Fed warns of a 'mild recession' this year, US inflation cools, Morgan Stanley's new lithium playbook

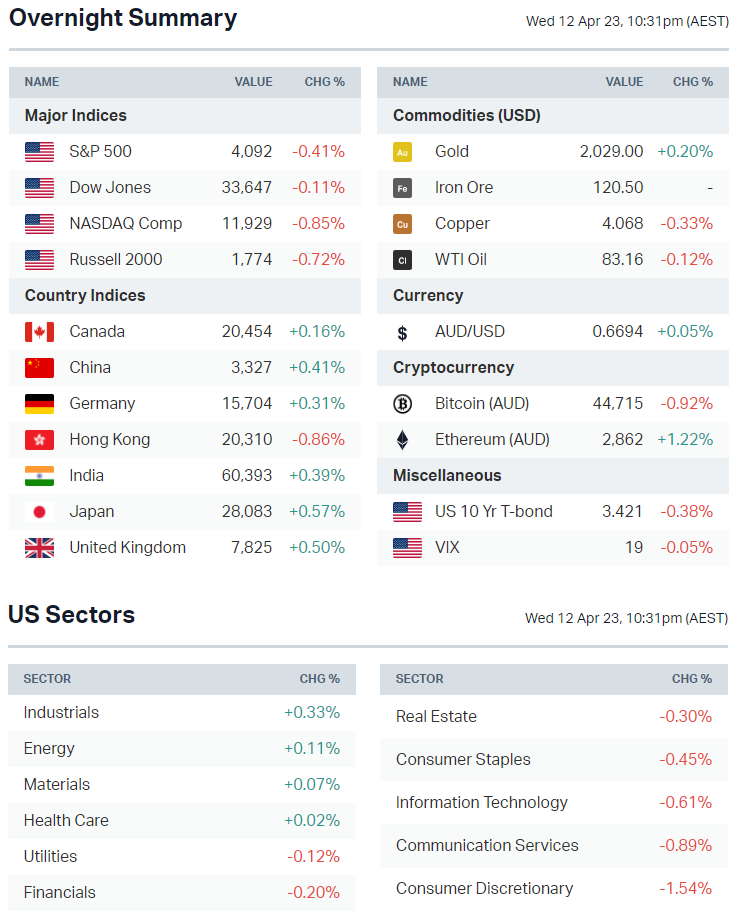

ASX 200 futures are trading 3 points lower, down 0.04% as of 8:30 am AEST.

Despite US headline inflation now being at its lowest level in nearly two years - equity markets didn’t respond all that kindly. At the Federal Reserve, a mild recession was the theme de jour as financial markets continue to price in rate cuts. But we’ve got a chart from Deutsche Bank that argues the markets are rarely right about the Fed. Plus, we’ve got two underweight calls in the lithium space from Morgan Stanley that have got the markets humming.

Let's go.

S&P 500 SESSION CHART

MARKETS

- S&P 500 closes at lows from session highs of 0.6%

- S&P 500 was trading about 0.4% higher but FOMC minutes triggered a sharp selloff

- Gold and bond yields also faded early gains

- Oil prices rally ~2% to levels not seen since November 2022

- S&P 500 witnessing its biggest pre-earnings rally since early 2009 (Bloomberg)

- China bonds rally on hopes PBoC will ease policy to aid growth (Bloomberg)

STOCKS

- Bets against airlines highest since March 2020 (Bloomberg)

- American Airlines signals profit hit from rising labour and fuel costs (Reuters)

- GM announces investment in lithium mining to secure long-term supplies (Reuters)

- LVMH results beat with big tailwind from China (Bloomberg)

US EARNINGS PREVIEW

- Tonight: Delta, Fastenal

- Tomorrow: JP Morgan, Citi, Wells Fargo, United Healthcare

- Note: First Republic Bank was meant to report tonight but that report has been moved to April 24th.

ECONOMY

- Fed expects banking crisis to cause a recession this year (CNBC)

- Fed officials considered rate pause in March (Reuters)

- US consumer prices rise moderately; underlying inflation too hot (Reuters)

- Bank of Canada holds rates firm, option to raise later if needed (Bloomberg)

-

Yellen says US economy performing 'exceptionally well' (Fox)

Deeper Dive

US inflation: Easing headline, sticky core

- Headline: +0.1% m/m (+0.2% est.), +5% y/y (+5.1% est.)

- Core: +0.4% (+0.4% est.), +5.6% (+5.6% est.)

A fall in shelter and gasoline prices allowed inflation to come down at both the headline and core levels in the US last month. But with core inflation still running at 5.6% year-on-year, there is no reason for the Fed to pause.

Within core prices, strength was again led by a solid housing segment. Rents in the US are up another 0.5% nationally month-on-month. But most economists believe that housing prices will continue to rise because there is a lag between asking rents and what flows through to the inflation spreadsheet at the Bureau of Labor Statistics.

The other point of interest is transportation. Used cars make up a large portion of the inflation composition stateside and it fell by nearly 1% month-on-month. But new cars, airline fares, and public transportation costs are all rising in leaps and bounds.

All attention now turns to US bank earnings which start tomorrow. How much has the wider banking crisis as well as higher rates crimped margins? Which banks will benefit from the deposit flight trend?

Fed minutes: A mild recession is coming

Financial markets knew this set of Minutes was going to be interesting. Following the shut down of three regional banks stateside, more than a few pundits wondered if this was the Fed’s “hike until something breaks” moment. In fact, some of the Fed’s own economists are now concerned about a mild recession starting later this year.

Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.

With this in mind, at least one Federal Reserve board member was arguing for a pause:

Several participants noted that, in their policy deliberations, they considered whether it would be appropriate to hold the target range steady at this meeting.

But if it weren’t for a banking crisis, others on the board would have wanted to see a 50 basis points hike:

Some participants noted that given persistently high inflation and the strength of the recent economic data, they would have considered a 50 basis point increase in the target range to have been appropriate at this meeting in the absence of the recent developments in the banking sector.

What most of them did agree on was that developments in the banking sector have caused them to lower their range of what would be considered sufficiently restrictive. There were still no hints about a pivot, let alone rate cuts. But it seems that some participants may have been listening to Reserve Bank Governor Phil Lowe in their deliberations:

Several participants emphasised the need to retain flexibility and optionality in determining the appropriate stance of monetary policy given the highly uncertain economic outlook.

If you recall the RBA’s decision a couple of weeks ago, they decided to pause because they wanted to buy some time and optionality in seeing how nearly a year’s worth of rate hikes are affecting our economy. It sounds like at least a few members of the Fed are angling for the same.

Charts of interest

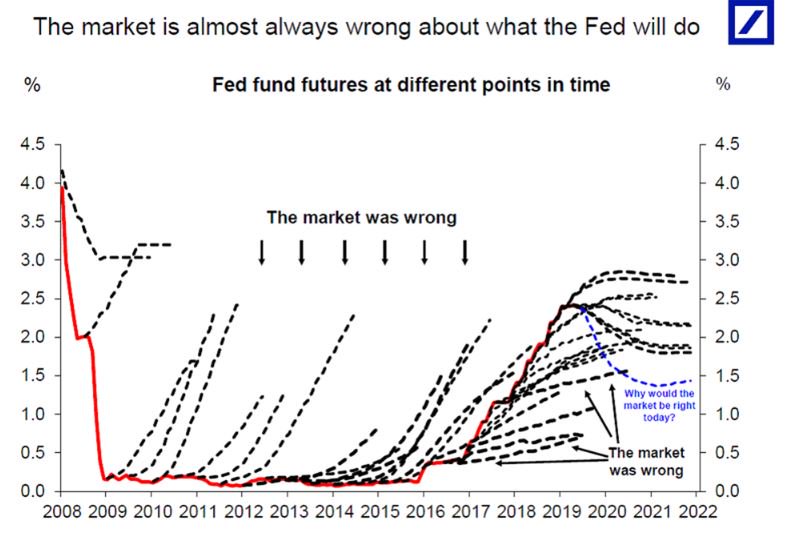

We talk about how the markets always seem to be one step ahead of central banks. That was certainly the case when ASX rates pricing had the first rate hike some weeks ahead of when the RBA actually first hiked in May last year. But being one step ahead doesn’t necessarily mean you are right. And to quote the old central bank adage, it’s not about what you think they will do but rather what they should do.

As this chart from Deutsche Bank shows, the market’s attempts to guess what they will do does not always land well. Deutsche Bank’s analysts believe that rate cuts are being priced in too soon although central banks will likely nail a soft landing.

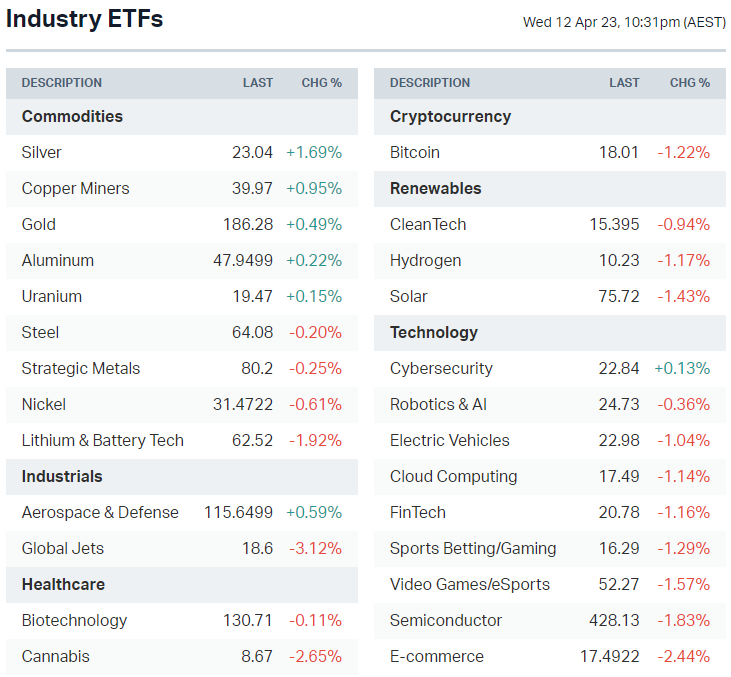

Broker watch: Lithium

Broker moves don’t always move individual stocks but Morgan Stanley’s fresh moves in the ASX lithium space certainly did. MS joined Goldman Sachs on the lithium bear trade, arguing that the short term picture does not look all that rosy.

“We remain cautious on near-term Li demand and battery inventory destocking putting downward pressure on lithium prices. As such we favour fully integrated producers, with a focus on volume growth and valuation to define our order of preference.”

They argue that the biggest driver of earnings growth going forward will actually be volume, given prices and earnings have peaked for this cycle.

Its new order of preference is:

- Allkem (ASX: AKE) - Price target of $13.75/share, OVERWEIGHT

- Mineral Resources (ASX: MIN) - Price target of $81.90/share, EQUAL WEIGHT

- IGO (ASX: IGO) - Price target of $10.55/share, UNDERWEIGHT

- Pilbara Minerals (ASX: PLS) - Price target of $3.15/share, UNDERWEIGHT

Pilbara shares fell 4% yesterday, proving it does pay to read the sell-side research at least once in a while.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Duxton Water (D2O), Horizon Oil (HZN), Best & Less (BST), SDI Ltd (SDI)

- Dividends paid: Brisbane Broncos (BBL), Pacific Current (PAC), Qube Holdings (QUB), Solvar (SVR), Brambles (BXB), Woolworths (WOW), Emeco (EHL), IVE Group (IGL), TPG Telecom (TPG), Peet (PPC)

- IPOs: None

Economic calendar (AEST):

- 11:30 am: Australian jobs data

- 4:00 pm: UK GDP

- 10:30 pm: US PPI and Jobless Claims

This Morning Wrap was first published for Market Index by Hans Lee.

1 contributor mentioned