Conviction and certainty: Meet the fundie betting big on the return to the office

When investors are asked for the one thing they dream of having more of, chances are they want more certainty. In an environment where a lot of listed assets have struggled, many are asking where the best defence will come from. Standard answers might include healthcare and consumer staples stocks, a healthy allocation to the bond market (in normal times), and a stockpile of cash.

But what about a top office and retail complex in the heart of Australia's fourth-largest city?

In its ongoing quest to find top-yielding assets across Australia's premium real estate, Centuria Capital and MA Financial Group recently teamed up to purchase the Allendale Square complex along the Perth shoreline for $223 million. The team behind the deal claims this hybrid office-retail complex can collect a loyal list of tenants whilst paying investors a forecast average yield of 7.25% over the next five years.

So how will it all be achieved? To answer those questions - and a few more - I sat down with Centuria Capital's head of funds management Ross Lees to talk us through the fund, the idea, and why this fund could be the solution to the problems investors have been pining for.

ROSS LEES, CENTURIA CAPITAL: FUND MANAGER Q&A

LW: What attracted you to this particular property?

Ross Lees: For context, we're one of the largest owners in the Perth CBD. We've got over 220,000 sqm within the City of Perth - some of the premier buildings there, including Exchange Plaza, 140 St. Georges Terrace, and buildings like 111 St. Georges Terrace as well.

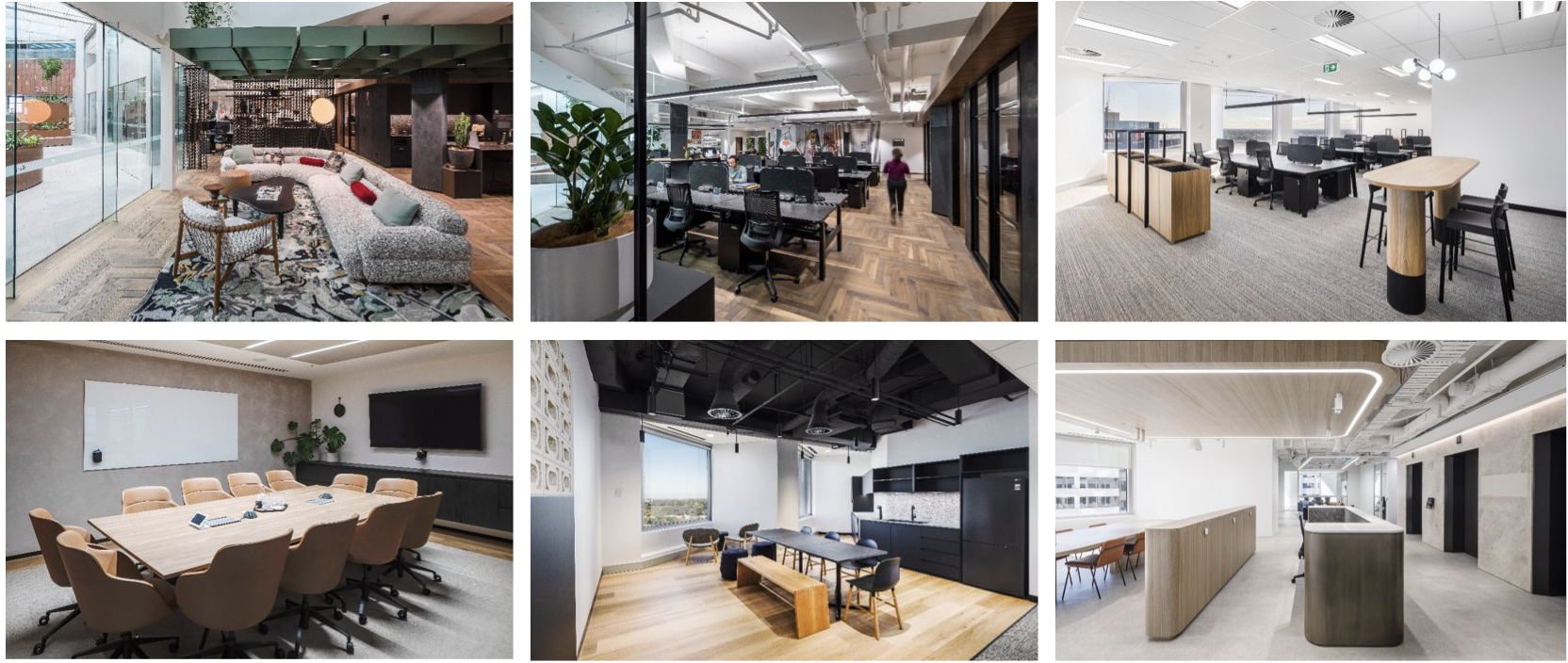

So we've got some fantastic assets in the market, and this is a premier asset that really lends itself to the attributes that those assets have. We believe there's a really good opportunity to reposition the property here, with a hands-on team on the ground. There's some vacancy in it that we think we can reposition.

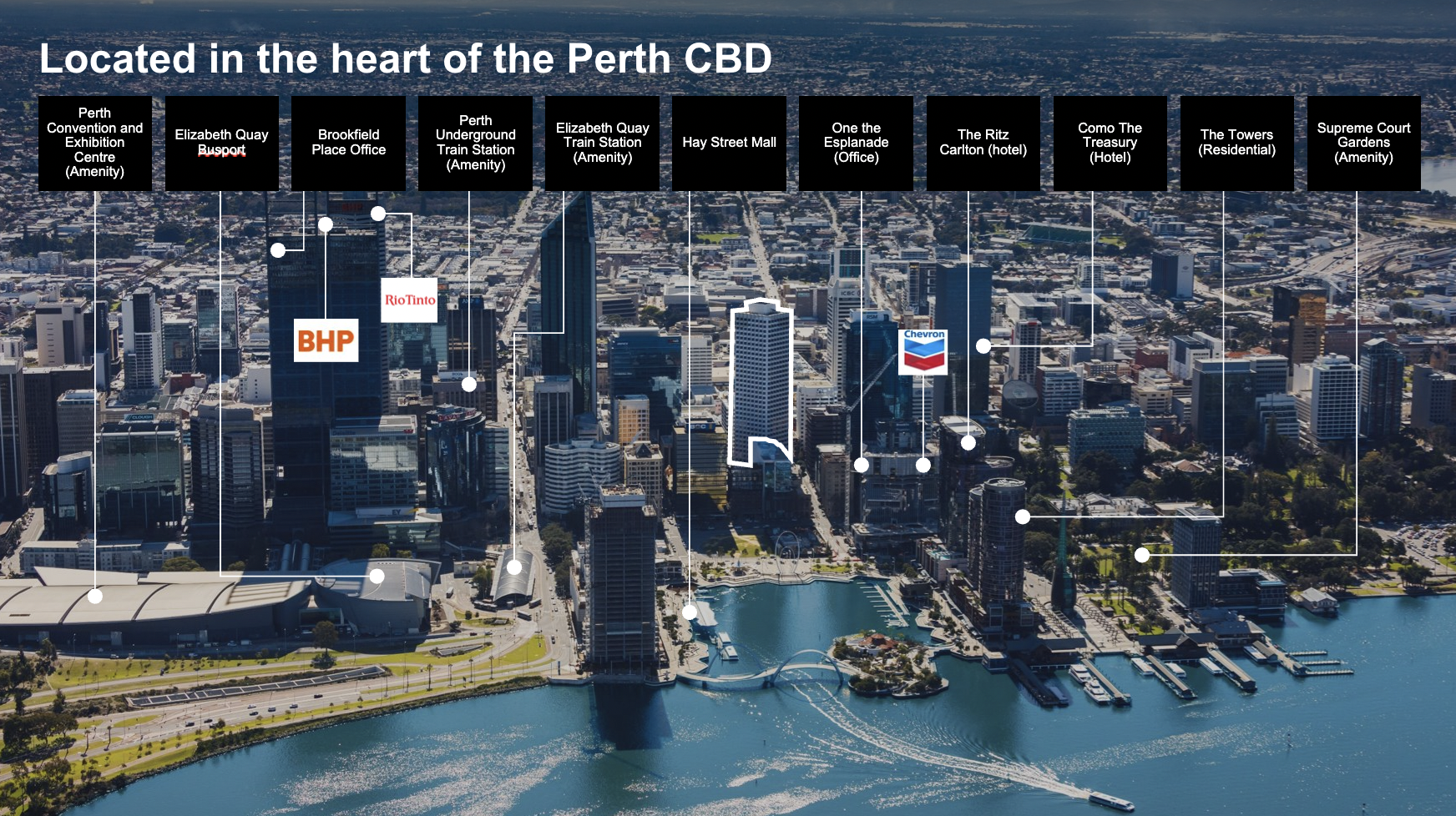

The location of the asset, which is paramount with any transaction, is right on the Elizabeth Quay redevelopment.

So we think there's a great piece of infrastructure coming in that's really going to underpin the location further over time. And it's a great asset that lends itself to our skills.

LW: How does Perth present itself as an investment opportunity?Ross Lees: There are two levels to look at, the macro and then the micro for the assets. So the macro, at the state level, is we're seeing good growth in state product and state final demand. We're seeing one of the highest CPI rates nationally coming under the Perth market at the moment. And it's underpinned by quite a strong and resilient resources sector. So against that backdrop, we feel like that's got great conditions for employment, employment growth that underpins office demand over time.

Looking at the micro of the asset, this really lends itself, as I said, to buildings that we feel we can reposition.

Net effective rents are forecast to grow quite strongly in Perth over the next few years, supported by that macroeconomic backdrop.

And the asset itself has lease expiries coming up over the next two to three years. So it allows us, through an active strategy, to capture that rent growth that we forecast to come through. It's going to be backed by a strong macro setting.

LW: Nearly all of this space is going to be office-related - but are you concerned the pandemic has kept more than a few workers permanently at home?Ross Lees: I think there are a few ways to look at it and it's something that people are naturally going to ask about what is the future of the office? And it's the great barbecue conversation of the weekends. What we are seeing is Perth specifically has the highest physical occupancy of any office market in Australia - 70% of pre-COVID levels is the current occupancy rate of the Perth CBD. When you start looking at that a bit further, think about how hybrid work may work. What we're not seeing is an equal distribution of days of the week worked.

People are coming in at a peak on a Wednesday, it bell curves down on a Tuesday and a Thursday, and then Monday and Friday are the lower point. But you can't lease the building for Monday and Friday, you have to lease the building for your peak occupancy.

What we're seeing is tenants are still leasing the same amount of space, if not more.

And we're seeing a lot of changes in workplace nature. Just in my career, when I started, people had offices. They then went to a fixed desk or a cubicle where the walls were removed. We then went to activity-based working or hot desking, and now we're in a world of hybrid work, and that's only in a 20-year window. So the workplace model's always evolving, it's always changing, but ultimately we're still seeing people lease space. Tenants and managing directors and CEOs and business owners fundamentally want people back in the office. And there may be a bit of an impasse, but over time we expect a see occupancy restored quite strongly.

LW: What makes this asset a "counter-cyclical" opportunity?Ross Lees: At the moment, there are divergent views on the future of the office, and we have a strong view that the office is going to be very relevant for organisations that want to thrive in the future. So coming in at a time when there might be a perception around the office that it has a divergent view on this outlook, we've got a strong view on that outlook and we're happy to invest in that thematic.

Onto yields, we've actually seen yields soften in Perth off the back of what has been higher incentives and a bit less demand in that particular market. Again, we're coming into a market that's got nearly 15.8% vacancy in the office market. Our own portfolio, however, only has a 5.02% Prime Grade vacancy in Perth. So we think there's a great chance to take a building that's priced for long-term structural vacancy and make it a very well leased and well-occupied building and leverage these tailwinds we expect to happen around return to the office strong macro thematic background, paired against our active asset management skill, to drive a really strong outcome.

So there's going to be some fluctuation on that as we go through our repositioning. So we've got some vacancies there at the moment, which we have rent guarantees on from the seller. So we're actually getting income on that space and some time to lease that vacancy. So we can do that appropriately and we can get the right tenants. We've got some more expiry coming up in year two of the fund.

What we see is, going through that churn, going through the repositioning and re-tenanting of the building, then having a much higher stabilised occupancy over time beyond that.

LW: You've paid $111.5 million for your share of this asset. Why was that a fair valuation for this building?Ross Lees: We look at "value" in a number of ways and the first way to look at it is:

What do we expect the future income that we can derive from the building to support and provide a fair return to our investors?

So looking at a few metrics, there was a book value or a peak valuation prior to which this value is quite below. We forecast what we believe the returns we can generate out of the building are and applied discount rates to that, and we feel that we can get strong returns. We are currently modelling a circa 11% internal rate of return (net of fees), which is contingent on a number of assumptions.

And the other thing that's quite relevant is replacement cost. And whilst you're not going to just go and sell a building for replacement cost if this building had to be replicated today, the acquisition of the land, the construction of the asset, the funding and tenant incentives and tenanting, we believe we're buying it about 40% cheaper than that replacement cost.

So one of our challenges is to actually bridge that gap between what we're paying for it today to extract a value that's close to that replacement cost, that's going to provide a good return for our investors.

LW: You say this asset could net an average yield above 7%. Where is that return likely to come from?Ross Lees: So the yield side is really income yield and what we really like about the proposed fund here is the amount of return we're generating from income. The building itself off the bat will generate an initial yield of in excess of 8%. We'll be paying out about 7.25% to our investors on an ongoing monthly basis and retaining some other funds to help with our repositioning strategy and manage future volatility.

But the modelled total return is about 11% per annum, and we expect to see at least 7.25% of that coming just from the income that's paid from the tenants.

And I spoke earlier about the quality of some of the tenants in the building, but looking at WA Bar Chambers, Minter Ellison, the Australian government, HopgoodGanim, Argonaut it's really underpinned by very high-quality tenants that are paying the rent.

We try to be fairly conservative in the assumptions we make. But we are looking at assumptions around whether the tenants will vacate or stay.

- What rents do we think we can re-let at?

- What kind of growth do we expect to come through the market?

- Can we save money on the outgoings?

- What tenant incentives are we going to have to pay to reposition the asset?

To maintain it to A- grade standard, what's the capital expenditure we have to put into the building? And we really heavily analyse all of those things and do extensive due diligence to make sure that the projections that we are making are all very well validated by data that exists in the market and by costings that we think we can validate.

LW: What is the level of gearing for this property and can investors can expect their distributions to be inflation protected?Ross Lees: The gearing that we're running on the property is approximately 50% loan-to-value ratio. And so that's 50% funded by equity, 50% funded by the bank.

The way we're looking at hedging for this particular fund or the interest rate outlook, is we're choosing not to hedge our debt. And the reason for that is there's quite a volatile forward curve at the moment and paying insurance against that might not be in the best interests of the unit holders. So we've actually allowed some very substantial buffers to manage future interest rate volatility.

One of the really key things with real estate by its nature is it's a real asset, and really, people have bought it over time for its protection against inflation. If we're in an inflationary environment, the replacement cost of buildings increases because construction costs increases. That moderates the supply that could come into a market. Tenants are probably making more money. They have the ability to pay more rent in that environment.

So we actually see real estate as an asset class as being very strong protection against an inflationary environment. And for going forward, if interest rates do move, we also expect to have an increase in the rental profile that can offset some of those costs as well.

LW: Are you concerned that a single-asset fund will heighten concentration risk?Ross Lees: What we find with our investors is there's some that love single asset trusts, and that's been the origin of Centuria and also Primewest over a long period of time. Identifying a building, identifying a business plan for that building, using our team to execute that business plan, and then selling the asset after an appropriate amount of time to deliver returns. And investors can go and look at the asset and they know exactly what they're investing into.

There are other investors who will love being in a diversified pool fund because they don't want the concentration risk that you just mentioned, but a lot of them are really attracted to the fact that they know exactly what they're buying into. They know the business strategy that goes with it. There's a defined business plan and exit process, and that's what really attracts them to this kind of investment.

This fund itself is targeted at sophisticated wholesale investors that meet the wholesale tests that go with it. And again, those kinds of investors do like to take conviction positions on many occasions and it really suits that type of market.

Learn more

Wholesale investors can get access to this exclusive A Grade office tower in Perth providing strong risk adjusted returns. Register your interest here

1 topic

1 stock mentioned

1 fund mentioned