It ain't what you don't know that gets you into trouble

Confidence sells. Unfortunately, when it relates to the future it is normally unwarranted. As always, Mark Twain phrased it better than most; “It ain’t what you don’t know that gets you into trouble, it’s what you know for sure that just ain’t so”. If 2022 taught us anything, it should be the retention of a healthy degree of caution when it comes to forecasting. There are some things we can know with a very high degree of certainty. Others, no matter how hard we try, are nothing more than educated guesses.

Additionally, as the systems and outcomes we are attempting to forecast become more complex and interrelated, the accuracy of forecasts will fall. 2022 saw a war in Europe, inflation above 8% in the US and into the double digits in much of Western Europe, yet oil prices ended the year almost flat. There were countless other events which featured in the forecasts of almost no one. Forecasts we can make with great confidence are that 2023 will hold some surprises and overconfidence is rarely the basis for a sound investment strategy.

Separating science and emotion

Emotion is not normally the friend of rational investment. Few issues are evoking more emotion than climate and energy currently. They are also issues with far-reaching ramifications for equity markets and economies, given the impact on both the operating environment and required investment for companies. The recently implemented A$12/GJ domestic gas price cap and A$125 cap on NSW and Queensland coal serve to highlight both the tendency of policymakers to intervene for populist rather than economic reasons and the unfortunate dominance of short-term thinking driving the intervention. Simultaneously, as Australia faces decades of necessary investment in energy distribution and generation, Origin Energy (ASX: ORG) is the subject of a $9/share indicative cash offer from a Brookfield/EIG consortium and AGL Energy (ASX: AGL) is being disrupted by a tech disruptor. Global energy market activity in the past year seemed to highlight a few issues:

- The vast majority of the global population passionately believe in the need to shift away from fossil fuels as quickly as possible.

- Very few understand the absolute dependence of the world on energy or the true cost and complexity of transition.

- Few want to pay higher prices for energy despite the need for higher prices to pay for massive energy reinvestment and encourage less consumption.

While wanting to avoid ill-advised forecasts, these mutual inconsistencies suggest the sector will create a few ongoing headaches.

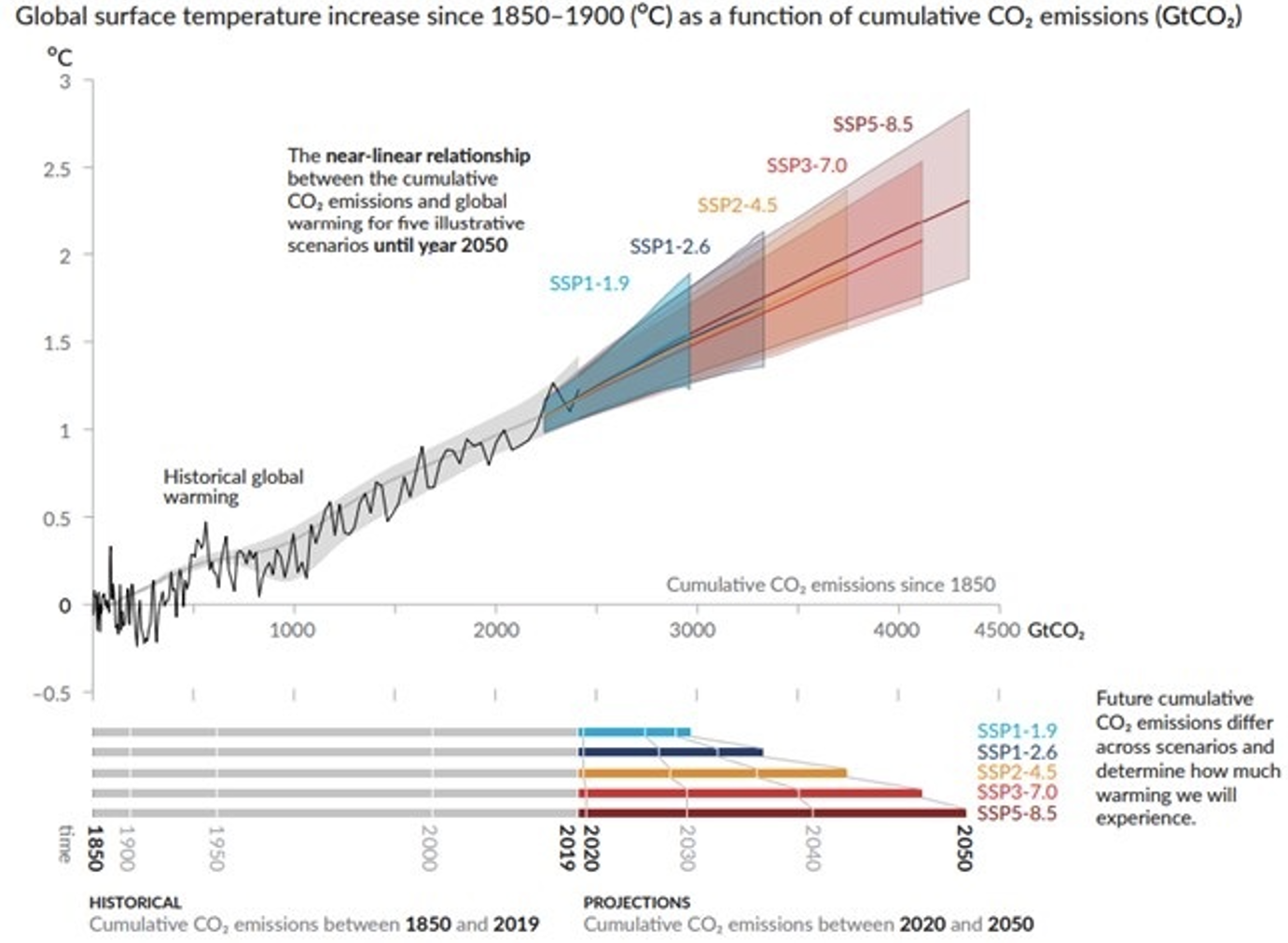

One of the larger headaches is the extent to which the emotion around climate change, particularly the use of modelling and forecasts such as well-intentioned 1.5⁰C and 2.5⁰C climate scenarios, has created urgency and panic. Urgency and panic do not sit comfortably with sound judgement and considered planning. The astute observer would note that 2040 and 2050 climate forecasts would fall into the category of long-range forecasts for highly complex systems.

The myriad of assumptions and complexity of data collection and measurement in making these forecasts is mind-boggling. Not only are error margins large, our understanding of how human influenced climate change interacts with natural influences is limited (e.g. our understanding of oceans, which hold most of the climate’s heat and influence the atmosphere significantly, is poor and comprehensive data history is only a few decades old). For those interested in understanding these issues better, Steven Koonin’s book ‘Unsettled’, was one of the more fascinating I’ve read in recent times.

Source: IPCC - Climate Change 2021

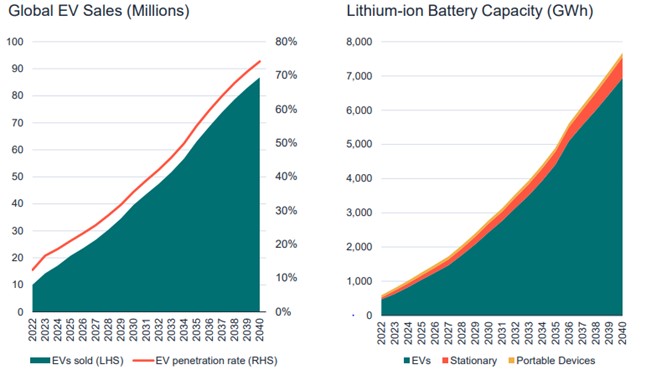

Much of the urgency and panic needs to give way to a more considered and pragmatic approach. Limitations on how quickly we can build infrastructure, and develop mines, technology and manufacturing capacity must dominate emotion. Similarly, we are hopeful the role of investment will continue shifting from marketing and emotion which has dominated early years, to the tangible and pragmatic. Forecasts for just about anything related to renewable energy, battery materials or electric vehicles look like the charts below; sharp upward sloping graphs with no interruption.

In real life, these are uncommon, not to mention potentially destabilising for economies. Wild enthusiasm around endless growth in e-commerce and technology has encountered a few hiccups in 2022, namely that delivering a lot more parcels and food has delivered a great deal more in losses than profits. As the same enthusiasm now embraces everything renewable, we would urge caution in simplistically buying upward-sloping graphs.

Source: Syrah Resources, Benchmark Mineral Intelligence

Some things are a little more certain

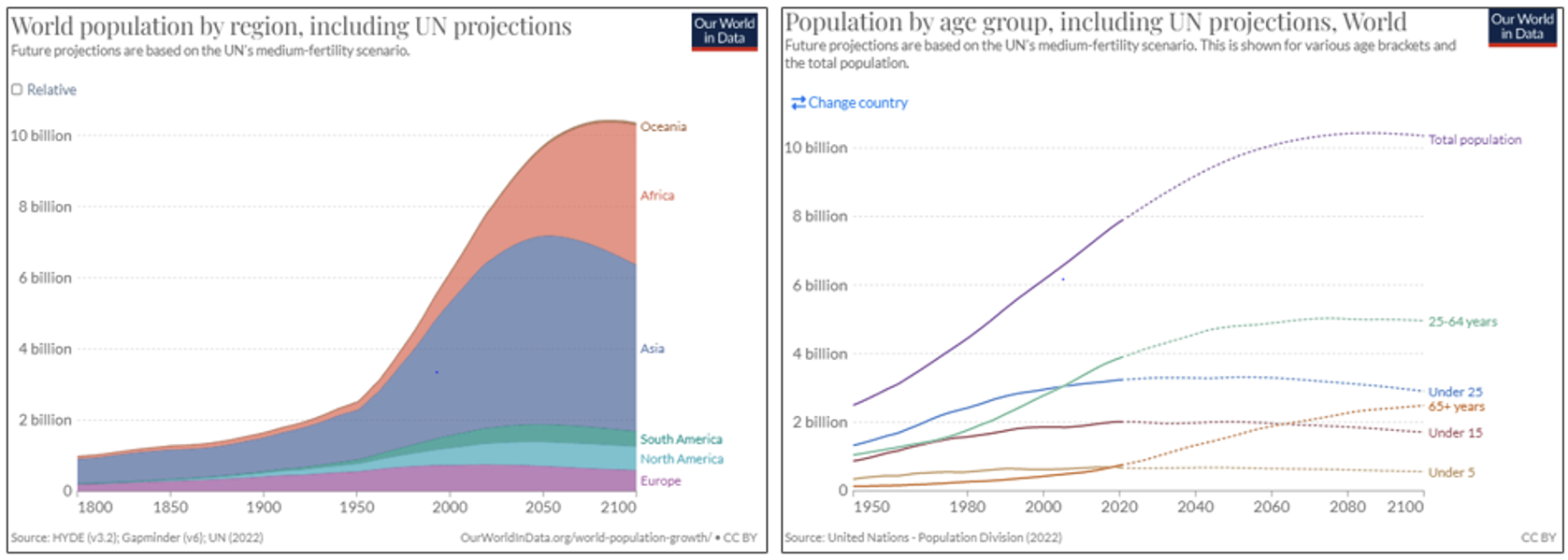

Population and ageing, unlike climate, have some decided advantages when it comes to forecasting. While it is feasible for pandemics, natural or man-made disasters to significantly reduce global population, fertility and the ageing process mean it is virtually impossible to get massive surprises in the other direction. There is not much we can do in terms of augmenting the working-age population for the next few decades. The cake is already baked. Life expectancy, the factor which can provide the surprise when it comes to growing the global population, may not be such a good one economically if it eventuates, given the already daunting challenges in supporting an ageing population.

Source: United Nations - Population Division 2022

Population trajectory and its ramifications still seem to us to be relatively ignored factors when it comes to the reliance of western economies on real estate prices, consumption and ongoing credit growth. Japan provides some salutary lessons when it comes to managing an economy in which incremental borrowing comes almost solely from an insolvent government and real estate is no longer a bank-sponsored Ponzi scheme. Europe is heading down the same path. This doesn’t necessarily mean declining living standards and doom and gloom. It does mean economic and business models need to change. Extrapolating economic growth rates, expecting ever-rising property prices and not anticipating significant changes in consumption patterns seem unwise.

Crowding out consumption

The early Christmas present for the Star Entertainment Group from the NSW Treasury in the form of new taxes expected to raise some $364m from Star and Crown casinos serves to highlight the ever-escalating game of ‘whack a mole’ being played by governments in trying to control the ever-increasing divergence between taxation and spending. Continuing to rely on taxing the earnings of a dwindling working-age population to fund outlays to the growing population outside this category who also own most of the country’s net assets is seemingly a recipe for disaster. The cost of living issues which have precipitated action on energy prices across the world are symptomatic of far deeper issues.

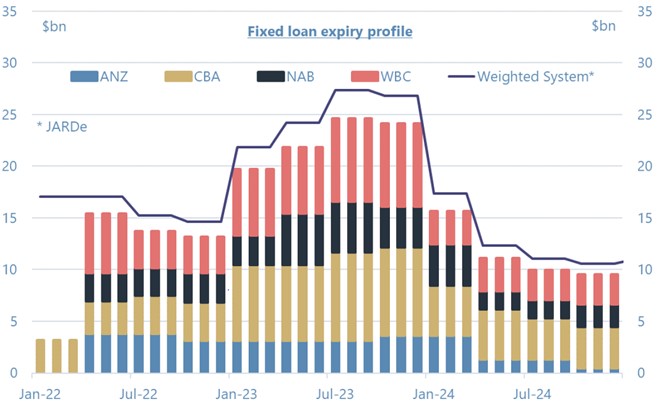

The reliance on the working-age population is deep. In addition to providing most of the tax revenue, they form the new businesses in the economy, they are the incremental borrowers in the housing market and the incremental consumers as families grow. Lowering interest rates has papered over growing cracks for many years. We’d expect higher interest rates will see the cracks widen quickly. Expiring fixed-interest rate housing loans will extract significant purchasing power from a demographic cohort already shouldering more than their fair share. We’d expect businesses, particularly those reliant on consumer spending will prove far more sensitive than is envisaged in many current forecasts.

Source: Jarden, Company reports

Kicking the cyclicals

The prospect of ongoing and potentially deeper cyclicality in many businesses sits uncomfortably with the populist calls for excess profit taxes to fund ongoing largesse elsewhere.

It is absolutely true we are fortunate to live in a country endowed with great benefits in terms of mineral and energy wealth and productive agricultural capacity. It is not true these benefits can be extracted without significant risk and capital investment. All businesses need to deliver reasonable returns to survive in the long run. Some deliver returns more smoothly than others.

The historic results of commodity-exposed businesses show solid excess returns can be quickly followed by periods of depressed profits or losses. Retailing, airlines, manufacturing and many other cyclical businesses are similar. Our investment philosophy has always tried to ignore cyclicality and focus on the longer run outcome. The price paid for an investment and the quantum of the returns earned through time is vastly more important than the path.

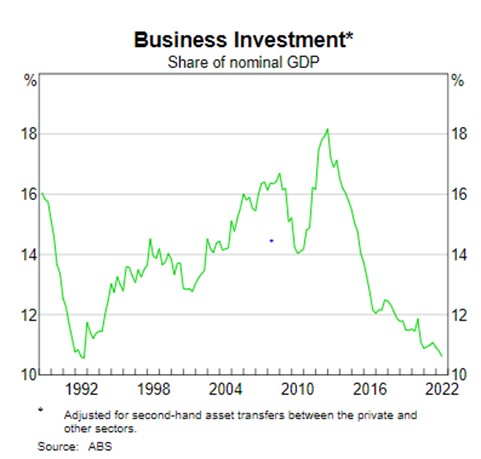

Cyclical earnings are less able to be funded through debt and most investors have been taught to love smooth and growing whilst shunning volatility, meaning the premium paid for smooth and growing reached stratospheric levels. Given a predilection to direct investment away from cyclical earnings, the prospect of strong returns in good times is even more important in encouraging investment in more cyclical industries. The positioning of the domestic economy on the business investment front would not suggest it is time to look for ways to discourage it.

Relatively buoyant economic conditions and COVID rebound have driven exceptional levels of profitability across many cyclical sectors and left many companies better positioned to fund investment. For many companies, this has reversed extended periods of tough competition from lower wage markets – often driving decisions to support profitability through ageing plant and equipment where conditions struggled to justify reinvestment. Whether it is an ageing airline fleet for Qantas (ASX: QAN), dated chemical and fertiliser plants for Orica (ASX: ORI) and Incitec Pivot (ASX: IPL) or the need for new mines across lithium, copper and other metals, investment will go where there is the prospect of profit and operating conditions which suggest someone else won’t try to take it away when and if it finally materialises. As the year ends with a $31bn NBN write-down from the government’s last effort at large-scale investment, there is probably good cause to remember Kerry Packer’s famous quote at a 1991 parliamentary committee;

“If anybody in this country doesn’t minimise their tax they want their heads read, because as a government I can tell you you’re not spending it that well that we should be donating extra”.

Understand the game

None of us knows what the future holds. Investing will always involve a fair amount of luck, no matter how much effort is expended in attempting to turn it into a science. Asset values are determined more by human behaviour than complex spreadsheets with a myriad of often unsupported assumptions. We prefer to frame the challenge as one of attempting to sensibly determine where the odds are stacked in your favour and where the odds are particularly poor, then placing wagers accordingly. High conviction, concentration, best ideas and assorted similar terms used with monotonous regularity in investment circles, profess certainty which doesn’t exist in the hope of conveying confidence to prospective clients.

Slow-moving waves

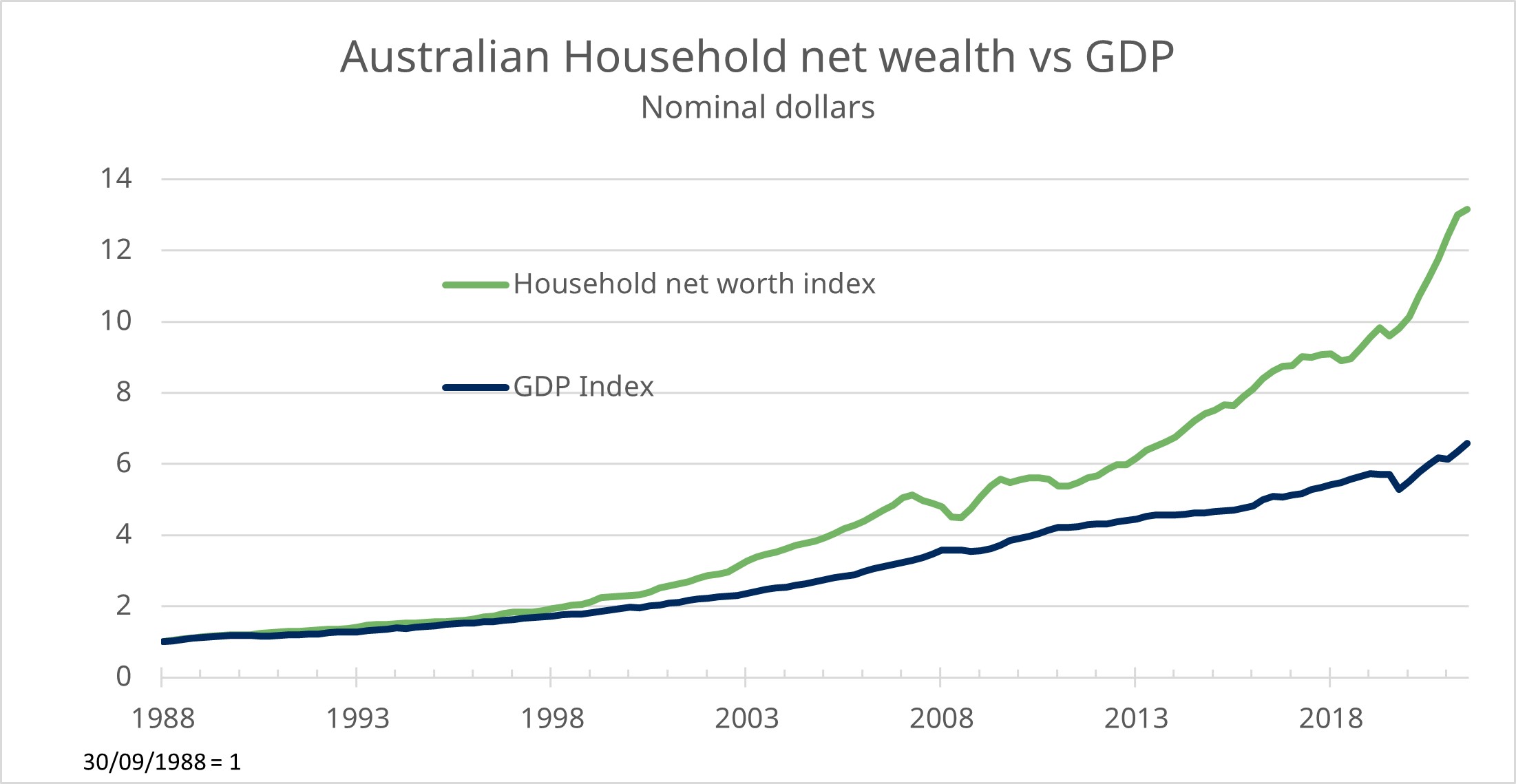

In terms of where we feel the odds are stacked, positioning to ride long, slow-moving waves will always be preferable to guessing short-term direction. Minimising frictional (transaction) costs which are certain and skewing toward businesses with a high degree of durability have always been useful guidelines in our experience. An extended period in which financial asset values have outpaced the growth in the real economy means we approach the future with circumspection.

Attempting to protect capital is likely to be more important than the asset flipping and speculation which has dominated the past decade or more.

Many are hoping for a return to the era of free-money-fuelled speculative valuations. While it is always possible, we feel it is far more likely the gravitational pull will be towards aligning valuations with the profits and cashflows the economy can deliver, rather than pricing ever more of the distant and uncertain future. In our view, the era of artificially cheap money has wrought damage on the economy which vastly outweighs any supposed benefits. The return of a modest and realistic cost of money (still below current inflation levels) has brought financial conditions back towards more sustainable levels. We are hopeful the wealth and generational inequality which free money has supported will ensure resistance to any plans to return to these conditions.

Valuation remains the best protection

Those of us acknowledging the uncertainty of the future tend not to want to pay exorbitant prices for anything. The longer you have to wait to get your money back, the more you expose yourself to this uncertainty. While valuations have partially retraced from the exorbitant levels of recent years, bargains remain very difficult to find. Long periods of artificially supported economic conditions have also meant profitability remains above normal levels for most companies while optimal work practices, productivity and staffing levels have erred in the wrong direction. Whilst continuing to believe the odds are better in real economy businesses than the more financially exposed, we believe sensible financial leverage and operational excellence will become increasingly more important. We don’t know much for sure but ensuring we don’t pay crazy prices will hopefully provide better protection than believing things that just ain’t so.

Learn more about investing in Australian Equities with Schroders here and below

5 stocks mentioned

1 fund mentioned