Does the uranium surge still have legs?

Dear Reader,

2023 has been a great year for the uranium bulls… A shining light on an otherwise dismal market for commodities.

But if you’ve been sitting on the sidelines, is now the time to jump in?

That’s what I’ll try to unpack today.

The risks and potential long term opportunity for this once hated sector.

So, let’s start by taking a quick glimpse at the recent price action…

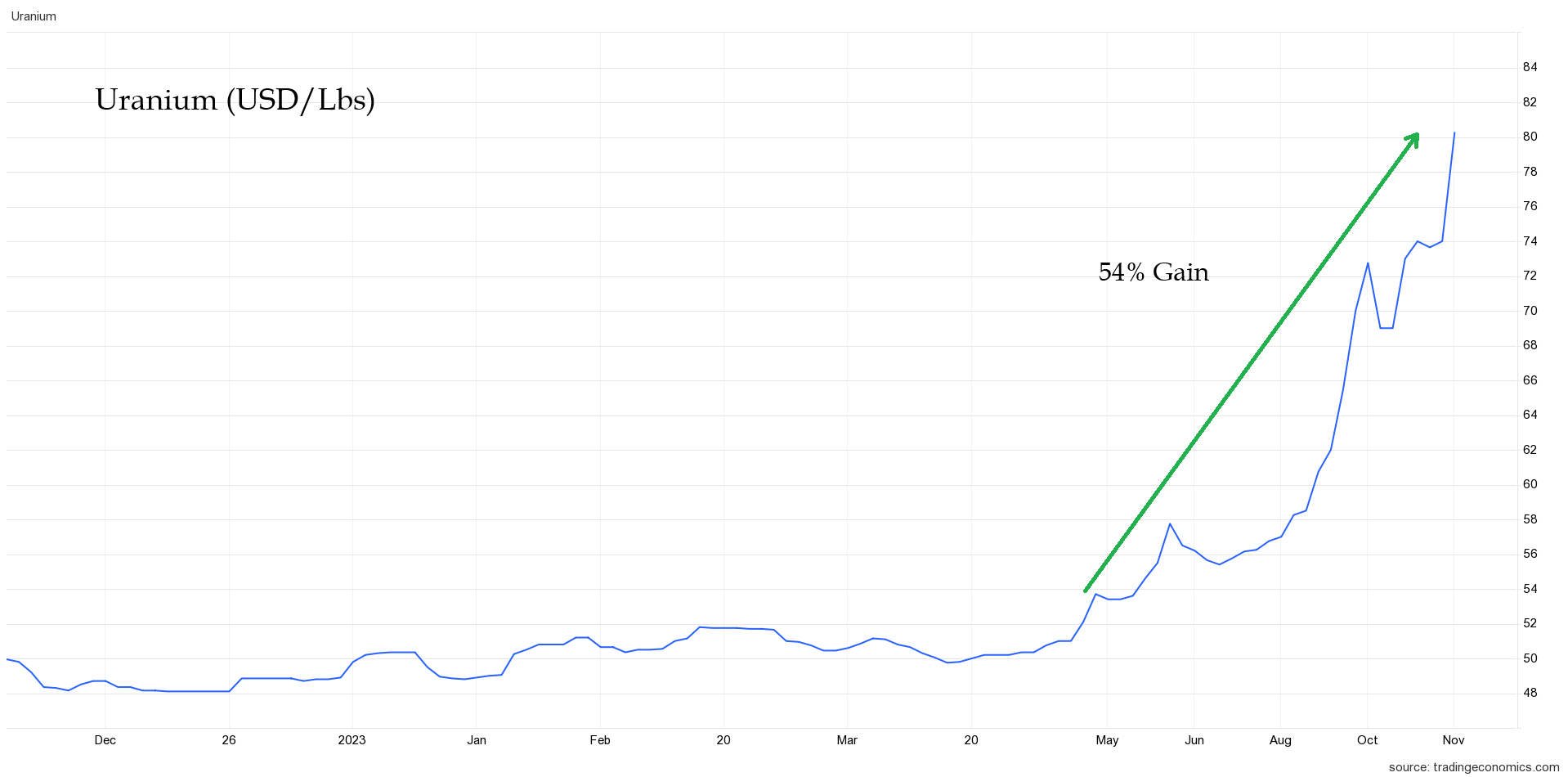

As you can see below, uranium shot up more than 50% after breaking out of a holding pattern in late April.

It’s a staggering move for any commodity, particularly one that’s sat in the gutter for the better part of a decade.

But really, the surge was inevitable.

This energy dense fuel which powers nuclear reactors is a simple solution to end the planets addiction to coal and oil.

Whether it’s sunny, cloudy, windy, still, day or night…. Nuclear produces clean, cheap base load power 24 hours a day.

It’s why I remain bullish on the long term direction of this commodity.

In fact, last January I put together a two part series on four commodity predictions I thought might play out in 2023.

Now I didn’t get all the predictions right, but I did say this about uranium…

"The development of new oil and gas fields needs a decade or more of sustained investment to replace depleting reserves, yet the last few years have been among the lowest investment on record in the industry.

So herein lies the only viable solution to the world’s biggest problem.

Ensuring the global economy can meet base load power requirements means we need something far, far greater than any solar, tidal, hydro, or wind power generators could ever achieve.

It brings me to the only achievable alternative for our future energy needs…nuclear.

Love it or loathe it, as an investor, you can’t ignore the potential for uranium in fuelling the nuclear industry.

Governments have either knowingly (or unknowingly) all but guaranteed that at some point in the near future, we’ll need to accept nuclear as our staple source of base load energy.

They’ve signed the death knell for fossil fuels…they’re totally blind to the issue of critical metal supplies.

It means we’re slowly walking into a new nuclear age.

While the 2011 Fukushima nuclear disaster in Japan still hangs large over the industry, the world has never faced the potential for global energy shortages on the scale that’s likely to hit over the coming years.

It comes down to lack of supply.

That’s why I believe nuclear will become a focus in 2023…uranium stocks will, of course, surge if this situation plays out."

If you’re interested in revisiting that article, you can do so here.

But, for those investors that didn’t get in on the initial action, is it too late to add exposure?

Now, it’s always dangerous to try and call a top in any strong rally like this.

But there are signs this sector could be overshooting, at least in the short term.

No doubt you’ve seen the flood of bullish headlines ballooning uranium’s prospects.

When trends hit the mainstream that’s your first warning that the market could be overheating.

But there are more tangible signals that suggest we could be approaching a near-term top.

Given I’m a geologist, I tend to focus on the rocks… First and foremost!

But I also like to use charts to understand where markets might be headed next.

Fukushima Resistance

Now, I always like to add a disclaimer that technical analysis offers probabilities NOT certainties.

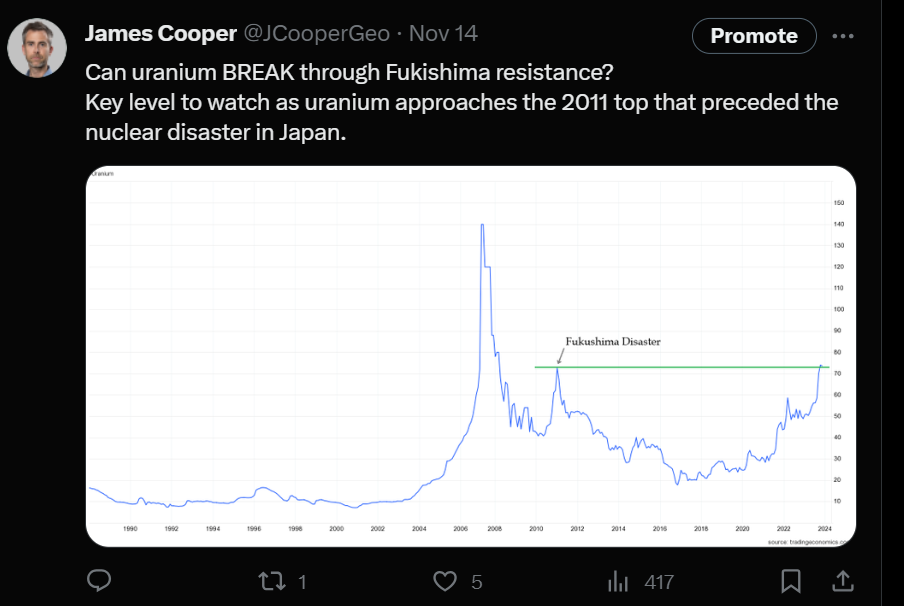

But here’s a long term uranium chart I shared on Twitter (X) last month, highlighting the potential resistance for uranium…

As you can see, uranium topped out at around $USD72 per pound back in 2011.

This preceded Japan’s Fukushima disaster which sent the sector into a secular BEAR market.

Global economies turned their back on nuclear energy. Demand for uranium sank to multi-year lows.

Yet all that’s in the past now.

As you can see on the chart (above) uranium has surged in the last three months and is now trading ABOVE the levels that preceded the Fukushima disaster at US$ 81 per pound.

And that’s where we have an interesting technical set up… Historical tops often mark future support or resistance.

Now, it might take some time for this to play out.

Prices MAY hover around the ‘Fukushima resistance’ levels for several weeks before we get a clear indication.

But in my mind, uranium sits at a critical juncture…

A sustained break above the top from 2011 and this would be very bullish, a sign of further strength and a continuation of the strong rally.

But any pull-back around these levels could result in a significant reversal.

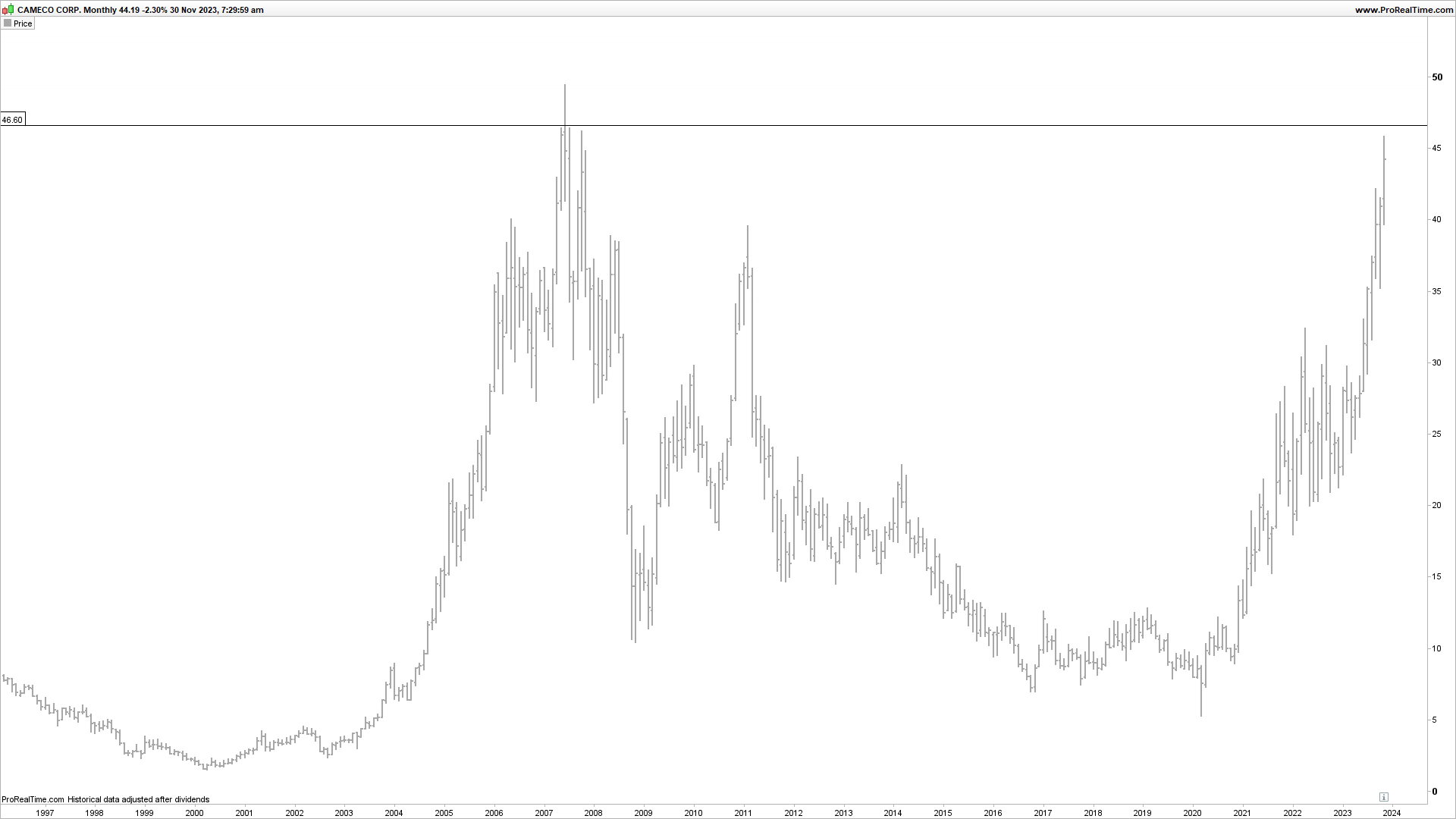

And it’s not just the underlying commodity approaching POTENTIAL resistance.

Miners tied to uranium extraction are also nearing historical tops.

Take Cameco [NYSE: CCJ] one of the world’s largest uranium producers… This Canadian based operator producers around 12% of global supply.

After undergoing a major surge in 2023, CCJ is now just a stone’s throw from its all-time top made in 2007.

Take a look for yourself below;

Again, historical tops often mark future resistance levels.

That’s why I believe investors should now heed caution in this heated market.

Now, I’m not saying the long term bull market is over, uranium could have several strong years ahead.

But given potential resistance is approaching, the probability of a reversal is rising.

If you’re not already riding the uranium surge, sitting back and watching how this technical set-up plays out could be your best course of action.

Let’s wait and see.

James Cooper is a geologist and mining analyst who runs the publication Diggers and Drillers. You can also follow James on Twitter @JCooperGeo

2 topics

4 stocks mentioned