How to think about your portfolio in times of war and rising inflation

My beat at Fat Tail Investment Research is looking for beaten-up/out-of-favour ASX 200 stocks and analysing the macroeconomic environment.

Having a good grip on macro can help you position your portfolio in more defensive/offensive ways, depending on the situation.

It sounds easy in theory, but it’s much harder in practice.

Especially when war breaks out between a major energy and commodity exporter in a time of already heightened inflationary pressures…

So in this wire, I want to discuss a few points that will help you think about portfolio positioning in 2022.

Energy

With oil prices surging to well over US$100 a barrel, there’s lots to talk about here. There’s obviously a large geopolitical premium priced in now. But this is not without reason. Russia is one of the world’s largest oil and gas exporters.

Most people think oil is inflationary and that central bankers will be forced to act.

That’s not the case. Oil price spikes are deflationary in that they act as a tax on the consumer and impact business margins. To the extent that they lead to rising prices as producers pass on costs, again, it’s a tax in the form of higher prices.

Is it too late to buy energy stocks?

In the short term, I’d say yes. Many stocks in the sector are approaching ‘overbought’ levels.

But have a look at the chart below. It shows brent crude (red line) and the ASX Energy Index [ASX:XEJ] (black line) since 2011. Their relationship is pretty tight.

Up until January 2021, that is. Since then, prices have completely decoupled. The ASX Energy Index is lagging behind massively.

So if you think this relationship will be renewed, energy stocks are a buy on any correction.

Source: Optuma

With or without war between Ukraine and Russia, energy prices are likely to remain elevated in the long term. The transition to a renewable economy will be very bullish for traditional energy because it discourages investment in new supply.

Increasing demand and a lacklustre supply response = higher long-term prices.

Interest rates

In the US, inflation is the number one political concern. With midterm elections later this year, that means the Fed must be seen to be ‘doing something’.

This is where I think the big risk lies and is what could cause more downward pressure on stock markets later this year.

That is, the Fed will raise rates into a slowing economy and potentially cause a recession. For a tech-heavy market on very rich multiples, this should be a big concern.

Right now, the market thinks war means the Fed will go easy on rate hikes. A 50-basis point increase in March is off the table. But a 25-basis point hike is locked in. And 100 basis points of tightening is expected by July.

Here’s the interesting thing though…

The yield curve has been flattening in the lead up to the tightening phase. The Fed hasn’t even raised rates yet (much less started shrinking its balance sheet), and the yield curve is saying a recession might not be far off.

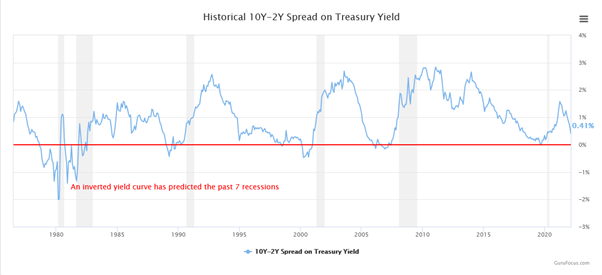

What is the yield curve? It measures the difference between short- and long-term rates. The chart below shows the difference between the US 10-year and two-year treasury bonds.

A rising yield curve generally signals a healthy expanding economy. A falling curve suggests the opposite.

Because of the (mostly) COVID/supply chain-induced inflation, central banks have moved to a tightening bias, and short-term rates around the world have shot up. But long-term bonds haven’t moved as far. Hence the falling yield curve:

Source: gurufocus.com

It peaked in March 2021 and has been falling since.

That suggests the US economy was at its strongest at that point. And by that, I mean it was flush with monetary and fiscal stimulus. But that tide of money and liquidity has since been receding. Now, with the oil price tax in play, the bond market is saying Fed tightening will cause a slowdown — if not a recession.

Also, consider that a lot of the strong economic activity you’ve seen recently is inventory rebuilding after the recent supply chain crisis. That creates manufacturing activity, but it doesn’t mean the final demand is strong. The bond market says it’s not.

If the Fed feels politically compelled to get inflation under control, the ‘Fed put’ that every equity investor is banking on may not exist at the levels expected.

In Australia, the RBA remains very dovish on interest rates.

This is strange, given the terms of trade boost we will get from the energy and general commodity price spike.

Back in 2009/10, the RBA hiked rates from an ‘emergency’ low of 3% to 4.75%, on the back of an iron ore boom.

This time around, we’ve had an even bigger iron ore boom, along with an LNG export boom (and now, surging energy prices), and the RBA are happy to sit on their hands!

If they want inflation, this is how they'll get it. It's positive for the equity market though. I think Aussie stocks are likely to outperform the US during this tightening phase.

Aussie dollar

Also, a look at the Aussie dollar suggests the outlook for Australia is reasonable. In the chart below, you can see that support has kicked in a few times at the US 70-cent level. Now, the currency looks like it wants to move higher.

A bottom could be in for the dollar here:

Source: Optuma

Stock markets

What does this mean for stock markets?

Well, US markets drive the rest of the world, so let’s start there.

The short-term outlook is bullish. The market wants to believe the Fed will go easy on interest rates, and with war-related uncertainty, it will. However, inflation worries will persist, and the Fed will likely turn hawkish again in the months ahead.

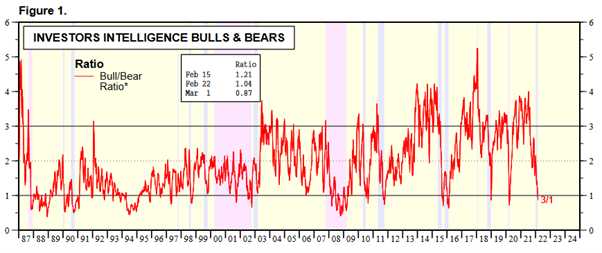

From a contrarian perspective, the short-term outlook is bullish too. Note the extreme bearish sentiment in the chart below. Such extremes are usually good buying points, certainly from a short-term perspective:

Source: Yardeni.com

You may want to use the rally to lighten up/get rid of positions you wish you didn’t have during the panicked down days.

The Nasdaq is the one to watch. It’s back above support, but it’s in a clear downtrend. If I’m right about a bullish short-term environment, look for the Nasdaq to rally back towards the all-time highs.

If it rolls over from there though (in response to a more hawkish Fed), be very concerned. Bull market tops/early bear markets are often characterised by a sharp sell-off followed by a rebound towards the old highs. When that rally fails, the bear usually kicks in:

Source: Optuma

For Aussie investors, the equation is a bit different. We’re a ‘value-oriented’ stock market with plenty of commodity exposure. We have lots of high dividend payers too.

In a ‘risk-on’ environment, we might lag the US. But when the mood turns to ‘risk-off’ again, as I suspect it will in the months ahead, we should outperform.

Conclusion

So the message is not to get too carried away with this relief rally. Use it to make changes to your portfolio in a non-stressful situation.

Expect the Fed to turn more hawkish again, as it seeks to tame inflation ahead of the midterm elections. That should put pressure on growth/tech and see the bear market resume.

Keep an eye on the yield curve. The closer it gets to zero, the greater the chance of recession. That’s the bond market telling the Fed it’s making a mistake in tightening too far.

Nearly all bear markets are preceded by some form of Fed tightening. This one will be different in that the Fed won’t even be able to tighten much before the economy and stock market cry uncle.

That should set us up for a wild bull ride into 2023 and beyond. But that’s a story for another wire…

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics