Growth headwinds - Fiscal drag and high inflation

Global economies and financial markets are now entering the late stages of the business cycle. Fiscal stimulus has peaked and household purchasing power from savings and earnings is being eroded by the higher inflation backdrop. As we look at the powerhouse of the global economy, the U.S Gross Domestic Product (GDP) growth in 2022 is still projected at 3.5%, materially above the 2.2% average of the last cycle. With anticipated downward revision of the U.S growth trajectory possible in the near future, this could trigger the re-evaluation of the investors blend of growth versus defensive assets.

Fiscal impulse is fading

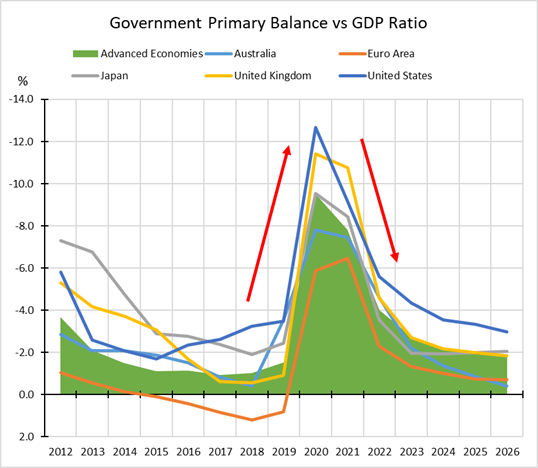

The COVID-19 pandemic shocked the global economy. Cities were locked down, businesses were closed, and millions of workers lost their jobs as consumer confidence took a battering. This was the most severe economic contraction since WWII, which triggered the largest fiscal stimulus package the world has ever witnessed. According to data from the International Monetary Fund (IMF), the U.S government’s primary balance vs GDP ratio, which measures the fiscal net expenditure excluding interest payments, went from -3.5% in 2019 to -12.7% in 2020 (figure 1). Even the governments in the Euro Area, who had a positive primary balance to repair their balance sheets after the European Crisis, ended the austerity and increased fiscal spending significantly to combat the effected slowdown caused by the pandemic.

Figure 1 Source: IMF, JCB.

The largesse of authorities mitigated the pandemic impact on consumption and output. Wage subsidies, transfers, and jobless benefits protected jobs and supported household income, which helped consumer spending get through this period. Governments also offered credit support to prevent corporates from bankruptcy, which avoided any contagion developing through the financial community. Economists from the Federal Reserve, University of Cambridge, and IMF estimated that the financial support boosted the GDP of advanced economies by 6.9% in 2020 Q2 and Q3¹.

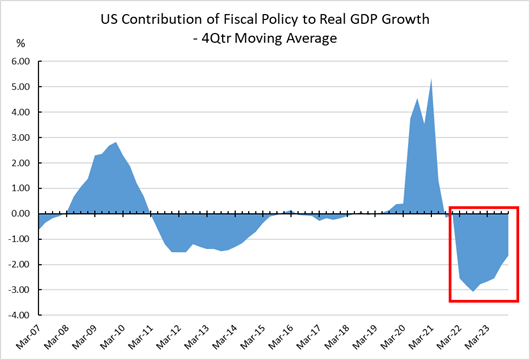

As the economy recovered, governments rightfully scaled back the stimulus that was required. The IMF expects the primary deficits to shrink rapidly from 2022 onwards. The unwinding of the fiscal stimulus means that its impact on the economic growth will turn from a booster to a drag. According to the Hutchins Center at the Brookings Institute, the 4-quarter average of U.S fiscal contribution to GDP peaked at +5.4% in 2021 Q1.

The fiscal impulse fell over the cliff and turned negative in 2021 Q3 – two quarters later. Subsequently it would drop further to -3.1% in 2022 Q3². This estimation would be revised up significantly if the Biden administration could pass the multi-trillion-dollar Build-Back-Better bill. However high inflation makes further stimulus unpopular among voters who are already sacrificing more consumption dollars with the uplift in energy prices. Given the political gridlock in Washington D.C and the approaching mid-term elections, passing that bill is still possible but not probable.

Source: Hutchins Center at Brookings Institute, JCB.

Consumption vs inflation

US GDP is projected to grow at 3.5% in 2022 vs 5.7% in 2021 despite the fading fiscal impulse. The key assumption behind the optimistic outlook is that excess savings from fiscal stimulus, wealth effects and solid wage growth would keep demand strong. Specifically, the fiscal drag would be offset by a further reopening of the service sector, pent-up demand for goods that were in short supply in 2021, and inventories restoking towards pre-Covid levels. Private consumption is expected to contribute 2.4% out of the 3.5% total GDP growth.

High inflation is a clear threat to these forecasts. It erodes the real value of the saving and wealth whilst also diminishing the purchasing power of the consumers income. Despite the fact that the U.S nominal hourly earnings grew at a respectable 5.1% year on year (YoY) in February, consumers can afford less goods and services than 12-months ago due to much higher inflation rate which was 7.9% YoY.

In addition, the current conflict between Russia and Ukraine makes the consumption outlook even worse. From when Russia began the large-scale invasion on 24 February to the time of writing (28 March), West Texas Intermediate (WTI) crude oil increased +19% and wheat price lifted by +23%. When consumers are spending more on the basics like food and gasoline, they simply have less disposable income for other products and services. If the U.S gasoline price remains elevated at the current price, more than 1% of GDP growth would be cut off.

Overall, fiscal stimulus has peaked and households' purchasing power from savings and earnings is being eroded by the high inflation. The US GDP growth in 2022 is still projected at 3.5%, way above the 2.2% average of the last cycle. Jamieson Coote Bonds is cautious about the optimistic growth outlook. Due to the headwinds, the more downward revision of the growth trajectory might be down the road, which could trigger the re-evaluation of growth and defensive assets.

¹Covid-19 fiscal support and its effectiveness

² Hutchins Center: Fiscal Impact measures

Jamieson Coote Bonds (JCB) is a specialist investment manager of domestic and global high-grade bonds including a global absolute return strategy. Stay up to date with our latest insights by following us on LinkedIn, or visit our website for more information.

3 topics