Japanese final GDP grew by 0.1% q/q, US CPI rose to 3.2% y/y

Let’s hop straight into five of the biggest developments this week.

1. Japanese final GDP grew by 0.1% q/q

Productivity in the Japanese economy is lower than previously thought despite shaking off recession concerns in the last quarter of 2023. The final GDP figure rose 0.1% from the preliminary estimate of – 0.1%, but significantly undershot the optimistic market prediction of a 0.3% growth. While not as strong as earlier thought, the Japanese economy demonstrated relative tenacity to alley recession fears.

2. UK claimant count change surged by 16. 8k in February

The UK labour market took a turn for the worse in February as significantly more people sorted unemployment benefits. The claimant count charge rallied by 16.8k from the previous downward revision of 3.1k. This was however less than the gloomy market forecast of 20.3k. High-interest rates continue to stifle labour uptake as businesses opt for automation to save costs.

3. US CPI rose to 3.2% y/y

Inflation is rebounding in the US at a faster rate than initial estimates. The CPI in the year to February rose to 3.2% from the previous 3.1%, catching markets that had bet on a static outcome by surprise. The inference is that US prices are vulnerable to energy prices.

4. UK GDP grew 0.2% in January

The UK economy opened the year on a high to pull out of recession, just as had been predicted by economic estimates. GDP grew 0.2% in January, a marked improvement on the previous – 0.1% shrink. Expansion in the all-important service sector largely accounted for the growth in output.

5. US retail sales surged 0.6% m/m

American retail sales rebounded at a slower pace than anticipated. Retail sales grew 0.6% in February, a significant rise from the previous upward revised figure of – 1.1%. This was however less than the 0.8% market prediction as rising prices at the pump continue to leave Americans exposed to higher prices across board.

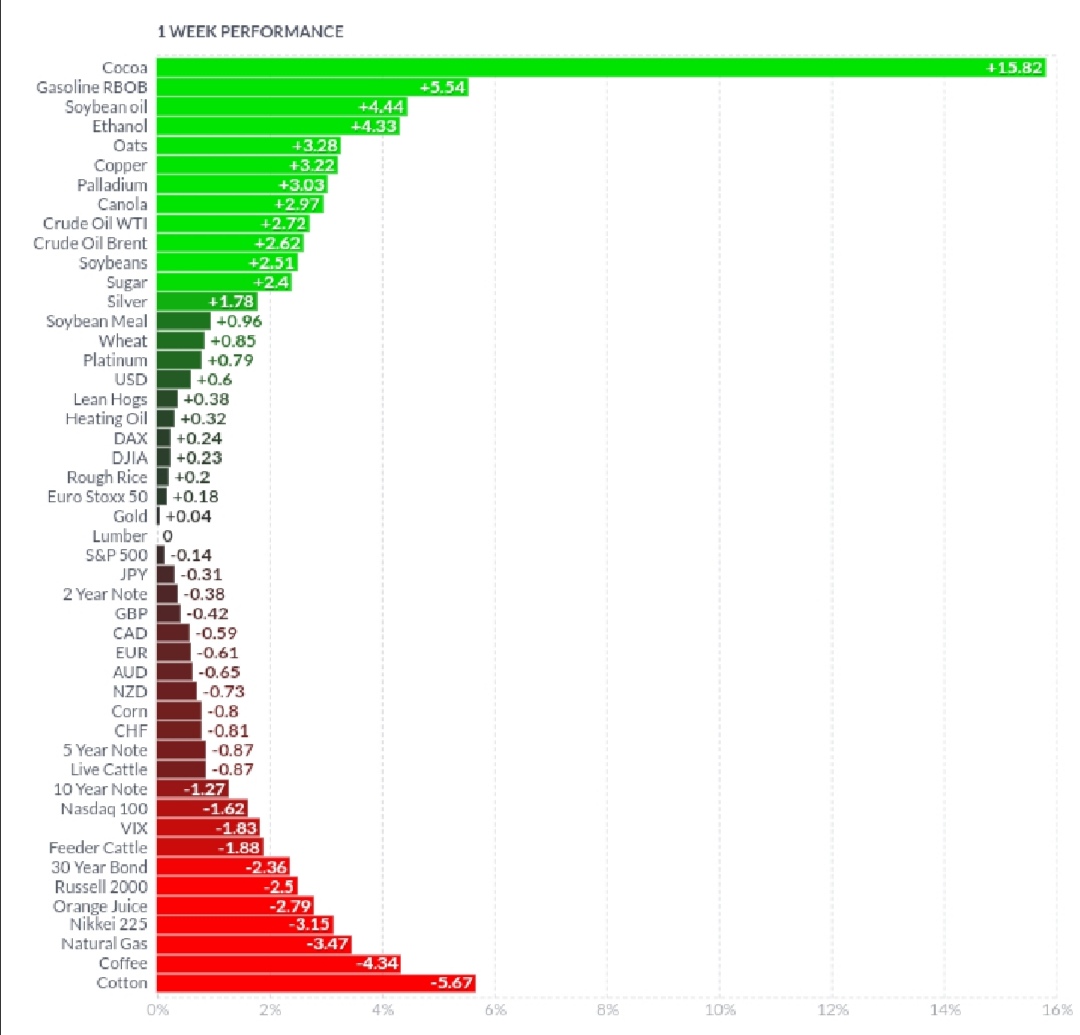

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Cocoa, soybean oil, and ethanol were hot for the week as wetter and colder than expected conditions persisted with predictions pointing to a further continuation. The energy complex surged on longstanding supply chain bottlenecks in the Red Sea as well as US military targeting of Iranian oil infrastructure for the first time since the Middle East debacle began. The VIX receded as investors discounted geopolitical risk to seek alpha in commodities as greed outstripped fear. Great demand for commodities left global indices vulnerable with most flat or down. Coffee and cotton were however down on oversupply.

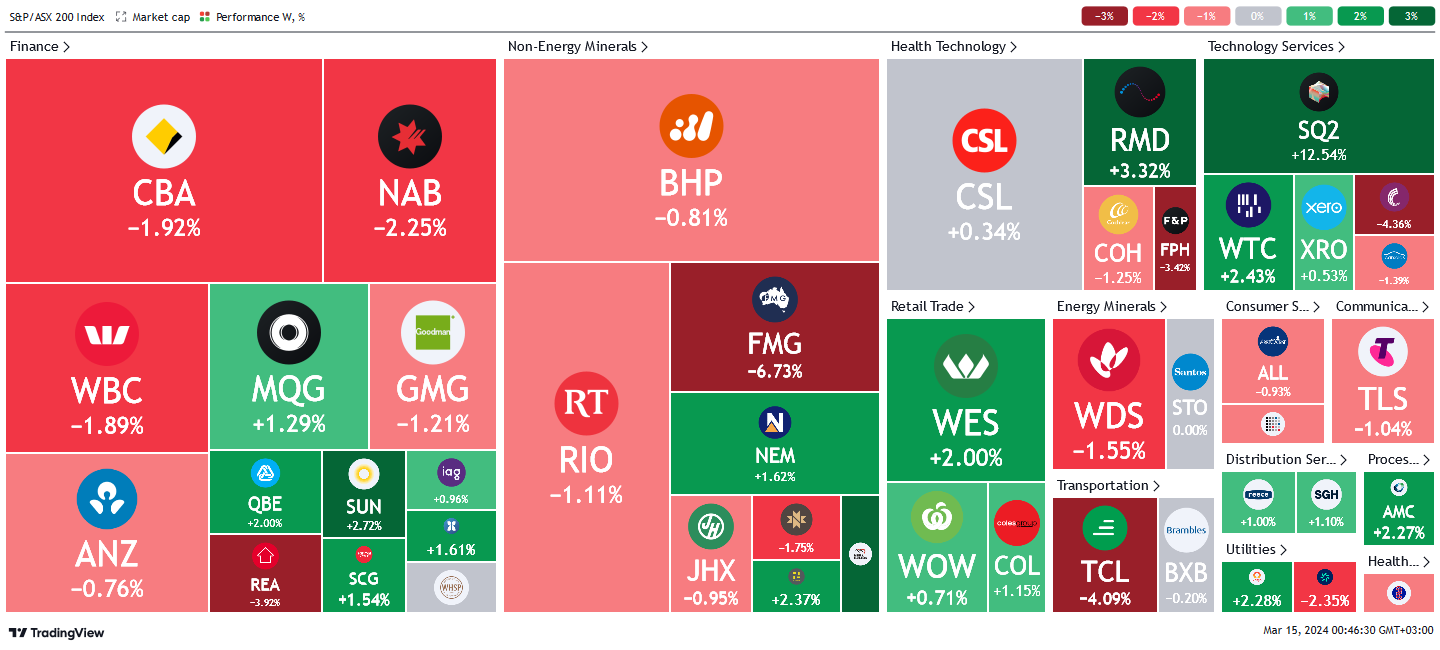

Here is the week's heatmap for the largest companies in the ASX.

A mixed but largely bearish week for the ASX with most stocks trending downward across sectors. Financials were mixed with a bearish bias. REA and NAB led the slip to close -3.92% and – 2.25% respectively as most stocks in the sector closed in the red. SGP and SUN however demonstrated relative strength to close up over 2.7%. Similarly, non-energy miners were mixed but trended down overall. Led by FMG’s – 6.73% sell-off, the sector sold off significantly but found support as MIN and S32 did most of the heavy lifting. Retail companies were green across the sector without exception, while health tech, tech services, transporters, utilities, and communications were all mixed.

Below shows our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics

5 stocks mentioned