Dalio’s 6-point checklist for spotting bubbles

High valuations in tech stocks, speculative behaviour in stocks and cryptocurrencies, and a rush of new investors to markets. You’d be forgiven for thinking that this type of behaviour is a sign we’re in the midst of a stock market bubble.

But bubbles are notoriously hard to spot while in one, and timing them presents real challenges. Ray Dalio, founder and Co-Chairman of Bridgewater Associates has seen a few bubbles since starting the firm in 1975. Over the decades, he’s developed a proprietary model to help identify bubbles in real time. He breaks it down into six measures, each with their own individual gauges, which he shared in a recent article.

In this wire, I summarize these six measures, what they’re telling us about markets today, and share a few recent quotes from Livewire contributors on the topic of bubbles.

Six measures of stock market bubbles

Before we get into the current situation, let’s first establish the six measures on which Dalio’s view is based:

- How high are prices relative to traditional measures?

- Are prices discounting unsustainable conditions?

- How many new buyers have entered the market?

- How broadly bullish is sentiment?

- Are purchases being financed by high leverage?

- Have buyers made exceptionally extended forward purchases to speculate or protect themselves against future price gains?

These measures seem to make sense. And the historical precedence appears solid. In the 1920s, every measure was either in “frothy” or “bubble” territory. In the dot-com bubble, every measure hit “bubble”. In 2007, conditions one and two were not met, but the Global Financial Crisis was undoubtedly a unique beast.

A look at markets today suggests that none of the six measures are in “bubble” territory, which might surprise some. While valuations on some tech stocks are no doubt extreme, lower valuations in other areas of the market largely offset this. However, “Emerging Tech”, if separated from the rest of the market, begins to tick some of these boxes.

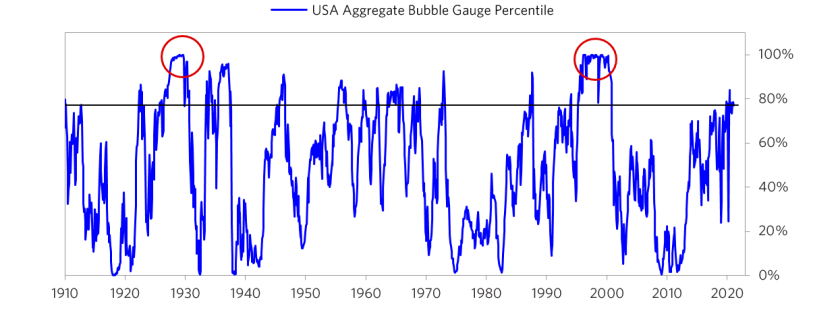

Overall, the bubble gauge is sitting at 77%, and appears to be trending higher. This is still a long way off the frothy heights of 2000 and 1929 though, which the gauge maxed out at 100%.

Source: Bridgewater Associates

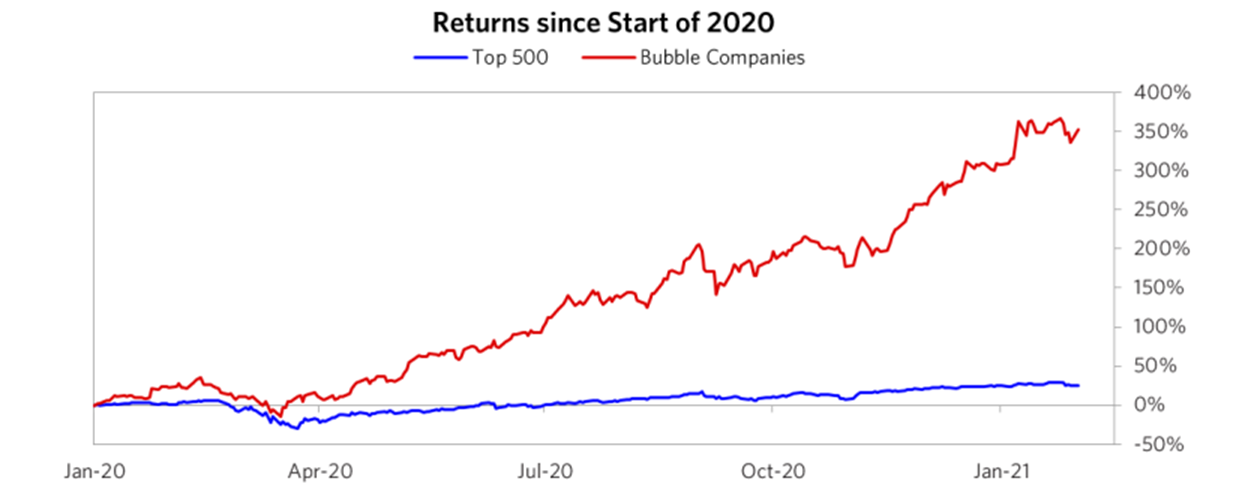

However, there is a clear divergence between the expensive tech stocks – “Bubble Companies” – and the rest of the market, as demonstrated by the chart below.

Source: Bridgewater Associates

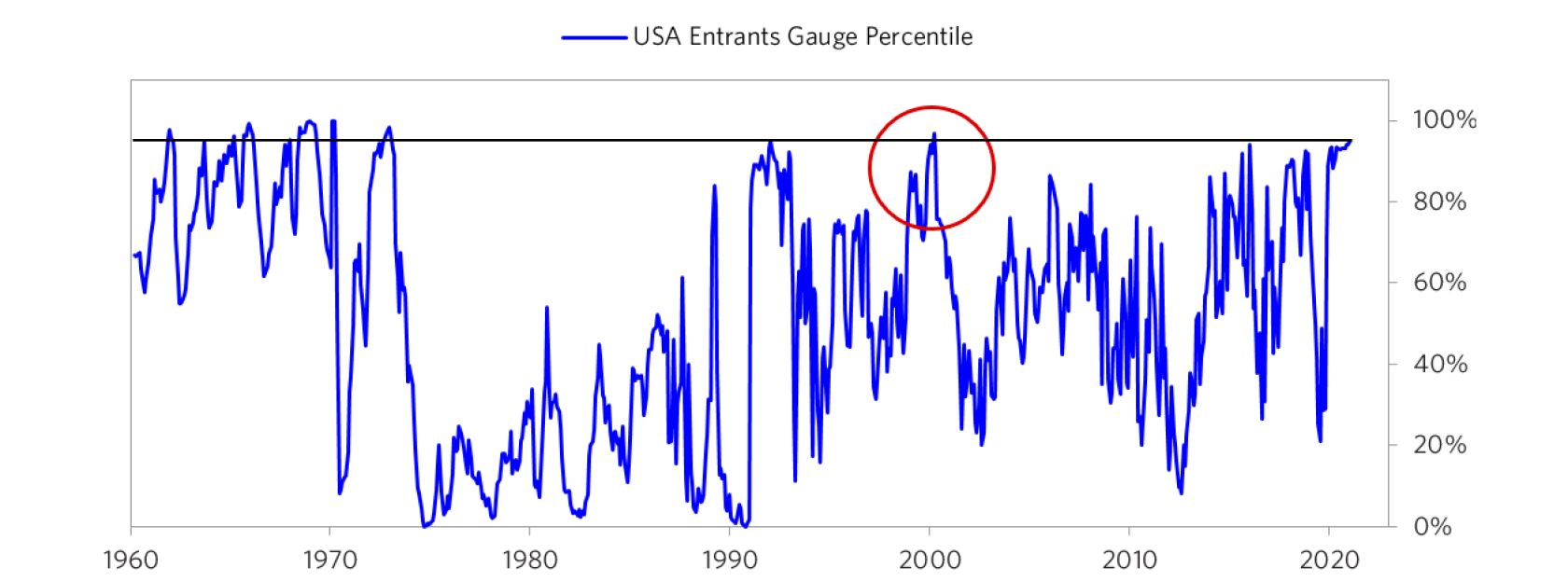

The bubbliest measure

In news that should shock nobody who’s been watching markets for a few years or more, the measure that scores the highest on the bubble-scale was number three, “how many new buyers have entered the market?” This measure scored in the 95th percentile, one of the highest readings ever recorded, and the highest reading since 2000. While discount brokerages such as Robinhood have no doubt played a role, it’s been the meteoric rises of Tesla, Bitcoin, and more recently, Gamestop, that have really captured the imaginations of retail investors.

Source: Bridgewater Associates

Peter Lynch, who is widely held to be the best mutual fund manager in history, often spoke of his ‘cocktail party theory’ of bubbles. In the final stages of a bull market, investors would first ask him for tips on what to buy (stage three), before finally offering him tips on what to buy (stage four). Are you being asked for stock tips (or crypto tips) by friends? Or perhaps they’re telling you what you should buy (after it’s gone up 300%)? Either way, caution is warranted at this stage.

Not so fast there

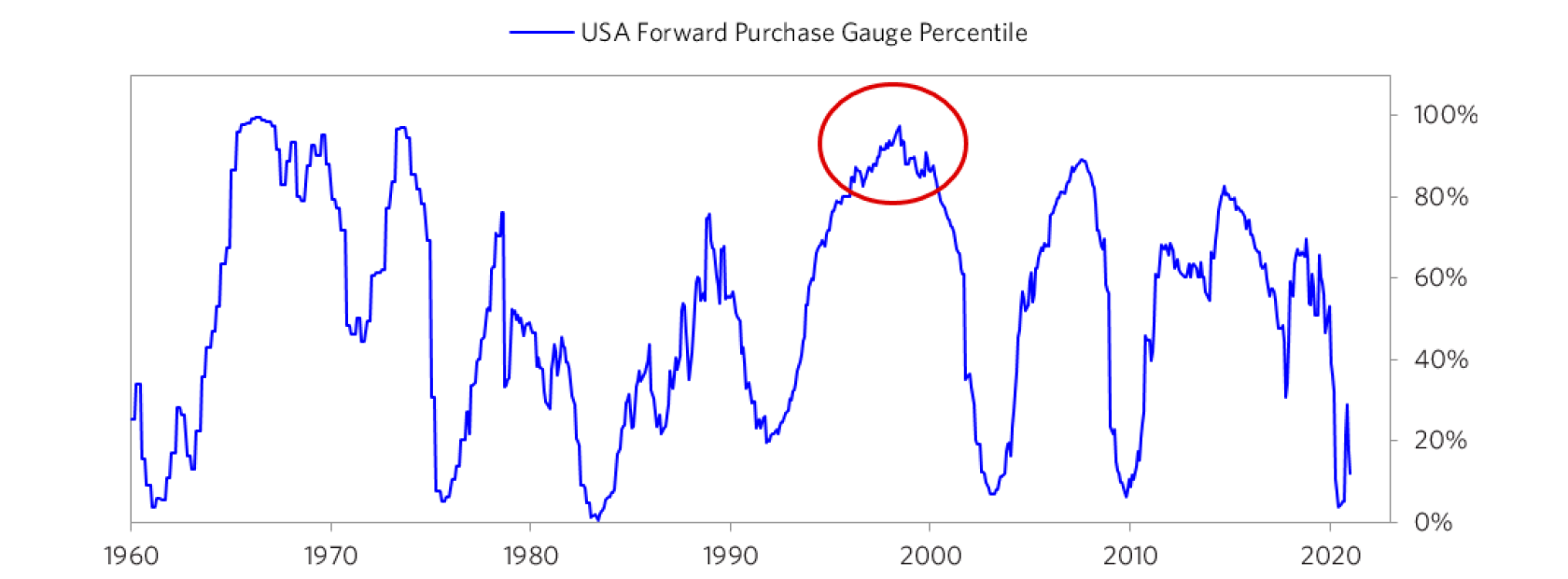

At the other end of the scale, the measure with the least-bubbly conditions is the final one, “have buyers made exceptionally extended forward purchases?” These purchases may be made to protect against future price rises, such as building additional inventory or buying futures of goods that will be required later. Or they may be speculative. Either way, people are betting on rising prices.

Source: Bridgewater Associates

This measure scored so low (approx. 10%) that it dragged down the aggregate of the overall gauge. Here’s what Dalio had to say on the topic:

“Corporations are the most important entity in terms of driving this piece via capex and M&A. Today aggregate corporate capex has fallen in line with the virus-driven hit to demand, while certain digital economy players have managed to maintain their levels of investment. Similarly levels of M&A activity remain subdued so far.”

The remaining gauges all came in around the 80% mark, implying conditions that are strong, but not yet overextended. See the full list here.

Other opinions

Dalio has almost unmatched experience in identifying bubbles, but his view is not the only one out there. So what are Livewire contributors saying about this topic?

Roger Montgomery from Montgomery Investment Management recently compared equity earnings to bond market yields, concluding:

“Today, as it stands however, on this measure at least, it doesn’t appear that the Australian stock market is in a bubble.”

On the topic of whether Quantitative Easing (when central banks buy government bonds to suppress yields) was creating bubbles, Christopher Joye from Coolabah Capital recently said:

“Contrary to countless hysterical claims, propagated by those hunting click-bait, the RBA’s current QE program has no role to play in blowing asset price bubbles.”

In an upcoming interview with Livewire, Sam Ruiz from T Rowe Price acknowledged that way may be in the early stages of a bubble, but doesn’t see it popping imminently:

“Even if we are in a bubble, there’s a very big difference between being in the early, or late stages of a bubble. Alan Greenspan coined the phrase ‘irrational exuberance’ back in 1996 when things felt pretty frothy. There was another three or four years until we saw the tech bubble burst, and a lot of upside to be made there.”

What next?

Whether we’re in a bubble or not, the broad consensus appears to be that there’s plenty of room left to run. While that doesn’t preclude an outside force from sticking a pin in it, as we saw in 2007 and 2020. Dalio stresses at the conclusion of his own note that:

“Timing tops and bottoms based on (the gauge) is precarious because while it shows what neighbourhood these stocks are in, there is nothing precise about it. So, it is tough to pick the levels and timing of tops and bottom based on it.”

If you’re looking for some ideas on how to invest in this environment, you may find them in a recent series we produced. If you think that we’re at the beginning of a new bull market, you may find value here. If, however, you think the bull is aged and nearing the end of its run, you might find more value here.

Or read the full note from Ray Dalio here.

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

3 contributors mentioned