Is this the start of another commodities supercycle?

Another day, another skyrocketing commodity - or so it seems. Over the past few months, various commodity-related stocks have taken off, while our local energy and materials sectors have soared 24% and 10% respectively year to date. Meanwhile, the S&P GSCI - the index which tracks the performance of the global commodities market - has lifted 26% (over the past year, it's up more than 50%).

Investors have pointed to long-term underinvestment in traditional energy sources, relatively new inflationary pressures, as well as Russia's war in Ukraine for their reawakened interest in energy and commodity stocks. But can these miners, producers and explorers continue to trade at elevated prices for longer than we think?

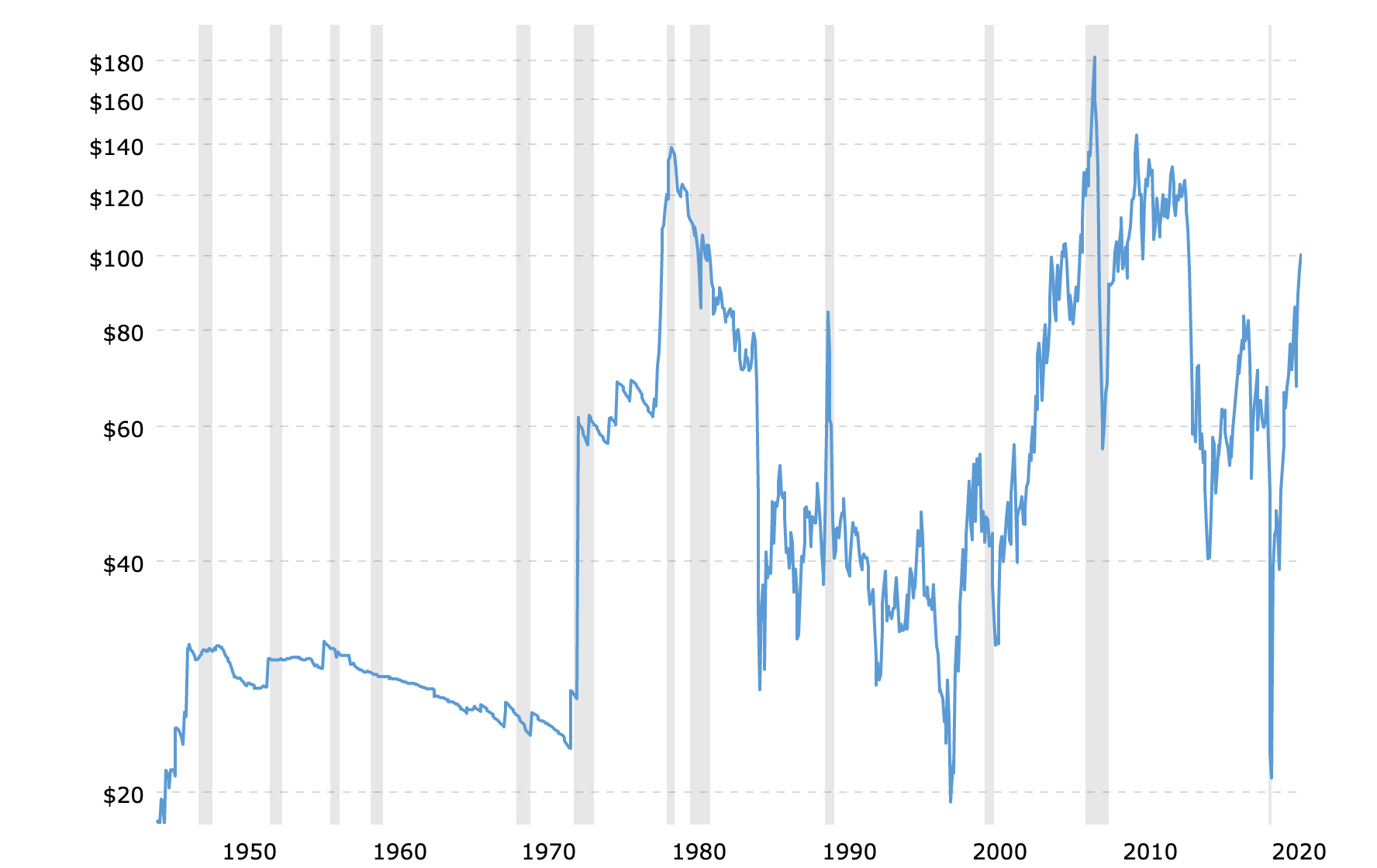

Interestingly, there have only been four "commodity supercycles" since the 19th century. The most recent started in the 2000s as China began to rapidly industrialize and modernise its economy. While this supercycle was briefly interrupted by the Global Financial Crisis, the bubble didn't truly pop until 2014, when oil peaked at US$107.95 a barrel (for some context, today, crude oil prices are trading around US$103.38 a barrel. See chart below):

So is this the start of another commodities supercycle? And which commodities (and stocks) are looking particularly attractive over both the short and long term? To answer these questions and more, we spoke to Tribeca Investment Partners' Jun Bei Liu.

Note: This interview took place on 29th March 2022. You can watch the video or read an edited transcript below.

Edited transcript

Could this be the start of another commodities supercycle?

Jun Bei Liu: We're probably unlikely to see the super boom that we saw in the 2000s. Remember those years were underpinned by incredible demand out of an emerging Asia, where they were building lots of roads and infrastructure. And the world was really going through an incredibly strong pick up in activity, and it was demand-led. Right now, the commodity cycle is actually incredibly interesting. It's really created by supply chain disruptions.

The globalisation we have seen in the last few decades has really brought all the world's countries together, in terms of where we source commodities.

Right now, the disruption that's taking place, whether it's caused by COVID related restrictions in some countries or whether it's due to the current conflict in Ukraine, all of that together has meant commodity prices have been incredibly high and resources companies are really going through an incredible boom period in terms of the earnings that they generate.

What has caused the price spikes in energy markets?

Energy prices, on the hand, are the same. It has essentially been caused by a lot of disruption and the global economy rapidly recovering. You're seeing inflation flying away in the US. It means the demand environment is very strong for the likes of energy, and they are really struggling to meet this demand because no one has really invested in traditional energy sources for some time.

But of course, this is aside from the conflict in Ukraine and all the sanctions that have been put in place in Russia. Russia, as we know, is a big producer of energy, as well as a few other metals. And then Ukraine itself is a big producer of a lot of soft commodities. So that has created an enormous spike across the commodity space. Prices have come off a little bit since their peaks, but with all these sanctions in place, it's very unlikely we will see those prices return very quickly to what they were.

How will decarbonisation impact energy and commodity prices over the next decade?

I think decarbonization is a very interesting thematic. It really gathered momentum in the last few years, with the media as well as institutions now really catching on to that wave. Now what we are seeing is that there's a significant shortage in terms of energy, and of course, there's other disruption. We talked to the conflict in Ukraine and a few other things that is creating that shortage.

Altogether, it just means that for the time being, energy prices will remain elevated because there hasn't been enough investment into those assets. And given the sanctions on Russia, they may well be sustained for longer than what we expect.

However, that theme, the decarbonization theme is not likely to go away. We'll see further investment into that space. It's just that we are going through that transition right now where we have to learn to live with higher energy prices.

Lithium stocks were among the best performers in 2021. Are you still finding attractive opportunities in this area of the market?

Lithium is a very interesting space that we are paying a lot of attention to. It's done incredibly well. Although the share prices of lithium stocks have done very well, it has become a little bit volatile because equity markets have become more volatile.

But I think that theme will remain intact for many years to come, because the underlying demand environment for lithium, or lithium batteries, has just gone from strength to strength. You've seen so many markets and economies now commit to really shifting to EV or at least partial EV. So the demand environment has expanded enormously.

And what we have, the existing lithium, is just not enough. So really, you need the technology to pick up to make lithium more efficient. At the same time, you need more lithium. So that sort of environment does make this sector look incredibly attractive. It's almost like a "buy the dip" sector at this point.

In your view, which commodity has the most upside?

I love this whole commodity space because there are so many opportunities. But it depends on the timeframe.

If we look at a longer-term timeframe, lithium looks incredible, but say over the next 12 months, it does make the energy sector look incredibly interesting.

It's becoming a bit more volatile from the disruption, because of the conflict between Russia and Ukraine. However, I think you can comfortably say that looking past that, energy prices will be well supported because of the sanctions in place and because of the reopening of economies. There will be more jet fuel consumed. There will be more demand for energy with very, very limited supply.

I think in terms of the company that's very attractive, say in the energy sector, is Santos (ASX: STO), that would be our number one pick. We think the business has been significantly undervalued given how much the oil price has gone up. And also because of what it's doing in that whole decarbonization space, that is incredibly valuable. So that's our number one pick for the oil space.

In terms of the lithium space, we like IGO (ASX: IGO). We think the business holds half of an asset that is probably the most valuable and most attractive lithium asset Australia has and the share price hasn't really performed as well as some other more topical lithium names. We think that is one of the more defensive lithium plays.

Accessing the perfect blend

Jun Bei's fund leverages the strengths of both quantitative and fundamental styles of investing by exploiting behavioural biases and identifying high-quality businesses with strong fundamentals. To learn more, click here.

3 topics

2 stocks mentioned

1 contributor mentioned