February Market Commentary: The Only Way is Up?

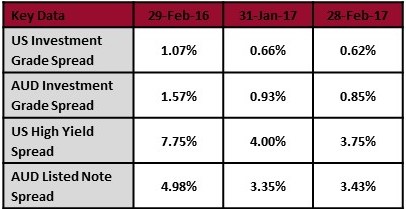

February brought more gains for risk assets and safe haven assets. Equities rose in all major jurisdictions including the US (3.7%), Europe (2.8%), China (1.9%), Australia (1.6%) and Japan (0.4%). Credit made gains across high yield, emerging markets and investment grade. Commodities were mixed with iron ore (9.6%), gold (3.1%) and US oil (2.2%) up whilst copper (-0.3%) and US natural gas (-11.8%) fell.

Market Sentiment

Economic data has generally been pretty good, giving markets extra impetus to push risk assets to all-time records and multi-year highs. The Eurozone PMI at 56 indicates that Europe might finally get some economic sunshine. The tone in the US is similarly upbeat with the deregulation and tax cutting agenda of the Trump administration widely seen as good news. Not all indicators are rosy, a handful of US data points have the economy at or near recession.

With US stock indices regularly hitting record highs there’s substantial debate about whether this rally is based on solid foundations. The most basic indicator, the trailing price/earnings ratio for the S&P 500 using the accountants view of earnings is at 24.8, well above 15-17 range which is generally seen as fair value. Taking the most optimist view, the forward price/earnings ratio using analyst forecasts of management’s numbers is at 17.7, slightly above fair value. This basic ratio analysis hides a lot of detail though, as mega caps are inflating the index with 40% of US listed companies loss making.

If you want reasons to say that stocks aren’t overpriced, the earnings yield over treasuries says that there’s more gains to come. There’s also views that a price/earnings ratio of 20 is reasonable in the current environment or that the Dow can hit 30,000 during Trump’s four year term. There’s also the treacherous argument that this time is different, at least for long term price/earnings ratios.

The evidence that investors are becoming euphoric seems much stronger. When celebrities are headline speakers at investment conferences and Warren Buffet is buying airline stocks it’s not looking good. Goldman Sachs sees stocks at peak optimism, the global complacency index is at record highs, investor optimism is at six year highs and the boom-bust barometer is flashing a warning. Bears have been slaughtered with some asking are there any bears left? With realised volatility at 21 year lows investors are giving up betting that volatility will spike in the near term. It’s hard not to respond by saying that we’ve seen this movie before and the ending isn’t pretty.

High yield debt is overpriced as well, SocGen has European high yield as expensive as it has ever been. Asian high yield deals are seeing an average oversubscription of 6.5 times. January was a huge month for US high yield issuance with 60% of that carrying the very junky CCC band ratings. 73% of leveraged loans are trading above par, giving borrowers the opportunity to beat lenders into accepting low margins and weak covenants. It’s fair to ask the question: stocks or high yield, which do you like least?

No discussion of sentiment would be complete without mentioning the impact of quantitative easing (QE) on asset prices. With Japan and Europe printing money and hoovering up assets, there’s been an enormous amount of unnatural demand. Most of the central bank buying has been of low risk assets, but that only serves to cascade demand into neighbouring asset classes. For instance, government bond buyers become corporate bond buyers, which then spills over into high yield, followed by equities and property. If this build-up of central bank balance sheets has driven markets higher, it seems logical to assume that the party stops when QE stops. Can central banks ever unwind this false demand without creating a downward spiral for asset prices?

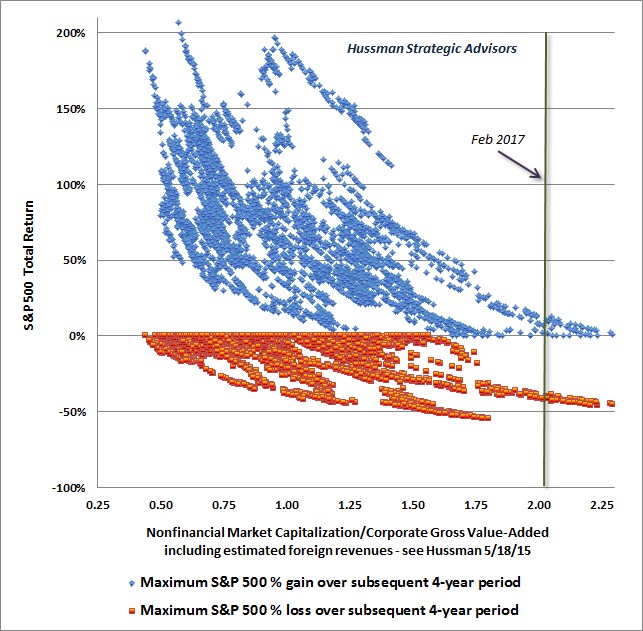

Two charts help sum up what the impact of higher than average prices mean for future portfolio performance. Firstly, Hussman Funds shows the historical upside and downside over a four-year period using the market capitalisation divided by gross value added. Whilst the measure used is a variation from a straight price/earnings ratio this chart is helpful in illustrating the skew in the potential upside and downside over the medium term.

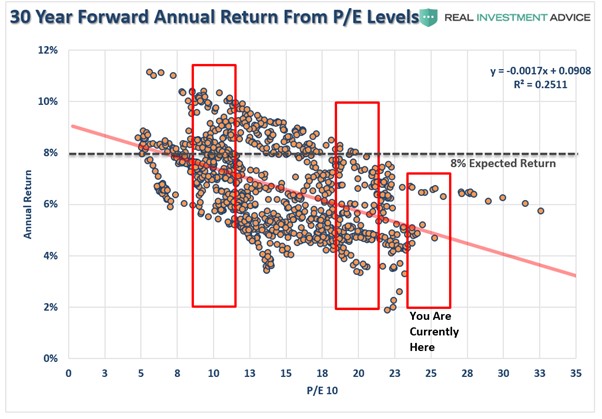

The chart below from Real Investment Advice does use the price/earnings ratio but looks out over a thirty-year period. This is particularly helpful for people under 60 considering what returns might be over their lifetime and for pension funds planning to a 25-40 year outlook. The “you are currently here box” indicates returns of 2-7% on US equities should be expected, way below what most pension funds and individuals expect.

Banking

Whilst the possibility of a trade war has received plenty of airtime, the possibility of a bank war is barely mentioned but fast becoming a possibility. Following the failure of Basel 4 negotiations, the US and Europe are starting to take sides and make threats. The Europeans are threatening to lock US banks out of Europe if Americans roll bank regulation. It wouldn’t be much of a step for the US to respond by locking out European banks that have lower levels of capital than their US peers. Each would argue that the other’s banks are unnecessarily risky. The evidence clearly points to European banks being in far worse shape.

The Italian Government has approved a €20 billion bailout fund for its banks. Monte Dei Paschi is the first to ask for taxpayer money but there’s a cue forming for others that need help. Italian banks are writing down their “investments” in the Atlas bailout funds. These funds were a mechanism for transferring capital from strong banks to their weaker peers, punishing the more prudently run banks and increasing the odds that the relatively better run banks will also require bailouts. There’s been suggestions that a pan-European bailout fund should be created, but as usual there’s no proposal on who will donate the money needed to recapitalise weak banks.

Deutsche Bank continues to struggle along, most employees received no bonus with the bonus pool down 80%. Management has said that this will be a one-off, but with no clear plan to meaningfully lift Deutsche’s capital levels more of the same is likely. No surprise it is struggling to retain and motivate staff with another round of staff cuts looming. The prospect of a small profit in 2017 provides some hope but who knows how much more in regulatory penalties are lurking. There’s also the risk that losses on loans could eat away potential profits, particularly on shipping loans where German banks have $100 billion of exposure.

US bank shares have enjoyed an enormous run up since Trump was elected with an agenda that includes bank deregulation. What’s been forgotten in all of this is that the agenda also includes banks raising capital levels. The current proposal includes a “regulatory off-ramp” for banks with high levels of capital. The Minneapolis Fed President thinks 20% capital is the right level, way beyond current levels. Banks might make greater profits if deregulated, but if they have to hold more capital the return on equity could be the same or lower. It seems that the market is assuming the positive and ignoring the negative.

In a development that looks an awful lot like pre-crisis stupidity, banks have been lending to hedge funds to help them juice returns on synthetic CDOs. The synthetic CDOs are supposed to reduce the credit risk of banks by transferring the risk to another party. Hedge funds are willing buyers of the assets, but the unlevered return doesn’t meet their targets. Banks are allowing them to borrow some of the purchase price, effectively negating the risk transfer benefits.

Oil, Gas & Commodities

The agreed cuts by OPEC have been implemented with a decent level of compliance, but that’s no guarantee that oil prices are on the way up. US producers are filling the gap once again and have largely taken away the role of swing producer from OPEC and Saudi Arabia. Saudi Arabia is continuing down the pathway of listing its oil business but their view of the valuation is hugely optimistic. Many potential investors will be scared off by replacement energy sources and sovereign risk factors like tax changes and nationalisation.

Hedge funds are either very positive on oil or running out of ideas as they are betting heavily on an oil price rise. ABN thinks that without OPEC cuts being extended the oil price will collapse. The recent jump in US gasoline and oil inventories, accompanied by a fall-off in demand seems odd in a context of prices rising. The fundamentals for US natural gas are also weak; warmer weather is reducing winter demand and the recent rains in California have allowed hydroelectric producers to start up again.

Those hoping for a renaissance in nuclear energy will be troubled by the unfolding disaster at Toshiba. In theory, nuclear energy should be a good base load replacement for coal in a world where there is a gradual transition toward low emission generation. The reality is that nuclear power plants are enormously expensive to build with Toshiba in financial distress from $6 billion of cost overruns on US nuclear plants. Toshiba is exploring a sale of its semi-conductor business to raise cash. There’s rumblings that Toshiba could send its US subsidiary off to bankruptcy, but as there’s cross guarantees that could take the whole group into bankruptcy. If Toshiba was to default, it would be an enormous event in Japan as Toshiba’s outstanding debt is equal to the total of all bankruptcy filings in 2015 and 2016 combined.

On a much more positive note, Glencore is rapidly knocking down its debt levels through assets sales, reduced capex and free cashflow generated by higher commodity prices. Fortescue is in a similar position, with the very strong iron ore price allowing for a big jump in the dividend as well as continuing to prepay debt. Both of these companies were on the edge of the financial cliff at one stage as they had elevated levels of financial and operational leverage when commodity prices dropped. Well managed companies contain their exposure of one or both of these forms of leverage, speculative companies maximise their use of both. These two look to have caught some luck and learnt a lesson.

Consumer Debt

Around the world there are signs popping up that consumer credit is getting excessive. In the US declining gasoline demand, lower restaurant patronage and increases in arrears on residential mortgages, timeshare loans and auto loans are small negative signals. The fact that half of student loans have defaulted or received no payment at all in the last seven years shows just how tough younger college graduates are doing with many not earning enough to hit the minimum income threshold for repayments. Some won’t be feeling sorry for those graduates though as student loans are mostly being used for lifestyle expenses.

The often forgotten concept that debt is mechanism to pull consumption forward underlies the concerns with US consumer debt being back near record high levels. If consumers have borrowed heavily now, their future will include less spending and more debt repayments. For developed economies where consumer spending tends to be more than half of GDP, that means a big chunk of GDP growth has effectively been pulled forward.

In Australia consumer debt is the big debt issue with signs that consumers are maxed out on debt. Record calls to the national debt counselling hotline in a time of steady employment are worrying. One moronic member of parliament suggested that residents should be able to borrow 100% of the house price if they have a good rental history. There was a little event called the financial crisis that showed how that turns out.

Monetary and Fiscal Policy

For those who are interested in understanding why there is a growing group of critics of central bank policy you might want to grab a copy of “Fed Up” by Danielle DiMartino Booth. As an advisor to the Dallas Fed President she got to see how monetary policy is shaped and her conclusions confirm what many have been saying. Her view is that the Federal Reserve loves PhDs and unrealistic models but has no time for evidence based policy and self-reflection. If you are short on time here’s a great interview with her explaining the issues.

In further evidence that central banks are out of touch, the Bank of England blamed its dramatically wrong call on the economic impact of the Brexit vote on the irrational behaviour of consumers. There’s no chance they would blame the irrational logic of their economists. Japan’s central bank is saying it will buy unlimited 5-10 year govt bonds to push rates down but there’s early signs of mutiny by financial markets against its policies. Pimco acknowledged the obvious but unspoken truth that central banks are engaging in currency war. Inflation is becoming a live issue for central banks and governments, notably in the US and China. The tailwind of cheap Chinese exports is gone, now Chinese factories are exporting inflation with their manufactured goods.

The German central bank thinks residential property is overvalued by 15-30% but fails to mentioned that low interest rates and a surge in population from migration will do that. German two year bonds trading at -0.95% as inflation increases shows just how mad monetary policy has become. The flipside is that other European governments are seeing their long term rates rise. The Netherlands will hold a parliamentary inquiry into use of the Euro as its currency, prompted by concerns about low interest rates robbing savers. The threat of one or more countries leaving the Euro and redenominating their debt is starting to be taken seriously. One ECB board member broke ranks and said there shouldn’t be any more interest rate cuts.

Emerging Markets

There’s another round of the three-way fight between the Greeks, the Europeans and the IMF. The IMF is giving mixed signals, saying it wants to kick the can past the upcoming German elections but also that Greece needs to undertake more structural reforms before the bailout will proceed. Greece has €1.5 billion of privately owned bonds maturing in July and if those are repaid it would be the ECB and the IMF paying out hedge funds. The essential structural reforms include attacking the black economy. Tax cheating is so rampant that the few businesses who pay their taxes in full are unable to compete with those who don’t. Greece still has capital controls in place at its banks, but it looks like another bank run has started. None are these problems are apparently the fault of politicians though, the chief statistician and two colleagues are on trial for getting the numbers right.

Venezuela is spiralling toward anarchy with 75% of the population losing an average of 19 pounds in 2016. 93% of people don’t earn enough to pay for their food needs and the country has the highest murder rate in the world. It’s also $750 million behind on repayments of its oil backed loans and has to make calls about whether oil is shipped to its lenders or sold to provide revenue for the government.

Turkey’s biggest syndicated loan has just had a missed payment. Kyrgyzstan is helping its citizens buy and store gold as alternative to other currencies and cattle. Egypt’s CPI is at 28% after the currency collapsed but foreigners still stampeded to buy 6 and 12 month debt. Zimbabwe is having yet another cash crisis as citizens and businesses can’t withdraw cash or make transfers.

The city of Rio is getting a government bailout from Brazil, but the forecasts underpinning that are very shaky. For those who think building infrastructure is the solution to every economic issue Rio is a lesson that building no infrastructure is better than building useless infrastructure. The 2015 utility debt restructure in Puerto Rico may have be restructured again and citizens who bought government debt there are pushing for special treatment in debt renegotiations.

Somalia might get some debt forgiveness, Ghana’s IMF bailout might have to be amended after $1.6 billion in expenses were “discovered” and there are fears that other African nations might default following Zimbabwe’s default.

Funds Management

As hedge funds continue to underperform index funds the focus is on their excessive fees. One possible explanation for the underperformance is that hedge funds are competing over a $30 billion pool of alpha, which doesn’t spread very far in a $3 trillion industry. Hedge fund managers at Baupost and Gotham both criticised their industry. Gotham and sixteen other hedge funds are moving to charge fees which are the greater of 1% management or 30% of outperformance, which should see investors paying less in almost all cases. Warren Buffet also criticised fund managers, but took the logical next step in criticizing asset consultants for recommending bad managers. Someone has to wear the blame for investing in and recommending dud managers.

A review of Calpers private equity exposure found that it is paying enormous fees but getting below benchmark returns. Calpers would be far from alone in that regard, yet private equity managers are still having great success in raising capital. Another rapidly growing sector is smart beta, but the growth increases the likelihood that alpha has been competed away and investors are just left with crash risk. A UK pension fund has bought $3.1 billion of middle market corporate loans from Credit Suisse and a Canadian pension fund has bought a UK private debt manager.

The Dallas Pension Fiasco is working towards a solution that will involve higher contributions from taxpayers, a higher retirement age and no cost of living adjustments. It looks like a band-aid solution that will probably last until the next downturn in markets blows out the underfunding gap again. Dallas isn’t the only Texas city with a badly underfunded pension; half of Texas pension funds are expecting to take at least 25 years to reach a balanced position.

A review of municipal bankruptcies found that if pensions aren’t cut, there’s a high likelihood that another bankruptcy will occur. In Ontario the government and the pension schemes are fighting over whether the government can use pension surpluses from good years to balance government budgets. In Illinois they’ve sacked most managers and have switched to index funds.

China

January was another record month for debt growth in China as shadow banking debt surged. The Chinese government is drafting rules to make clear that asset management products are not guaranteed. This can’t come soon enough as 90% of peer to peer lenders could close in 2017 due to poor governance and weak lending standards. After strong gains last year, it looks as though the residential property market is rolling over. The much vaunted Chinese foreign currency reserves have officially fallen below US$3 trillion.

Local government borrowing is increasingly being denominated in US dollars to attract more investors. Despite attempts to attract foreign investors they are staying away concerned about currency and rule of law risks. Chinese investors are chasing yield in Indian and Indonesian debt. Goldman Sachs obviously supports diversity of thought, one of its research teams sees plenty to be worried about in China and another thinks that property developers are a bargain buy. The growth in debt levels combined with an aging population indicates that high levels of GDP growth cannot continue in the long term.

Venture Capital

Fintech firms have made a lot of noise about disrupting banks but so far there’s been little impact on banks. The combination of regulation, cheap deposits and scale means banks often have a solid moat and fintech firms are increasingly choosing to sell-out or partner with banks.

After Tesla pulled some tricks to get a positive cashflow in the third quarter, it recorded a $1 billion cash burn in the fourth quarter. This cash burn means it will need to raise fresh equity soon, with a range of $1.5-$3.0 billion put forward. Whilst Tesla has great marketing and a powerful combination of solar, batteries and car technology the substantial cash burn raises the possibility that it might have very different ownership by the time it can maximise the potential profit from its offering. If there’s a share market crunch venture capital valuations could come crashing back to earth and Tesla might find itself in a very tricky funding position.

The Bloomberg start-up barometer is 20% down from a year ago and the IPO of Snap will be a test of whether pie in the sky valuations still apply. Bitcoin is back to record highs with Chinese buyers seeking to get around exchange controls suspected of pushing up demand. Lenders are starting to provide debt funding to energy storage projects in a sign that the technology is becoming bankable. In a personal anecdote on the Uber versus taxis battle, I caught one in each direction on a recent Melbourne trip. The Uber cost $32.24 and the taxi $43.90. With such a substantial difference in cost it’s no wonder the taxi industry is in trouble.

Media Worth Consuming

There’s no doubt that Trump is dividing opinions on a whole range of issues with 1,000 tweets a day calling for his assassination. The mainstream media loves to attack his style and substance but his wide ranging 77-minute press conference was the most interesting and forthright engagement from a President in a long time. Whilst Obama and Clinton dodged taking media questions Trump is happy to battle it out. Trump must be good for ratings as the media is covering him more than ever.

The selective press briefing for favoured journalists was a very bad look, but Obama was a hypocrite when it came to media treatment so the mainstream media looks biased for only attacking Trump. A host on MSNBC stated that it’s the job of the media to control what people think, highlighting the offense some in the media take when Trump bypasses them. With news show hosts making comments like that, it is no wonder some think Trump is giving the media the slap down they deserve.

The issue of immigration highlights the ultra-partisan positions that many are advancing. Trump’s executive order was rightly condemned for going too far when it included banning some green card holders from returning to the US. Yet the ban wasn’t based on a bias against Muslims, it was based on Obama’s list of countries with a history of citizens coming to the US and planning terrorist activities. The left leaning Huffington Post banned a contributor and deleted a story that detailed the problems Sweden has had after accepting very high levels of refugees. A Stanford study found fake news had virtually no impact on the US presidential election.

Swedish citizens are paying their taxes early as the interest rate paid by the tax office is higher than the banks. A Swiss referendum knocked back higher company taxes. Trade unions in Finland are opposing universal basic income, worried that citizens won’t be willing to undertake dirty jobs. Canada is worried about an immigration crack-down as the country depends on migrants to do dirty jobs Canadians won’t. A Florida initiative found that 85% of people stopped claiming foods stamps when required to work, train or volunteer at least 20 hours per week. Maine dropped over 75% of food stamp recipients for the same reason. Perhaps the lack of work ethic is because the cost to the individual of a perpetual adolescence is pretty low. A Philadelphia sugar tax lead to a 30-50% drop in sales of sugary drinks.

The tech industry is finding that blue collar workers can make good coders. If rust belt jobs aren’t coming back then residents should be encouraged to move elsewhere for work. Perhaps they could move to California where government employees get paid more, have better work conditions and better pensions than the private sector. The “revenues” of ISIS are collapsing and its “employees” are calling in sick.

Are dolphins using poisonous blowfish to get high? The CIA gives a medal to a Saudi prince for efforts against terrorism and promoting peace. US banks hate the public complaints database but consumers love it as their problems get resolved. Russians have figured how to win on slot machines. The Australian central bank governor notes the benefits of being a woman who has studied economics when many organisations are seeking to meet gender quotas. Two financial legends in one interview, Howard Marks answering questions from Barry Ritholtz.

6 topics