Key tenets for managing small-cap risk

Record low interest rates, unprecedented government stimulus in the wake of the COVID-19 pandemic and faith that central banks will ride to the rescue have encouraged investors to take on ever-greater levels of risk to chase returns in certain sectors, despite the fairly uncertain economic environment as we head into 2021. These factors helped Australian small-caps surge +29% over the last six months, offsetting most of the initial sharemarket losses recorded by the shutdown of many parts of the economy in March.

These gains have been driven by a variety of factors, although far and away the most extraordinary feature of the last six months has been the gains in some of the more speculative areas of the sharemarket, such as the ‘buy now pay later’ sector (Chart 1 below).

Chart 1: Increase in Aggregate Market-Caps of Buy Now Pay Later Sector, 2019 - 20

Sources: FactSet, IRESS

It is not totally out of character for the small-caps sector of the sharemarket to be dominated at times by momentum and speculation when many investors chase trendy fads – we have seen this happen many times in the past. What makes this current rise so extraordinary is that it is happening at a time of great economic uncertainty and when the global economy is going through its worst downturn since the Great Depression – a time when one would have thought that investors would be extremely cautious, given the uncertain economic outlook.

Not only are investors not showing the degree of caution that may seem prudent, but some of the market valuations of the ’hot’ stocks of the last six months have reached levels that seem completely irrational. Afterpay, for example, which has yet to become profitable, has a market value of almost A$29 billion. Just to put that into context, that market value is more than that of Amcor and Brambles. How a credit provider that has designed an app to give instant credit and that is yet to make a profit is worth the same as two of Australia’s global successes which make a combined earnings (EBIT) of A$3.24 billion after taking decades building their networks globally to become among the world’s largest packaging and pallet pooling operators defies reality.

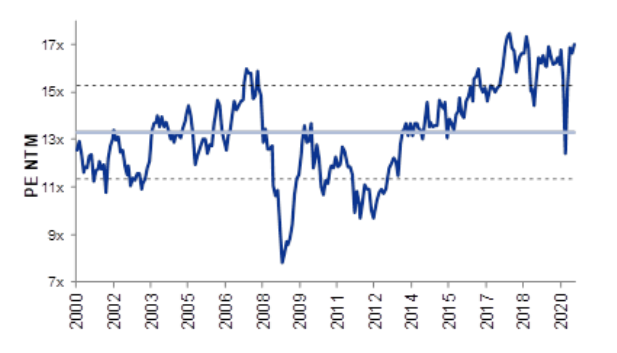

The rally in the small-cap sector since March, and in particular in many of the more speculative stocks, has pushed the valuation of the Small Ordinaries Index to near record high levels, as Chart 2 shows.

Chart 2: S&P/ASX Small Ordinaries Index Price/Earnings Ratio, 2000 – 20

Source: Goldman Sachs

The Key Tenets for Managing Risk in the Small-Cap Sector

Interestingly, despite the near-record high PE at which the small-cap sector is trading, we continue to find a lot of good value in the sector. IML’s small-cap team remains focused on managing what we see as the key tenets of risk management in small-caps investing – capital preservation, investing for the long term, and dividends.

A focus on capital preservation means remaining patient and only holding stocks that our research can justify due to their quality and appealing underlying valuation. Entering a stock with a margin of safety to its fair value lowers the risk of capital loss. In addition, the lower the entry price, the higher the potential for capital gains as the stock rerates over the long term.

Given the fairly unpredictable current environment, we continue to invest on a stock-by-stock basis, putting together a portfolio of well-diversified, resilient and good quality companies which we believe are trading at reasonable prices. When markets eventually come back to fundamentals, a portfolio of good quality stocks will show more resilience and recover more quickly than a portfolio of speculative, loss-making stocks, many of which promise a lot of ‘blue sky’.

Sustainable competitive advantage is critical, particularly in a slowing economy where competition often intensifies. Companies that have a sustainable competitive advantage operate assets or have characteristics that are difficult to replicate, and possess key attributes such as being the lowest-cost provider, or having pricing power through ownership of well-known brands, increasing barriers to entry for competitors. We also like companies that have strong or improving balance sheets, underpinned by solid asset backing and cash generation. We also look for resilient companies that can continue to grow over the long term, for example through market share gains, taking out costs, acquisitions, or contracted revenues. Examples of these in our portfolio are Crown Resorts, Pro-Pac Packaging, and Integral Diagnostics.

Active management and building cash weights to take advantage of volatile periods is another way of managing risk and preserving capital. Exiting a position can often be harder than building one, especially when a stock or the market is falling. As stocks we own become more expensive and approach our target price, we tend to reduce our holding by trimming or selling out of a position and taking advantage of liquidity when it is available. We also manage risk by investing for the longer term. Investing – as opposed to speculating – means patiently putting together a diversified portfolio of companies that in our view can generate sustainable cashflows for dividends or reinvestment. Many investors fail in the long term because they are too busy trying to outperform the market in the short term, often by trading in and out of lower-quality stocks.

Dividends are also key to managing a small-cap portfolio’s risk, as dividends can act as a ‘safety net’ in times of volatility. The level of dividends from a diversified portfolio of quality companies is largely uncorrelated to the level of the sharemarket. When the market declines, the prices of quality companies with recurring earnings can fall just as readily as speculative and riskier companies. However, quality companies with a history of paying healthy dividend streams often recover a lot more quickly than more speculative companies. Although some of the small-cap companies we own have suspended dividends in recent months as COVID-19-related shutdowns have significantly affected their current cashflows, we are confident that they will be able to start generating cash and resume dividend payments within a reasonable period of time.

Invest in quality companies at attractive valuations

IML’s focus on investing in quality rather than chasing the latest market trends allows us to avoid market fads with our aim of delivering favourable risk adjusted portfolio performance for our clients over time. To find out more, please visit our website.

6 stocks mentioned