Israel strikes Iran: Impacts on crude oil and the ASX 200

In a significant escalation of Middle Eastern tensions, Israel has launched targeted strikes against Iranian nuclear and missile facilities. Israeli Prime Minister Benjamin Netanyahu stated that the operations aimed to dismantle critical components of Iran's nuclear weaponisation and ballistic missile programs, vowing to continue until the perceived threat is neutralised.

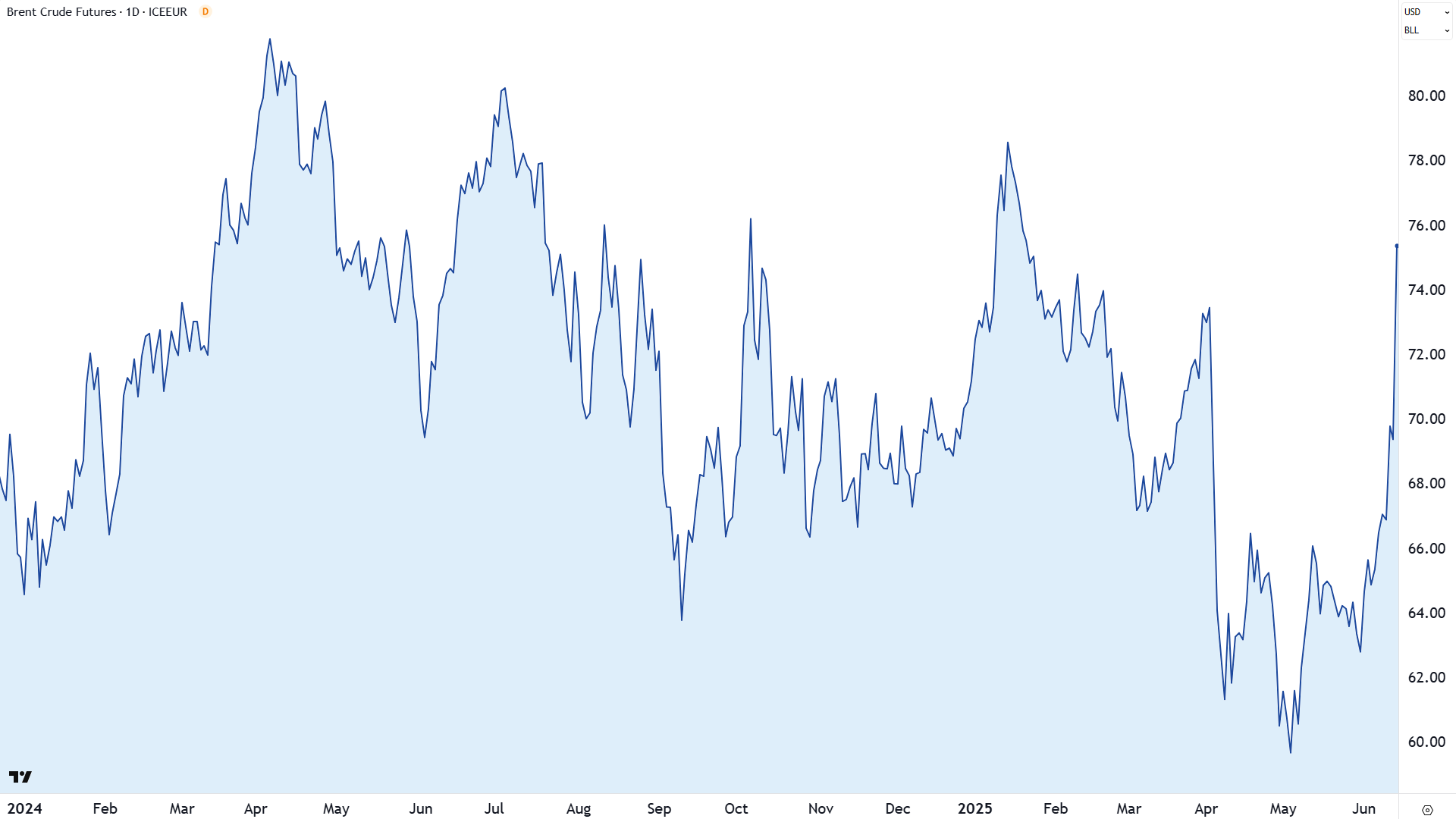

The immediate market reaction was pronounced: Brent crude oil futures on the ICE surged by over 8.7% to touch US$75.50 per barrel, well up from yesterday’s close of US$69.36 and from the sub-US$60 per barrel prices as recently as last month.

Oil markets react

Iran is the fourth-largest oil producer in the Organisation of the Petroleum Exporting Countries (OPEC). Based on recent reported data, it produces approximately 3.28 million barrels per day. But this is only part of the potential impact Iran could have on global oil supply if it wanted to.

Approximately 21% of the world's oil supply passes through the Strait of Hormuz, a narrow passage that Iran could potentially threaten in retaliation to today’s strikes. Iran has already vowed to hit US military targets in retaliation to any US action against its nuclear program. It may view the attack by Israel as sanctioned by the US, and therefore, the possibility of retaliatory actions aimed at hurting its enemies, plural, is real.

Historically, Brent crude prices have exhibited sharp increases during periods of Middle Eastern conflict. For instance, during the 2024 Israel-Iran missile exchange, Brent crude moved from around US$60 per barrel to US$83 per barrel (a very similar-looking move to current). This move was small, however, compared to other more protracted conflicts such as the Gulf Wars and the initial invasion by Russia of Ukraine, where oil prices doubled in value in a short period.

Analysts at JP Morgan and Citi have each predicted that US$120 per barrel is achievable in a “worst-case scenario” and a “bull case scenario”, respectively, with both citing a major escalation in Middle-East tensions that leads to a disruption in the supply of oil through the Strait of Hormuz as a catalyst. Both, however, considered this a low probability, but I am yet to read research from either post-these latest Israel attacks (I will keep you updated with another article when I get them!).

ASX energy stocks surge, but what’s the broader potential impact?

The ASX energy sector responded positively to today’s news, but it had been rallying in advance with recent gains in the oil price. The S&P/ASX 200 Energy Index (XEJ) is up 3.8% at the time of writing, just off its earlier 6% gain. Majors Woodside Energy (ASX: WDS) (6.5%) and Santos (ASX: STO) (+4.5%) are leading the charge, but smaller producers like Karoon Energy (ASX: KAR) (+9.6%) are seeing even bigger gains.

%20chart.png)

Looking outside the energy sector, the impact is likely to be far less positive. The price of crude oil is a key input in the global inflation equation, as it influences the cost of transport and of other refined products that are used in industry, and of course, our hip pockets when we go to fill up at the bowser.

The benchmark S&P/ASX 200 (XJO) is lower after the news, but only modestly so, down around 0.2%. The gain in energy stocks is no doubt helping offset losses in sectors that are most likely to suffer should we see a protracted period of higher oil prices, such as Consumer Discretionary (XDJ) (-0.80%) and Industrials (XNJ) (-0.60%), in which airline operator Qantas (ASX: QAN) (-5.2%) resides. Clearly, there are winners and losers from today’s developments.

Conclusion: Navigating a volatile landscape

And that’s the key takeaway for investors. The situation remains fluid, with potential for further escalation. Israel has indicated a willingness to continue operations against Iranian targets, while Iran has demonstrated little caution against launching its own strikes against its old enemy.

It’s probably less of a question as to if or when Iran retaliates (the answer to these questions are likely “yes” and “soon”), and more of a question of whether it chooses to widen the conflict to the broader region, including US military targets and to deliberately disrupt oil flows through the Strait of Hormuz. The US, although not directly involved in the recent strikes, will play a crucial role in this outcome, and has made it clear it will respond to any actions that threaten the global oil supply.

Oil price fluctuations have far-reaching implications, influencing consumer spending, inflation rates, and overall economic health. Investors should remain vigilant, closely monitoring geopolitical developments and their potential impact on energy markets and broader economic indicators.

This is a follow up to yesterday’s rather timely Evening Wrap ChartWatch focus on Brent crude oil and a deep dive into our two major energy producers Woodside Energy and Santos.

This article first appeared on Market Index on Friday 13 June 2025.

5 topics

8 stocks mentioned