Is the 60-40 portfolio model still relevant?

As inflation has begun to tick up in recent months, prompting a shift in central bank policies around the developed world, the yields on fixed-income assets have also risen. This saw US 10-year Treasuries hit a three-year high 0f 3.2% on 9 May, though they’ve since pulled back to around 2.8%.

Key takeaways

- 60/40 has served many investors well: Schroders and Morgan Stanley Wealth Management

- The new macro regime means bonds are no longer the best approach for the times: WealthLander

- The old balanced portfolio model leaves investors at risk of missing diversification benefits: Talaria Asset Management

At the same time, risk assets (primarily stocks) have been even harder hit by geopolitical events including the Russia-Ukraine war and China’s heightened struggle to control the new spreads of COVID-19. Large swathes of global stock markets have sold off, the US S&P 500 closing below 4000 points on 10 May before rising slightly, then diving again on 19 May, its lowest levels since last March. And the NASDAQ is at its lowest point since November 2020.

This saw parts of the fixed income market emerge as the “least-worst” option for many investors, at least the shorter-duration and floating rate credit assets.

What do these recent market events mean for investors trying to build a balanced portfolio?

For decades, the 60/40 model – 60% stocks, 40% fixed income – was the rule of thumb. But this guideline has taken some knocks over the years, particularly for those nearing retirement. It’s a subject that’s been raised several times on Livewiremarkets.com in the last six months:

As inflation looks set to remain elevated for the foreseeable future, this three-part series weighs the relevance of the 60/40 model. I asked the following contributors for their thoughts:

- Simon Doyle , CIO and head of multi-asset, Schroders Australia,

- Alexandre Ventelon, head of research and investment strategy Australia, Morgan Stanley Wealth Management

- Jerome Lander, CIO, WealthLander

- Chad Padowitz, co-chief investment officer, Talaria Asset Management

In part one, they each discuss whether they believe the 60/40 model for a balanced portfolio is still relevant.

Investors underestimate the timeframe

Simon Doyle, Schroders Australia

The 60/40 ‘balanced’ portfolio has served investors (in aggregate) well over a long period of time. The model fundamentally recognises that equities pay investors a premium over time, and that for the most part, bonds and equities are good diversifiers. Looking back over the last few years, and ignoring recent volatility, this has held largely true.

We also know that these ideas don’t always hold. Equities can perform poorly for long periods and bonds won’t always act as a good diversifier, particularly if markets are grappling with inflation. It’s worth remembering that between 1966 and 1982 (over the 16-year period traversing the stagflation of the 1970s) US equities declined by around 2% pa in real terms. Likewise, between 2000 and 2009 (through the tech bubble bust and the Global Financial Crisis) real returns from US equities declined by just over 3% a year, in real terms. Both were extended periods where the 60/40 model did not serve investors well.

This suggests that investors underestimate the investment horizon needed for the model to deliver the real return outcomes that they seek. We’ve done a lot of analysis on this – starting back in the mid to late 2000s, when we had clients concerned about markets but with limited ability under a fixed strategic asset allocation framework – such as the 60/40 portfolio – to adjust positions.

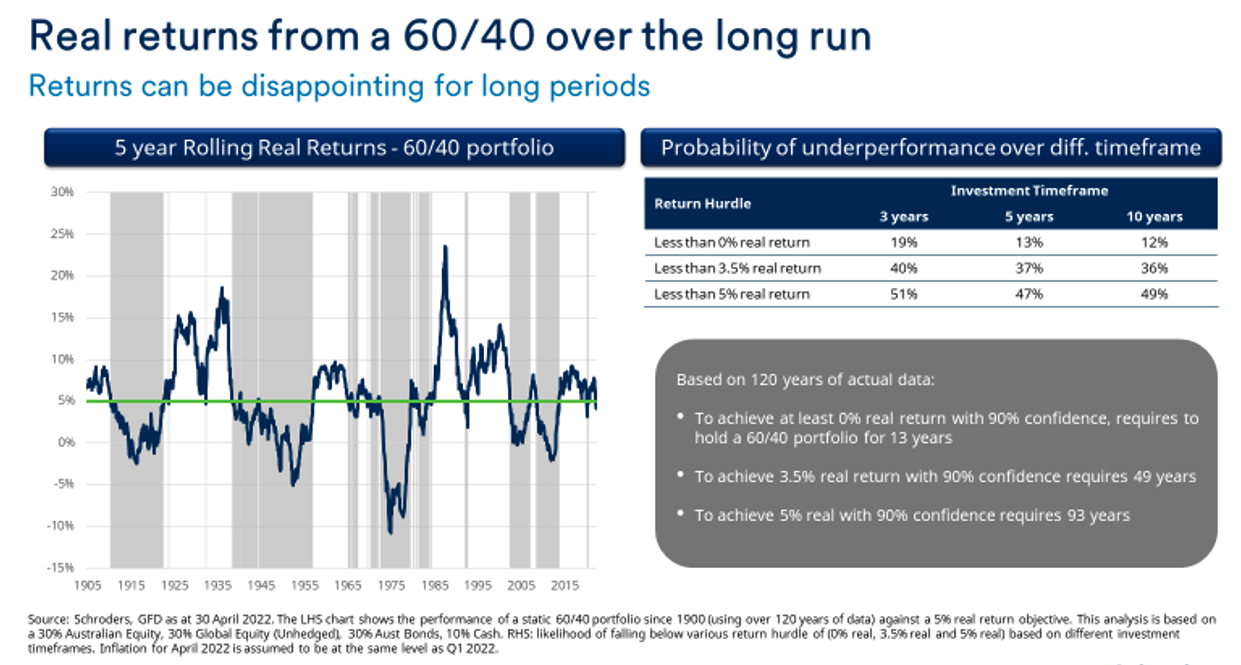

The chart below highlights this point. If we consider a long sweep of history as our data set (120 years), we’d need a time horizon of almost 50-years to be 90% confident of a real return of 3.5% a year.

The most challenging periods tend to correspond with periods of high and problematic inflation (like the 1970s) or following extreme overvaluation. Starting to sound familiar?

Doubts are understandable, but...

Alexandre Ventelon, Morgan Stanley Wealth Management

Based on the recent performance of stocks and bonds it is reasonable for investors to be challenging the relevance of the traditional 60/40 balanced portfolio.

This is the worst start to a year on record for bonds, with the Bloomberg Global Aggregate Total Return (USD) Index down around 7.5% year to date. This performance has also coincided with a sell-off in equities, with the MSCI World Net Local Total Return Index down around 15.5% over the same period.

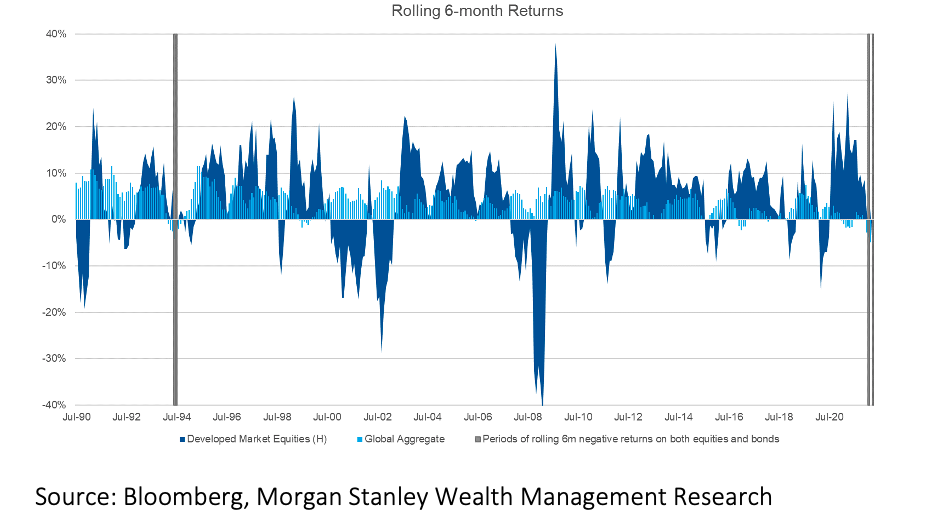

The last time we saw a multi-month sell-off in both global equity and bond markets was in 1994 – a time when the Federal Reserve also had to sharply reverse policy.

Since 1990 global bonds and global equities have posted negative six-month cumulative returns together only twice

So, this weakness in both bonds and equities is extremely uncommon. Since 1990, it has occurred for only around 10% of the time in any given month and less than 1% based on six-month rolling periods. It is also important to note that periods of negative returns for both bonds and equities tend to be:

- Associated with a rise in the inflation pulse, which in turn forces key central banks to accelerate their tightening paths, thus pushing markets to reprice a new trajectory for rates; and

- In general, short-lived. After an inflation push, either the economic momentum resumes and equities recover, or on the contrary, recession risks rise.

In the latter scenario, bond yields mostly end up falling and consequently bond prices rally. This in turn provides a diversification benefit, offsetting losses on stocks.

Further support for the traditional 60/40 balanced portfolio is provided through back-testing our 60/40 Strategic Asset Allocation model over the last 30 years. Our analysis showed that this balanced allocation would have returned 8.6% a year, creating 6.3%. of value above inflation. In addition, our Core Balanced Model Portfolio, which has a targeted 60/40 split between Growth and Defensive assets, has returned 8.3% annualised since its inception in 2012 – and this is despite the recent price falls in risk assets. This shows that, for investors with a medium-term horizon, the 60/40 portfolio has done the job and it has done it well.

In addition, over the long run, asset class returns are largely driven by starting valuations. When we last ran our capital market assumptions in August 2020, the Bloomberg Global Aggregate Index yield was at around 1.0%, it is now at around 2.6%. Similarly, the MSCI World 12 month forward P/E was trading at around 19.4 times, versus 15.2 times at present. Therefore, value is now more evident in both bonds and equities and we believe investors can reasonably expect more "‘normal" returns on a balanced portfolio. In this context, the traditional balanced allocation remains particularly relevant for long term investors.

“It’s no longer the most suitable approach”

Dr Jerome Lander, WealthLander

It is still relevant only in the sense that it is the basis of most investment approaches, and the status quo takes time to kill. But it is no longer the most suitable approach for the times now that the investment regime has changed.

We’ve moved out of a period of peaceful prosperity and globalisation when disinflation and ever lower interest rates were the norm, and the central banks reacted aggressively and favourably to every problem. This period lasted for a very long time but the outlook is now far more challenged.

In the old macroeconomic regime, the 60/40 portfolio did reasonably well because just about everything in this approach went up as discount rates came down, and bonds and equities were often negatively correlated when they didn’t.

Now we’ve moved into a new regime of deglobalisation, great power politics, and more overt frictions between major powers. Large challenges such as inflation, war, climate change, and physical supply issues to energy and food will likely provide greater impairment to corporates valuations and/or profits and changes to the way societies trade and organise their economies.

Bonds may more frequently exacerbate rather than diminish risk from equities. This new regime may also see higher inflation persisting for a decade or more (albeit potentially in a volatile manner), and less market-friendly central banks and governments. There is a greater risk of stagflation and recessions as real growth is low and the underlying fragilities of the previous periods are exposed in an era of low growth and high debt. In this environment, greater portfolio selectivity and risk diversification is required.

As we have many times in the last century, we could even see a 10 or more year period when bonds and equities broadly make no or little returns and instead simply expose investors to unrewarded risks.

In our view, being different is now a feature not a bug and producing more thoughtful and actively managed portfolios gives investors a greater chance of not being exposed to a predictably poor outcome.

“Investors are still at risk”

Chad Padowitz, Talaria Asset Management

Historically bond prices moved inversely to equities, as investors seek a safe haven in difficult times as well as the expectation that interest rates may drop in such an environment. This enabled investors to diversify into these two asset classes that complimented each other well. But due to this correlation turning positive – that is, bonds and equities both rise and fall together – this is of much less value. It is partly lower bond yields (higher bond prices) that have helped drive equities higher as well.

Currently, higher yields from historically very low levels of bond prices have affected equity markets, particularly those of longer duration (think higher PE or Growth stocks) which have come to dominate the equity index. Investing in higher PE stocks leaves investors further away from getting their money back, as inflation means a dollar today is worth less in the future. We believe this dynamic is still prevalent and investors are still at considerable risk of not getting the diversification benefits of a 60/40 portfolio. For this reason, they need to find other avenues to deliver returns and diversify risk.

In conclusion

So, that’s two each for the affirmative and the negative. In the previous discussion, Schroders’ Anthony Doyle continues to support the 60/40 model, with the caveat that investors must understand the need for an adequate investment timeframe.

One of the wealth managers surveyed, Alexandre Ventelon of Morgan Stanley Wealth Management, largely agreed with Doyle's view, though acknowledged he understood why some investors would question the approach, given the long period of positive correlation between stocks and bonds.

On the other hand, WealthLander’s Jerome Lander believes the new era means greater risk diversification is required. And Chad Padowitz of Talaria Asset Management voiced a similar view around the greater risk that investors using a 60/40 portfolio are at risk of missing out on the diversification benefits the model historically delivered.

Stay up to date with this series

Make sure you "FOLLOW" my profile to be notified when later parts of this series are published. In part two, our contributors will discuss whether rising bond yields could change the way investors think about fixed income allocation. And in part three, they each discuss one aspect of the market they believe investors should consider.

2 topics

5 contributors mentioned