retention. Claims also declined materially, as elective hospital admissions and “extras” such as dentistry dropped sharply and in some cases were temporarily banned. Rather than banking this potential profit sugar hit, NIB and the PHI sector more broadly responded with premium givebacks, premium rise deferrals, reinvestments in service levels and provisioning for future claims to avoid any perception of “profiteering”.

This claims drop-off led to widespread fears of a “catch-up”, albeit three years on from the pandemic, hospital and ancillary claims are still yet to materially exceed pre COVID-19 levels.

There are potentially a number of reasons to believe that claims ratios could well be lower for longer. Rehabilitation and mental health treatment have arguably structurally moved away from in hospital treatment towards community care, respiratory admissions are down as hygiene practices in settings such as aged care have improved, prostheses cost reform has led to lower costs, some older patients continue to defer elective surgeries due to an unwillingness to risk catching COVID in a hospital setting and staffing constraints are impacting healthcare throughput. It is not obvious to us that these factors will all prove to be completely temporary. So, if NIB’s profit margin returns to 6-7% in the coming years as analysts are expecting, there is a chance that it happens through multiple years of premium rises below inflation, which should materially improve the value equation for new members, helping NIB continue to grow market share.

Consensus forecasts have arhi profit declining 24% between FY22 and FY25, which we think could prove overly pessimistic. Another important offset is Midnight Health and Honeysuckle Health, which are currently annualising an above-the-line loss of $17m (9% of group NPAT) which could potentially be reined in to smooth out the impact of any acceleration in claims growth.

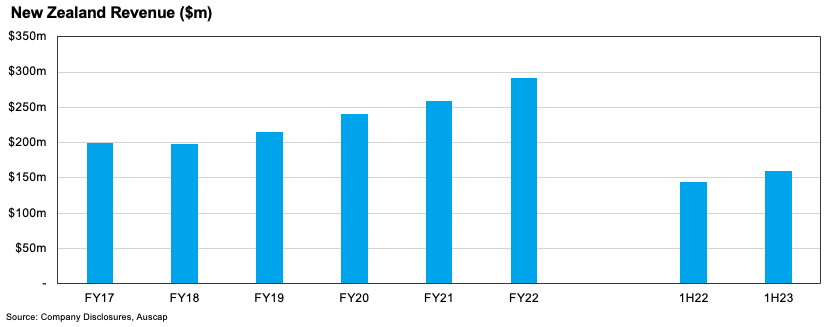

New Zealand

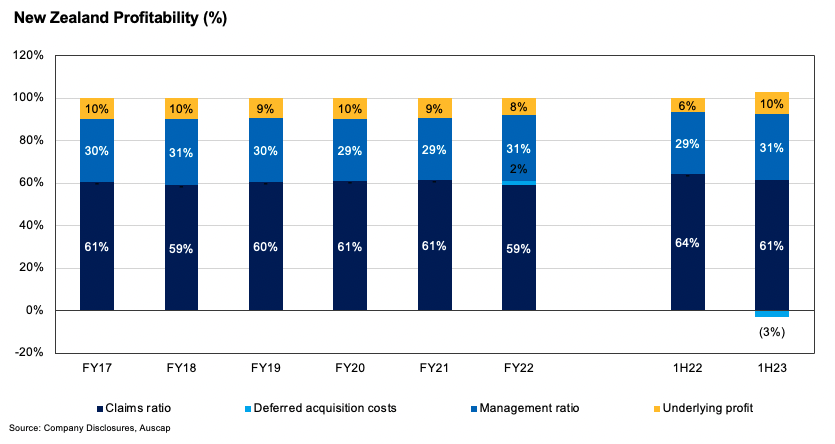

Dynamics in New Zealand PHI are broadly comparable to Australia, although its member pool is older and the market does not share Australia’s concept of “portability”, where those with pre-existing conditions can change health insurers without re-serving a waiting period.

These are some of the reasons as to why NIB’s New Zealand business has less policyholder churn, higher premium growth and higher net margins relative to NIB’s arhi business.

iihi (International Inbound Health Insurance)

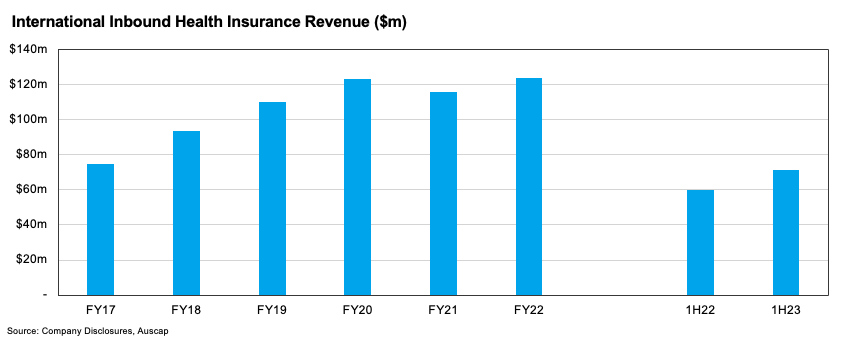

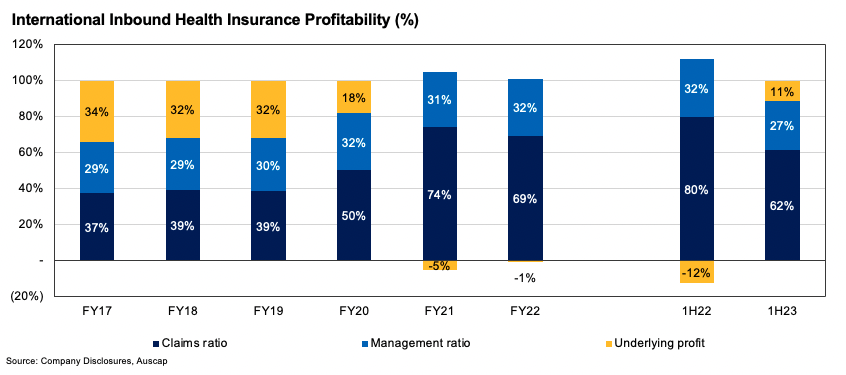

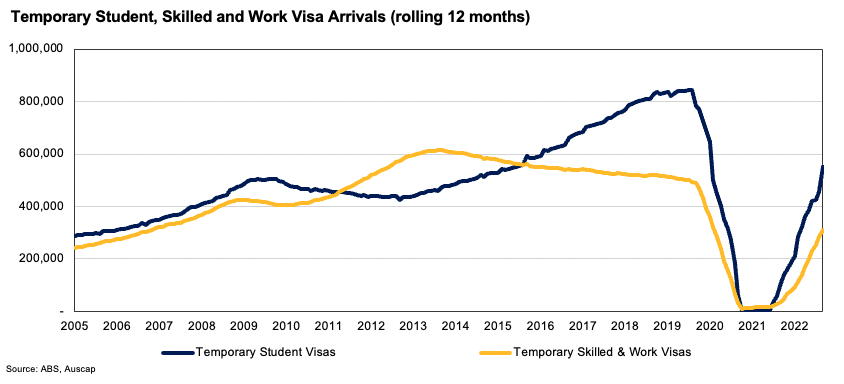

Australian Medicare eligibility is generally restricted to Australian citizens, New Zealand citizens or permanent visa holders, so for students or those on working visas, PHI is either formally required or strongly recommended by the Home Affairs Department. This is historically a highly attractive business for two reasons. Firstly, it is exposed to growth in Australian immigration and international student demand, with NIB partnering with fast-growing organisations such as IDP Education. This has led to good revenue growth over time.

Secondly, the claims ratio has historically been quite low, given international students tend to be young and healthy, whilst not claiming much in the earlier period of their stay. These dynamics reversed in recent years as COVID-19 led to closed borders, with new premium revenue dropping sharply. In addition, more students began to stay in Australia over university holidays, leading to more claims. So iihi moved from margins above 30% to losses.

However, this division’s outlook is now once again decidedly positive, with record current immigration and a renewed push to entice international students. The division’s recovery is still in the early stages, with profitability only being restored in the recent December 2022 half. January was a record sales month, with February also very strong. The 1H FY23 margin of 11% is still well below the businesses’ pre-COVID profitability of greater than 30%, so we see that there is considerable scope for margin and thus profit improvement.

Travel

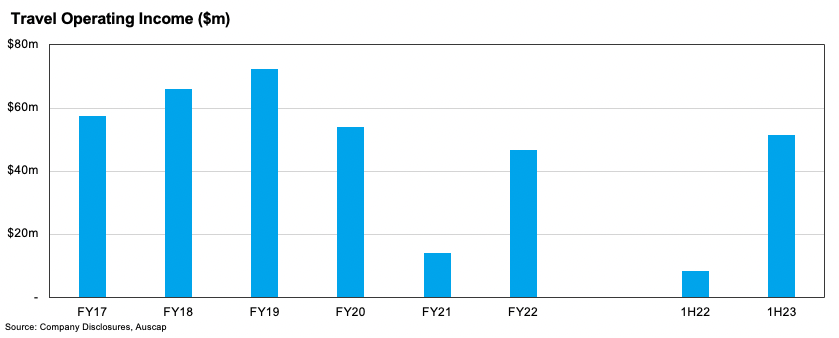

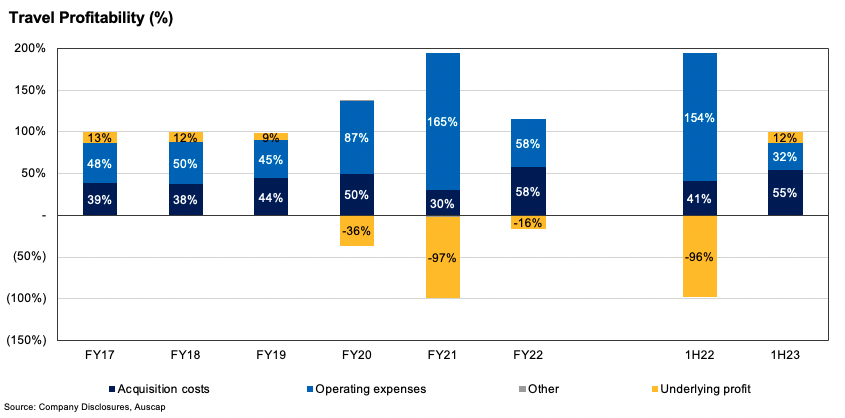

NIB entered travel insurance through the 2015 acquisition of World Nomads Group (Australia’s third largest travel insurance distribution business) and the 2018 acquisition of QBE Travel (Australia’s fourth largest travel insurer). Travel is a logical adjacency to PHI, as the majority of travel insurance claims are medically related. This is run as a distribution business, with NIB outsourcing claims risk to underwriters or reinsurers. Whilst these acquisitions originally progressed largely to plan, this all changed with COVID-19, as new policies plummeted. The combination of lower revenues and a large cost base led to large losses.

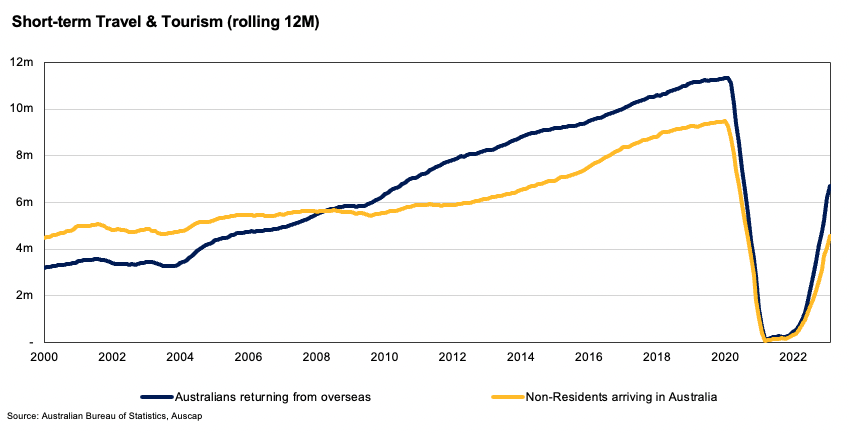

NIB has responded with structural changes to the division, including a new underwriting agreement and permanent reductions to the cost base. As international travel rebounded, gross written premiums rose to above pre-COVID levels in 1H23, with the business delivering a profit of $6.4m in 1H23, roughly equivalent to its pre-COVID full year profit of $6.6m in FY19. NIB Management has indicated that it expects the business to continue to exceed pre-COVID profitability.

As short term arrivals into Australia continue to rebound, we expect good growth in revenue and profitability for this business.

nib Thrive (NDIS)

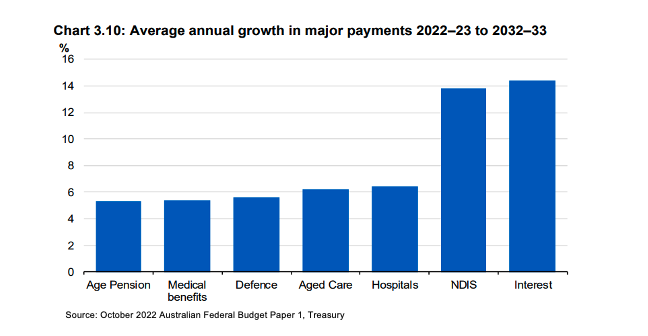

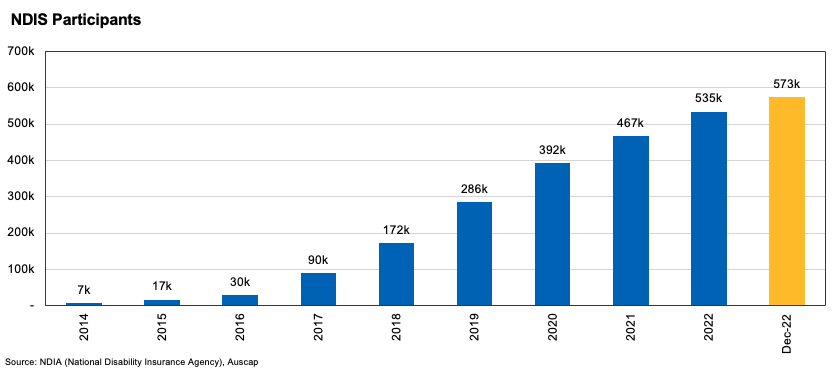

In 2013, the NDIS was introduced. In the latest October 2022 budget, the Federal Government forecast the NDIS to grow at a 13.8% CAGR to hit almost $100bn in 2033.

Whilst the NDIS has grown quickly to almost 573,342 participants as of December 2022, it is still far from maturity. The Australian Government estimates that 18% of the population, or 4.4 million Australians have a disability.

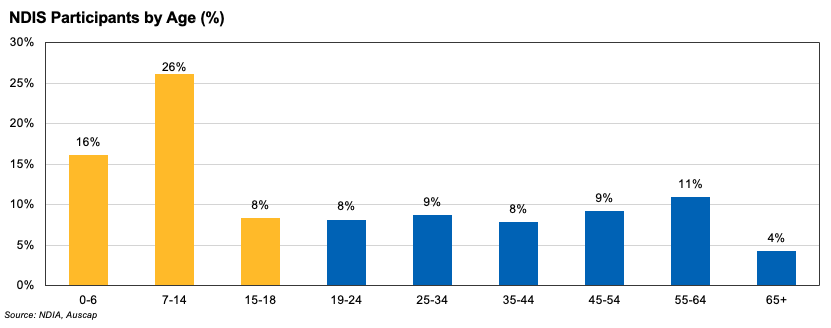

Australians cannot apply for the NDIS once they turn 65, so the NDIS pool currently skews very young, with half of all current participants under the age of 18. As the scheme reaches maturity, NDIS participation will grow strongly. One other reason that the NDIS skews very young is that there have been a large number of children with developmental delay and autism entering the scheme. In response, some people, including NDIS Minister Bill Shorten, are questioning whether the NDIS is taking on too big of a role for these conditions. However, “early intervention” is a key focus of the NDIS and these categories have relatively low budgets and payment levels relative to other NDIS conditions. Participants outside ‘SIL’ (Supported Independent Living) aged 0 to 14 receive an average annualised payment of about $19,000, well below the average for participants outside SIL of $41,000.

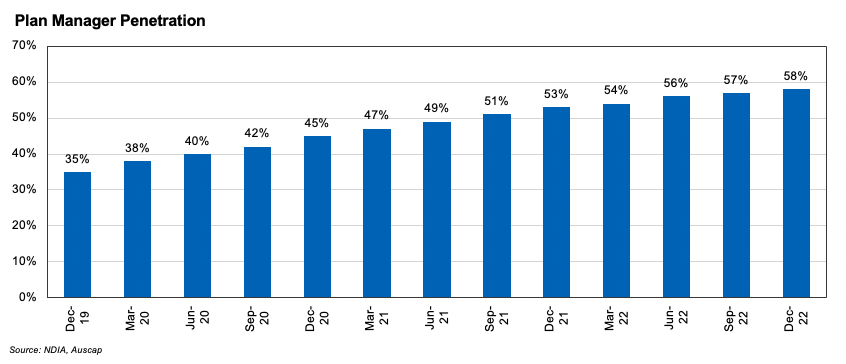

The vast majority of NDIS expenditure, in the order of 95%, is paid to service providers to deliver support to those with disabilities. A small percentage is paid to intermediaries who help participants with services such as budgeting, administrative support and negotiating with a network of appropriate service providers. These intermediaries are known as Plan Managers, Support Coordinators or Local Area Coordinators. NIB sees this intermediary function as analogous to its PHI role of connecting members with health care service providers. Plan Managers are particularly popular, and continue to gain penetration within the NDIS, rising from 35% to 58% penetration over the last three years. Plan Managers do not approve NDIS applications and are paid fixed fees by the NDIA separate to participant budgets. Since November 2022, NIB has acquired four NDIS Plan Managers, including the 4th largest (Peak Plan Management), 6th largest (Maple Plan) and 9th largest (Connect Plan Management) in Australia. NIB is now a top 3 plan manager, with the other two scale players owned by private equity and a listed salary packaging business, respectively. The presence of a trusted and experienced player like NIB, who is incentivised to help maintain rigour and integrity in the sector, may be seen as a positive by the Government.

Whilst reform of the NDIS has been flagged, Bill Shorten this month reaffirmed his expectation that the program will continually grow in size every year. NIB is targeting 50,000 Plan Management customers by 2025 and expects the NDIS to double in size by 2030, which many would argue is conservative. It sees opportunity in Plan Management, other NDIS intermediary functions such as Support Coordination, as well as offering services to Australians who identify as having a disability but are not part of the NDIS. nib Thrive was roughly breakeven in the December 2022 half, however its recent growth should lead to full divisional reporting relatively soon, which may lead to more investor appreciation.

Valuation

NIB is trading on a 17.5x forward Price to Earnings (P/E) ratio, towards the bottom end of its historical range since the 2014 Medibank IPO. This multiple is based on declining earnings expectations for the core arhi business, an earnings drag from Honeysuckle Health and Midnight Health, Thrive earnings just emerging, and each of Travel and iihi still in an earnings recovery.

Conclusion

We believe that NIB is a high-quality defensive business led by a highly capable management team with exposure to multiple attractive end markets. Trading on a reasonable valuation, with good forecast earnings per share growth over the coming years, we are enthusiastic about the future prospects for the company.

2 topics

1 stock mentioned