Opportunities galore

Since this article on 9th April 2020 we have started to take a few profits - we have a new Livewire Wire explaining that called Taking the Top Off - CLICK HERE.

They say you should never let a good crisis go to waste - This Wire is designed to give you some good stock ideas that take advantage of the COVID-19 crisis - this was published for our Members on Thursday.

We are going to look back on this moment and rue the day we took Chicken Little advice from advisers paralysed into inactivity during one of the best long term buying opportunities in a decade.

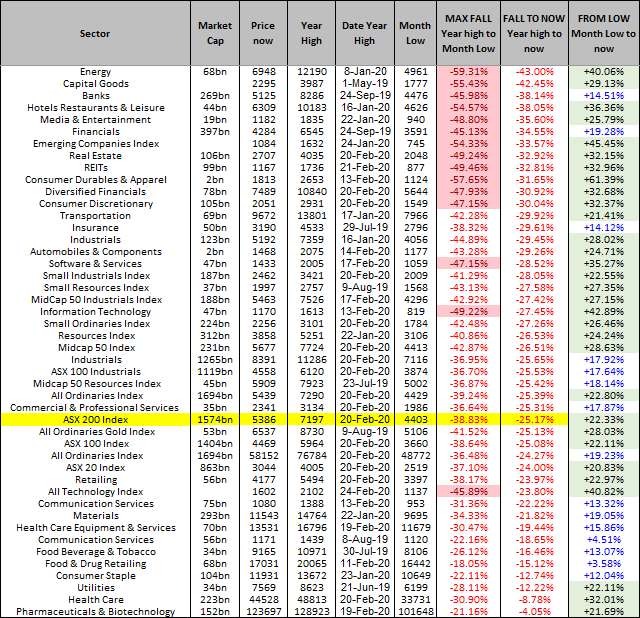

First of all lets look at the damage so far - a few tables here - bear with it.

Our market is down 26.7% from the top having been down 38.8%. It is 19.8% off the bottom. The US market is down 21.63% having been down 35.4%. It is 21.3% off the bottom. The worst sectors include the Energy sector still down 44.9% from the top, Banks down 38.1% from the top, REITs down 35.9% from the top.

All tables are as of Thursday morning:

Sectors – Worst first - Obvious observations the winners: Healthcare, Food, Utilities, Telecoms, Gold. Obvious losers: Energy, Hotels, Restaurants, Media, Real Estate, Banks, REITs, Infrastructure (Transport), Consumer Discretionary (Retailers), IT & Software (Growth stocks).

Top fifty damage - Listed in order of worst performer from the top to now:

Next 50 damage:

GETTING BACK TO NORMAL

These are the COVID-19 charts out of the Financial Times. This crisis is clearly NOT endless. The debate now is when it ends and the stock market conundrum is what economic and corporate damage it did. At this point, whilst there are still some Super Bears the stock market is happy to look on the brighter side and stock market sentiment shows every sign of getting back to normal on some timeframe. At ‘peak fear’ this crisis was endless. Now the end is visible.

Daily confirmed cases:

.png)

Daily confirmed deaths:

.png)

The Financial Times free corona tracker is HERE

The message from the charts is obvious, curves are flattening, particularly in the high profile European countries that led us into the crisis, most notably Italy France Spain and Germany where the number of new cases are now in decline following in China’s footsteps. Whilst the death tolls are still climbing in the US and UK, there are signs that they are going to hit 'peak virus' at any moment.

Meanwhile Australia doesn’t even rate a mention which explains why Morrison’s approval rating is the highest for any Prime Minister in a decade. And in a bit of good news, Boris has risen from the dead. It is Easter after all. The world needs colour.

It’s Easter weekend (our market is closed Friday and Monday, the US market is open on Monday but closed Friday) and whilst I’m not sure Trump has quite got his wish of people crowding churches in the United States at Easter, there’s no doubt we are heading back towards “normal”. When we get there is another question, but all the signs are pointing the right way at the moment.

They include:

- A significant technical bottoming in all major stock markets. See the charts below of our market, the US market and the Italian market. The Italian market was always a bit of a lead indicator for the other markets.

.png)

.png)

.png)

- Momentum - The market recovery has momentum, and whilst it is punctuated by sharp reversals intraday (robots running the asylum?), a technical uptrend is in place.

- Volatility has undoubtedly peaked. See the VIX volatility chart below. And it continues to head down. The stock market is undermined by volatility, it eats confidence. Confidence takes three times as long to build as it does to destroy. It will not build unless the volatility dissipates. It is.

.png)

- Bond yields are basing on improving economic expectations.

.png)

.png)

- The Aussie dollar bottoming – a barometer of economic sentiment which is obviously improving.

.png)

STRATEGY SUMMARY

Still happy to be fully invested - see our "All In" Livewire article from March 25 - But let’s make this clear, we are not wedded to that position. We are being careful not to join the herd, the new more positive herd. Just because we are fully invested and it suits our book does not mean you lose your mind, become a headless convert and lose objectivity. You have to remain Spock like, of no set view, and be prepared to reconsider any position as events unfold on a daily basis. For now, on the current information, we have no reason to doubt the “All in” position.

STOCK PICKING OPPORTUNITIES

With the asset allocation decision made, and the volatility dying down, we are now getting back to stock selection. It is quite odd, I find myself edging back into the pre-CV-19 routine, reading the press, reading research, looking at charts, worrying about individual stocks. Its child's play after the last month or two. I can't believe we used to worry so much.

On stock selection there are a few themes and opportunities and we present below some of our ideas on the opportunities if this recovery process continues.

Note that this article is not about long term portfolio picks, it is about the opportunities that CV-19 concerns have presented, opportunities that are available right now, that may be gone in the next few months.

OPPORTUNITY KNOCKS

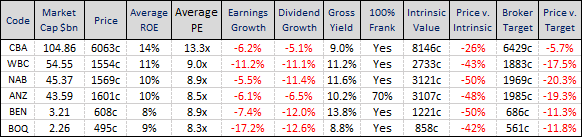

First up is the opportunity presented by the probably misplaced fear of a financial crisis.

The market has been running scared of a financial crisis, a credit crunch. APRA fed that fear this week with its ‘over prudential’ instruction to the banks to materially reduce dividends. We think, based on the CV-19 curve flattening, that the financial crisis fear is overdone and that this has provided multiple buying opportunities in the banks and companies with high levels of debt. This include REITs and infrastructure stocks. It also includes banks. And there are a few non REIT and non Infrastructure stocks that are being sold because of their high debt levels – BLD for instance.

Note: We have added columns to our ALL ORDS SPREADSHEET that monitor debt to equity, debt, cash, net debt and a debt to market cap ratio - over 1x is a worry. CLICK HERE for the MARCUS TODAY ALL ORDINARIES SPREADSHEET. This spreadsheet is available to Marcus Today Members and is updated weekly. We provide it to you free today as a window on the fabulous service our Members get and so that you think about becoming one!

.png)

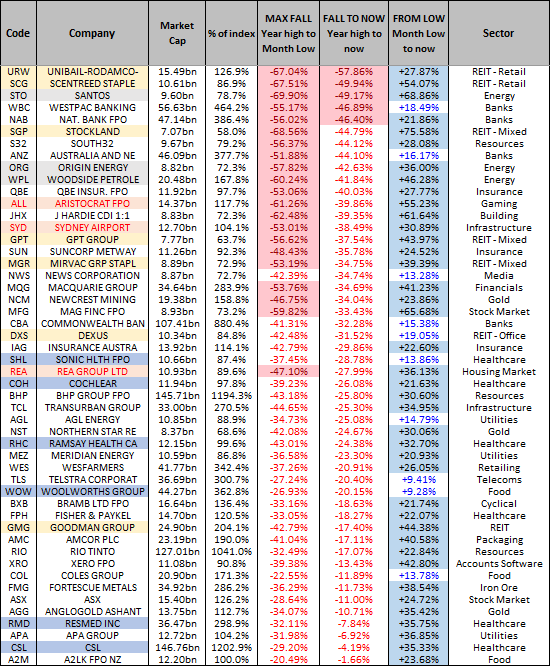

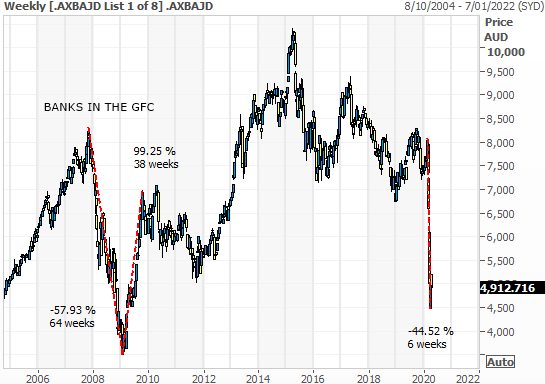

BANKS – Sector still down 38% - Fears overdone, fed by APRA. We should welcome today’s paranoia. In the GFC this sector fell 57% then bounced 100% in less than a year.

It is getting oversold again. We are checking the broker research this morning after the APRA letter yesterday – all brokers are re-assessing. The likelihood is that the next dividend for all the majors will be missed and they are now priced for that. Any better outcome than that and sentiment will improve.

Someone emailed this week asking where if anywhere they could put their money and earn a 10% yield in the long term. There is a saying in the stock market that anything that yields 10% - doesn't! Because if the price is down there it usually means the dividend forecasts are wrong. 10%! Laughable....but is it?

Just maybe, for once, if you can ignore the loss of the next dividend, there is just a chance that COVID-19 has thrown up that opportunity in this sector. It won't be obvious for a year, but this is the moment, surely. The average bank stock yield is now 10.7%.

Note that in all the tables a stock that is ‘cheap’ will have a negative number in the Price to Intrinsic Value column and the Price to Target column. Negative numbers mean the share price is below the intrinsic value or below the average broker target price.

Sector performance:

.png)

REITS - Sector still down 35.9% - Whilst we run a growth portfolio and are not naturally interested in REITs we do think there is a significant recovery trade to be had in the sector and are watching the charts for the sector bottoming. Beyond the recovery from financial crisis fears we are less enthusiastic, CV-19 has clearly created real issues for the property sector, Office and Retail in particular.

Look at the discounts to broker target prices at the moment.

.png)

Sector performance:

.png)

INFRASTRUCTURE - Sector still down 34.82% - The sector has also seen a sell off on debt concerns that may not materialise. Whilst SYD and AIA will be directly affected by the CV-19 shutdowns, at some point they will present a great recovery trade as things get back to normal. It is possibly a little early for that, there is danger in every announcement from these companies in the short term, but these are long term assets and we are doubtless going to look back on this dip in the share prices in years to some and say that was a great buying opportunity.

.png)

.png)

Of less risk are TCL and ALX. Whilst they have doubtless seen traffic numbers crater in the short term, these too are long term assets and are less directly affected than the airline infrastructure.

.png)

.png)

Here are the numbers on Infrastructure and Utility stocks - again look at the discounts to broker target prices.

(You can ignore the intrinsic value calculations on infrastructure stocks - they are based on earnings and earnings for infrastructure companies are manipulated by great swathes of depreciation and amortisation related to large assets. They are not 'reflective' of underlying earnings, which is why some short sighted value investors never buy these stocks. They don't 'look through' the headline earnings numbers - all they see is a company that is unprofitable and overvalued).

.png)

Sector performance:

.png)

ENERGY STOCKS - Sector still down 44.9% - There is an obvious opportunity in energy stocks. We have already bought them at the lows and are happy to continue to hold them on the expectations that OPEC+ will muddle through to end the price war. You don’t need to get too smart here, the big ones are fine. WPL, STO, ORG, OSH and we hold WOR which has always provided a fairly geared play on oil price moves.

.png)

Sector performance:

.png)

STOCK MARKET STOCKS - Stocks to play for the stock market rebound include stocks like MFG, MQG, PPT, PTM, ASX maybe. Be quick to sell if we have another down-leg but these are geared proxies to a stock market recovery.

.png)

Sector performance:

.png)

GROWTH STOCKS - When CV-19 popped up and the market fell over the first stocks to get nailed were the high PE and no PE (loss-making) growth stocks that had been given the benefit of the doubt in the bull market, but were dropped like a cockroach when the market turned. There are obviously some significant opportunities in the list but it’s the same game as in the bull market, share price performance is based on hope/faith/sentiment rather than earnings and value. Confidence, or over-confidence in some cases, is their main fuel and we’re not quite ready to go there again just yet. It’s a bit early for the far end of the sentimental bell curve to feature in any size in our portfolios. But that won’t stop a lot of you having a go, its too tempting, and with limited liquidity in many stocks, if institutions return, these will fly again.

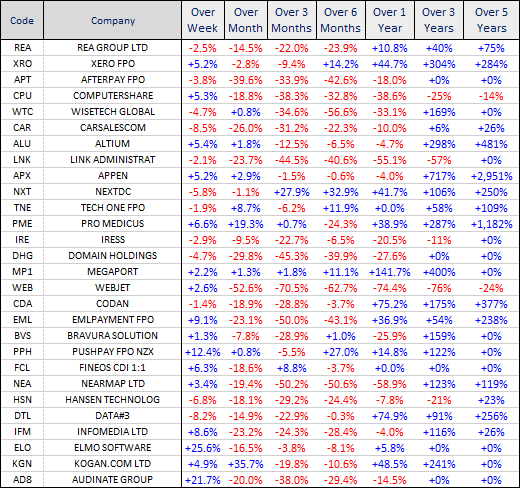

But beware of the significant 'announcement risk' in these stocks. The risk that they ‘blow up’ at the next announcement is high. Some are more likely to crater than others. On this list (which is the ALL TECH INDEX in market cap order) some of the safer businesses should be – XRO, NXT, KGN, PME, AD8. On the riskier side are businesses like REA, DHG, APT, CAR, WEB, IEL which have clearly been touched negatively by the shutdowns. Then there’s a list of others that we will have to assess on their own merits, companies that are well off their highs and were once given the benefit of the doubt and almost certinaly will be again – all the previous market darlings like WTC, ALU, APX, EML, NEA.

Stock performances:

RESOURCES – Sector down 26.8% - Not really a big sector to play for recovery. Will do OK on the economic sentiment improvement, you wouldn’t be underweight as a fund manager, but its not really the most geared recovery sector and the performance hasn't been terrible.

.png)

Sector performance:

.png)

HEALTHCARE – Sector down only 10.8% and 29% off the bottom - Healthcare has seen one of the biggest bounces from the bottom - The first sector we bought back into. Long and happy.

.png)

Sector performance:

.png)

OTHER SURVIVORS - Include stocks like WES, WOW, COL, TLS, A2M, APA, FMG, ASX, FPH, RIO, BXB, AMC, AGL, SPK, AST, TPM, DMP, JBH, MPL, CCL, CEN, CWY - whilst they have all outperformed I have not featured them because they are not going to outperform on the way back up. They might well be great portfolio stocks, great long term stocks, but this article is about exploiting the crisis, not surviving it.

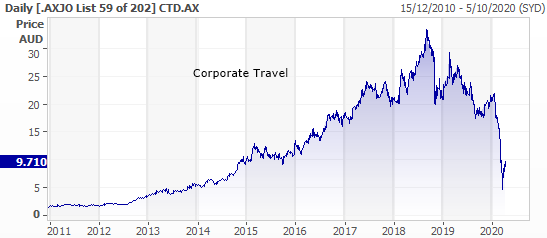

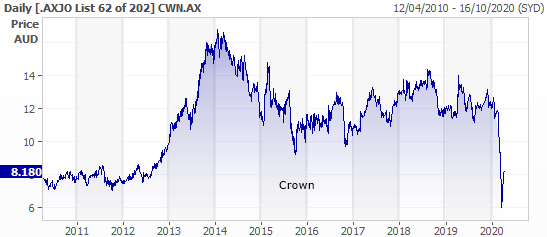

CV-19 DAMAGED STOCKS - Companies like AIA, SYD, QAN, REA, WEB, FLT, CTD, ALL, CWN, SKC, plus some retailers, restaurants, bars, casinos, travel, tourism, hotels, entertainment (you can probably name some more) have seen genuine damage to their businesses from the CV-19 episode. They have become high risk. Whilst they also offer potentially high rewards as well, we do not feel the need to be this aggressive. Every announcement could be a disaster. The full extent of the damage is as yet unknown. The profit and balance sheet uncertainties prevent us from stepping into the line of fire. We do hold some in small size but generally, we are not making a play on recovery in these stocks…yet. They are at the top of the risk/reward profile. We'll play lower down the risk curve for the moment but make no mistake, we have them all on the radar every morning.

If you would like to join other Marcus Today Members and investors click here for a free trial or here to subscribe - we have created a Promotional Code for Livewire readers for Easter only - use this when subscribing - LWXMT20

Footnote: Emma and I are now hoping for “Peak Nirvana” – can’t go back to work, but the golf course opens. Wouldn’t that be terrible. No golfers in Victoria are terribly happy with Dan Andrews (the Premier) – he is himself a golfer but whilst the other States are happily golfing, he’s banned it. Presumably because he would be seen as being self-interested. We don't care. Come on Dan. Its Easter….Lift!

4 topics