Flight Centre riding the winds of recovery in a sector with proven resilience

Discretionary spending may be down but travel is up, as Flight Centre's (ASX: FLT) first half results demonstrate.

According to Flight Centre CEO Graham Turner, the global slowdown in growth is yet to hit the sector. So while travel is a discretionary purchase, it tends to be prioritised above other discretionary items.

“While we continue to monitor market conditions, we are not currently seeing evidence that the recovery is slowing with the leisure business currently trading at post-COVID highs and corporate travel activity escalating after the traditional holiday period," says Turner.

“This underlines both the significant pent-up demand that still exists for travel in this early recovery phase and the sector’s proven resilience."

In this wire, Michael Jenneke, Portfolio Manager for Australian Equities at Credit-Suisse Wealth Management gives us his read on Flight Centre's first half results - which carry no surprises, and he says that's a good thing.

Note: The interview took place Wednesday 22 February, 2023.

Flight Centre (ASX: FLT) 1H Key Results

- Revenue up 217% to $1 billion

- Underlying EBITDA of $95m - within guidance

- Total transaction value (TTV) of $9.9 billion, up 203%

- Reaffirms FY guidance of EBITDA between $250-280 million

- Cash burn of $92 million, compared to $224 million outflow this time last year

- Cash on balance sheet of $770 million, vs $866 million in June 2022

- No dividend declared

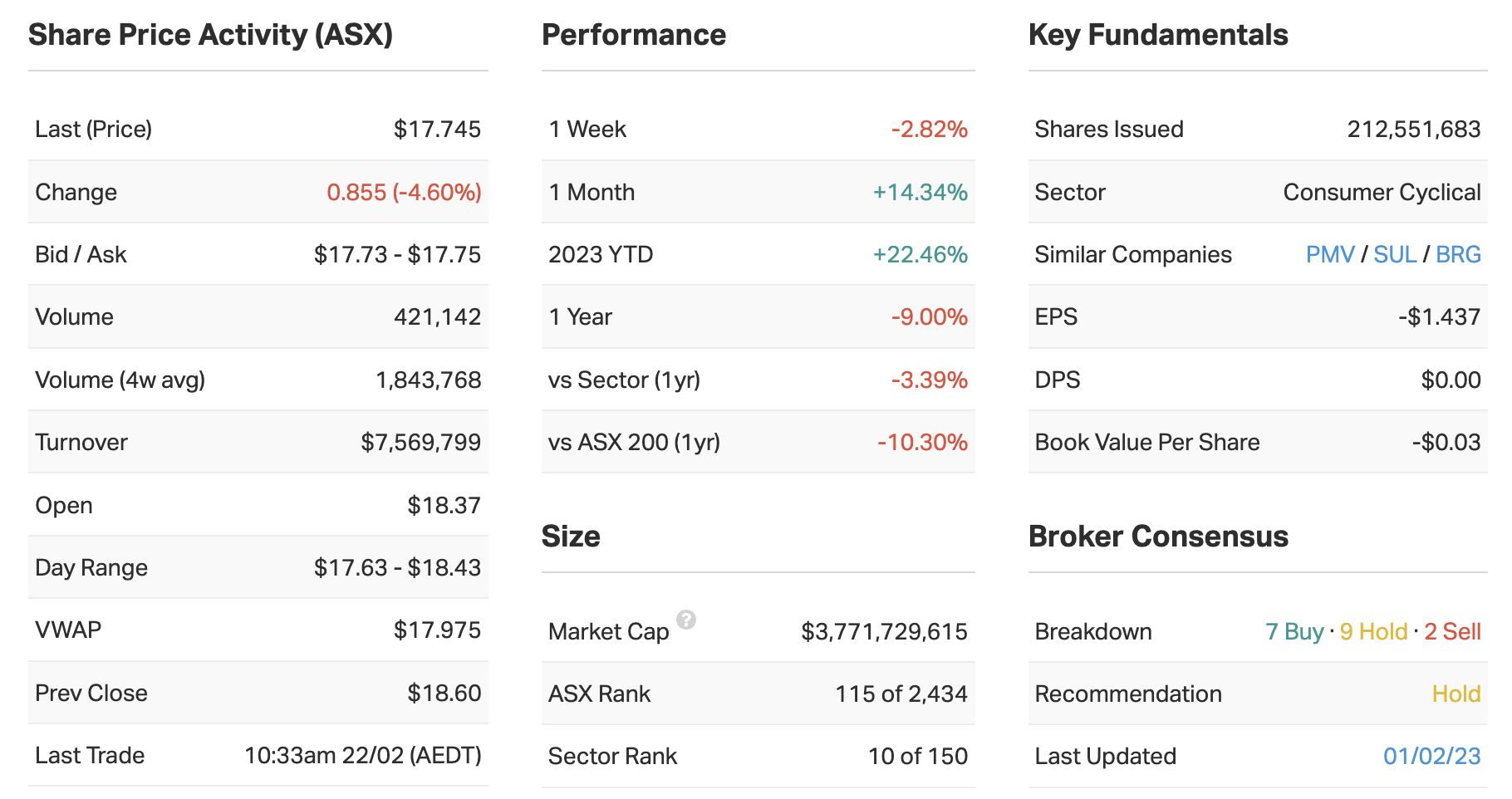

Key company data for FLT

MarketMeter

FLT was ranked eighth by Market Meter among ASX 100 companies for CEO effectiveness. For more information on MarketMeter, please click here.

What was the key takeaway from this result?

The result confirms the company's restructured business model is well positioned to benefit from the normalisation of global travel demand.

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

The stock price has performed strongly year to date, it's up about 25%. Management gave pre-guidance in January and there was a lack of new news today. So a degree of profit-taking seems appropriate under the circumstances.

It seems to be more a macro-driven sell-off in the absence of news. Consumer demand stocks have all been soft today given some of the interest-rate news.

Were there any major surprises in this result that you think investors should beware of?

The company is tracking an operational recovery that is in-line with market expectations, so there are no surprises on that front.

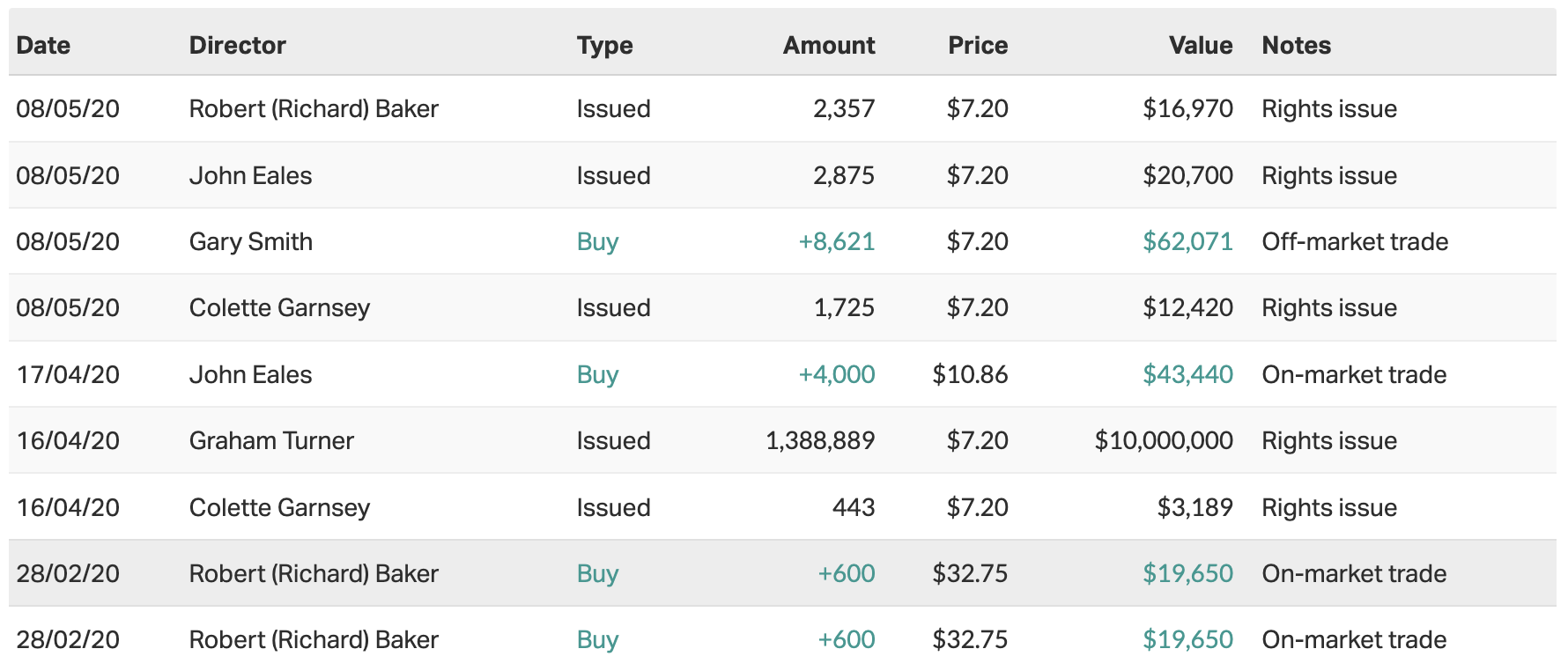

I would flag, though, that management have flagged a capital review that warrants attention. The group potentially has a significant convertible note refinancing ahead of it, and the company's strategy has always been to run a conservative balance sheet with optionality to grow through incremental acquisitions.

We'd like to see the company stabilise its financial positions further as it moves into a post-recovery phase. Management did flag that review is underway and we'd like to see the outcomes, we think it's important.

Would you buy, hold or sell FLT on the back of these results?

Rating: HOLD

The share price has rallied strongly this year, and it is incorporating a significant amount of better news. There are potential risks around travel demand and uncertainties on the balance sheet, so we think the stock will need to do some work around here as some of those uncertainties unfold over the next few months, but we're optimistic over the longer-term.

What’s your outlook on FLT and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

We're positive on the prospects for the travel sector over the next year. Travel demand should maintain a healthy recovery trajectory despite slower economic growth because pent up demand remains high.

On the risk side, a significant economic downturn or recession could pose recovery risks in both corporate and leisure travel demand. How this translates at the FLT level is that the company is still recovering, so if there were setbacks to the demand recovery, that would raise its risk profile.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious on the market in general?

Rating: 4

If I was to put a rating on it, I'd give it a 4. We regard the Australian market as reasonably priced overall, but that's largely due to its weighting to cheaper resources and finance sectors. Elsewhere we generally see a significant number of expensive valuations as pricing is only adjusting slowly to the higher cost of capital. Given that view, we're cautious on the market but we prefer Australian equities to international equities.

Most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

2 topics

1 stock mentioned