Hybrid risks just fell...

While I doubt whether any investors noticed, ASX bank hybrid risks likely just fell in a long overdue way. In particular, the probability of a bank hybrid being automatically converted into equity if a bank suffers losses has declined as a result of a new regulatory framework outlined by APRA, which it will finalise this year. Coolabah Capital Investments has been forecasting this change since APRA first canvassed the possibility way back in 2018.

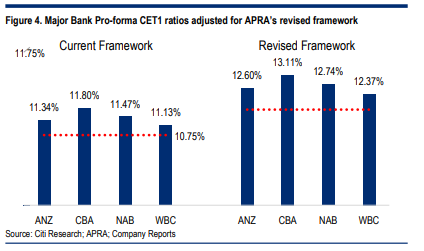

Under proposals released on Tuesday, APRA will adjust the way banks calculate and report their first-loss equity capital, known as Common Equity Tier 1 (CET1) capital. This will result in the major banks' capital ratios increasing by about 1 to 1.5 percentage points according to APRA (thought there will be no actual increase in the dollar value of capital held). So whereas CBA currently reports an 11.8% CET1 ratio, this could be expected to increase to 12.8% to 13.3%. The table below shows Citi's estimates of the changes in the CET1 ratios reported across the big banks.

All Aussie bank hybrids contain a clause that stipulates that they must automatically convert into bank equity if the bank's CET1 ratio declines to 5.125%. The current distance to default in the case of CBA would require its 11.8% CET1 ratio to shrink by 56.6% in order for a CBA hybrid to be converted into equity.

Under APRA's proposal, CBA would have to suffer greater losses that reduced its new 12.8% to 13.3% CET1 ratio by between 60% and 61.5% to get down to the 5.125% hybrid conversion trigger.

Because of the unique way APRA has historically calculated capital, Aussie banks report substantially lower CET1 ratios than they would if they were regulated by overseas authorities. To assist with comparability, they also report what they call an "internationally comparable" CET1 ratio.

On this basis, CBA's 11.8% CET1 ratio jumps to 17.8%, which is the highest core equity capital ratio of any large bank in the world according to CBA.

Coolabah Capital Investments estimates that about 70% of all bank hybrids globally have equity conversion triggers set at 5.125%. Australian banks, hybrid investors, and APRA were therefore artificially disadvantaged because the distance to default embedded in Aussie bank hybrids was artificially small compared with foreign peers (ie, the distance between 5.125% and 11.8% in respect of CBA).

This artificially compressed gap gives APRA less time than global banking authorities to avoid a disruptive hybrid conversion by coming to the aid of a bank that is experiencing extreme duress. By moving the reporting of Aussie bank CET1 ratios closer to their internationally comparable benchmarks, APRA has bought itself and the banks more time to mitigate these hazards. It has also arguably helped ameliorate the risks investors in Aussie bank hybrids face.

The changes to APRA's capital framework will have other consequences. They will boost the capital banks are required to hold against riskier high loan-to-value ratio (LVR), investment property, and interest-only home loans while reducing capital for low LVR products. The net result will be a modest increase in the overall capital banks hold against home loans, which will, at the margin, lower the profitability of these assets.

Concurrently, APRA will reduce the capital banks have to hold against small business, corporate and commercial property loans, which should improve the profitability of these assets.

Finally, the new framework will mean that all banks report comparable CET1 ratios, which has not historically been the case in Australia. In particular, the large major banks, Macquarie and a couple of others, also known as "internal ratings-based banks", report different (and higher) CET1 ratios than their smaller peers, called "standardised" banks.

(These two labels refer to whether the bank uses internal models to determine the amount of capital it holds against assets, which the larger banks do, or if they simply refer to a standardised regulatory guide to compute these numbers.)

2 topics