Is this a correction or the beginning of the end for shares?

Central banks in advanced economies have come to realise elevated inflation will persist for longer. They no longer see inflation as transitory, and recognise it will take longer for the supply side of the economy to catch up with surging demand.

As COVID 19 transitions from a pandemic to an endemic that we live with for years to come, shortages in key elements of the supply chain from semiconductors through to shipping will continue for longer.

The energy transition is complicating matters further with tightness in coal, gas, oil, and uranium markets. Coal shortages in China, gas shortages in Europe and the US, and oil shortages in the UK (brexit-related) are placing upward pressure on energy prices. You may recall the important role energy played entrenching inflation in the 1970s.

The longer inflationary pressures persist, the more established they become. Household expectations of inflation are key — product shortages and images of fuel queues are not helpful.

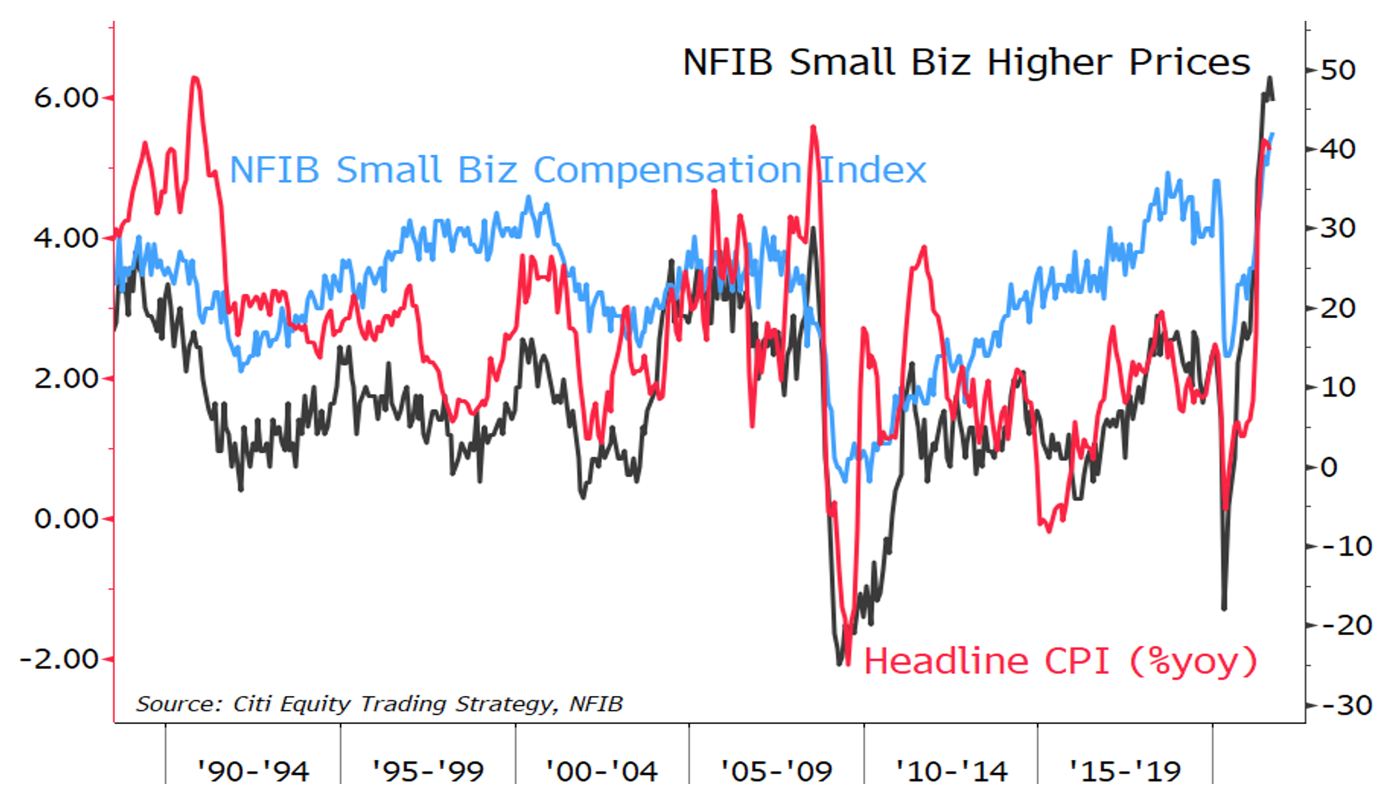

While there is slack in the labour market, this is in the services sector. Employers elsewhere are struggling to entice people back to work. This chart shows how compensation pressures for small businesses are building rapidly and how they intend to push price increases through.

US wages and prices are accelerating

Central banks have become more hawkish in recent weeks and interest rate markets have adjusted quickly as bonds have sold off across the term structure.

The US Federal Reserve has committed to a tapering of asset purchases faster than expected and cash rates have risen in a number of OECD countries.

Meanwhile, the Reserve Bank of Australia has been steadfast in sticking to its 2024 timetable for the first rate hike, given benign inflation conditions in Australia.

“Wage and price pressures remain subdued in Australia," the RBA's recent monthly report says. "In underlying terms, inflation is running at around 13-14 per cent and wages, as measured by the Wage Price Index, are increasing at just 1.7 per cent. While disruptions to global supply chains are affecting the prices of some goods, the impact of this on the overall rate of inflation remains limited.”

The large gap between market rates for maturities out to 2024 and the RBA’s forward guidance would indicate the central bank is well behind the curve tightening policy. The Australian dollar actually rallied after the announcement, suggesting currency traders have little confidence in the guidance.

Central banks typically act in concert when the environment changes and the tone has definitely changed in recent weeks. The tightening cycle has begun.

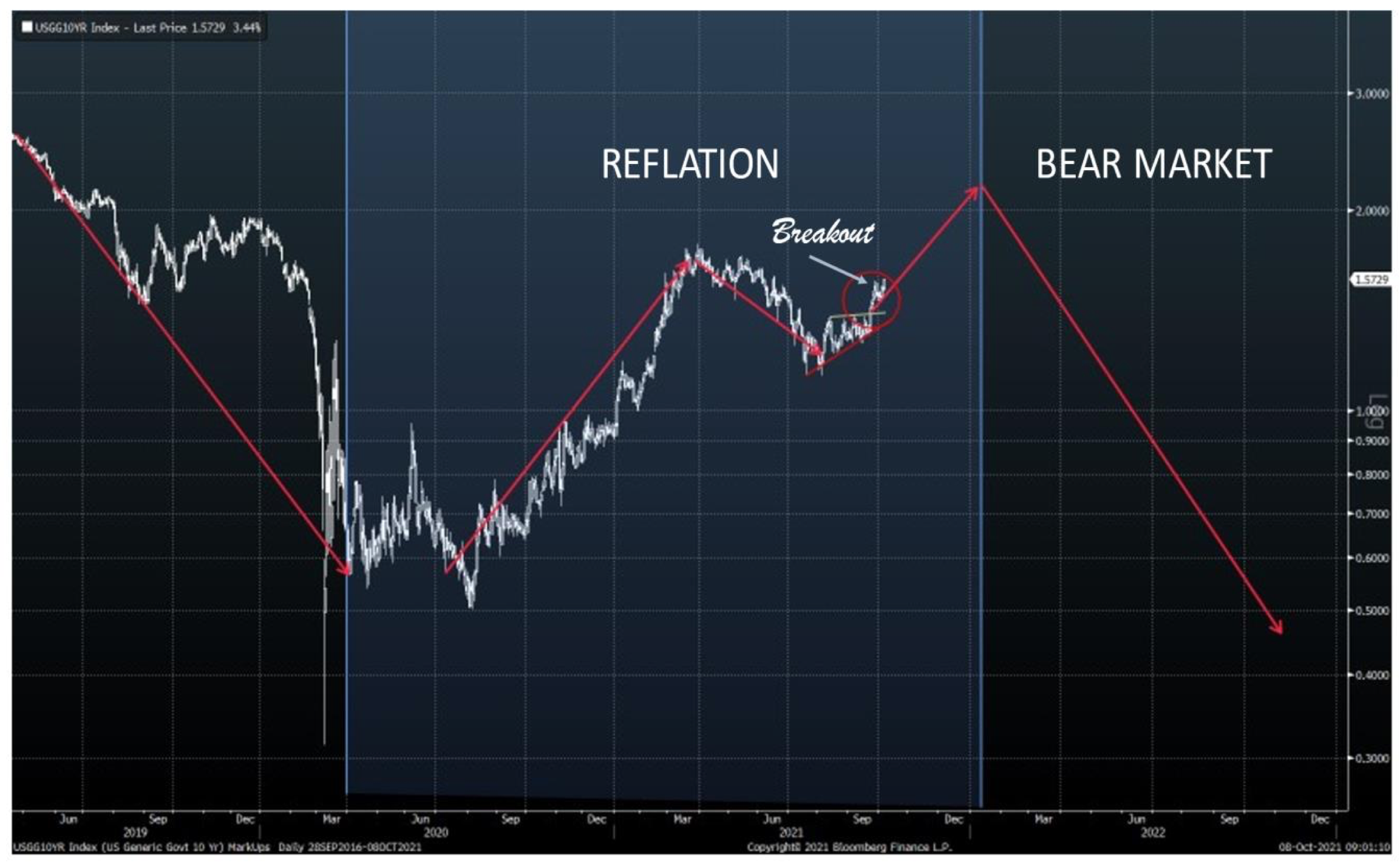

The chart below shows how US 10 year treasuries have been falling (yields rising) since the depths of the crisis in March of last year. This is the reflation phase. Bond prices reversed and started rallying again from mid-year as delta hijacked the recovery. With the success of vaccines in containing the disease, bond investors are now looking beyond delta and have resumed their selling. Yields have broken out, as the chart indicates.

This is a clear signal to equity investors to re-engage in the reflation trade. We would expect this next phase to continue into next year before policy tightening pushes us into the next bear market in shares and bonds resume their long march higher (yields lower).

US 10-year treasury yields break out

Source: Bloomberg

The other key indicator to watch in the reflation trade is the US Dollar Index (DXY), which has moved up and down in sequence with treasuries. While the dollar hasn’t broken down as clearly, reversals in cross rates such as the AUD:USD would suggest a US dollar peak is imminent. This will be the next penny to drop, before doubling up on the reflation trade, eg, buying domestic cyclicals and mining.

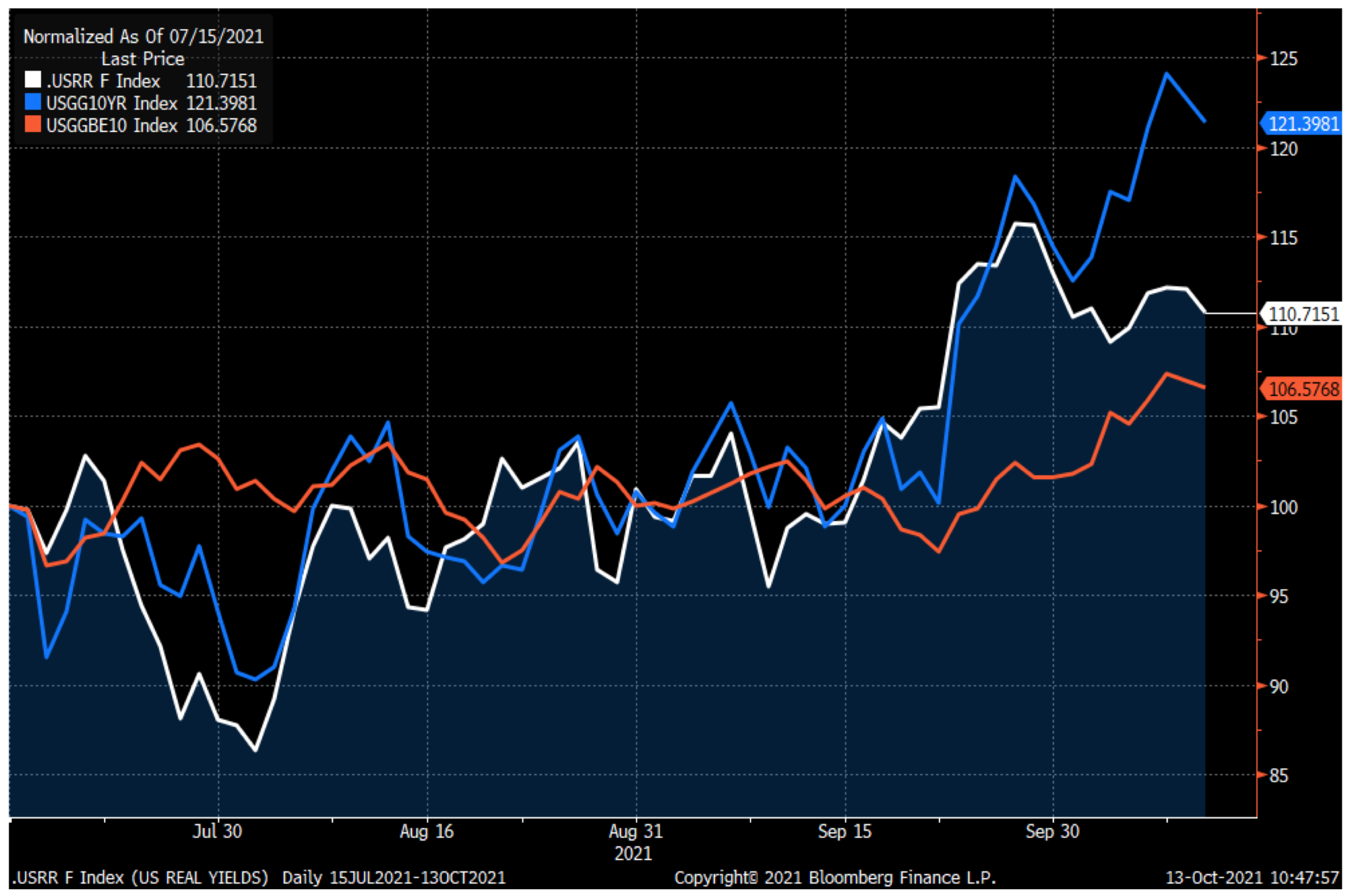

The nominal bond yield is the sum of the real underlying interest rate on a bond plus inflation. A 10 year US treasury is currently yielding 1.6%. As we can observe inflation expectations directly via an inflation-adjusted bond (break-evens), we can establish what the real underlying bond yield is.

At a real yield of -0.9%, you are assured of losing money, after adjusting for inflation, if you hold these bonds to maturity. This is true for bonds in most western economies, including Australia.

Real interest rates will move up and down with growth expectations for the economy as central banks manage policy settings through the cycle. They will increase when the economy is growing above potential and fall when the economy is operating below potential.

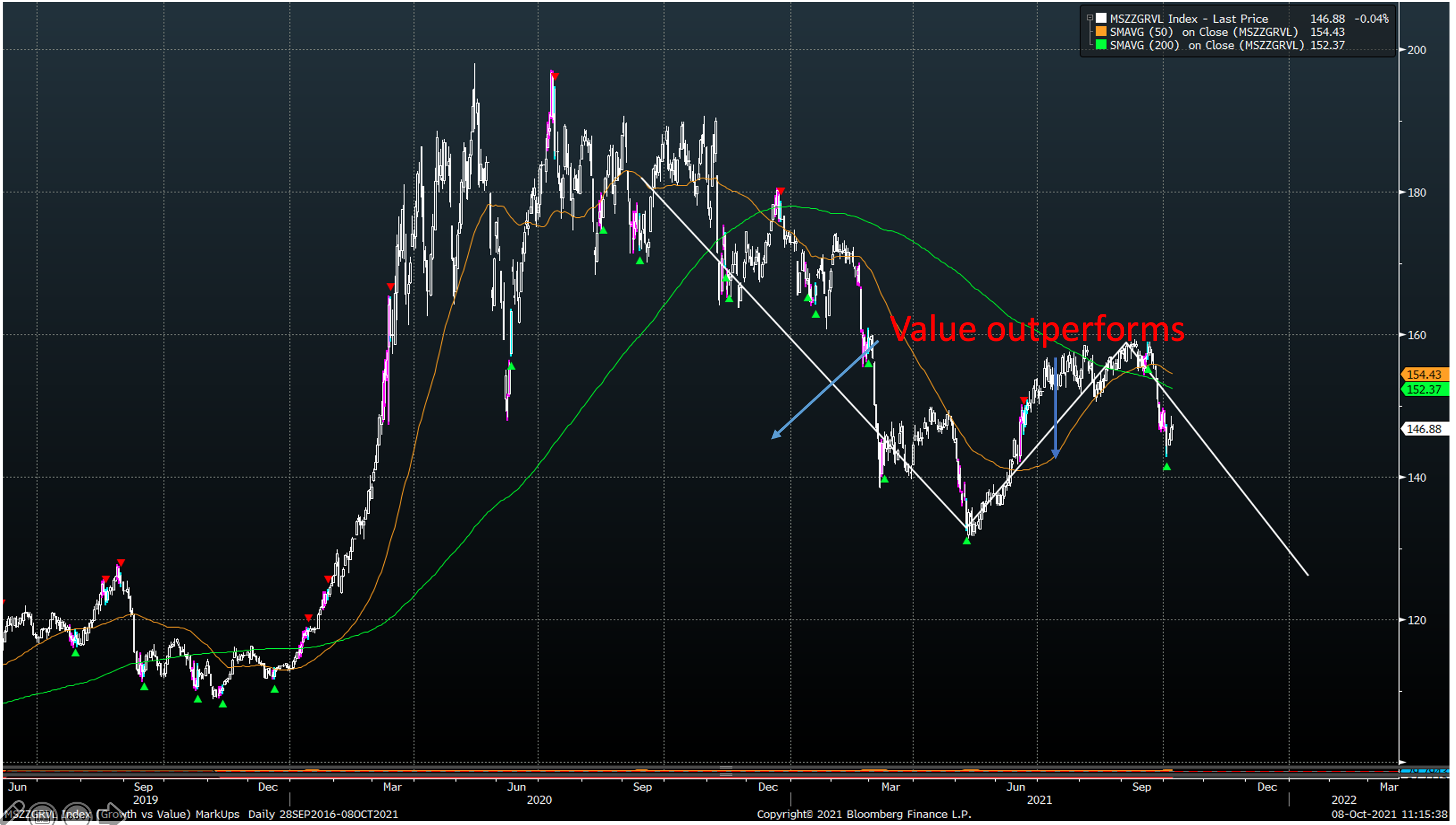

It is important to try and unpick these two underlying factors influencing bond pricing as they have different implications for the share market. If inflation is the key driver, then value sectors will outperform growth, which has been the case in recent weeks. If economic growth is the catalyst, then cyclical shares will outperform.

In the chart below you can see the breakout in bond yields (blue line) has been driven principally via rising inflation expectations as reflected in break-evens (orange line). Real rates are largely unchanged, in keeping with the weaker economic data (white line). The break-evens (USGGBE10 Index) are the best indicator of inflation to track. Since moving higher, the commentary from central banks has become distinctly less friendly and share markets have corrected.

What is moving bond yields higher?

Source: Bloomberg/Watermark

Bond yields are crucial in setting prices for risk assets more broadly. As yields rise, shares should de-rate (in price/earnings or valuation terms). Higher P/E sectors (growth) are more vulnerable to this shift than lower P/E sectors (value).

Reflecting this, we have seen a rotation out of growth sectors such as healthcare and technology in favour of value sectors such as energy and banking in recent weeks.

Value has started to outperform growth sectors again

Source: Morgan Stanley Indexes

Economists have been cutting growth forecasts for months now as delta rages. Expectations for US growth in this quarter have been slashed from 8% at the beginning of the year to just 2% currently. With growth decelerating, defensive shares have been outperforming cyclical shares that are more exposed to economic activity.

To complicate matters further, many value segments are also cyclical sectors (eg, media, building materials, contractors, steel, chemicals). These value segments have not been bid up because the economic data has been weak.

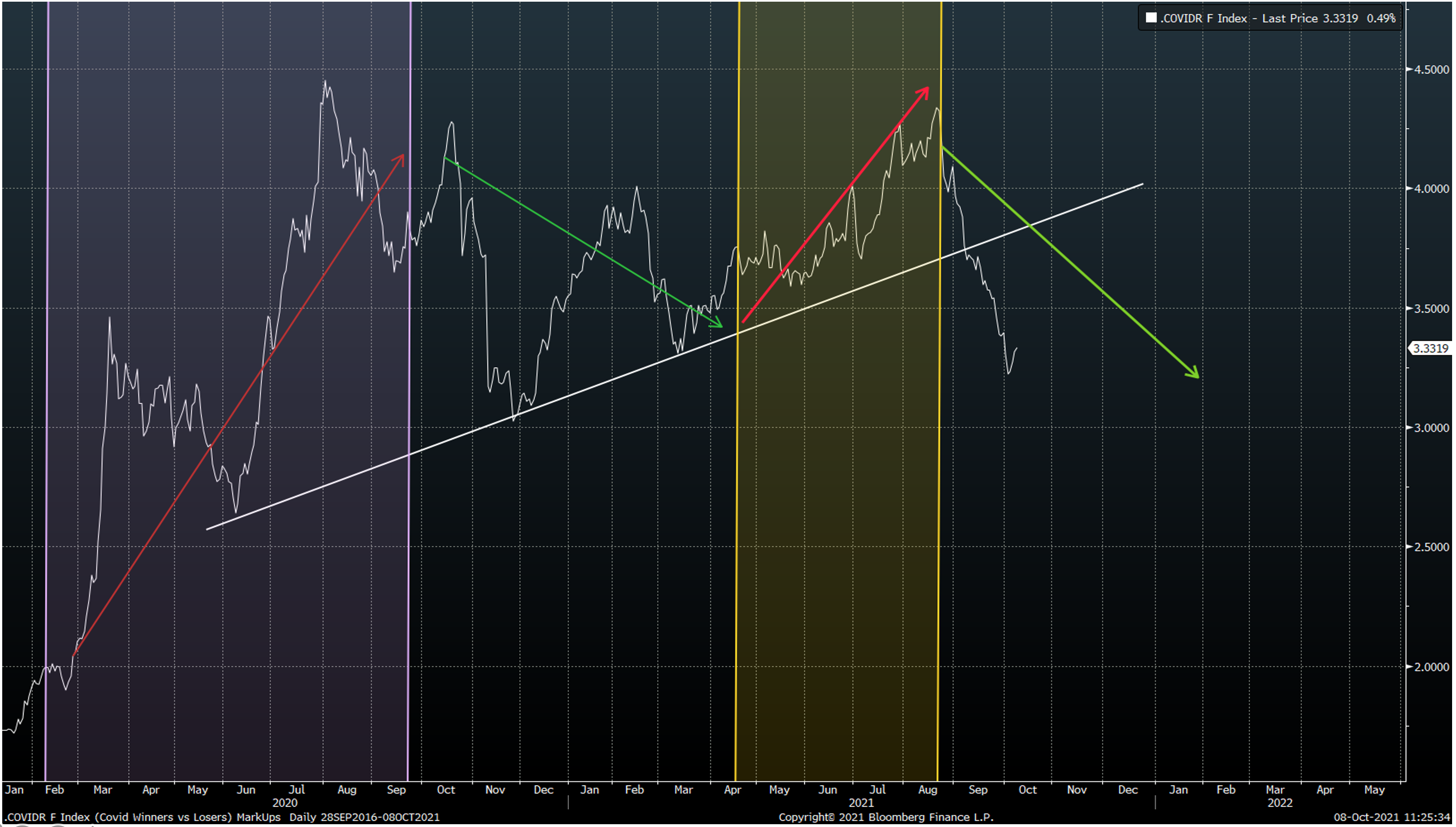

The other major theme influencing leadership has been the progression of the disease itself. Sectors that outperformed in the worst periods — COVID winners such as groceries, healthcare and e-commerce — have been outperforming since delta erupted in May.

With the infection rate now falling in major economies, these sectors are now underperforming again while COVID losers such as travel and leisure, fuel retailers and casinos have resumed their leadership. We have curated indexes for these groups and show the relative performance of COVID winners versus COVID losers in the chart below.

The two major waves of the disease are highlighted. COVID winners outperformed through these periods. As Delta passes, COVID losers will again outperform.

COVID winners versus COVID losers

Source: Watermark Indexes

As economies open up, we should start to see the activity data improve in the months ahead. Cyclical sectors will return to favour and lead the market higher.

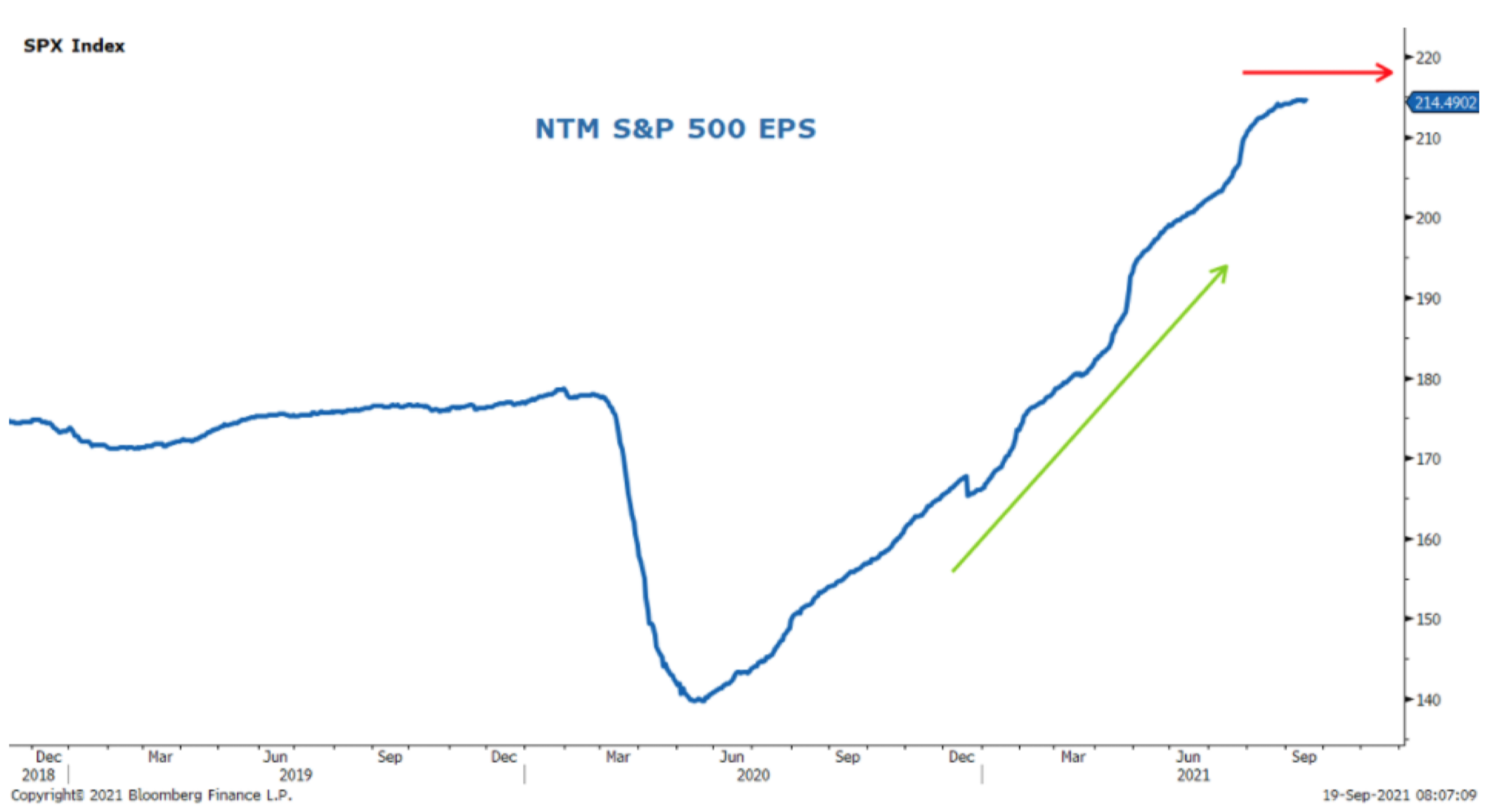

A word of caution, though. The chart below shows we are well past the sweet spot in this recovery cycle, as leading indicators such as the purchasing managers' index have peaked along with profit expectations. Sell-side forecasts for company profits this year have stopped going up and may well fall as US companies report third-quarter earnings in the weeks ahead.

S&P 500 profit expectations have peaked for the year ahead

Source: Bloomberg

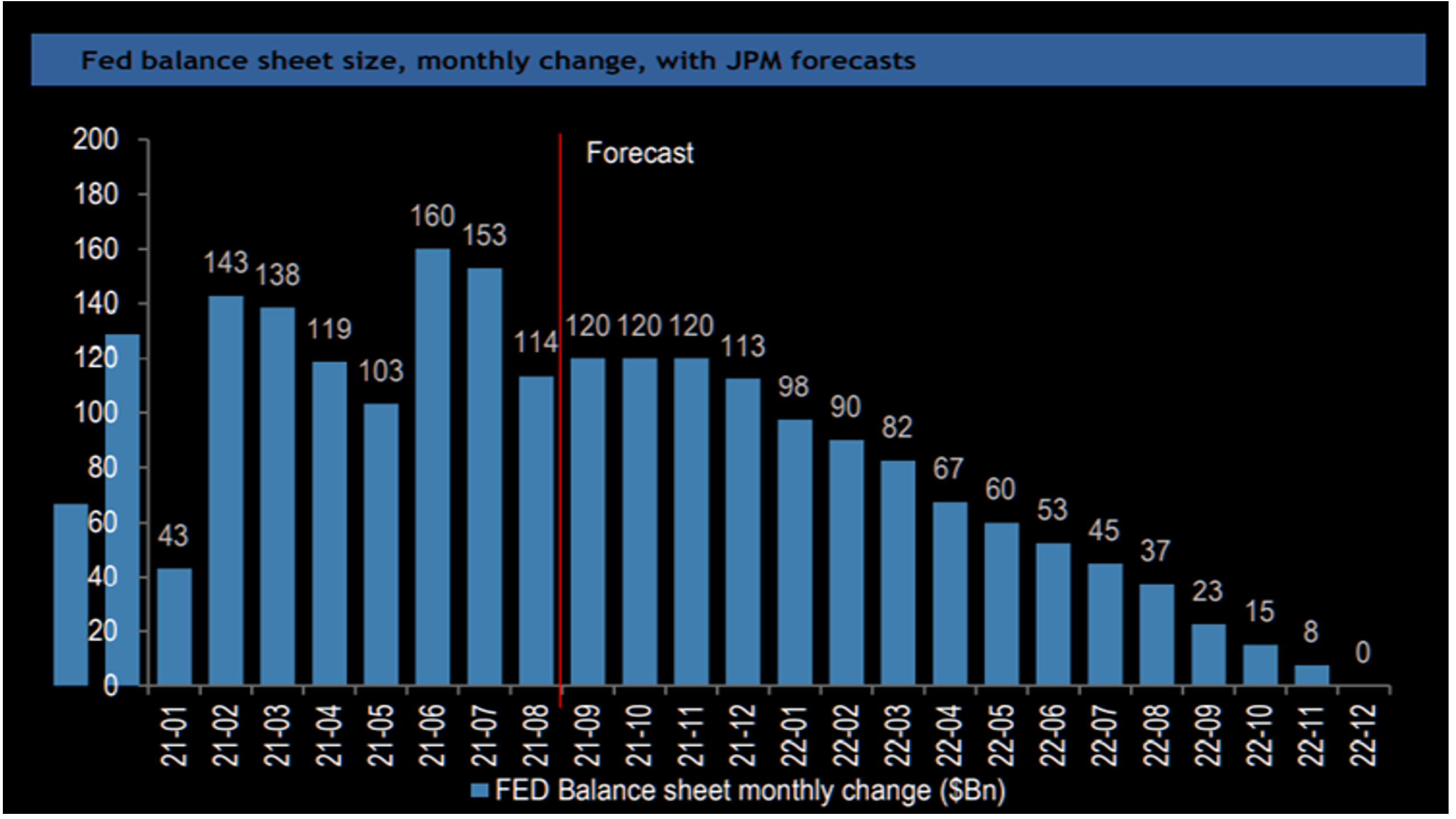

Moving into next year, monetary stimulus will be progressively withdrawn, as the chart below shows, and investors will be challenged by rates increasing across the spectrum, especially if inflationary pressures persist as expected.

Withdrawal of central bank liquidity is becoming a major headwind

Source: JP Morgan

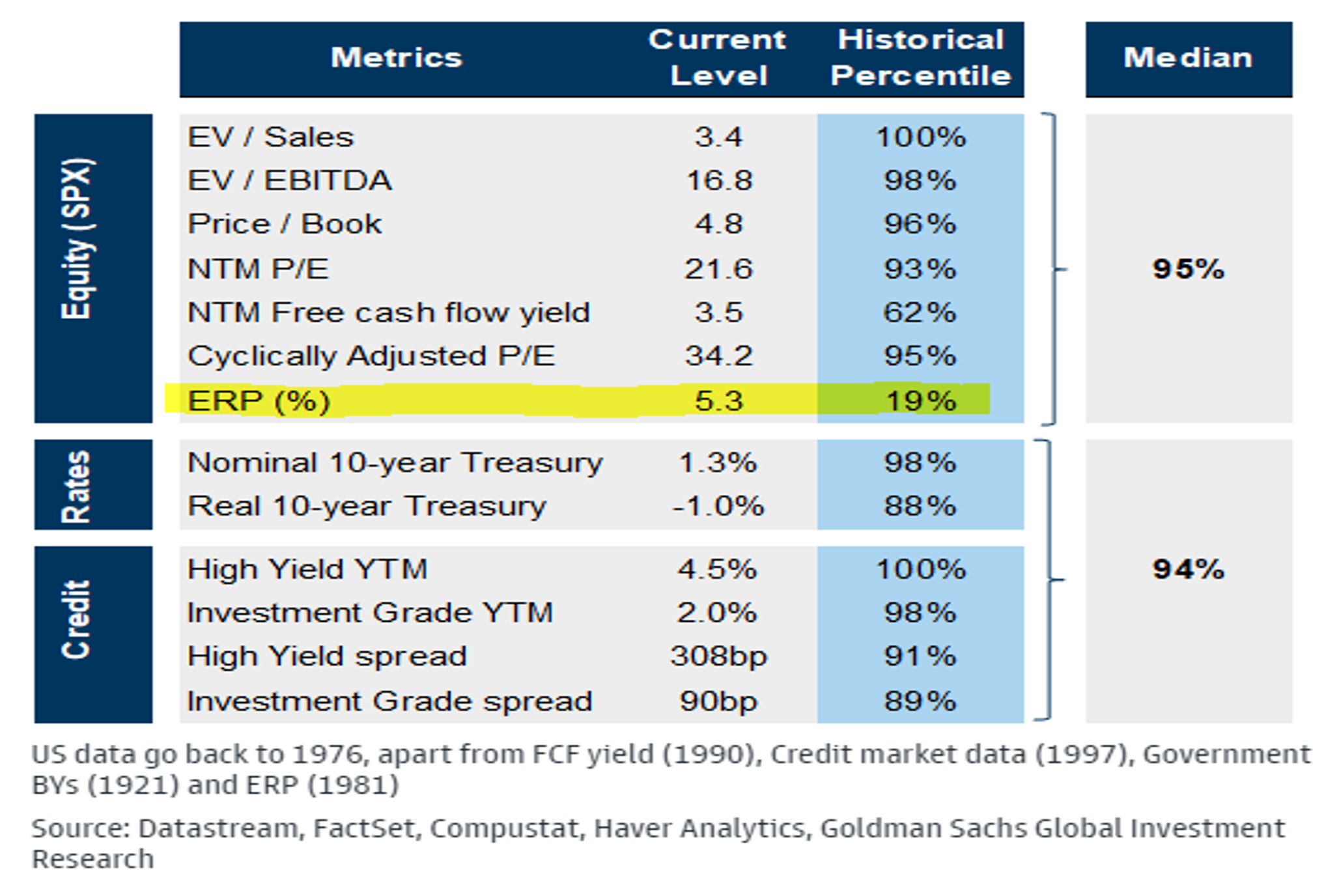

Finishing off with valuations, you can see in the chart below how expensive shares are under a range of valuation metrics. Goldman Sachs have looked at the historic data using seven common valuation metrics and in most, shares are above the 90th percentile. Only in comparing shares with bonds, the basis of calculating the equity-risk premium, can investors find comfort. However, this simply reflects how overvalued bonds are at more than 90% versus history. As reflation pressures re-assert themselves, bonds will continue to sell off, taking away this one last support for equity values.

Credit markets are also pricing little risk. High-yield bonds (junk bonds) with default risk are offering little more than 3%. This is what you get when there is no alternative but to take risk given real rates are so low. Valuations and risk spreads are extremely stretched.

Valuations at extremes for shares, bonds and credit

In summary, central banks have recognised in recent weeks that they need to back away from emergency settings. In anchoring the cash rate at the zero bound until 2024, the RBA could easily find itself well behind the curve, with real interest rates as low as -3% in Australia, and back-pedalling fast. This would be very disruptive for asset markets.

While October is one of the more volatile months of the year for shares and may still hold some surprises for us, I suspect the correction is over for the time being.

Shares are likely to rally in the fourth quarter and into next year, led by cyclicals, with the market reaching new highs. Investors should see this move higher as a top-building process, but a peak forming in the first half of 2022 will signal the end of the 12 year bull market.

Enjoy the last and final leg into year-end, then get ready for a more difficult year for shares. We are well-positioned for the challenges that lie ahead, as demonstrated by the portfolio’s resilience in recent months as share markets have corrected.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics