Dividends are personal for Michael Price and his strategy shows it

Michael Price loves a challenge, whether it’s wrangling yield from a market at 30-year lows or outmanoeuvring his family in a cut-throat round of Hegemony.

As Portfolio Manager of the Ausbil Active Dividend Income - Wholesale he specialises in maximising yield and franking credits while steering clear of valuations that don’t stack up.

For Price, markets are part numbers and part human nature – a shifting mix of psychology, geopolitics and the occasional curveball. With more than 35 years in financial markets, he’s learned when to press an advantage and when to bank the gains.

This week, Price is leaning into resources, adding Fortescue Metals (ASX: FMG) for its long term iron ore and copper potential, and scouting Ramelius Resources (ASX: RMS) post-merger for growth and income upside. At the same time, he’s been trimming Westpac (ASX: WBC), wary of banks trading at premiums their earnings can’t justify.

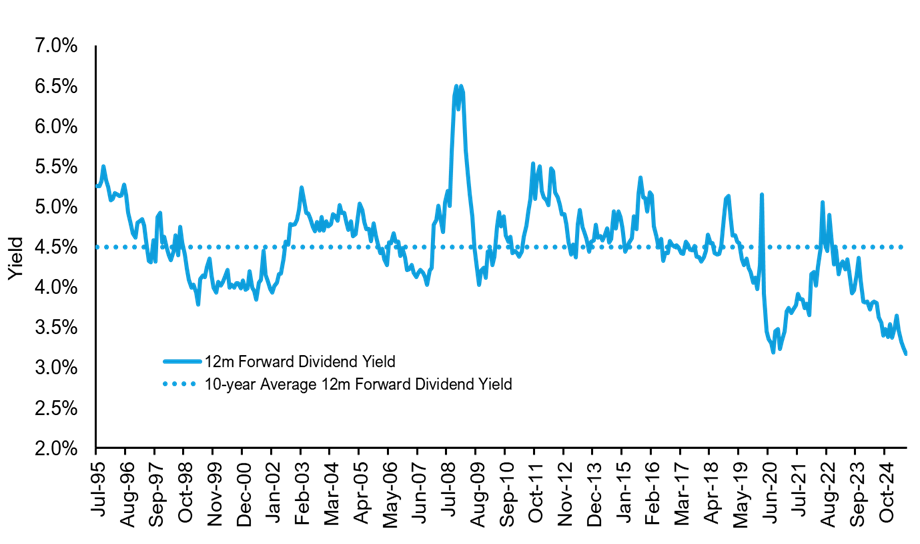

Price also sees opportunity in scarcity, with the ASX 300’s forward dividend yield at a 30 year low, active strategies like his can take advantage of dislocations to lock in extra income for investors. For him, it’s not just a job, it’s personal. His own family’s retirement income depends on the very strategy he manages.

In this week’s Q&A, Price shares the highs, lows and lessons from the week – from gold miners to Life360 wins, and why dividends are never just numbers on a page.

What’s your most recent investment and why?

I have recently added Fortescue Metals (FMG) to the active dividend income strategy. FMG is one of Australia’s largest mining companies, and one of the largest iron ore miners in the world.

The iron ore market has recently experienced volatility, with demand influenced by the Chinese economic and construction backdrop. However supply-side reform in China should lead to a tighter market and the longer-term demand prospects for iron ore and copper are extremely strong.

FMG has recently refocused their business towards existing operations which we believe should provide strong cash-flows and dividends over the medium term, subject to market conditions and commodity prices.

Which investment did you add to your watchlist this week?

On the resources theme, I just added Ramelius Resources to my watchlist.

Following the completion of its large-scale merger with Spartan Resources (SPR.AU), Ramelius Resources (ASX: RMS) may be strategically positioned for near-term re-rating potential, with prospective inclusion in the ASX 100 which may enhance market liquidity and index-linked demand.

RMS is targeting ~500koz annual gold production by 2030, according to the company, positioning it among Australia’s leading gold producers by output while maintaining a cost profile at the lower end of the production curve.

RMS continues to generate sector-leading free cash flow per ounce, underpinned by long-life cornerstone assets at Mt Magnet and Rebecca–Roe.

The company’s $784m cash balance (as of 31 July 2025) provides both operational resilience and capital management flexibility, supporting its disciplined and consistent dividend policy.

RMS has delivered $193m in shareholder returns over the past five years, with dividend yields materially above the mid-tier ASX gold peer group, a trend management has indicated they aim to sustain, though this is not assured.

RMS has significant exploration upside having increased their budget for FY26 to $80-100m, looking to continue to increase their reserves and resource numbers across their prospective tenement package.

What is the most recent investment you have trimmed or sold, and what drove this decision?

I have been trimming WBC. Ausbil is underweight banks as a house and that includes the active dividend income strategy.

Banks have run very hard and have been trading well over their long-term average forward PEs, and well above the market in general.

This is largely because international investors and super funds were caught underweight banks during the rapid monetary tightening in 2022 and 2023, and have since overcompensated, bidding up the sector to heady valuations.

We are underweight banks mainly on the basis that, according to consensus, their earnings growth outlook for FY26 is just +1.1%, and only +2.2% for FY27[1], which in our view cannot justify their current valuations.

We have seen the bank trade unwind in the last few weeks as they demonstrate some weakness and reversion towards their mean, but in our opinion, still expensive relative to the earnings growth on offer.

What’s your favourite chart or data point from this week?

This is my favourite chart at the moment, the forward dividend yield on the S&P/ASX300, which is at a 30-year low.

This is a challenge for dividend investors looking for extra income, and a major opportunity for active dividend income strategies like ours as we aim to maximise yield through dividend harvesting and optimised franking credits.

The exciting thing is that there is a potential forward reversion in yields for quality companies demonstrating superior earnings and dividend growth which we believe may present opportunities for active dividend income strategies, including ours, to seek to maximise the market yield.

Chart 1: Forward dividend yield for S&P/ASX 300 is at a 30-year low

Source: Bloomberg, Ausbil as at 31 July 2025.

What was your weekly high – a standout market moment or highlight?

The Life 360 (ASX: 360) result has been my weekly high. This might seem like a strange one as it is not in the active dividend income strategy (as it is not a dividend paying stock) but it is in most other Ausbil strategies.

The fund relies on a strong analytical team, and you need to celebrate the teams’ successes when bottom-up research pays off. We have been reaping rewards on our long and detailed work on 360.

What was your weekly low – a market disappointment or challenge from the week?

We were disappointed with the market’s reaction to the JB Hi-Fi (ASX: JBH) result and the special dividend. We think the reaction was harsh for a quality result from a quality company, but clearly the market had already priced in a positive outcome and is taking a breather on the name.

We think that a stock as good as JBH and with such a strong track record will just sail through this noise to its next result, so we are not worried on a strategic level.

Short-term profit taking does not build long-term returns.

What first drew you to markets or this sector?

Although I trained as an actuary, it wasn’t until my Dad retired that I realised how much work the industry must do to look after the needs of retirees. I can relate to retirees and people who rely on their investments for income, and it is a personal mission of mine to look after them the best that I can.

I am passionate about the detail and the information in the numbers, and I simply love being able to harvest a dividend yield and a franking allocation for investors.

As my parents invest in the strategy to generate income for their retirement, you could say that delivering good outcomes is personal as well as professional for me.

What continues to motivate and inspire you as an investor?

Markets are infinitely fascinating - they are not just about numbers and trades; at any point in time, they are a reflection of group psychology, geopolitics, economics, technological innovation, the season, the time of the year, even the weather.

This is because trading involves humans (even if many deploy robots to trade for them) interacting with other humans. All of this means that opportunities exist both in the unexpected and the expected, and there is usually a chance to actively chase an excess return. I’d be doing this even if I wasn’t employed by someone to do so.

How do you unwind when you’re not thinking about the market?

I really enjoy playing modern board games with family and friends, especially those with a co-operative or interactive component. They are both social and intellectually stimulating. My son recently added a game called Hegemony to the gaming table and it has been a lot of fun as well as an interesting reflection on politics and the economy.

4 topics

5 stocks mentioned

1 fund mentioned

1 contributor mentioned