Deferred loan repayments are hitting the banks

How badly has the COVID-19 pandemic impacted our banks? A quick look at recently released data on hardship-induced loan deferrals tells some of the answer. And it’s a pretty bleak picture for most of our lenders.

The banks and other lenders continue to trade at a considerable discount to historical price to book ratios due to the risk of material credit losses resulting from the COVID-19 induced recession. One of the difficulties in assessing the risk of credit losses and capital destruction is the APRA provisions extended to approved deposit taking institutions allowing them to exclude loans that are accessing hardship provisions from arrears data. This provision was originally expected to end in September, but was extended to the end of March 2021 in an announcement from APRA during July.

APRA recently released data showing the volume and value of loans for each of the banks that had been allowed to temporarily defer repayments as at the end of June and the end of July. Given that loans that are currently utilising hardship provisions provided by the banks in response to the COVID-19 pandemic are also likely to be the loans at the greatest risk of default, this data provides some comparative insight into the risk of material capital loss in the loans books for each bank.

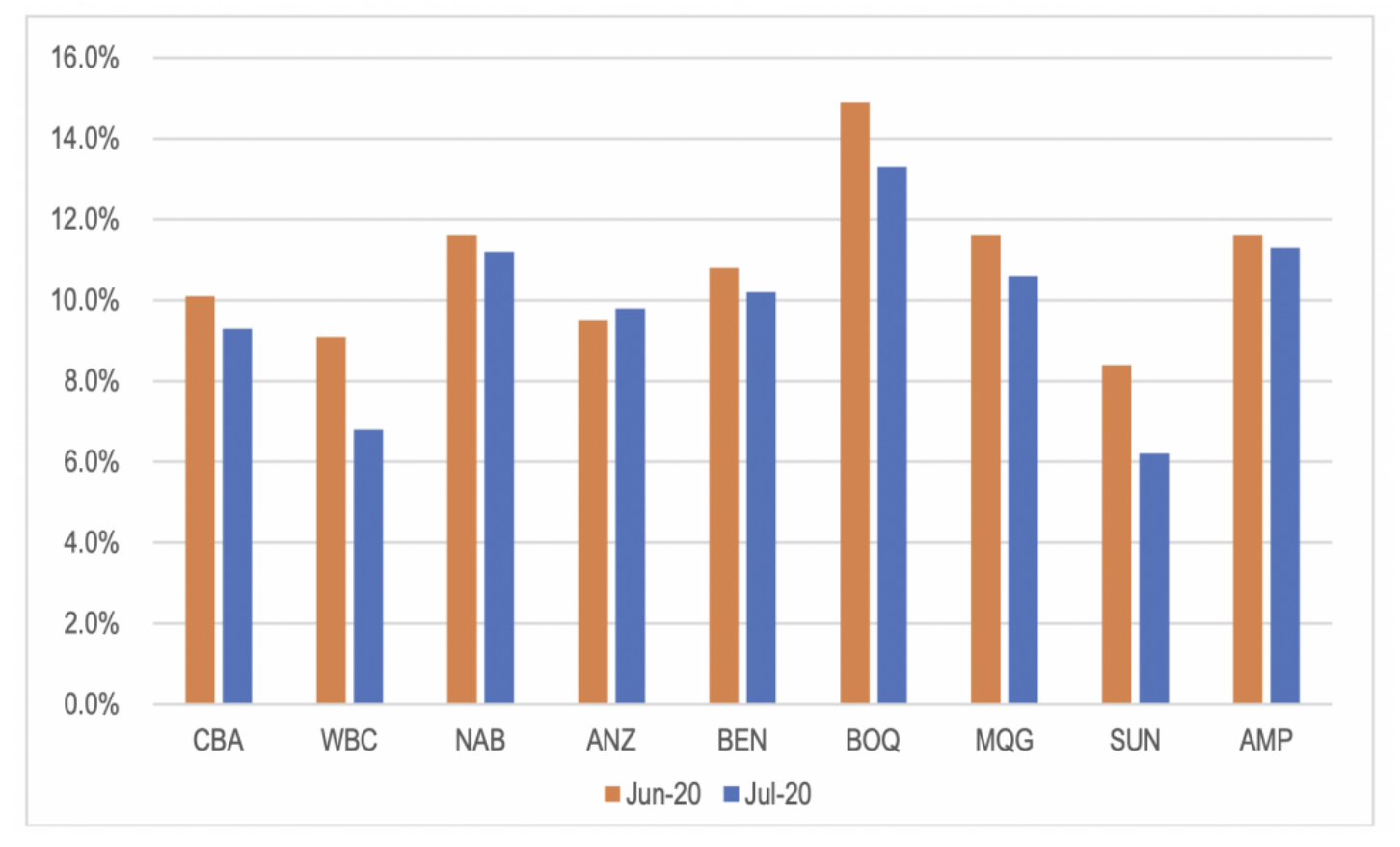

The data at an aggregate level shows that between 6 per cent and 13 per cent of loans for each bank have some sort of repayment deferral applied at the end of July, with most of the banks at around 10 per cent. Bank of Queensland has by far the highest proportion of its loan book accessing repayment deferral provisions at the end of July. The other noticeable feature of the data is the significant reduction in the percentage of loan on repayment deferrals between June and July for Westpac and Suncorp.

Figure 1: Loans with Deferred Repayments as a percentage of All Loans

Source: APRA

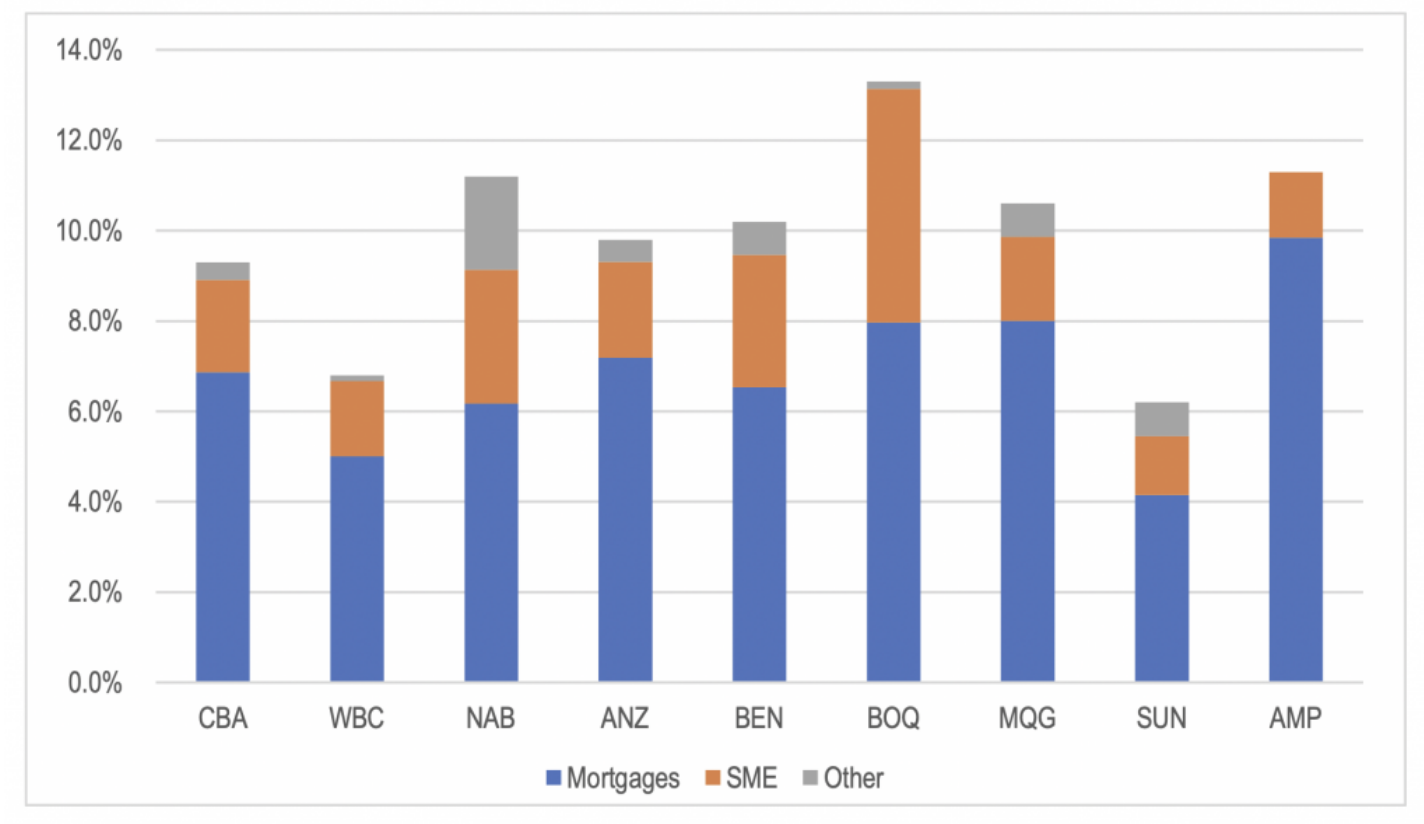

If we break that down between mortgages, small to medium size enterprises (SME) and other (mainly business and unsecured consumer) loans, we can see that NAB has the most exposure to business loans in deferral on a relative basis, while AMP’s mortgage is showing the greatest proportion of hardship provisions as a percentage of its overall loan book.

Figure 2: Loans with Deferred Repayments as a percentage of Total Loans by Type: 31-July-2020

Source: APRA

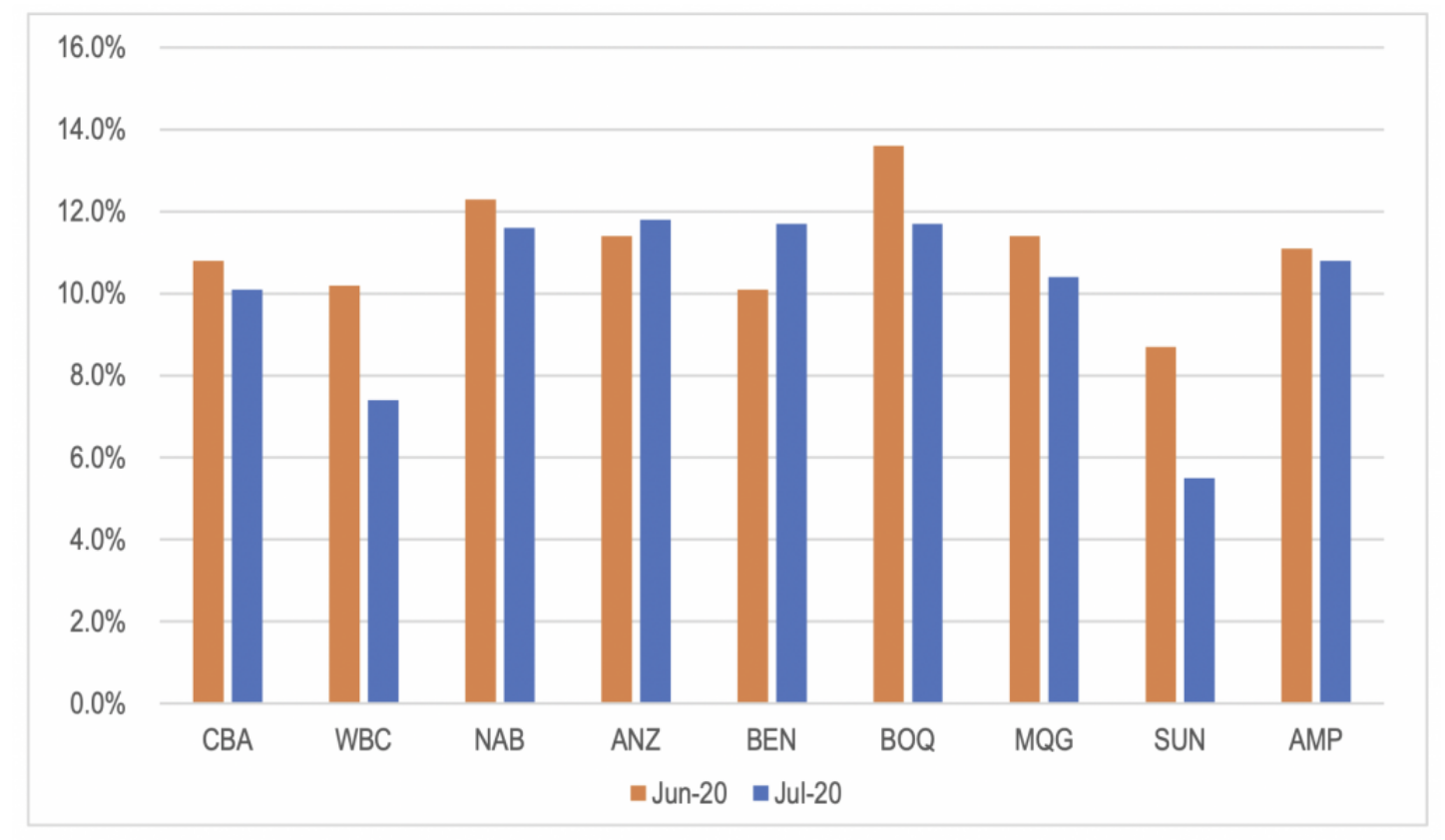

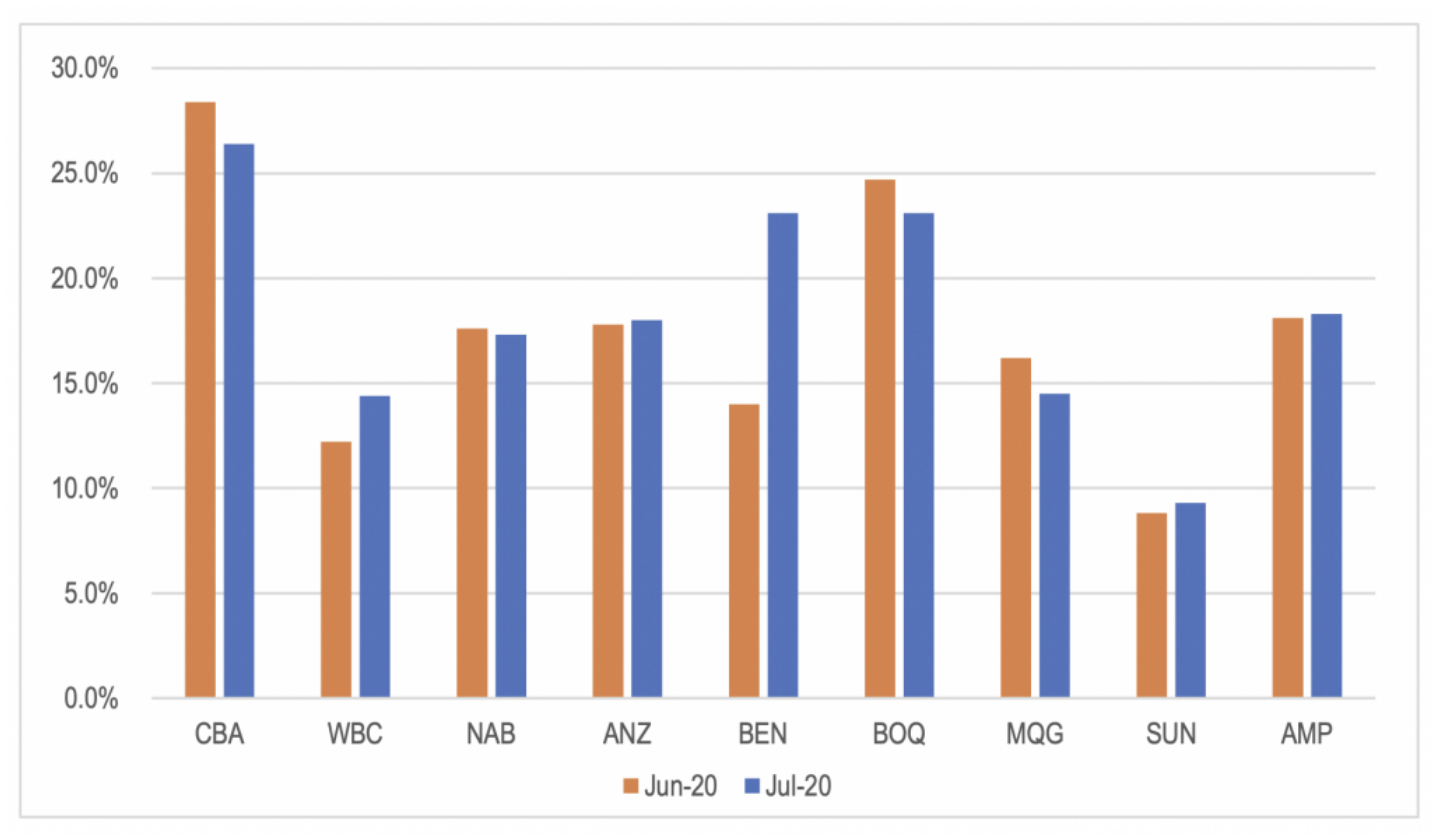

If the data for the mortgage and SME loan books are looked at in isolation, it shows that most of the banks have a similar percentage of their mortgage loan book on some sort of deferred repayment schedule. For SME loan books, the percentage on deferral varies more significantly, with CBA the highest followed by Bank of Queensland. Again, Westpac and Suncorp appear to have made the most progress in bringing customers back to full repayments during July and have the lowest percentage of loan on deferred repayments for both mortgages and SME lending.

Figure 3: Mortgages with Deferred Repayments as a percentage of All Mortgages

Source: APRA

Figure 4: SME Loans with Deferred Repayments as a percentage of All SME Loans

Source: APRA

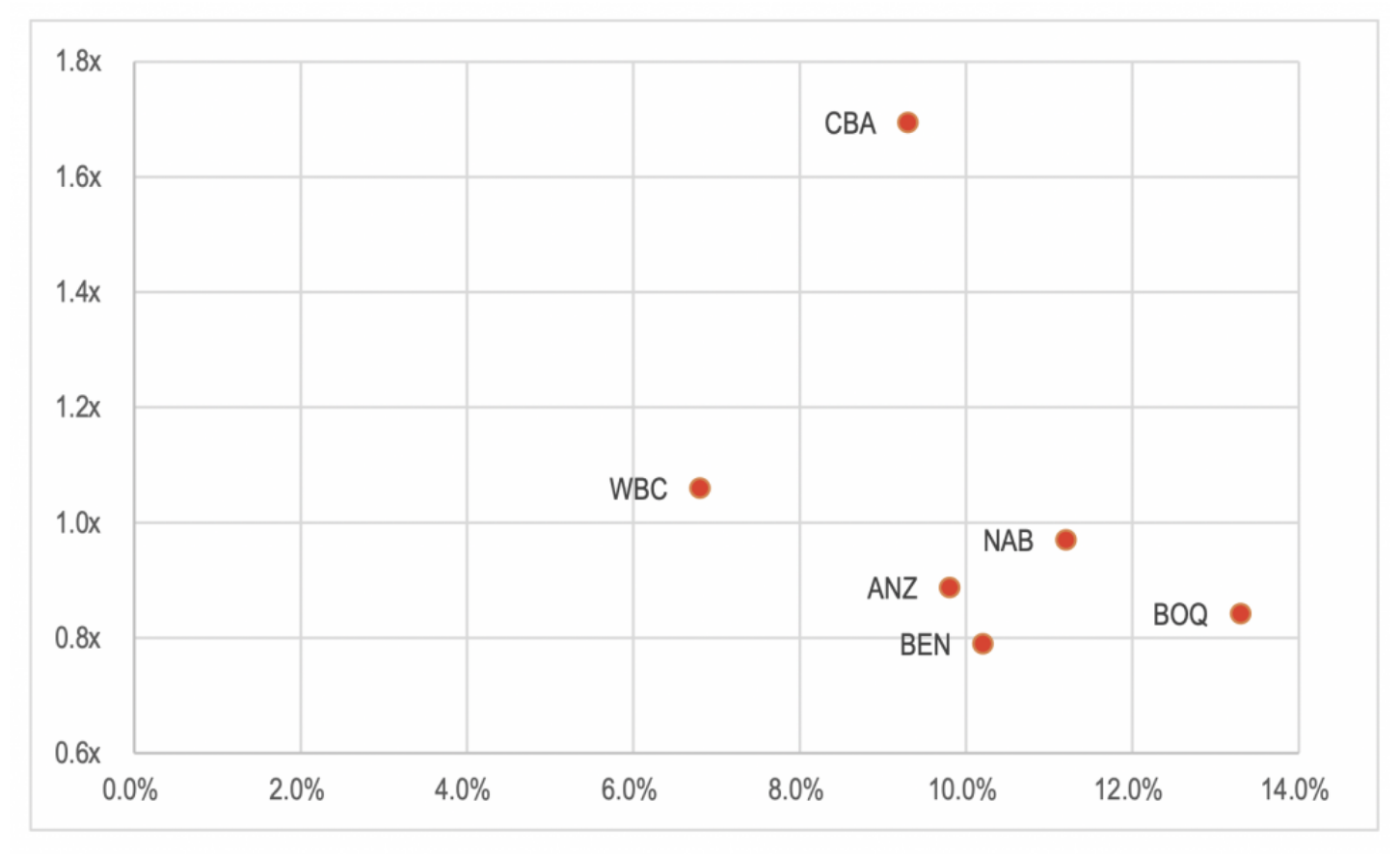

To provide some assessment of the risk to the loan book from credit losses arising from COVID-19 related hardship, the chart below plots the percent of each bank’s loan book on some form of payment deferral versus its price to net tangible asset ratio. CBA is an outlier as the country’s premium bank, but among the other banks, the data indicates that Westpac could be pricing in relatively more credit losses than its repayment deferral data would deserve. Conversely, NAB and Bank of Queensland’s share prices appear to be factoring in relatively less given the proportion of their loan book that was on some form of deferred repayment.

Figure 5: Percentage of Loans on Repayment Deferrals Vs Price/NTA

Source: APRA, ASX

Of course, this treats all loans on deferred repayment equally. Some loans will be on a reduced repayment schedule while others will be making no repayments at all. Additionally, the data does not adjust for differing levels of hardship required to qualify for repayment deferrals, the length of the initial period of deferrals and/or extensions of hardship provision periods for each customer.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

9 stocks mentioned