Is Cochlear too expensive?

Cochlear (ASX:COH) is one of Australia’s shining examples of technical adroitness and export attractiveness, an example to entrepreneurs of what can be achieved in Australia despite punitive wages and regulation.

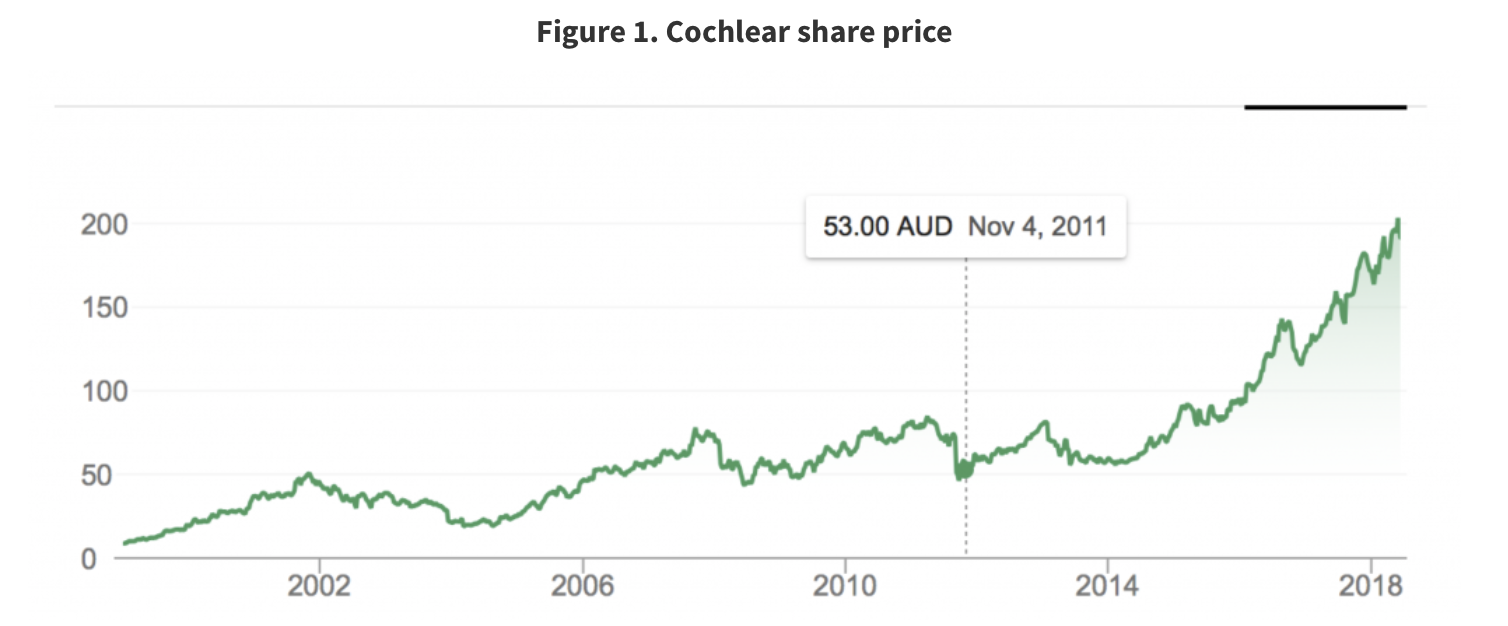

Back in September 2011, we added to our [then] position in Cochlear in The Montgomery [Private] Fund at a price below our then estimated intrinsic value of A$59.00.

The Cochlear share price had plunged to $51.30, or about 40 per cent, since its April 2011 high of $85. From 2004 until 2011, the price had been persistently above our estimate intrinsic value estimate, which meant the combination of circumstances that pushed the share price below our estimate of the then intrinsic value was worth exploring.

In simple terms a great Australian company, founded in 1981 and with significantly larger estimated market share than its nearest rivals, Advanced Bionics and Med-El, had fallen on temporary tough times.

After announcing a voluntary recall of its flagship Nucleus CI500 implant range (the Nucleus accounted for more than 70 per cent of sales and the recall was on the back of a 1 per cent failure rate – or about 250 units that hadn’t yet been implanted), investors sold the stock heavily.

It was obvious that the proactive and patient-focused response of the company was designed to ensure that any long-term reputational damage was minimised.

At the same time, one of Cochlear’s rivals had received FDA approval to sell its product (which was itself recalled in November 2010) into the US market.

It was not unsusal for companies in the space to gain and lose sales as a result of newer and superior products being launched. It was however unusual for Cochlear to stumble and many market participants were clearly unprepared and unimpressed.

Source: Bloomberg

While the financial impact was unknowable at the time, it was clear that it would be temporary rather than permanent. It was therefore worth examining the company’s history to gain a sense of its capacity and capability.

For the decade to 2011, Cochlear had increased profits every year with the exception of 2004. In 2002 profit was just $40 million and profits had grown to $180 million by 2011. Operating cash flow over the same period had risen from less than a $1 million (an exception for 2002) to more than $201 million, allowing debt to decline to just $63 million from nearly $200 million in 2009. Net gearing had fallen to minus 1.86 per cent.

In very simple terms, profits for the ten years to 2011 had grown four-and-a-half-times but after the recall-related share price sell-off the shares were just 36 per cent higher than a decade earlier. More importantly, unit sales had grown five-fold over the same period from less than 5000 units to more than 25,000 units.

Even with only a cursory glance we could see this company, with a brilliant track record for adding value, was being unfairly treated by a market that often treats that which is temporary, as permanent. It was clear that the shares were cheap.

Markets always swing, from extreme bouts of pessimism to equally extreme bouts of optimism, and at this juncture in the interest rate, economic, and credit cycle, it is worth pausing and reflecting on whether unbridled enthusiasm has now gripped the shares.

In 2002 Cochlear generated a profit of $40 million and the share prices was about $34.00. In 2018, the company is expected to generate a profit of about $250 million (a falling $AUD will go some way to boosting 2019 too) and the share price is $203.00. In other words, profits are up about six-fold in the last 16 years, and the share price is up about the same. It’s no way to value a company, but if profits drive share prices, then over long stretches of time they should probably be reasonably aligned. Remember, in the long-run, the market is a “weighing machine”.

Most importantly, the company continues to generate returns on equity that are the envy of many, if not most, companies in the world. Despite increasing equity, the company consistently produces returns on its equity of over 40 per cent.

But the company also sold 32,554 units in 2017, which is only a third more than in 2011. As numbers get bigger it becomes harder to generate the same rates of growth that could be achieved off a smaller base. So more of the profit growth must come from price increases.

Our view is that to be safe, it would be wise to buy Cochlear at a lower price. That may yet be delivered through a market-wide dislocation or the company may one-day find itself falling on temporary hard times. Time will tell and it’s one to watch.

2 topics

1 stock mentioned