How to earn higher income for lower risk

When it comes to liquidity, Australian investors think inconsistently across their portfolios, especially in relation to where they source income. While most are typically comfortable buying a residential investment property to generate a modest yield (accompanied by high transaction costs), they’re often hesitant to deploy their capital into a locked-up vehicle that targets yields and income up to 2-3 times more than the current rental yield.

With short-term interest rates remaining at 0.10%, or lower, in 2021 and well beyond, and term deposit rates not that much higher, we believe 2021 is the year to begin capturing the illiquidity premium offered within sub-sectors of the global credit markets.

Why should investors consider adding illiquid assets to their portfolios?

In order to earn a return above the risk-free rate (0.10%), by definition, investors must take risk. These risk premiums include: equity risk premium, term risk premium, credit risk premium and illiquidity premium. When constructing the core components of an actively-managed diversified portfolio, the first three risk premiums are typically accounted for, but the illiquidity premium is often overlooked.

The illiquidity premium is essentially the additional compensation to investors for limiting their ability to take advantage of future market dislocations should they arise as their capital is locked up for a specified period. As a result, illiquid investments should offer a premium in the form of higher yield expectations. These comparably higher yields can be a helpful income-generating component of a portfolio. (It could be argued that to some extent residential investment property represents this illiquid component in portfolios given that investors are making a multi-year capital commitment, but unfortunately the current low rental yield provides little compensation.)

Combining both liquid and less-liquid income-generating alternatives in a portfolio, such as in the High Income Model we discussed in a recent article, is one way of capturing some of this illiquidity premium.

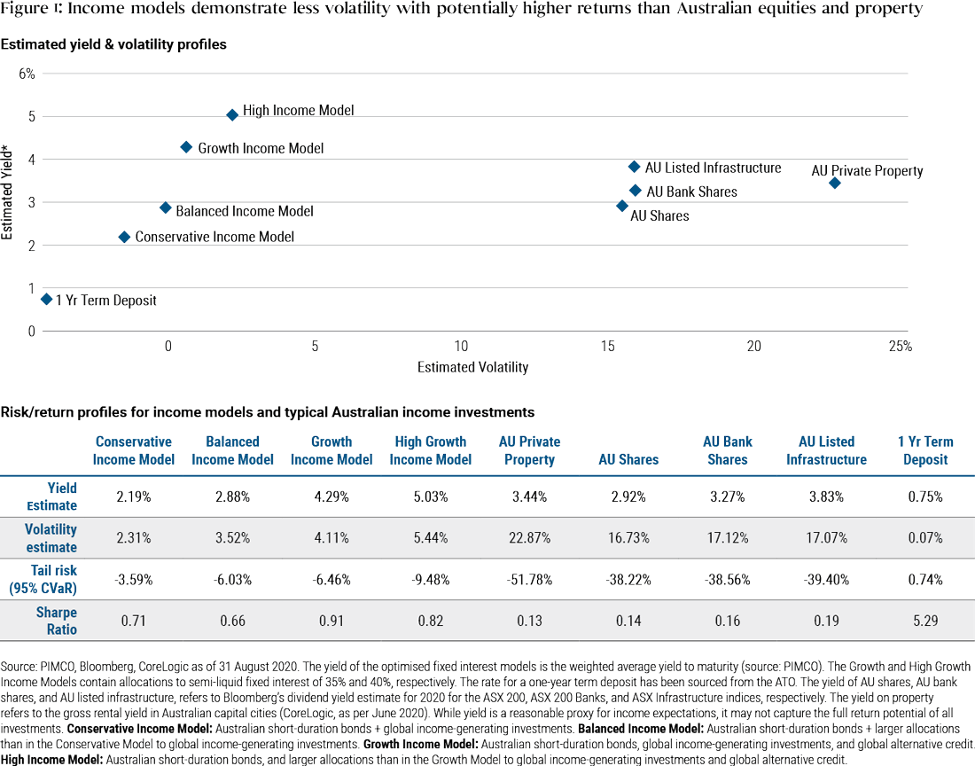

In this research, we analysed a number of potential income models that comprise a range of fixed income investments that cater to varying risk tolerances. Each was optimised and stress-tested using our proprietary risk analytics infrastructure. The High Income Model comprised Australian short-duration bonds, global income-generating investments, and modest allocations to global alternative credit in order to capture some illiquidity premium. In this case, alternative credit investments referred to financing provided to borrowers that either require non-standard, customized terms, or are private in nature because the issuer cannot access public credit markets, making these investments sit on the more illiquid end of the investing spectrum.

For investors prepared to have some of their portfolio allocated to less liquid assets, our analysis estimates that by investing in a high income portfolio, they could achieve expected total returns greater than 5% (see Figure 1). This is higher than our return estimate for Australian equities, yet demonstrates only a third of the volatility and a quarter of the left tail risk as Australian equities or property investments.

Why focus on the illiquidity premium in 2021?

Now more than ever, investors need to consider all of the available risk premiums when building an efficient portfolio for their future. This may mean a number of things, including boosting diversification and taking advantage of unique opportunities caused by the current dislocations in areas like alternative credit.

In our view, alternative credit currently looks extremely attractive on a relative basis. Central banks have been supporting the most liquid, traditional areas of capital markets. A lot of that liquidity hasn't found its way into the less liquid, alternative areas of credit markets such as private corporate debt or real estate opportunities.

Importantly, investing in alternative credit requires intense bottom-up research and expertise in areas such as commercial and residential real estate, direct lending and distressed investing. Fund manager selection is therefore key: Funds need to be appropriately sized and managers experienced and well-resourced to target these opportunities.

One thing investors can't ignore in 2021

The above wire is part of Livewire's exclusive series titled "The one thing investors can't ignore in 2021." The series will culminate in the release of a dedicated eBook that will be sent to readers on Monday 21 December. You can stay up to date with all of my latest insights by hitting the follow button below.

1 topic