Geopolitical shocks keep markets on edge

Investors could be forgiven for waiting to exhale.

Bond yields are hitting multi-decade highs. The U.S. House of Representatives is speakerless. Russia has ramped up the Avdiivka assault, its largest since Bakhmut. Geopolitics in the Middle East has necessitated a visit by US President Joe Biden, with the US deploying the USS Gerald R. Ford Carrier Strike Group to the Eastern Mediterranean Sea. Meanwhile further east, Russia’s Vladimir Putin has dropped in for tea with his friend Xi Jinping.

This is a heavily abridged list of the shocks the world has experienced in the past few months, and governments have been and will continue to take action. The U.S. Commerce Department said it would “significantly constrict” exports of artificial intelligence chips, taking aim at sales of Nvidia GPU’s (and the equipment needed to manufacture them) to China. U.S. Commerce Department Secretary Gina Raimondo said China could develop access to advanced semiconductors that could “fuel breakthroughs in artificial intelligence and sophisticated computers” for the Chinese military.

Large companies hold on nonetheless

Nvidia has clearly evolved beyond being just a gaming GPU company, as it was a decade ago. This ability for disruption names to pervade most aspects of our lives is part of what allows them to be so dominant in the indices. The magnificent seven – Nvidia, Microsoft, Alphabet (Google), Meta, Apple, Amazon and Tesla – have notched an impressive YTD return.

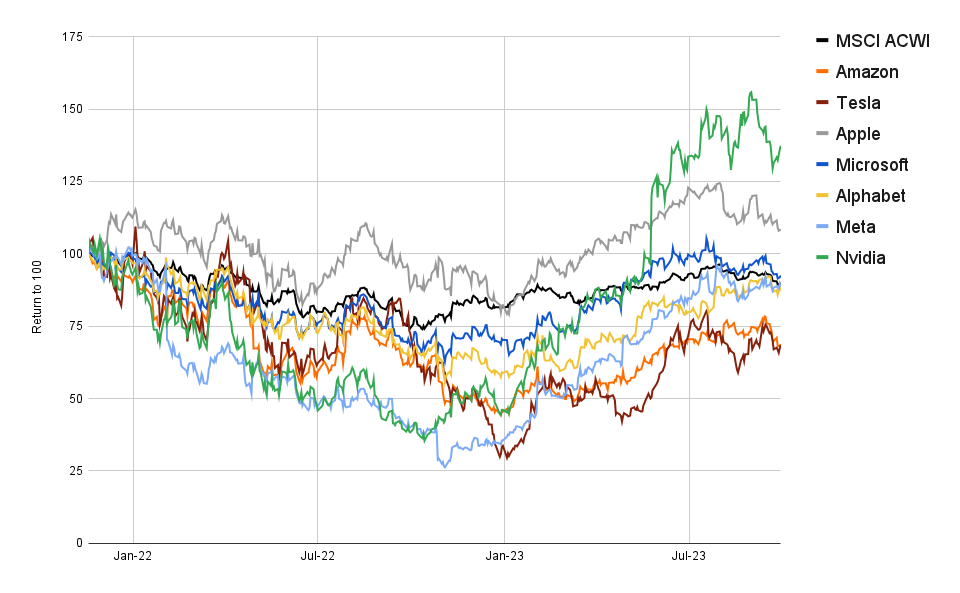

Some onlookers believe they are expensive and that the rally they have experienced will broaden out into other companies. We disagree. These companies were sold down severely in 2022 and only two, Apple and Nvidia, have meaningfully outperformed the MSCI All Countries World Index (ACWI, shown in black) since the peak in November 2021.

The MSCI ACWI is mostly ahead of these names

.png)

The narrow rally that some commentators have pointed to is more a consequence of observing these stocks year to date. When taken from around their previous highs and providing a fuller context of price movement, these stocks have not outperformed nearly as dramatically.

Some commentators see growth ahead

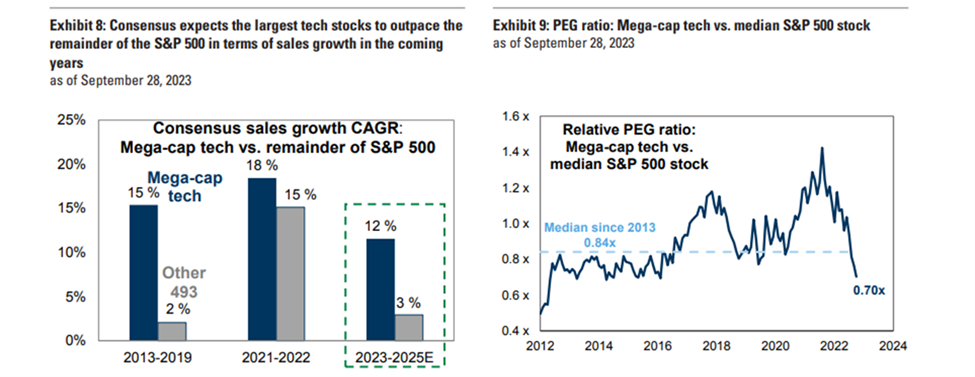

.png)

Source: Goldman Sachs, Mega-cap tech refers to the magnificent seven

What is more, the technologies and scale of these companies are allowing them to broaden their revenue streams. This is why after two years of revenue growth parity with the other companies in the S&P 500 they remain well positioned.

The PEG ratio (Price / EPS / growth) for this group is currently at 1.3x while the median S&P 500 is 1.9x. A PEG ratio is a rule of thumb which takes the price-to-earnings (PE) ratio and divides it by the growth rate (all integers), to give a measure of how expensive growth is, with lower numbers cheaper. While we do not use PEG ratios as part of our valuation methodology, it is worth noting this divergence, which puts the group on the largest discount on this measure since 2013.

Where are all the AI apps?

Since the start of the year, generative AI has exploded into the public consciousness and strapped a rocket to the valuations of companies considered exposed to this emerging technology. Ten months later, onlookers may be left wondering, “what is actually happening?”

The answer: cost effective AI is still very much constrained by computational power and hardware. The broad emergence of AI applications is some way off. It’s going to be a game of scale initially so the big players will lead in the near term.

It was Microsoft that kicked off the generative AI buzz (though there has been much going on for many years) with its US$10bn investment in OpenAI. Since then, Microsoft has spun off a series of products that integrate OpenAI’s GPT model with the fastest growing product being GitHub Copilot, a code writing tool that has found tremendous acceptance already.

For reference, GitHub Copilot is the model that writes code based on human language prompts – increasing the productivity of coders by a significant margin. GitHub is the world’s largest repository of code. Chances are most of the software you use every day was developed collaboratively on GitHub as virtually all firms use it. Microsoft owns that development space and sells seats to companies and individuals for storage space as well as add-ons like GitHub Copilot. Google has a similar product known as Duet.

.png)

Source: Shutterstock

The uptake numbers here are impressive. In its last earnings call, Microsoft reported 27,000 organisations using the service. The more general Copilot for Microsoft 365 (for use in Word and Excel) was restricted to 600 companies. The wider roll out of this second AI service could generate some meaningful revenue, even for Microsoft which has annual revenue in the order of hundreds of billions of dollars. The company has said as much, expecting to break out AI revenue in early 2024.

Things may become a little clearer this week after Google, Microsoft, Meta and Amazon report. Of Microsoft, Goldman Sachs wrote, “We continue to pick up signals of elevated demand (with tens of thousands of enterprise users in the Microsoft 365 Copilot Early Access Program), consistent with the conversations we had at our conference over the past few weeks. The rollout to a solid base of Windows 11 Enterprise customers (with this cohort generating >$1bn in revenue ) and over 160 million commercial Office 365 users can serve as a benchmark for industry-wide adoption and product feedback. Investors are now likely to look to November/December and C1Q24 [first quarter 2024] to evaluate how this pipeline converts to adoption and monetization over the course of the next twelve months. Microsoft should be able to capture a part of its $135bn+ target addressable market within M365 [Microsoft 365], with additional opportunities across Azure, Windows, Dynamics and Bing/Edge.”

By the end of November, 80% of the Loftus Peak portfolio will have issued results and given guidance for the remainder of the year. Following this busy initial week for AI, Nvidia’s earnings in late November are of particular interest. We expect to see further developments out of these large companies as they are able to disrupt markets with their innovative technologies and colossal existing user bases to which these technologies can be sold.

4 topics

6 stocks mentioned