Forget economic recession, it's the 20-40% collapse in earnings investors should be worried about

Ok, I get it. That is not the most positive headline. And although I am a glass-half-full gal, Chad Padowitz, the co-chief investment officer at Talaria Asset Management, believes that this is very much investors' reality as we sidle up to the all-important August earnings season.

But who is Padowitz? And why should you take notice? Glad you asked.

Talaria is one of the very few global investment managers that have managed to deliver stellar returns over the past 12 months, in what otherwise is a sea of red.

In fact, from what I can see from the ASX's fund data, only five managers were able to deliver returns of more than 10% (the Janus Henderson Global Natural Resources Fund, Ausbil's Global Resources Fund and Long Short Focus Fund, the Epoch Global Equity Shareholder Yield Unhedged Fund, and Talaria's Global Equity Fund, which returned 10.39% over the 12 months to the end of May).

In this wire, I'll take you through some of the main takeaways from Talaria's latest media update, including why corporate earnings are the next major risk that should be on investors' radars, the sectors and stocks that the Fund is exploiting to outperform in this tumultuous environment, as well as the companies Padowitz and his team have been buying amid the global market sell-off.

.jpg)

Unfortunately, this time is different

Look, if we know anything right now, it's that inflation is running hot and interest rates are going up. However, as Padowitz explained, historically, when economies are slowing down, investors could cling to the prospect of interest rates heading south too.

"But because of a confluence of events - COVID-19, record levels of fiscal stimulus, and monetary expansion with zero or negative interest rates in some cases, as well as supply chain issues - inflation went from what was thought by some to be transitory to now entrenched and embedded," he said.

"That environment of higher interest rates into a lower economic environment doesn't happen often. It's only happened four times in the last 50 odd years... And all of those times have tended to be pretty poor for equity markets, as you would expect."

The first market impact has been the steep decline in the share prices of long-duration companies, as investors turned to companies that could deliver profits in the short term. The next, according to Padowitz, is a fall in corporate earnings.

"There's always going to be a lag. And when one looks at the historical context of margins, of how much companies earn relative to labour, it's at extreme highs. So there's quite a long way to go where earnings can fall," he said.

How much could earnings fall? Well, Padowitz believes it could be in the 20-30% range, and grimly, even up to 40%.

"We think we're heading into an earnings recession, or even potentially worse than that," he said.

How to know when to pivot

According to Talaria analyst Max Welby, there are two signals that investors can use to get a better idea of when the market may have reached its low point.

"Since 1950, if you look at S&P 500, one or both of two things have really signalled the bottom of the market," he explained.

"That has either been a change in central bank policy towards a more supportive approach. And the second thing is a bottoming of the economy, particularly a bottoming of leading economic indicators."

He pointed to the ISM manufacturing index (or the purchasing managers' index PMI) as a key indicator for the Talaria team, one which typically lags interest rates by around 18 months.

"So right now, that is telling us that not only are we a long way off from a change in central bank policy, but we also think we are a long way off from the economy bottoming as well," Welby said.

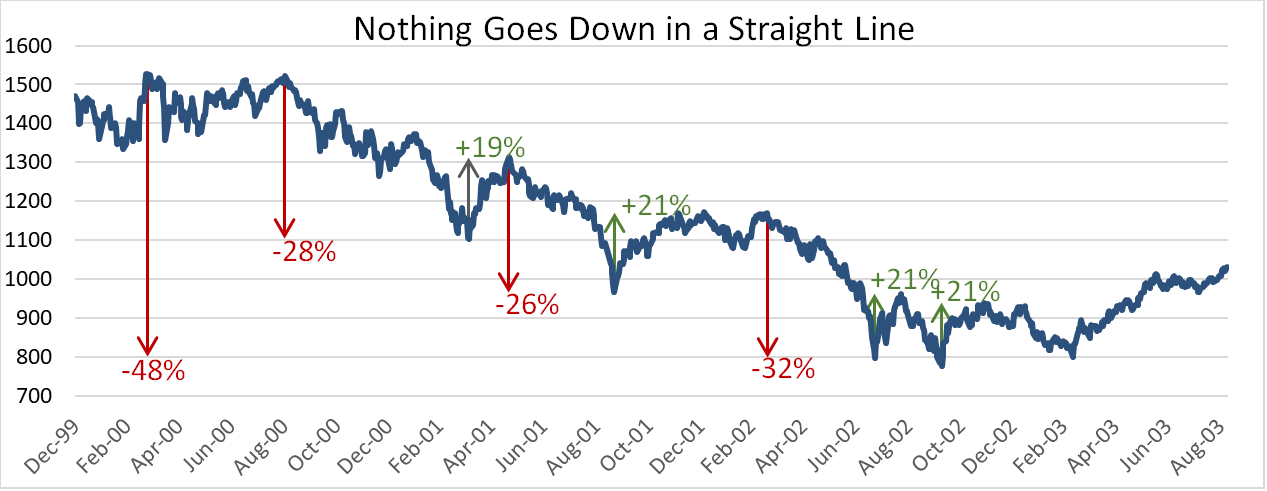

"Now, what that doesn't mean is that you can't get very sharp recoveries in the market. If you look at bear markets over time, bear market rallies are the norm, not an oddity. What that supplies you with is an opportunity to (rebalance investments)." (see below)

So how should you be positioned? Welby believes investors should be owning assets that are:

- Low-beta (so avoid investments that track the market, like exchange-traded funds)

- Short-duration (companies reporting profits now)

- Low-volatility (companies with share price rises that are boring but beautiful/consistent)

"We want to buy the best company that valuation would afford, not the best company, period," Padowitz added.

"Microsoft (NASDAQ: MSFT) is a great company... The issue is how much you pay for it. Quite recently you were asked to pay over US$2 trillion for it, which was over 30 times earnings.

"At 0% interest rates this might make sense. However, if rates and inflation are at say 5% then the value of this today is much lower and thus the valuation reduces dramatically."

This is exactly what has happened and is at risk of continuing, he said.

"Now that inflation's higher, it certainly does matter how soon you get back that $10 billion or a hundred billion," Padowitz said.

"We have an expectation of every investment to make a minimum of 8% compound a year... And the reality is that (companies like Microsoft) would probably be struggling to make 1-2% over a five to 10-year period."

Instead of investing in big tech, Padowitz recommends that investors own companies like McKesson Corporation (NYSE: MCK), an American pharmaceutical company, or Novartis (SWX: NOVN), a Swiss pharmaceutical company.

"McKesson's revenue is in the ballpark of Amazon - hundreds of billions. But you can buy that company on a $30 to $40 billion market cap. And it makes about $3 billion. Where Amazon would be 30-40 times earnings rather than 10 times earnings," he said.

"Novartis, which we've talked about before, they have an 8% earnings yield. So if you buy that company, $80 out of a thousand comes back to you every year, after spending about $7-8 billion on R&D.

"So if that share doesn't move for the next 12 years, you've doubled your money because you've effectively got all your money back. When you compare some of those other (big tech) companies, you've gone from maybe 35 to 40 times earnings to 25 times earnings. You still have to wait 25 years."

So which companies could outperform in this environment?

As Talaria is investing in low-beta companies, as well as those that are less exposed to the overall market and the economy, its biggest sector weight at the moment is healthcare or global pharma (25% of the portfolio).

That's across five companies. Those companies are Sanofi (EPA: SAN), Roche Holdings (SWX: ROG), Novartis (SWX: NOVN), Gilead Sciences (NASDAQ: GILD), and Johnson & Johnson (NYSE: JNJ).

"These companies tend to have very low or no net debt, very attractive valuations, reasonably high dividend yields and patented cash flows," Padowitz said.

"And we think that's a very, very good place to be, in an environment where most segments of the economy are particularly challenged."

Another area that Talaria is finding opportunities in right now is insurance, which is currently a 6-7% exposure in the portfolio.

"Insurance companies actually benefit from higher interest rates, where financials, as in banks, have higher interest rates benefits, but they have a bad debt risk as well," he said.

"Insurance companies have a lot less of those balance sheet problems, but they get the income solution from higher interest rates."

These include companies like Everest Re Group (NYSE: RE) and NN Group (AMS: NN).

"They have done well in the last six to 12 months. When we look at the world today and their valuations and the market's challenges, we see no reason why they won't continue to do very well," Padowitz said.

He also points to Japan as a region that is looking attractively priced. Currently, around 15% of the fund's capital is invested in four Japanese companies.

"We have Asahi (TYO: 2502) - they're one of the largest global brewers in the world," Padowitz said.

"Obviously, with COVID, their earnings are a bit messy because of lockdowns, but if you look at 2019 and where they'll probably be over the next 12 to 18 months, they're on about a 12 times earnings where their peers, the likes of Heineken are they're trading on about 17 to 20 times."

Other Japanese investments include Secom Co (TYO: 9735), a security company with "very stable earnings that has just announced a share buyback, Mitsubishi Electric Corporation (TYO: 6503), which is "exceptionally cheap and net cash", and Sumitomo Mitsui Trust Holdings (TYO: 8309), a financial holding company with "a book value of around 7000 yen that trades on around 4000 yen". As an added benefit, Sumitomo Mitsui pays out a third of its profits in dividends.

And two stocks that Talaria has been buying in the recent sell-off

Talaria uses put options on prospective positions, helping to lower its entry price, providing a nice premium as the stock price falls, and reducing risk.

"We have been buying Alibaba (NYSE: BABA)," Padowitz said.

"So that's a good example of us using our implementation process where it trades at around US$115, but we're agreeing to buy it at basically $90-95 and getting paid for it. So even though the shares are quite attractively priced, we get paid a significant premium for buying them at quite a big discount. And if it drops below that price, we are happy to own it."

Another example is Intel Corporation (NASDAQ: INTC).

"Intel was around US$55. They're now around $38. We are agreeing to buy that at $32.50. That's an example of where a stock has come down 25-30%, where we weren't interested at the valuation where it was," Padowitz said.

A final note

While Padowitz agrees that, yes, the market has dropped, and yes, investors may be tempted to dive on in, he is adamant about one thing:

"Price is a liar"

"When you actually look at the individual stocks, there was a lot more value on offer in the February and March period of 2020, during the COVID crash," he said.

"I think the mistake you can make is looking at where prices have dropped and assume that they must be great opportunities... It is very, very difficult to have complete confidence in where share prices are going to go.

So what can you do?

"Do the best you can to make sure that you've got the least amount of big problems if you're wrong," Padowitz said.

"And have the greatest proportion of things that will be on your side - like valuation, business fundamentals, and balance sheets."

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

5 stocks mentioned

2 funds mentioned

1 contributor mentioned