Kessler: "More excited about the value on offer than ever before"

As Warren Buffett famously said: 'Be greedy when others are fearful'. It's simple advice that's pretty easy to give, but much harder to follow, particularly when markets are collapsing all around us at record speed.

However, Buffet's sentiment was echoed by Rhett Kessler, Fund Manager at Pengana Australian Equities Fund when he took the time to conduct a webinar for investors yesterday. Rhett said that he and fellow PM at Pengana, Anton du Preez:

"...are feeling probably more excited about the value on offer than ever before. But we know there's a valley ahead and it's going to be rocky, it's going to be testing our courage, but we think we're well positioned.

Keen to bring you the view from one of the most highly regarded managers in the market, I sat in on the webinar to understand how Rhett is thinking about markets right now.

I've pulled out a few highlights for you below, and the full presentation and transcript is below that. So read on to hear about his strategy, the opportunity and risks as he sees them today, and two stocks that he has always wanted to own - and now can.

Three key strategies

Long frustrated at frothy valuations leading into this event, Rhett and Anton had stuck to their process and taken steps which have put them in a better position today than most.

Firstly, they had increased their cash position, taking profits in key holdings such as Credit Corp, which they had previously held 9% of, along with JB Hifi, which Rhett said had got 'really carried away', as well as CSL and Resmed.

Interestingly, they had also wisely bought put options as insurance, saying that:

We also persisted with accumulating the put options, even though it felt like we were tearing up money, we liked the fact that we had the insurance, but as we kept buying them, the market kept racing ahead and we stuck to our discipline. Vols were ridiculously low, but we persisted.

Since the crash, they have lightened their holdings of the puts, which Rhett says has already yielded more than three times the original investment, while there is 'still a significant position that has gone so deep into the money that it's now like a future'.

With this insurance paying out, and the cash elevated, Rhett said he is now starting to allocate capital extremely judiciously:

"We're kind of like a sniper, sitting far back and I'm using up our bullets very, very selectively and keeping our powder dry. We've mainly added to existing holdings. Credit Corp, NIB, Telstra, Viva Reit, Aristocrat. These have been very selective. All these companies we think have got good strong balance sheets and the valuations are quite solid".

The opportunity and the risks

The collapse in equity valuations has - very suddenly - brought prices back to a level that looks attractive to Rhett. He made the point that fundamental value needs to be rebased given the inevitable hit to earnings, but even then, value is appearing:

"From Anton and my perspective, this is refreshing, painful, but very refreshing in that for the first time in a long time we feel there is a lot of value on offer."

Rhett flagged the drastic change in sentiment that has consumed the market, saying that "FOMO has turned well and truly into fear":

"We're seeing that there are liquidity events or panic and what we call noise, but it's becoming a bit more real than noise in that there now are concerns due to margin calls. We've had a couple of hedge funds blow up, et cetera.

He also pointed out the increased risk inherent in any forecasts at all right now, which includes many companies withdrawing their guidance, which makes life very hard for any analyst trying to project cashflows.

Now, the implication of this is that not even the company management themselves can forecast earnings through this period, certainly, not over the next six to 12 months. So analysts are going to really struggle and we think there's a lot of forecast risk inside this environment.

Two stocks we have always wanted to own

Rhett briefly discussed two companies that he said they had 'always wanted to own. These are Meridian Energy (ASX:MEZ) and Rio Tinto (RIO), both of which are down ~24% from their recent peaks at the time of writing.

On Rio, Rhett said that:

"At these prices, we think it gives us the share price, and allowing for a 50% full in the iron ore price, we think we can buy the iron ore business, which is 80 cents in the dollar, at a 10% after-tax cash earnings yield, which gives us quite a big margin of safety. Importantly, it has a rock solid balance sheet with almost no debt. And, in addition, we've just got a 4% fully franked dividend yield.

And on Meridian, he said that:

Meridian is a very, very strong company that operates in New Zealand and generates electricity out of its hydroelectric power stations, has a very strong cash yield, and we've managed to buy that, started nibbling at that on a 7% after-tax cash earnings yield.

Watch the presentation below, or read the transcript to get Rhett's full thoughts on positioning in this market, as well as other stocks including Telstra, Evolution Mining, Viva REIT, and Woolworths.

Presentation

You can access the video by clicking here.

Transcript

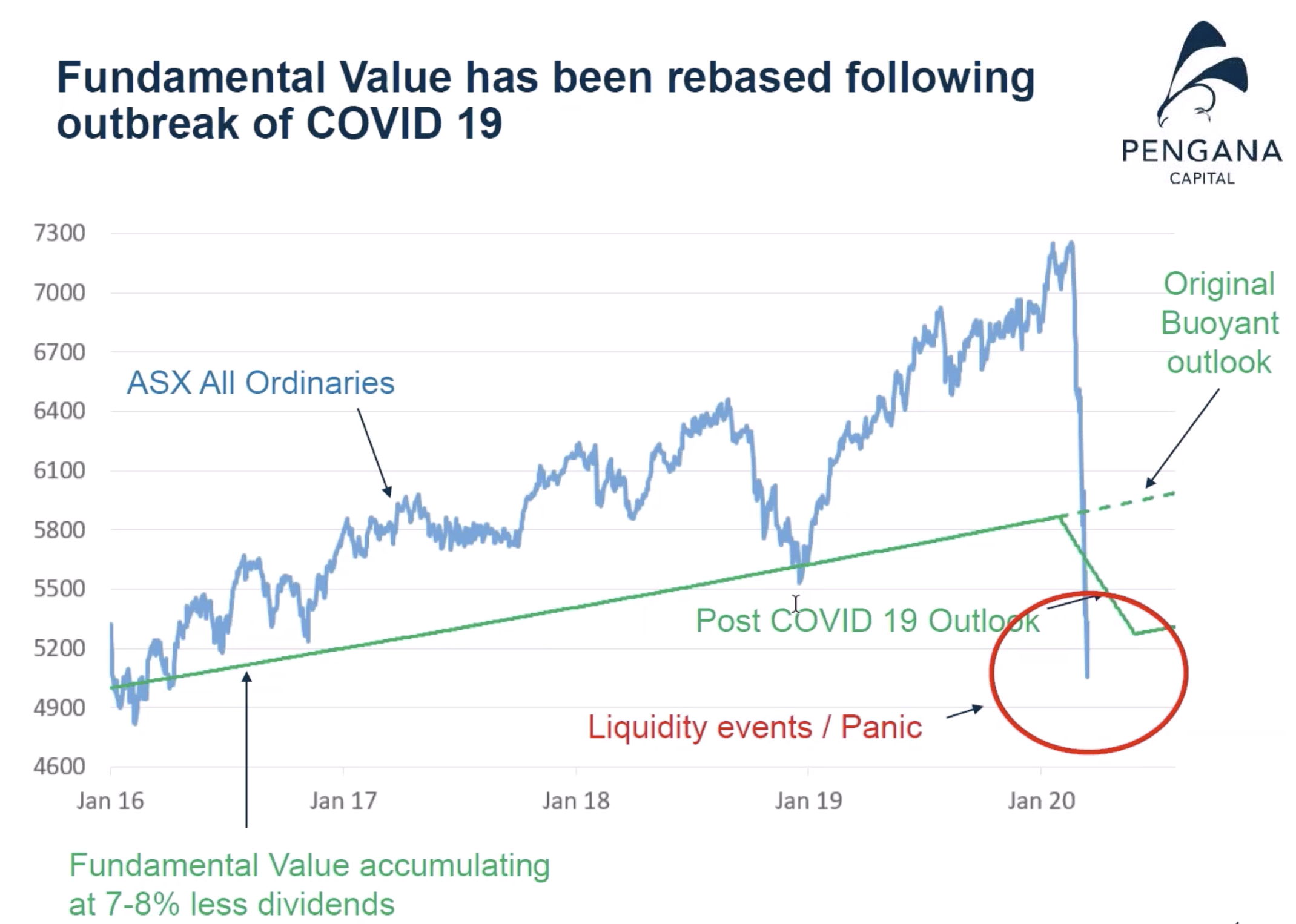

The first slide is really what I've been saying for some time and our team's been saying is that for some time, share prices have decoupled from fundamental value. And I've tried to demonstrate that there where we feel, as a market in total, it's been very, very strong and for some time we've been saying there's too much exuberance.

As a result, we've built up cash. We've been very focused on price and defensive companies and we've been a little bit left behind as you would have known.

As we move forward into the last few months, we got particularly worried and we bought puts to protect ourselves. Now, this is a black swan event, as you all know. I'm not saying anything you don't know. And what we've seen is that not only does the market have to come back to what were original fundamentals, but it has to, actually, original fundamentals have been adjusted down due to the post-COVID-19 outlook.

So there's a lot of credit risk. There's a big interruption to consumer and corporate business or economic momentum. And so, we've seen a real adjust down in the underlying fundamental value.

Now, in addition to this, we're seeing that there are liquidity events or panic and what we call noise, but it's becoming a bit more real than noise in that there now are concerns due to margin calls. We've had a couple of hedge funds blow up, et cetera. And in my view in a number of stocks we are now trading below fundamental value.

From Anton and my perspective, this is refreshing, painful, but very refreshing in that for the first time in a long time we feel there is a lot of value on offer.

We have a lot of cash, we have the protection of puts, but everything is being sold off indiscriminately due to the fact that FOMO has turned well and truly into fear.

So, that's a very brief summary of how we see things happening. I must stress that many many companies are withdrawing their guidance. Now, the implication of this is that not even the company management themselves can forecast earnings through this period, certainly, not over the next six to 12 months. So analysts are going to really struggle and we think there's a lot of forecast risk inside this environment.

Now, we remain focused on what we're calling, and I know toiler paper's got a bad name lately in Australia, but we are very, very focused on toilet paper and toothpaste type businesses. We're focused on good business models. We're focused on companies that will be able to survive through this because of the good management and the balance sheets.

So how have we positioned the portfolio? So first of all, leading up to the market correction, our cash holdings increased to 18% in the lead-up. We took significant profits in a number of companies that we felt were getting too expensive.

These included stocks like Credit Corp. You'll remember we used to be a 9% shareholder in this company. We sold significant amounts of our holding to the extent that we're only are a 3% shareholder in the company now. JB Hi-Fi got really carried away, we took off a lot from that. CSL, ResMed and a whole host of companies that we trimmed.

We also persisted with accumulating the put options, and I've put there in red, even though it felt like we were tearing up money, we liked the fact that we had the insurance, but as we kept buying them, the market kept racing ahead and we stuck to our discipline. Vols were ridiculously low, but we persisted.

And then we've had a very careful selection of defensive stocks. Telstra, you'll see Evolution Mining there, which we don't think we can predict the gold price, but we think that's the lowest cost gold factory. And therefore that provided us with a hard asset.

Viva Reit, which is a landlord whose tenant is coles in the petrol stations. It has 11 years of long WALE leases with 3% escalation. And we've got a significant position in Woolworths.

We also have health insurers. We've got leasing companies that supply leases or salary packaging to the health sector, et cetera, et cetera.

So the big fall has arrived a lot sharper than we would've expected and a lot more vicious. And how are we approaching the sharp full in the equity prices?

Well, first of all, you can think that we're kind of like a sniper, sitting far back and I'm using up our bullets very, very selectively and keeping our powder dry.

We've mainly added to existing holdings. Credit Corp, NIB, Telstra, Viva Reit, Aristocrat. These have been very selective. All these companies we think have got good strong balance sheets and the valuations are quite solid.

The way we've approached our valuations is we've continued to stick to after-tax cash earning yields and we've said there's going to be a dip for at least six months and then a slow buildup. So earnings should be impacted for at least two years.

We remain focused on our investment criteria.

The puts have been exceptionally helpful. The price of puts have gone through the roof. We've lightened our put options at extreme levels and we now have got three or four times our money back on the puts as well as still got a significant position that has gone so deep into the money that it's now like a future.

Importantly though, we also want to make sure we keep our heads up and we're remaining alert to new opportunities. So there's a couple of companies we've always wanted to own. We've selected two.

One of them is Rio Tinto. At these prices, we think it gives us the share price, and allowing for a 50% full in the iron ore price, we think we can buy the iron ore business, which is 80 cents in the dollar, at a 10% after-tax cash earnings yield, which gives us quite a big margin of safety. Importantly, it has a rock solid balance sheet with almost no debt. And, in addition, we've just got a 4% fully franked dividend yield.

Meridian Energy is a very, very strong company that operates in New Zealand and generates electricity out of its hydroelectric power stations, has a very strong cash yield, and we've managed to buy that, started nibbling at that on a 7% after-tax cash earnings yield.

Importantly, we think the portfolio is well-positioned. We think there is extreme fear and we think some liquidity events, as the markets sell off, we remain very liquid. So we still have approximately, depending how you calculate it, between 13 and 18% in cash. The reason for the difference is in the 13%, we don't count the put value, which is about 3 to 4% now, that if we liquidated today, we could turn that into cash. So 13% without that, 17 or 18% with that, and remember, the put gives us good insurance.

Today we're seeing quite extreme sell offs in particularly the smaller end of the market where liquidity is at a premium. We're watching this carefully. We think we might add to a few, but we want to make sure that we use our bullets very, very wisely.

Importantly, I think what you can take away from it is we're absolutely not panicking. We've kept ourselves psychologically sound by having the cash and having the puts and having high-quality companies. Our team is working well together.

Anton and I are feeling probably more excited about the value on offer than ever before. But we know there's a valley ahead and it's going to be rocky. It's going to be testing our courage. But we think we're well positioned".

1 topic

8 stocks mentioned

2 contributors mentioned

Alex happily served as Livewire's Content Director for the last four years, using a decade of industry experience to deliver the most valuable, and readable, market insights to all Australian investors.

Expertise

Alex happily served as Livewire's Content Director for the last four years, using a decade of industry experience to deliver the most valuable, and readable, market insights to all Australian investors.