Great Crypto-Currency Ponzi Scheme Crashes as Bitcoin loses US$800 billion...

As a result of sharply higher inflation and interest rates, the great unregulated crypto-currency "ponzi scheme" has finally started to unravel, as we warned it might in December 2021 and January 2022.

In concert with its highly correlated listed equities masters---the S&P500 and NASDAQ Composite indices---bitcoin has plummeted 63% from a peak of US$68,991 in late 2021 to a low of just US$25,424 this week. At this nadir, bitcoin's market capitalisation had shrunk by US$800 billion, prompting some investors to start referring to it as simply "bitcon".

It is certainly a hedge fund's dream with droves of retail investors beguiled by a preternatural "buy-the-dip" reflex only to see more sophisticated short-sellers pummel crypto-currencies ever-lower. Twitter has been awash with rumours that powerful hedge funds, including Ken Griffin's legendary Citadel, have led the waves of short-selling that systematically turn these rebounds into punishing dead-count-bounces. These allegations have, nonetheless, been denied by Griffin's independent market maker, Citadel Securities, and his hedge fund, Citadel.

Even more sensationally, so-called "stable coins", which are supposed to be pegged to specific currencies, such as the US dollar, and trade dollar-for-dollar with them, have collapsed as investors belatedly question the quality of the unstable assets (or collateral) backing these purportedly safe investments.

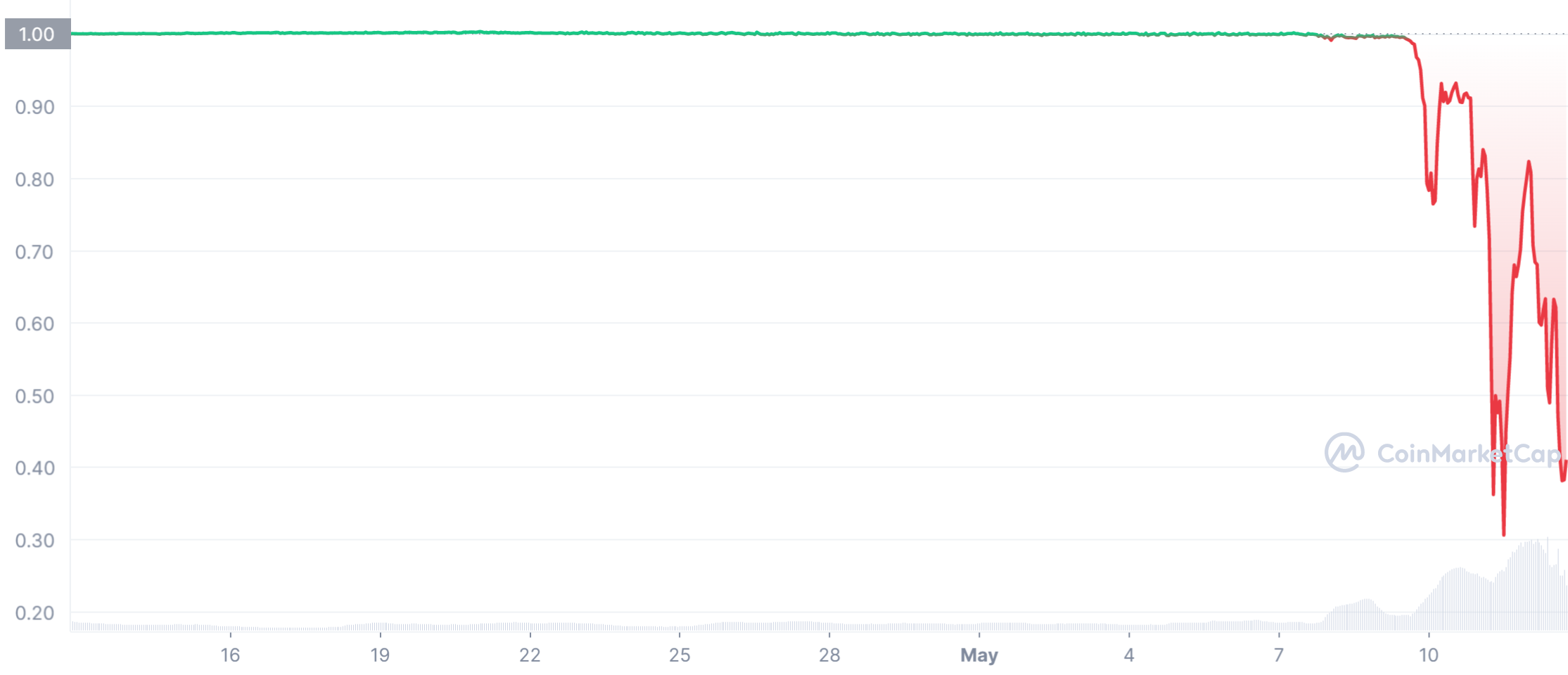

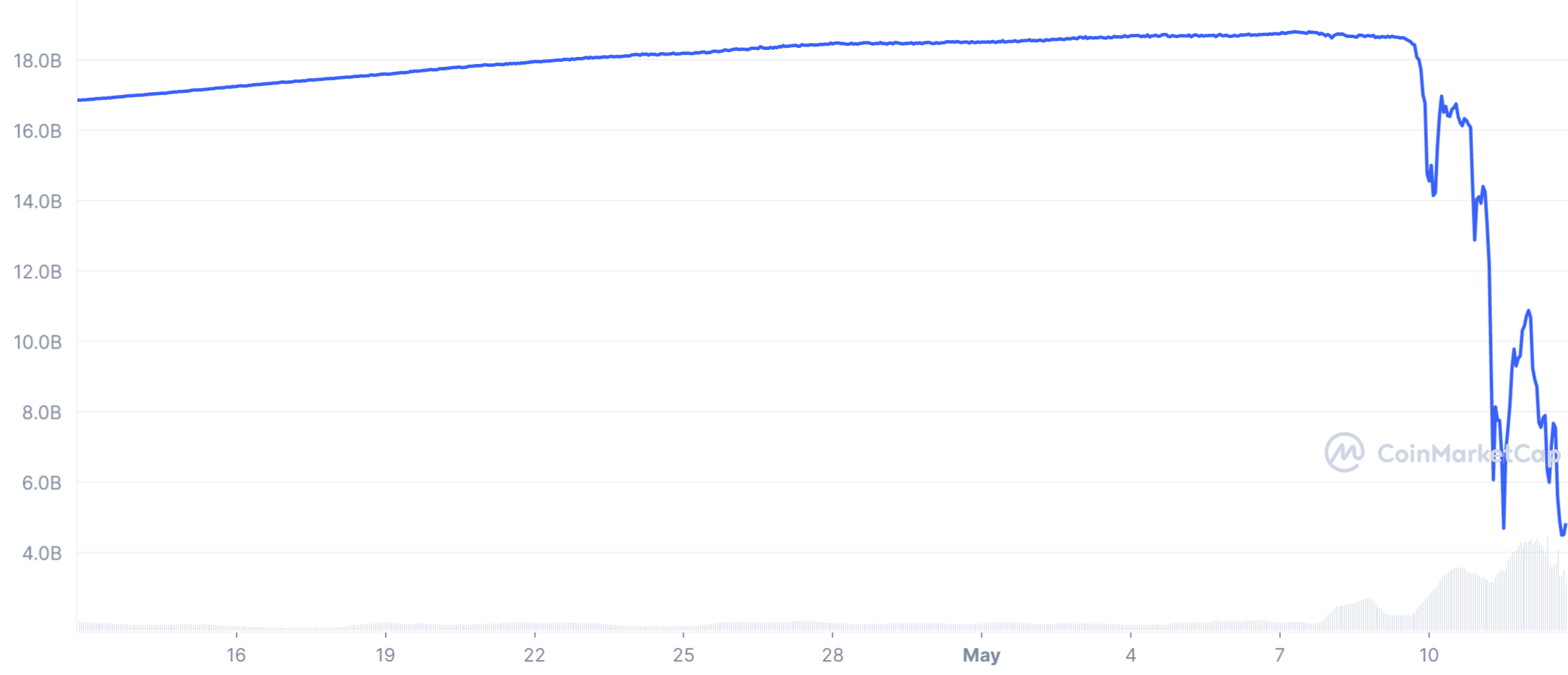

The TerraUSD stable coin, which is remarkably backed by bitcoin, used to trade consistently at US$1. In the past week, it has plunged 73% to a low of just 27c after the value of its collateral had dropped like a stone. Some US$14 billion of TerraUSD value has vaporised as a result.

It beggars belief that these financial products have been pushed on naive consumers--that have little-to-no financial literacy--without a shred of regulatory protection in place. The vast crypto ponzi schemes make the sharemarket "boiler-rooms" in the 1980s and 1990s (popularised by the Wolf on Wall Street film) look positively trivial in comparison! Global regulators, including the SEC in the US, the FCA in the UK, and ASIC in Australia, have all been missing-in-action as the crypto-currency ponzi has exploded.

.png)

.png)

As we explained in January in a piece that argued crypto-currencies could become a 21st century version of the great Tulip Bulb Bubble, the key drivers of the crypto craze were interest rates on conventional cash (eg, bank deposits) going to zero during the pandemic while at the same time governments poured trillions of dollars of cash into households' savings accounts in an effort to stimulate greater spending, investment and speculation. Animal spirits were certainly liberated, as all asset-classes soared to record highs.

Yet as these forces now reverse as interest rates sky-rocket (making cash look suddenly appealing) and governments withdraw their stimulus measures, crypto-currencies have proven to have little value beyond the "hopium" that investors can convince others to impute a higher price to them.

The likes of bitcoin and ethereum were serially spruiked to punters on the basis of several key sales propositions, all of which have been debunked:

- The first popular idea was that crypto-currencies were a tractable hedge against a bout of inflation. And yet since the advent of sustained inflation, these non-income producing and highly speculative assets have had their valuations torched.

- A second narrative was that crypto-currencies were a powerful portfolio diversifier, protecting investors against declines in the value of other asset-classes, like equities and bonds. In practice, however, crypto-currencies have proven to be highly correlated both with one another and with listed equities, amplifying traditional portfolio risks rather than reducing them.

- A third pitch was that crypto-currencies would serve as an alternative (and presumably safe) store of wealth. In the first serious inflationary stress-test that they have faced, crypto-currencies have failed miserably, inflicting massive losses on households. If you were worried about inflation and equity risks, crypto-currencies have been the worst possible place to hide. You would have been much better off simply putting 100% of your money in the NASDAQ Composite Index.

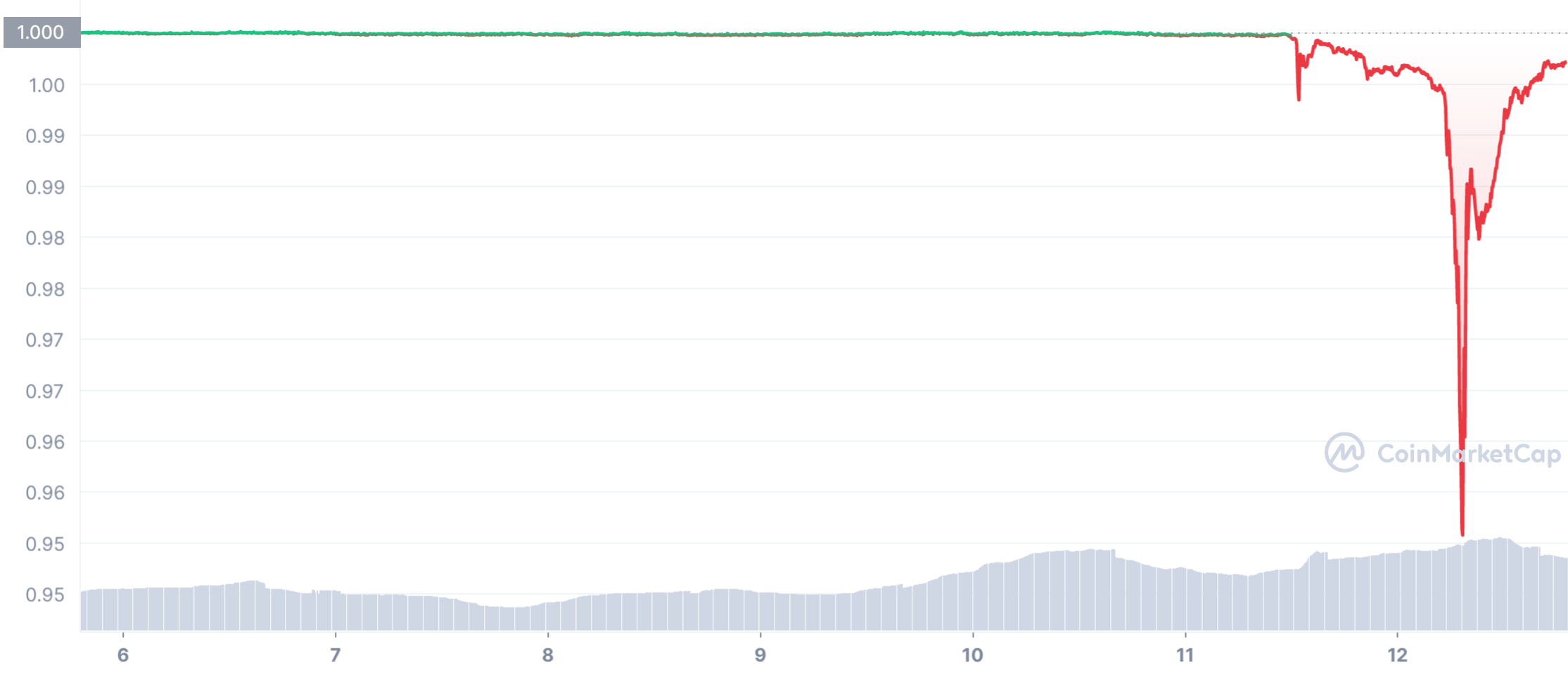

- A fourth angle was that the emergence of "stable coins" could protect investors against the extreme volatility of conventional crypto-currencies by pegging their value to a specific currency, such as the US dollar, and trading US$1 for US$1 with that currency. But as investors tragically discovered this week, stable coins are also a con, because they have been backed by the most dodgy collateral imaginable: other crypto-currencies! Witness the 73% decline in the value of the TerraUSD stable coin. Even ostensibly safer stable coins, like TetherUSD, which is backed by much more secure collateral (eg, corporate and bank bonds), have had their US dollar pegs smashed (TetherUSD, which had always traded at US$1, tumbled down to US95c during the week).

- One final idea has been that non-income producing crypto-currencies would have some inherent practical use (or utility) that could supplant the traditional bank and credit card intermediated payment system. That is to say, you could use crypto to buy any manner of goods and services. And yet 13 years since folks started minting and trading bitcoin, it is almost impossible to use it in any normal setting. A similar observation applies to the allegedly revolutionary (and associated) blockchain technology, which has yet to be adopted on a widespread basis anywhere.

The one pervasive use-case for crypto has been in the criminal and non-democratic domains where digital currencies have been relentlessly harnessed for money laundering, tax evasion, cyber-crime, and to fund many other nefarious and highly illegal activities, including terrorism, Russia's war against Ukraine, paedophilia, and to help dictators and despots circumvent sanctions.

The most common application of crypto-currencies is pure speculation. That is to say, people principally use bitcoin and ethereum to buy, sell, and provide finance (or lend) against other crypto-currencies.

It is world of ponzi schemes built on other ponzi schemes that relies crucially on the greater fool theory: that there is always a lesser mortal out there willing to buy some worthless crypto-currency off you at a higher price.

Another popular application has been to use crypto-currencies to buy and sell seemingly value-less digital images, aka non-fungible-tokens (NFTs). Like the crypto used to pay for then, NFTs have been gripped by the mother-of-all ponzi-induced speculative bubbles that is now sadly unwinding.

It bears repeating that crypto-currencies are not inflation hedges: the only thing they have demonstrated is that they exacerbate inflation risks. They are not portfolio diversifiers: crypto-currencies are all highly correlated with one another, and with equities. They are not a safe or stable store of wealth that can be compared to, or compete against, traditional cash instruments, such as government-guaranteed bank deposits. (Un)stable coins likewise provide no assurance against catastrophic losses, as we have seen. And to date, crypto-currencies have proven to be devoid of any practical uses outside of promoting ponzi schemes, speculating on other digital currencies, trading digital images, money laundering, tax evasion, and supporting highly illegal activities, including the evil kleptocrat Vladimir Putin's war against a free and democratic Ukraine.

4 topics