Is it time to hit the brakes on Carsales?

Livewire Markets

Poor Carsales. It must be hard to win when you're number one. It's expensive, the result was already priced in, and now they're idling in neutral, says Market Matters' James Gerrish.

Which will come as a surprise to some. After all, when the world shuts down, masks are made compulsory on public transport, and household wealth grows exponentially, you'd think Australia's largest online car trading platform would be growing at full speed ahead.

Whilst the numbers mostly remained positive in this mornings earnings report, investors were quick to shed their holdings as the stock did a U-Turn (pardon the pun) and dropped 2% at the market opening.

James Gerrish, who doesn't own Carsales, admitted he may have missed the boat in March when the stock was trading at $11.60. Now, with the company's PE sitting at a solid 44.8, and the share price above $20, the only metric that would have convinced Gerrish on the company is if they were able to beat expectations. Unfortunately for Gerrish, Carsales just met their expectations.

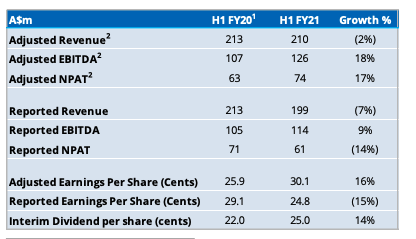

Carsales key result metrics:

- 2% decline in adjusted revenue year on year

- 18% growth in adjusted EBITDA (Earnings before interest, taxes, depreciation and amortization)

- 17% growth in adjusted NPAT (Net profit after tax)

- 14% growth in interim dividend per share (now sitting at $0.25)

In this Q&A, I discuss the key takeaways from this morning's result with Gerrish, the outlook for the company, and why, despite being withheld across the board, guidance is still critical for any investor analysing company results.

Source: Carsales investor presentation

Why don't you own Carsales.com?

It's a good point. The valuation has always concerned me. Also their push overseas - so they're in South Korea, Latin America etc. But it's probably a stock I've missed, to be honest with you.

What were the key points of the recent result?

Obviously, Carsales has done a good job in some challenging conditions, and it hasn't turned out to be as bad in terms of the backdrop for sales that was feared in March. Their revenue was $199 million for the half, which was a good number. If you break that up, $87 million of that comes from the dealer network.

So if you break the components of the business up you have:

- The dealer network, which is probably the biggest chunk of revenue. That was up 10% year on year. So that's obviously a good result and that's showing you that car sales through the dealer network are performing well.

- The private sales were an area that struggled. The numbers this morning showed $33.6 million in revenue for private sales. It was in line with expectations. But again, it shows the impact of COVID-19 - the social distancing restrictions, the lockdowns etc. and how this impacted private sales. So this is a negative of the result, but they talk to improving this trend at the back end of CY20 and that has successfully continued into 2021.

- Then you have display revenues, so the advertising and marketing. That was down 12% year on year. Again, that's another consequence of the declining private sales.

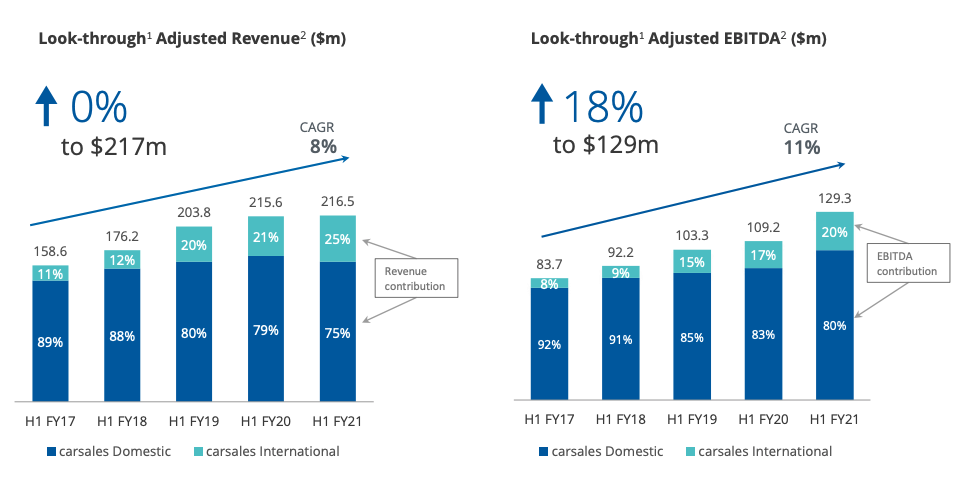

- The remainder of the revenue comes from international business. Carsales has got South Korean operations and Latin American Operations. These are relatively new, they're investing and growing over there. South Korean revenue was up 23%, and Latin America was up 11%. So that has grown which is promising.

- Another weak point of the result was their tyre sales business. That was weak again, but it's not a huge part of their business.

Source: Carsales investor presentation

So this morning saw a mixed result. But if you think about the half that they've just been through, they had a really weak period going into March, April and May and they've come out of that strongly towards the back end of 2020. They also talked this morning about the January run rates being similar to the exit run rates of December which is positive.

How did the results compare with your expectations? And those of the broader market?

Carsales had a really strong run going into the results. So in March, it was nine or ten bucks. It's now $22. That's a really strong resurgence. They've given trading updates throughout that period, and I think today's result was just not a lot of new news. Or news that will prompt the share price to go higher from here to trade at 37, 38 times. To me, in today's update there was nothing new to drive buying of the stock.

If you think about their outlook commentary, they talked about January being fine. But they then provided this customarily, fake outlook statement. They forecasted moderate adjusted revenue growth, and they talk about strong adjusted EBITDA and profit growth. So if you think about what moderate growth means in terms of adjusted revenue, you probably think that's high single digits, which would be my conclusion. The market is already at 9% adjusted revenue growth for the full year, so we're already there. That is not going to provide with impetus for the stock to go higher.

The crux of it is, the market was already factoring in these numbers and the numbers have delivered smack bang on expectations. You need more news to see the stock continue to run higher. Similar things are happening in the retail space at the moment - they're coming out with good numbers, but not above expectations which is causing the share price to fall.

What would it take for you to add Carsales to the portfolio?

To me, Carsales trade on too high a multiple for the business it is. It has such dominance in Australia, but that lends itself to competition. We haven't actually seen any competition for this company and that speaks to the footing that they've got in the market.

Carsales is expensive. As an investor you can't own everything, and this is something we don't own.

Gerrish's reporting season takeaways

I also took the opportunity to ask Gerrish about reporting season more generally, and why company's have been reluctant to offer guidance for the upcoming half. I asked, given this lack of guidance, if investors should still be placing emphasis on the company outlook. Here's his response:

You should always be focused on the outlook. At the end of the day, the majority of companies pulled guidance in the last six months, some have reinstated it and some are intentionally staying away from it. There's still a lot of uncertainty out there. Think about the backdrop - you have all the stimulus checks, JobKeeper and Seeker and you probably don't have an understanding of how that's going to impact your business. There are so many factors that could impact guidance so if you don't have to offer it, why would you? You would rather invest in a company that doesn't issue guidance as opposed to one that puts it out and steps away from it. What I'm getting at is reporting season is just a flow of upgrades. So even though guidance is not firm, I mean, the run rates at all these companies are coming out of the period, and it's really strong.

Want more earnings season Q&As like this?

Hit like so we know that you want more of this type of content.

Throughout February, my colleagues Glenn Freeman, James Marlay, Mia Kwok, Nicholas Plessas, Patrick Poke and Angus Kennedy will also publish similar Q&As on Livewire readers' most-tipped big caps and small caps. Hit FOLLOW on out profiles to be notified when these wires are published.

1 topic

1 stock mentioned

5 contributors mentioned

Bella is a Content Editor at Livewire Markets.

Expertise

Bella is a Content Editor at Livewire Markets.