Four mining services companies where we see value

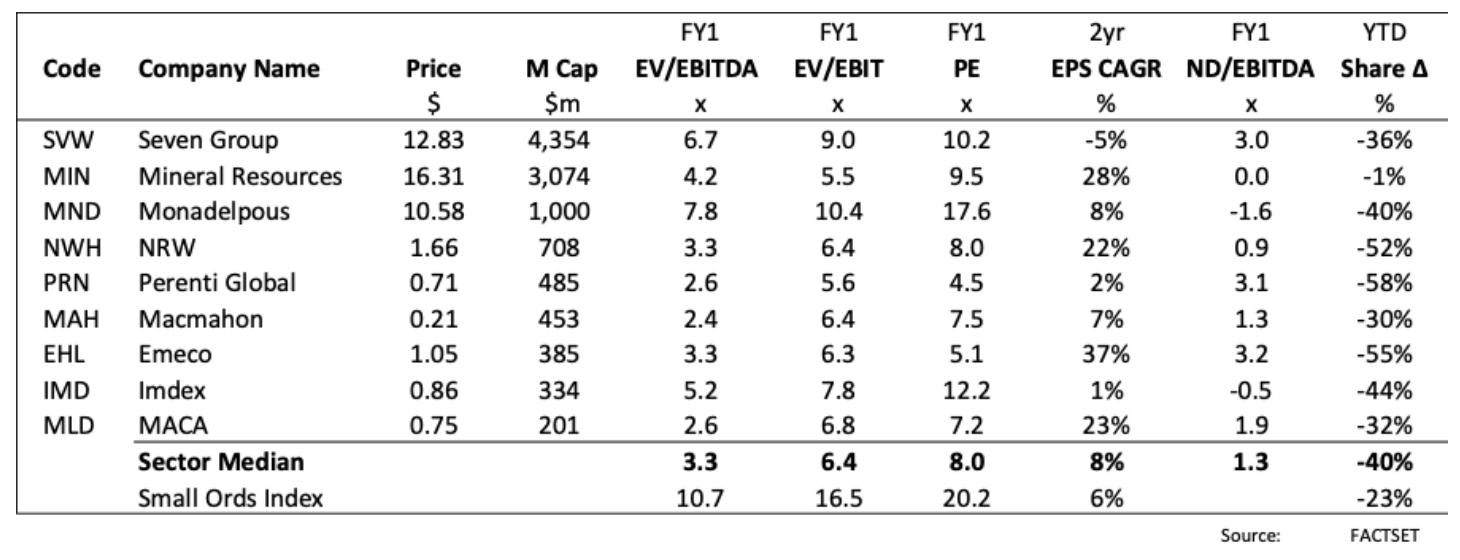

Investing in small cap mining services firms is not for the faint hearted given their exposure to the commodities cycle. But with the sector down around 40 per cent year to date (vs Small Ords down 23 per cent), and most major miners continuing to produce, we see value as attractive for the risk. There are four companies we particularly like.

We have recently taken advantage of depressed valuations and selectively added to our small cap mining services exposure. While this is a cyclical sector, the risk-reward profile appears better than prevailing share prices would otherwise suggest.

Mining has been designated an essential service in Australia (coal and iron ore royalties have perhaps never been more important for the Government’s ailing coffers) with production and development activity largely uninterrupted to date. This indicates near-term earnings for mining services companies may prove stronger than initially feared. Notwithstanding the less certain medium-term demand picture for commodities in a COVID-19 impacted world, fixed asset investment has historically played a central role in fiscal stimulus policies which potentially underpins a relatively solid mining services outlook.

As derivatives of underlying mining activity, mining services stocks tend to represent an expression of risk appetite towards the commodities cycle. Whereas the economics for mining companies reflect production volumes, realised prices and cash costs to produce, outsourced mining services companies are predominantly leveraged to their mining clients’ production volumes (tonnes of earth or ore hauled) and expansionary initiatives (exploration and/or development spend). They aim to make a return on labour or assets utilised throughout the various stages of the mining cycle and represent a cost to the miners (either opex or capex). The case for employing specialised outsourced mining services contractors over inhouse resources generally relates to productivity improvements and a more efficient allocation of scarce capital.

When investing in the mining services sector, we strategically take a portfolio approach to manage the inherent risks, preferring the larger, more diversified players with high calibre management teams and strong execution track records. More recently, balance sheet strength and liquidity has also become an important focal point for investors. This portfolio approach ultimately attempts to reduce downside risks associated with specific projects or individual clients whilst also providing leverage to mining cycle activity. Our current sector holdings include Seven Group (ASX:SVW), Mineral Resources (ASX:MIN), NRW Holdings (ASX:NWH) and IMDEX (ASX:IMD). These are discussed further below.

Seven Group Holdings (ASX:SVW) ($5 billion market cap)

Seven Group Holdings is a high-quality small cap play on three key investment themes – resources capex, east coast infrastructure expenditure and east coast gas. Management recently withdrew FY20 earnings guidance despite reportedly seeing only limited impact from COVID-19 on its mining and construction operations. WesTrac (Caterpillar equipment and parts sales) was tracking 5 per cent ahead of budget with revenue up 15 per cent year to date, while Coates (equipment hire) was trading within 1 per cent of internal expectations with revenue 3 per cent higher than the prior period. We think the outlook remains robust considering WesTrac is leveraged to Pilbara sustaining tonnes projects (required to maintain rather than grow output levels plus iron ore price still well above production costs) and Coates’ infrastructure pipeline could be fast tracked to stimulate domestic economic activity. We also like the leverage to a potential oil price recovery – the paper value of SVW’s 29 per cent stake in Beach Energy (ASX:BPT) has been materially impacted by the recent oil market rout (negative oil prices? Wow!). SVW shares have fallen 36 per cent this calendar year (vs the Small Ordinaries Index down 23 per cent) and are now trading on a FY20 EBIT multiple of 9.0x (big discount to the market on 16.5x).

Mineral Resources (ASX:MIN) ($3 billion market cap)

Mineral Resources is a highly entrepreneurial company which has earned a place in the portfolio based on the strong growth potential from its iron ore and lithium operations as well as management’s proven track record of value creation (more than 20 per cent ROIC since listing). The hybrid model comprises a leading contract crushing and processing business driven by domestic mining production volumes, an expanding WA iron ore mining footprint (now Australia’s fifth largest Fe producer) and hard rock lithium interests which offer significant longer-term upside potential. The company has reportedly only encountered minimal disruptions from COVID-19 which shouldn’t materially impact near-term earnings. Consequently, MIN remains well placed to deliver into a strong iron ore market and we see upside risk to consensus estimates (FY20 guidance was conservatively set). Importantly, the net cash balance sheet has ample capacity to fund continued investment in the company’s various expansion projects. While iron ore remains the key earnings driver over the next few years, looking further out MIN’s joint venture with Albemarle and stake in the downstream conversion plant represents an option on a potential recovery in the lithium market and a play on electric vehicles. MIN shares are broadly flat year to date, trading on 5.5x FY20 EBIT with solid upside earnings risk.

NRW Holdings (ASX:NWH) ($760 million market cap)

NRW Holdings is a first-class contractor when it comes to project execution and risk management and provides investors with a diversified exposure to domestic mining production and development activity (largely iron ore, coal and gold), as well as infrastructure spend. The company’s recent market update highlights that the business continues to trade in line with internal expectations with no observed signs of changed client behaviour nor delays in project awards. FY20 revenue forecasts of around $2 billion were already mostly secured by contracts, so risks to near-term earnings should only be modest. Furthermore, the BGC Contracting acquisition delivers a step change to the Group’s scale and diversity with a full year earnings contribution in FY21. Many competitors have fallen by the wayside over the past few years so we see NWH as strongly placed to capitalise on a pipeline of opportunity currently valued at $10 billion. We also like management’s capital-light approach to delivering mining services – the majority of mining or construction equipment utilised is either hired or funded by asset finance arrangements, meaning it can be easily returned if clients reduce activity levels. NWH shares have more than halved this calendar year. At these levels, the stock is trading on 6.4x FY20 EBIT and 4.8x FY21 which includes a full year of BGC.

IMDEX (ASX:IMD) ($400 million market cap)

IMDEX is a leading global mining technology company specialising in subsurface instruments designed to improve drilling productivity and mineral extraction. Demand is strongly leveraged to exploration expenditure levels, mainly in gold, copper and iron ore ( more than 80 per cent of revenues). Although the gold price remains elevated, we see some risk to IMD’s near-term earnings considering exploration expenditure is typically more discretionary than mining production (may be curtailed to conserve cash) and some global operations would likely have been impacted by government enforced shutdowns in response to the COVID-19 outbreak. That said, IMD has outperformed during past downturns (its tools drive productivity) and we would expect the market to largely look through any short-term cyclical earnings weakness considering the fundamentals remain strong and the significant upside potential from the company’s new product pipeline which is progressively being commercialised. We have also already seen consensus earnings estimates pulled back over the past month (FY21 EPS reduced by 18 per cent). The balance sheet is strong (net cash) with plenty of capacity to weather any prolonged demand slump. From our perspective, IMD represents a differentiated mining services play – while end markets are cyclical, this is a technology-driven company generating high returns on capital and with a strong and sustainable competitive advantage. The shares are down 44 per cent calendar year to date, implying 9.1x FY20 EBIT (with minimal contribution from the new products which present upside potential).

Mining Services Peer comparison

4 topics

4 stocks mentioned